February 29, 2008

SaskPower tries retrofit route

SHAWN McCARTHY

Globe and Mail

Wednesday, February 27, 2008

OTTAWA — Saskatchewan's provincially owned utility said Wednesday it will spend $758-million, on top of $240-million provided by this week's federal budget, to rebuild an aging power plant into North America's first clean-coal unit that will capture and store carbon dioxide.

Armed with $240-million in federal funding announced in Tuesday's budget, Saskatchewan's Minister for Crown Corporations, Ken Cheveldayoff, said the provincial utility will proceed with a 100-megawatt plant that will capture a million tonnes a year of CO{-2}.

The greenhouse gas will then be piped to nearby oil fields, where it will be injected underground to boost the recovery of crude.

The Saskatchewan project represents a major shift in the search for technology that would allow utilities to burn cheap and plentiful coal without emitting greenhouse gases that cause global warming.

Until recently, companies focused almost exclusively on new gasification plants that separated the carbon dioxide prior to combustion. In this project, SaskPower will rebuild a coal unit at the Boundary site in the southeastern part of the province, extend its life by 30 years and include postcombustion capture technology.

"It's a leading-edge project that, if it works out well, it can be replicated in other plants," Mr. Cheveldayoff said. He added the clean-coal project will allow SaskPower to cut its greenhouse gas emissions by 7.2 per cent from 2006 levels.

The Boundary site is near Estevan, where EnCana Corp. already uses carbon dioxide – piped from North Dakota – in an enhanced oil recovery project. The EnCana operation has been widely studied, and scientists believed the CO{-2} injected there will remain trapped for thousands of years.

SaskPower had considered constructing a new, 300-megawatt clean-coal plant that would capture the carbon dioxide prior to combustion but cancelled the project because of rapidly rising costs.

SaskPower president Patricia Youzwa said the demonstration project is a critical step in the commercialization of clean-coal technology.

"By doing a project like this, we'll better understand what the economics are and how the technology performs relative to other alternatives that there may be for reducing greenhouse gas emissions," she said in an interview.

She said SaskPower has not yet chosen the technology that it will use to capture the gases from its flue, though experts say there has recently been progress with ammonia chilled scrubber technology.

The province has committed to sharing the information from its demonstration project with coal-dependent utilities in Alberta and Nova Scotia.

There have been substantial advances in postcombustion clean-coal technology in the past year, and several North American utilities are now considering projects.

David Lewin, senior vice-president with Edmonton-based Epcor Utilities Inc., said the industry will be watching the Saskatchewan project to assess the commercial viability of retrofit carbon-capture.

David Keith, a University of Calgary environmental engineer, said the retrofit technology could be an important tool in the battle against climate change.

But a recent task force on carbon capture and storage, on which Dr. Keith served, recommended that government spend $2-billion to implement the technology throughout Western Canada. This week's budget effort, he said, will leave Canada far short of its goals to reduce emissions.

© The Globe and Mail

Clean coal

Sask. Party moving forward with plans for clean coal project

James Wood

Saskatchewan News Network

Wednesday, February 27, 2008

REGINA -- With federal money in hand, the Saskatchewan Party government is moving forward with plans for a clean coal carbon sequestration demonstration project.

A day after the federal budget earmarked $240 million to the province for the project, Crown Corporations Minister Ken Cheveldayoff and SaskPower president Pat Youzwa announced plans for a seven-year, $1.4 billion project that involves the retrofit of one of SaskPower's coal-fired power generation units at Boundary Dam near Estevan.

The end result is intended to be the production of 100 megawatts of power with zero greenhouse gas emissions, reducing the Crown corporation's emissions by about one megatonne a year.

Casting a shadow over the project however is SaskPower's last foray into clean coal, which saw a planned new 300-megawatt plant shelved last year, partly because projected costs rose from $1.5 billion to $3.8 billion.

The U.S. government also recently pulled its funding for a clean coal project in Illinois because of cost overruns.

But Cheveldayoff expressed confidence in the financial projections for the new project.

"It's happening immediately. Planning is beginning right away, we're looking at construction starting in 2011. It's happening as soon as possible. We're keeping our finger on the numbers that are out there. This is the best information that we have recognizing the cost escalations that are happening around us and some of that has been built in," he told reporters at the provincial Finance building.

SaskPower will put $758 million into the project on top of the federal funding.

With the plant itself projected to cost $1 billion, the additional $400 million is needed for surrounding infrastructure such as the pipelines for the carbon dioxide.

Cheveldayoff said the government will look to the private sector for the additional funding, with the anticipation that costs will be offset by the sales of carbon dioxide for use in enhanced oil recovery.

Youzwa said the facilities at Boundary Dam would need to be refurbished or replaced in coming years in any case, which the company estimated would cost $800 million without the clean coal component.

The SaskPower president cautioned that the company must still undertake detailed engineering work, choose the technology to clean emissions at the stack and complete discussions with the oil industry on the carbon dioxide sales.

"Until that's completed we won't be ... bringing forward decision items to commit large amounts of capital. The project has to work and make sense both environmentally and economically," she said.

The prospect of a coal-burning plant with minimal greenhouse gas emissions through the capture and storage of carbon dioxide has been a beacon for Saskatchewan governments of all stripes given the province's large coal reserves, its per capita greenhouse gas emissions that lead the country and the prospect of selling the developed technology to other jurisdictions.

NDP Leader Lorne Calvert said he's glad to see the government moving forward with a new clean-coal project but he's concerned about the uncertainty around many aspects, especially the private-sector funding.

There is also a question about the potential for cost escalation given the seven-year timeframe involved, said Calvert, whose government put the $300-megawatt project on the backburner.

"If they haven't even determined now the technology they're going to use, how can they be definitive about the numbers," he said.

The ex-premier noted that if the costs do go up, it's unlikely the federal investment will rise in kind and those increases will likely fall on the province.

The Saskatchewan Party government has committed to keeping the greenhouse gas targets adopted last year by Calvert's government, which included stabilizing emissions by 2010 and cutting them by 32 per cent by 2020.

The projected reduction from the new clean coal project represents a roughly six per cent cut from the province's greenhouse gas emissions in 2005.

While the interest in clean coal and carbon sequestration is growing among governments and industry, it represents a mirage for many environmental groups.

"If the government told SaskPower it needed to reduce its emissions by one megatonne, it could invest probably one-tenth to one-fifth of that amount ($1.4 billion) and get one megatonne of reductions, by investing in efficiencies, by investing in other renewable sources of power," said Dale Marshall, climate change policy analyst with the David Suzuki Foundation.

The costs for Saskatchewan's new project are in fact significantly higher than recent power-generation projects brought on line by SaskPower.

The Centennial Wind Power project, officially commissioned in 2006, cost $250 million and provides 150-megawatts of generation. The planned addition of two natural gas-powered turbines near Kerrobert is estimated to add nearly 100 megawatts at a cost of $150 million.

Cheveldayoff and Youzwa said the government is looking at all options for power generation.

But coal-fired generation represents part of Saskatchewan's "base load power" while wind power faces limitations because it is intermittent, said Cheveldayoff.

Natural gas, while cleaner than regular coal-fired generation, still has significant greenhouse gas emissions.

Bob Stobbs, the chair of the Canadian Clean Power Coalition industry group, said the price for future clean coal projects will come down once a plant is actually up-and-running.

© Canwest News Service 2008

February 28, 2008

Alaska town sues 24 energy companies on climate change

Village sues energy firms for climate change

Elizabeth Bluemink, Anchorage Daily News, 27-Feb-2008

Alaska town sues 24 energy companies on climate change

Timothy Gardner, Reuters/Guardian, 27-Feb-2008

Village sues energy firms for climate change

KIVALINA: 23 companies blamed for emissions

tied to coastal erosion threat.

By ELIZABETH BLUEMINK

ebluemink@adn.com

Anchorage Daily News

February 27th, 2008

The eroding village of Kivalina in the Northwest Arctic is suing Exxon Mobil and 23 other energy companies for damage related to global warming.

The suit was filed Tuesday in the U.S. District Court in San Francisco on behalf of the Native village's federally recognized tribe and its city government, according to lawyers for the village.

Kivalina, located on a shrinking barrier island in the Chukchi Sea, says the energy companies should pay to move the village to safer ground.

"We need to relocate now before we lose lives," said Janet Mitchell, city administrator for Kivalina, in a news release announcing the lawsuit.

The companies are contributing to global warming that is threatening to destroy the village, according to the lawsuit, which demands a jury trial. The defendants include one coal company, nine oil companies and 14 power companies. Three of the oil companies -- Exxon, BP and Conoco Phillips -- operate on Alaska's North Slope.

Exxon spokesman Gantt Walton said Tuesday that the company needs more time to review the lawsuit before commenting. Conoco and BP officials in Alaska declined to comment for this story.

In the past few years, cost estimates to relocate Kivalina to the mainland have varied between $95 million and $400 million.

State and federal officials are working on plans for additional shoreline protection for Kivalina and other coastal villages threatened by erosion. There is no plan for relocating them yet. One village, Newtok, has begun relocating itself.

State officials hadn't heard about the lawsuit Tuesday and didn't know how it would affect their planning.

"Now there is a good question. ... It would take quite a bit of time to accomplish anything through the courts, as evidenced by Exxon Valdez and other things," said Mike Black, deputy commissioner for the state Department of Commerce, Community and Economic Development. He was referring to the civil lawsuit filed by fishermen and other plaintiffs for damages related to the Exxon Valdez spill in 1989. The case is being argued in the U.S. Supreme Court today.

SEVERE STORMS

Kivalina's nearly 400 residents, most of them Inupiat Eskimo, have been buffeted by severe storms in recent years. Last fall, many residents briefly evacuated Kivalina worrying that a big storm would wipe out homes and other buildings. The storm wasn't as bad as feared but it took out a chunk of the village's seawall.

The lawsuit cites reports published by the U.S. Corps of Engineers and the U.S. General Accountability Office that have linked erosion in coastal areas of Alaska to climate change and rising temperatures.

Sea ice forms and attaches to the coast later in the year, breaks up earlier and is less extensive and thinner, exposing the village to storm waves and surges, according to the lawsuit.

"Each of the defendants knew or should have known of the impacts of their emissions on global warming and on particularly vulnerable communities such as coastal Alaskan villages," the complaint says.

ALLEGED CONSPIRACY

Some of the companies, especially Exxon, also are liable for damages to Kivalina because they are guilty of conspiring to "create a false scientific debate" about global warming to deceive the public, according to the lawsuit.

The legal complaint details the alleged conspiracy, saying that trade associations have "formed and used front groups, fake citizens organizations and bogus scientific bodies. ... The most active in such efforts is and has been defendant Exxon Mobil," the suit claims.

Walton of Exxon defended his company's stance on climate change. The company takes the issue seriously and is reducing its greenhouse gas emissions, funding research and talking about climate change policy with governments around the world, he said.

The law firms spearheading the lawsuit are the San Francisco-based Center on Race, Poverty & the Environment and the Anchorage office of the Native American Rights Fund.

Nine other attorneys are involved. Some are litigating other climate change-related suits, including defending California's attempt to force auto makers to comply with its greenhouse emissions limits, which are stricter than federal regulations.

This isn't the first time an Eskimo group has pointed blame at others for climate change. In 2005, the chairwoman of the Inuit Circumpolar Conference and more than 60 Inuit hunters and elders in Alaska and Canada asked the Inter-American Commission on Human Rights to hold hearings in Canada and Alaska to investigate harm posed to Inuit people in the Arctic by climate change, and to declare the United States in violation of human rights law as the largest emitter of greenhouse gases.

The commission rejected the petition but allowed testimony at a brief hearing last March in Washington, D.C.

In addition to Exxon, BP and Conoco, the Kivalina lawsuit names Chevron Corp., Shell Oil Co., Peabody Energy Corp., AES Corp., American Electric Power Co., DTE Energy Co., Duke Energy Corp., Dynegy Holdings Inc., Edison International, MidAmerican Energy Holdings Co., Mirant Corp., NRG Energy, Pinnacle West Capital Corp., Reliant Energy Inc., Southern Co., Xcel Energy Inc. and a few other affiliated companies.

Find Elizabeth Bluemink online at adn.com/contact/ebluemink or call 257-4317.

Alaska town sues 24 energy companies on climate change

By Timothy Gardner

Reuters/Guardian

Wednesday February 27 2008

NEW YORK, Feb 27 (Reuters) - An Alaskan village north of the Arctic Circle has filed suit in a U.S. District Court against 24 energy companies, in an attempt to link erosion damage from global warming to the defendants' actions.

Residents of Kivalina, a village of about 400 native Inupiat located on the tip of a barrier reef between the Chukchi Sea and two rivers, filed suit on Tuesday against the companies in U.S. District Court in San Francisco.

The suit is one of many global warming cases that have been filed after the U.N.'s climate change panel last year squarely placed the blame for global warming on human actions.

Village residents claimed that greenhouse gas emissions from the companies help warm the atmosphere and melt sea ice that used to protect them from winter storms. "Houses and buildings are in imminent danger of falling into the sea as the village is battered by storms and its ground crumbles from underneath it," the suit said.

The residents seek relocation costs which could run to $400 million.

Late last year, the U.S. National Oceanic and Atmospheric Administration offered a gloomy report on global warming's impact on the Arctic, finding less ice and hotter air.

The defendants, including Exxon Mobil Corp, BP Plc, Chevron Corp, coal miner Peabody Energy Corp, and power generator American Electric Power, are some of the largest producers of products that emit the main greenhouse gas carbon dioxide, or sell coal, the dirtiest fossil fuel.

Matt Pawa, a lawyer for the plaintiffs, said in an interview that under nuisance laws any major contributors to pollution problems can be sued.

He said since greenhouse gases combine together in the atmosphere to cause the overall problem of global warming, the biggest polluters can be blamed for contributing to the damage in Alaska. "Individual CO2 molecules don't have name tags," he said when asked if the companies could be directly linked to damage to the village.

The companies were chosen because they conduct some business in California, where the suit was filed. Pawa represented environmental groups in a successful automobile greenhouse emissions case in Vermont late last year that major automakers are appealing.

Gantt Walton, a spokesman for ExxonMobil, the world's largest publicly traded oil company, said the company had no comment on the case because it was still reviewing it.

He said ExxonMobil takes global warming "very seriously" and that the risks have warranted action by the company including reducing greenhouse gas emissions at its operations and supporting research into technology that could lead to breakthroughs.

Representatives of two other companies, Peabody and Chevron, did not immediately return telephone calls.

(Editing by Matthew Lewis)

February 26, 2008

Stelmach wants full report on oilsands moratorium

Groups seeking no new development in three areas until 2011

Jason Markusoff and Renata D'Aleisio

Calgary Herald

Monday, February 25, 2008

CALGARY - The Alberta Conservatives will not decide for months on a request from several major oilsands companies to halt development leases in three huge and environmentally sensitive swaths of the oilsands region, Conservative Leader Ed Stelmach said today.

The request threatens to pit Stelmach's commitment to environmental protection against his campaign mantra of not "touching the brake" on energy development, although he repeatedly dodged that question as the final week of campaigning towards next Monday's election began.

Industry giants including Petro-Canada, Imperial Oil, Husky Energy and Suncor Energy support the request for protected conservation areas in a January letter to the Alberta government by the Cumulative Environmental Management Association. The letter asks that the government not sell oilsands leases in the three areas until at least 2011.

"Although the sale of leases does not guarantee that commercial bitumen production will occur in that specific location, it does open the door to that possibility and the accompanying ecological disturbance," the letter states.

Last week, the Assembly of Treaty Chiefs in Alberta also unanimously supported the resolution for an oilsands moratorium.

Stelmach noted some oilsands firms disagreed with the letter's recommendation, and suggested if re-elected, the Tory government would hold off until final recommendations from CEMA come in June.

He said the government would have its own study completed by then with a plan to limit certain air-emissions from the oilsands sector.

"All recommendations that come forward we take seriously, but even if there wasn't a request to hold back any of the leases, we would be looking at leases if it extends beyond what we think, environment thinks, is the right level, the most appropriate level of emissions in that area," Stelmach said.

"So the cumulative environmental effect will take precedence because we want to make sure we maintain the air quality around Fort McMurray."

EnCana and Canadian Natural Resources are among CEMA's members who opposed the recommendation, although non-industry players including the local government, environmental groups and Environment Canada side with CEMA's majority.

Chief Allan Adam of the Athabasca Chipewyan Dene First Nation and a member of the Keepers of the Athabasca organization brought the resolution to the Assembly said the province hasn't properly consulted aboriginals over oilsands development.

"The cumulative impacts of oil sands development has all but destroyed the traditional livelihood of First Nations in northern Athabasca watershed," Adam said in a statement.

In Calgary, Stelmach reiterated he doesn't want to slow development. However, he didn't link his "no touching the brake" slogan with this request, but rather took it as a springboard to continue attacks on his rival Alberta Liberals.

"Governments do not control the economy," Stelmach said. "The last time the economy was controlled by a government was back in the 1980s and it was the federal Trudeau Liberals... we're not going back to those dark days.

Taft's party has no formal links to the federal Liberals, and he has slammed the Tories for fear-mongering and name-calling. Taft said the calls for a moratorium show the province needs to rethink how it's developing the oilsands.

Taft said if the Liberals formed government, the party wouldn't approve new oilsands projects until a detailed plan is drafted for managing impacts on the environment, infrastructure and labour.

"The consensus is we need to manage oilsands development better," he said. "The Tories have allowed a free-for-all. This is the biggest industrial development on the planet. We need a plan."

NDP Leader Brian Mason said his party has always favoured a more regulated pace of development in the oilsands.

"The devastation on water and on the environment is severe," he said in Edmonton. "And it's really one of the reasons we think we need to be reforming our economy into a green energy economy."

February 24, 2008

AECL: Canada's nuclear fallout

JESSICA LEEDER

Globe and Mail

February 23, 2008

DEEP RIVER, ONT. — He was a newcomer to the Canadian Nuclear Safety Commission, a refugee from the Crown-owned nuclear facility at Chalk River who brought with him a sparkling bit of inside knowledge.

His colleagues were reviewing a set of safety upgrades, designed by Atomic Energy of Canada Ltd. to modernize the NRU, the 50-year-old research reactor that supplies more than half of the world's medical isotopes.

"Staff in Ottawa were totally convinced that the [upgrades] were in," said one CNSC insider who spoke on condition of anonymity.

The new man knew better: Not all the upgrades were done.

Former Canadian Nuclear Safety Commission president Linda Keen speaks to journalists after testifying before the Commons natural resources committee on Parliament Hill in Ottawa January 29, 2008. REUTERS/Chris Wattie

That bit of information — confirmed days later in November by AECL — launched a frenetic 10-week tussle between the company and Canada's independent regulator that led to the shutdown of the isotope-producing nuclear reactor, so vital in the diagnosis and treatment of cancer and heart disease. Fearing an international crisis, the government intervened, overruled the regulator and ultimately fired its president, Linda Keen — a move that stunned the global nuclear community.

Insiders suggest the firing was intended to distract attention from the ugly spill of evidence leaching from the dispute: At the dawn of the nuclear renaissance, with the appealingly green industry planning a series of multibillion-dollar projects, Canada's nuclear flagship is wobbling. If it falters, potential sales of the trademark Candu reactors to industrialized countries could be jeopardized, and the prospect of the Conservative government allowing AECL to be swallowed by an international competitor could climb — putting Canada's reputation as a world nuclear heavyweight at risk.

Over the past month, The Globe and Mail has interviewed dozens of people with intimate knowledge of the company and the global nuclear landscape, including AECL employees, retirees, former board members, federal bureaucrats, former government ministers, current and former members of the CNSC and business people with close ties to AECL.

The interviews revealed:

* AECL has been fraught for years with internal management problems that were repeatedly acknowledged by government officials and flagged by business partners and the federal auditor-general, yet never fixed;

* the company's lobbying campaign to have the government decrease tensions with the CNSC, backed by private-sector partners, has been mounting steadily for more than a year;

* Minister of Natural Resources Gary Lunn was allegedly e-mailed information about problems at AECL at least two days before he admitted to learning about the reactor shutdown (he denies seeing the e-mail);

* emergency legislation passed last December restarted the reactor only days earlier than it could have been if the safety commission had not been overruled.

While AECL's long-festering tensions with Ms. Keen — seen as the company's main obstacle to new reactor sales — were defused by her firing last month, the red flags raised by the isotope debacle and all that seeped out in its wake may have created new hurdles for the Crown corporation.

"It's not good for AECL. They look incompetent. They look sloppy. They look unbusinesslike," said Anne McLellan, who oversaw the company for five years during the mid-1990s as natural resources minister. "Canada doesn't have that many signature technologies. This is your last, best shot to see AECL survive. I think in an area like this, you have to fish or cut bait."

A slippery slope

AECL was created as a Crown corporation in the postwar heyday of 1952. The company's first three decades are historic: The work done by scientists at Ontario's Chalk River and Manitoba's Whiteshell Laboratories cemented Canada's reputation as a producer of some of the world's top nuclear research.

But in the late 1980s, the company slowly began its downward slide. Brian Mulroney's Conservative government considered privatizing parts of the company. By 1991, MDS Inc., an international drug and medical research company, won a bid to buy Nordion International Inc., the profitable isotope-producing arm of AECL. The price tag: $165-million.

"They got a heck of a deal," said Robert Ferchat, the former Bell Mobility chief executive who was chairman of AECL in 1991. "They got a company who had a lock on the world markets for the isotopes, and no competition."

The deal included a long-term agreement under which AECL was compelled to provide MDS with a continuous stream of isotopes or face penalty.

Mention of the deal still raises ire in Deep River, where most Chalk River employees live. The tiny community northwest of Ottawa was created in 1944 for the Manhattan Project where the first atomic bomb was made. The deal marked the beginning of an era in which the company's commercial obligations started taking priority over research pursuits.

Through the early 1990s, the deal began to cause problems when NRU, built in 1957, and its older backup, NRX, started showing their age. AECL struggled — and failed — to get funding for a replacement.

"That reactor was old and tired in 1994. They were using equipment that was primitive — old Black and Decker drills, everything about it looked and felt decrepit," said Mr. Ferchat, who tried to raise alarms about company spending. "Executives kept telling me I'm only supposed to look after the board. They didn't want you in their business."

With prospects of a new reactor looking grim, AECL began designing a $32-million package of upgrades for NRU that would, among other things, add a backup emergency power supply that was fire-, flood- and earthquake-resistant, to convince the regulator to extend NRU's lifespan past 2000. The undertaking was "very demanding," said Phil Gumley, an engineer involved in the plans. "When we first learned about the requirement, I kind of felt a bit depressed knowing exactly what we had to do. We knew we were in for a long haul in 1992."

Progress on the upgrades slowed in the mid-1990s when the Liberal government began a nationwide program of cuts. AECL became "a skeleton of an organization that could barely function," said one former middle manager.

Ms. McLellan, the natural resources minister at the time, defended the approach. "Back in the early 1990s, it wasn't clear what the future of nuclear was," she said. "There had been no new facilities built in many years. [The nuclear accidents at] Chernobyl and Three Mile Island were still fresh in people's minds. It was a time of great uncertainty."

But AECL could have done more with its resources, Ms. McLellan said. "I don't think they ever stepped up to the plate in the way their main competitors did. However, AECL did have one hand tied behind its back in the sense that government could never provide them with the dollars they felt they needed to compete effectively. I also thought that they were an undisciplined operation."

Part of Ms. McLellan's antidote was to appoint Reid Morden, the former director of the Canadian Security Intelligence Service, as AECL's CEO in 1994.

"When I was first appointed, it was to bring about managerial change," Mr. Morden said, adding that guarding the isotope supply was a clear priority. Early in his term, that issue was highlighted by the threat of a strike involving one of the unions at Chalk River.

"I think it's one of the few times I actually had a call from the minister saying, 'Whatever is going on up there, fix it,'" Mr. Morden recalled.

That same year, MDS Nordion agreed to foot the $140-million bill for a pair of new reactors, called Maples. "MDS felt it was a big price, but there was a good feeling," said a former MDS Nordion executive, adding: "They quickly ran into problems and the problems just kept coming."

The major stumbling block occurred during commissioning tests that showed the reactors have a positive power coefficient instead of the negative power coefficient that design plans predicted. Reactors can work in either mode. However, until AECL is able to explain mathematically why their predictions were wrong, the regulator will not sign off on the Maples' operation.

"Being able to predict things is absolutely key in the nuclear business," said John Waddington, a former director-general of the CNSC.

As the Maples situation heightened tensions between the regulator and AECL, politicians became increasingly unwilling to step in, the former MDS Nordion executive said.

"[MDS Nordion's] petition was always … remember if something bad happens to NRU… Canada is going to be hurt, and we're going to look really bad. Having this high-tech business where Canada is the best in the world in health care, you really don't want to mess that up.

"This project was considered a tar baby. If you touch it, it sticks to you."

Butting heads

When Conservative cabinet minister Gary Lunn inherited the Natural Resources portfolio in February, 2006, it appeared problems at AECL were beginning to subside. Fed up with trying to explain the Maples' ballooning costs and six-year delay to shareholders, MDS Nordion had agreed to a mediated settlement with the Crown corporation that effectively transferred the Maple problems back into AECL's custody. MDS Nordion was paid $25-million, and a new 40-year isotope supply agreement was struck.

Within a month of becoming minister, Mr. Lunn met with Ms. Keen, the Liberal-appointed, two-time head of the nuclear regulator. He shared with her the new government's view that regulatory oversight could be streamlined. The pair had "great discussions," Mr. Lunn recalled this week. However, sources in Ottawa told The Globe the meeting had an icy tone, punctuated by Ms. Keen's reminder to Mr. Lunn of the CNSC's quasi-judicial, arms-length status.

Soon after, Ms. Keen took the podium at the Canadian Nuclear Association's annual convention and gave notice that the commission was imposing more rigorous safety standards and, being underfinanced and understaffed, could not meet the booming industry's timelines for new approvals.

For AECL, the announcement was a blow. The company was counting on the commission to conduct prelicensing consultations on the ACR1000, the next-generation Candu seen as the company's hope for future commercial success. Such consultations are common in countries that are home to major reactor companies and critical to ensuring that companies don't proceed along expensive, flawed design paths.

Ms. Keen's suggestion that her overstretched commission would no longer prioritize prelicensing was seen as obstructionist.

AECL's private-sector partners, including SNC-Lavalin, GE Canada and Hitachi Canada, hired some of the best-connected lobbyists in Ottawa to carry that message forward; other industry members complained directly to the Prime Minister's Office, sources said.

"We've tried to communicate however we could to whomever we could, to make this point," said Patrick Lamarre, president of SNC-Lavalin's nuclear division.

Michael Burns, the B.C.-based wind power executive who Mr. Lunn appointed as chairman of AECL, began to lobby the minister, whom he said he spoke with once a week during his chairmanship, about addressing the problems with Ms. Keen and her commission.

"I told [Mr. Lunn] then the dysfunctional relationship was going to cause serious trouble for commercial operations at the company. I told him we were going to have a train wreck. And I gave him a plan to fix it," Mr. Burns said.

The goal, he said, was to induce the government to legislate an overhaul at the CNSC, including Ms. Keen's position.

Mr. Lunn refused to discuss whether he attempted to push that reform in Ottawa, saying he is "not at liberty to talk about … discussions with cabinet colleagues."

Mr. Burns said his impression is that Mr. Lunn tried, but "couldn't get any traction."

A reactor shuts down

The train wreck that Mr. Burns forecast began in slow motion during the first week of November, 2007.

A dearth of leadership was beginning to show at AECL. The company's Mississauga-based president, Robert Van Adel, had spent little time in the office since announcing his retirement that June, and, because the company was embarking on a restructuring plan, there were no immediate plans to hire a new CEO. On top of that, Mr. Burns, the company's frustrated chairman, decided to resign.

While the leadership at AECL's headquarters in Mississauga was hollowing out, a problem at Chalk River was heating up. There, a CNSC staffer and former AECL employee (who declined to be interviewed for this story) divulged to his new boss his hunch that a final element of the NRU safety upgrades — the connection of two seismically qualified pumps to the new emergency power supply — had not yet been completed.

Staff were working on the assumption that the pumps had been connected, based on a letter that AECL sent to the regulator in December, 2005, confirming completion of the work. "All seven NRU Upgrades are now fully operational …" the document read.

Confused, the CNSC inquired about the pumps, and, after an internal scramble, AECL confirmed the problem. For the next week, staffers on both sides quietly tried to figure out what led to the miscommunication. In the midst of this, AECL shut down NRU for monthly maintenance. As tensions with the CNSC rose, it became clear the reactor would not be restarted.

"AECL considered the implications of starting up again. We were pushing back. They were taken by surprise," the CNSC insider said. "It was like a game of chess."

Two weeks later, AECL attempted to get the regulator's consent to restart the reactor with one of the new pumps connected. But their technical argument, called a safety case, was rejected.

"It was not good. It needed more work. It was about 12 pages of cold calculations," one insider said.

With AECL and the CNSC still trying to hammer out a compromise, concerns about the isotope supply began to catch politicians' attention. Mr. Lunn and Health Minister Tony Clement began to publicly criticize Ms. Keen, characterizing her as a partisan zealot blind to the health impacts of her decisions on Canadians in need of isotopes, and guilty of safety overkill.

As they lobbied against the CNSC, it seemed of little importance to the ministers, as well as to Prime Minister Stephen Harper, that the Chalk River facility sits on earthquake fault lines. The area has never experienced a major earthquake, but two minor quakes struck in December, registering 3.0 and 3.6 in magnitude.

"There will be no nuclear accident," Mr. Harper announced in the House of Commons on the day Parliament was to vote on a bill to overrule the regulator.

That same day, after being served with a government directive informing the CNSC to take into account the health of Canadians, Ms. Keen told Parliament that she could allow the reactor to return to service with one new pump connected in about a week if AECL provided the commission with a proper safety case.

But AECL said they could not complete the safety case until Dec. 13, meaning that, without government intervention, the reactor would remain shut down until around Dec. 18.

Dissatisfied with the timeline, Parliament voted to enact Bill C38, allowing AECL to restart the reactor once one pump was connected without applying for consent to the regulator.

The reactor was officially restarted on Dec. 16 — just days earlier than Ms. Keen may have allowed without parliamentary interference.

Still, the following month, Ms. Keen was removed from her presidential post, a move that raised questions about whether the ugly, two-month power play was really about isotopes.

"This should never have come to a midnight session in Parliament," said Duane Bratt, a nuclear policy expert at Calgary's Mount Royal College. "The real issue is these new reactors that are about to be approved. The Canadian nuclear industry is facing competition in their backyard. There is fear."

With a report from Shawn McCarthy in Ottawa

Enbridge gets pipeline approval from NEB

Globe and Mail, CP

February 23, 2008

The National Energy Board has given its approval of the $2-billion Alberta Clipper oil pipeline proposed by Enbridge Inc. but attached certain conditions in response to concerns raised in public hearings last November. The pipeline will stretch from Alberta to Wisconsin. The Canadian portion stretches 1,078 kilometres between Enbridge's terminal near Hardisty, Alta., and the Canada-U.S. border near Gretna, Man. The Calgary-based pipeline company must conduct an emergency response exercise at its South Saskatchewan River crossing to allay concerns about safety. The company says it's reviewing the details of the board's decision. ENB (TSX) closed up 13 cents at $40.83.

NEB Alberta Clipper proceeding - OH-4-2007

OH-4-2007 Reasons for Decision

Southern Lights - Enbridge pipeline project clears regulatory hurdle

Globe and Mail, CP

February 21, 2008

Enbridge Inc. says the National Energy Board has approved the $2.2-billion (U.S.) Southern Lights pipeline project, which will ship chemicals from the U.S. Midwest to northern Alberta for oil sands development. The new line will carry 180,000 barrels per day of diluent - light hydrocarbons or chemicals used to dilute the oil sands enough to allow it to flow through pipelines. The full Southern Lights plan involves laying nearly 1,100 kilometres of new pipe, reversing the flow in some existing lines and using other existing facilities. ENB (TSX) closed up 54 cents to $41.24.

NEB Southern Lights Proceeding OH-3-2007

OH-3-2007 Reasons for Decision

Enbridge revives $4-billion pipeline

New demand from Asia, domestic clients; Chinese pullout cancelled earlier project

NORVAL SCOTT

Globe and Mail

With files from Reuters

February 22, 2008

CALGARY -- Enbridge Inc. has lined up enough support from a clutch of Asian refiners and Canadian oil producers to revive its $4-billion plan to build a pipeline from the oil sands to the West Coast, just months after China pulled out of the project.

Enbridge has now turned to Southeast Asia to find customers for its Gateway pipeline and attracted enough funding from refiners there to accelerate work on winning regulatory approval, says Enbridge chief executive officer Patrick Daniel. "The pull from the other end of Gateway, initially, was primarily from the Chinese, but in this initiative the Chinese are not participants," Mr. Daniel told investors at a conference in Whistler, B.C., yesterday.

The project was shelved last year when PetroChina Co. Ltd. - a Chinese national oil company that had said it would buy half the Gateway crude - withdrew and rebuked Ottawa for not doing enough to support the project.

Mr. Daniel has travelled to Asia regularly, leading Enbridge teams seeking to woo potential customers. Now, he said, customer demand for the pipeline "ranges from Japan down to Singapore - so [there is a] much broader Southeast Asian interest."

Print Edition - Section Front

Section B Front Enlarge Image

The Globe and Mail

The Enbridge pipeline would enable Canadian oil sands producers to tap into a new and fast-growing market. The U.S. Midwest accounts for most oil sands exports, putting producers at risk if that market becomes saturated and prices plummet.

Oil sands producers have been leaning heavily on pipeline builders such as Enbridge to connect Alberta to new markets, including the U.S. Gulf Coast. Some producers had cooled on Asia as a potential destination as U.S. refiners showed they were willing to take on more Canadian production. Enbridge is looking for support to build a pipeline from Illinois to Texas that would allow Canadian crude to reach markets further south.

But interest for an Asian outlet seems to have returned. Kinder Morgan Canada already operates a medium-sized pipeline from Alberta to British Columbia's coast that it plans to expand. It usually supplies crude to California or the U.S. Northwest.

Last year, a record amount of that crude - as much as seven oil tankers, or about 550,000 barrels of oil - travelled to buyers in Asia last year, according to the National Energy Board, Canada's energy regulator.

The increased shipments suggest that Asian firms have been testing both Canadian heavy crude and light synthetic crude in their refineries to see how well they work, with a view to taking more in the future.

"The crude needs to be tested in refineries, and that's what is happening," Ian Anderson, chief executive of Kinder Morgan Canada, said in a recent interview.

"It will take some time until there's a meaningful [Asian] market developed that producers will commit significant portions of supply to. But in the next several years we'll see Canadian crude penetrate that market more and more, until there's a critical mass that would underpin both producers making a commitment [to Asia] and a significant pipeline expansion," Mr. Anderson said.

While Enbridge would not say which countries or companies have committed to Gateway, South Korea would likely join Singapore and Japan as customers.

Enbridge is still in talks with some Chinese firms about getting involved in Gateway, spokeswoman Jennifer Varey said. She wouldn't say how much funding customers have committed to the project.

ENBRIDGE INC. (ENB)

Close: $40.70, down 54¢

February 15, 2008

Water Provides an Ocean of Opportunity for Clean Energy

RedOrbit News

14-Feb-2008

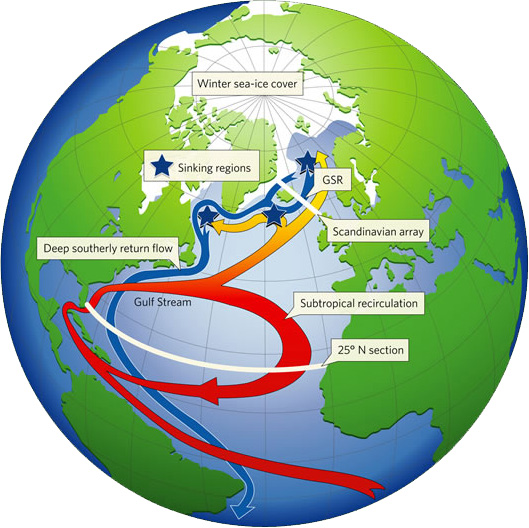

As researchers continue their search for new sources of clean energy, their attention has turned to the Gulf Stream. Rushing at 8.5 billion gallons per second, the Gulf Stream represents a potential non-stop flow of new energy.

Florida Atlantic University researchers plan to test a small turbine later this year. They say that the currents could one day be used to produce as much power as 10 nuclear plants and supply one-third of Florida’s electricity.

The university received a $5 million grant from the state in hopes of developing technology that big energy companies can utilize to offer clean efficient energy. As of now, there are currently no commercial projects directed toward ocean currents.

"We can produce power 24/7," said Frederick Driscoll, director of the university's Center of Excellence in Ocean Energy Technology.

Researchers hope that while the initial cost to begin the process may be high, the currents will allow for a cheaper source than fossil fuels. But many things remain unknown, such as the “Cuisinart effect” by which the spinning blades could pulverize the creatures of the ocean.

David White of the Ocean Conservatory said that due to the lack of actual testing in the ocean, the environmental effects are currently unknown.

"We understand that there are environmental trade-offs, and we need to start looking to alternative energy and everything should be on the table," he said. "But what are the environmental consequences? We just don't know that yet."

Federal Energy Regulatory Commission spokeswoman Celeste Miller said that they have issued 47 permits for ocean, wave and tidal energy projects. However, most of these permits only allow researchers to study an area’s potential rather than apply equipment.

"It's the best location in the world to harness ocean current power," Driscoll said of the 30 mile wide Gulf Stream.

As an alternative, on the West Coast, researchers are looking at waves as a possible way to generate energy. For example, Canada-based Finavera Renewables has received a FERC license to test a wave energy project in Washington state, which will include four buoys that could generate enough energy to power 700 homes.

Roger Bedard of the Electric Power Research Institute said the organization found that these projects could only be able to supply about 6.5 percent of modern electricity needs.

"We've got a limited amount of flat sandy bottom on the Oregon Coast where we can put out pots and where we can fish, and the wave energy folks are telling us they need the same flat, sandy bottom," said Nick Furman, executive director of the Oregon Dungeness Crab Commission. “It's not the 10-buoy wave park that has the industry concerned. It's that if it's successful, then that park turns into a 200- or 400-buoy park and it just keeps growing."

---

Electric Power Research Institute: http://www.epri.com

Finavera Renewables: http://www.finavera.com

Federal Energy Regulatory Commission: http://www.ferc.gov

Center of Excellence in Ocean Energy Technology: http://coet.fau.edu

Oceans Eyed As New Energy Source

By BRIAN SKOLOFF

AP - Associated Press

14-Feb-2008

DANIA BEACH, Fla. (AP) — Just 15 miles off Florida's coast, the world's most powerful sustained ocean current — the mighty Gulf Stream — rushes by at nearly 8.5 billion gallons per second. And it never stops.

To scientists, it represents a tantalizing possibility: a new, plentiful and uninterrupted source of clean energy.

Florida Atlantic University researchers say the current could someday be used to drive thousands of underwater turbines, produce as much energy as perhaps 10 nuclear plants and supply one-third of Florida's electricity. A small test turbine is expected to be installed within months.

"We can produce power 24/7," said Frederick Driscoll, director of the university's Center of Excellence in Ocean Energy Technology. Using a $5 million research grant from the state, the university is working to develop the technology in hopes that big energy and engineering companies will eventually build huge underwater arrays of turbines.

From Oregon to Maine, Europe to Australia and beyond, researchers are looking to the sea — currents, tides and waves — for its infinite energy. So far, there are no commercial-scale projects in the U.S. delivering electricity to the grid.

Because the technology is still taking shape, it is too soon to say how much it might cost. But researchers hope to make it as cost-effective as fossil fuels. While the initial investment may be higher, the currents that drive the machinery are free.

There are still many unknowns and risks. One fear is the "Cuisinart effect": The spinning underwater blades could chop up fish and other creatures.

Researchers said the underwater turbines would pose little risk to passing ships. The equipment would be moored to the ocean floor, with the tops of the blades spinning 30 to 40 feet below the surface, because that's where the Gulf Stream flows fastest. But standard navigation equipment on ocean vessels could easily guide them around the turbine fields if their hulls reached that deep, researchers said.

And unlike offshore wind turbines, which have run into opposition from environmentalists worried that the technology would spoil the ocean view, the machinery would be invisible from the surface, with only a few buoys marking the fields.

David White of the Ocean Conservancy said much of the technology is largely untested in the outdoors, so it is too soon to say what the environmental effects might be.

"We understand that there are environmental trade-offs, and we need to start looking to alternative energy and everything should be on the table," he said. "But what are the environmental consequences? We just don't know that yet."

The Federal Energy Regulatory Commission has issued 47 preliminary permits for ocean, wave and tidal energy projects, said spokeswoman Celeste Miller. Most such permits grant rights just to study an area's energy-producing potential, not to build anything.

The field has been dealt some setbacks. An ocean test last year ended in disaster when its $2 million buoy off Oregon's coast sank to the sea floor. Similarly, a small test project using turbines powered by tidal currents in New York City's East River ran into trouble last year after turbine blades broke.

The Gulf Stream is about 30 miles wide and shifts only slightly in its course, passing closer to Florida than to any other major land mass. "It's the best location in the world to harness ocean current power," Driscoll said.

Researchers on the West Coast, where the currents are not as powerful, are looking instead to waves to generate power.

Canada-based Finavera Renewables has received a FERC license to test a wave energy project in Washington state. It will eventually include four buoys in a bay and generate enough power for up to 700 homes. The 35-ton buoys rise above the water about 6 feet and extend some 60 feet down. Inside each buoy, a piston rises and falls with the waves.

The company hopes later to be the first in the U.S. to operate a commercial-scale "wave farm," situated off Northern California. The project with Pacific Gas and Electric calls for Finavera to produce enough electricity to power up to 600 homes by 2012. Finavera eventually wants to supply 30,000 households.

Roger Bedard of the Electric Power Research Institute said an analysis by his organization found that wave- and tide-generated energy could supply only about 6.5 percent of today's electricity needs.

Finavera spokesman Myke Clark acknowledged that wave energy is "definitely not the only answer" to the nation's power needs and is never going to be as cheap as coal. But it could be "part of the energy mix," and could be used to great advantage off the coasts of Third World countries, where entire towns have no connection to electrical grids, he said.

Nick Furman, executive director of the Oregon Dungeness Crab Commission, said he fears the wave technology could crowd out his industry, which last year brought in 50 million pounds of crab and contributed $150 million to the state's economy.

"We've got a limited amount of flat sandy bottom on the Oregon Coast where we can put out pots and where we can fish, and the wave energy folks are telling us they need the same flat, sandy bottom," Furman said.

"It's not the 10-buoy wave park that has the industry concerned. It's that if it's successful, then that park turns into a 200- or 400-buoy park and it just keeps growing."

February 14, 2008

Oilpatch profits to hit $23B this year

CBC News

Thursday, February 14, 2008

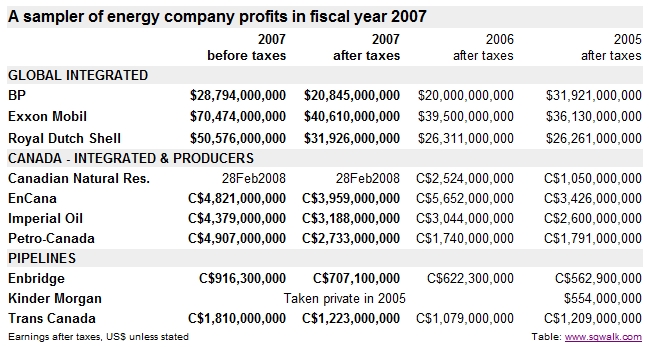

Record high oil prices and rising production from the oilsands should see profits in Canada's oilpatch hitting almost $23 billion this year, the Conference Board said Thursday.

That would represent an 18 per cent jump from 2007's profit figure.

The processing plant at the Suncor oilsands

project in Fort McMurray, Alta.,

pumps steam into the air.

(Jeff McIntosh/Canadian Press)

"With the price of oil expected to stay well above $80 US per barrel for the entire year, industry profits will once again reach new highs in 2008," said Conference Board economist Todd Crawford.

"However, rising industry costs and an expected decline in prices next year, due to additional global supply coming online, should cause profits to weaken in 2009," he said.

Crawford predicts that the ever-cyclical industry will see its profits tumble by 29 per cent in 2009 before recovering in 2010.

The report calls for a 9.2 per cent increase in total crude production this year, with the extra production coming from non-conventional sources like the oilsands. Conventional production will continue to drop.

The big profit increase this year will come despite rising costs and labour and material shortages, it says.

The independent research group also forecasts that Alberta's royalty increases in 2009 will have little effect on oilpatch investment as high oil prices will continue to attract new money.

http://www.cbc.ca/money/story/2008/02/14/oilpatch.html

Groups say federal review of Keystone line is inadequate

COMMENT: Increasingly, North Americans are focussing on the greenhouse gas emissions associated with Alberta's oilsands. In the news item that follows these comments, the intervention being reported on is in the US regulatory process for TransCanada's Keystone Pipeline, which is proposed precisely to move oilsands production to US refineries and markets. It is one example of how that focus on oilsands related GHGs is playing out.

In its own approval decision for the Canadian portion of the Keystone Pipeline, the National Energy Board makes no mention of greenhouse gases, other than to indicate that it was requested to include consideration of them in the List of Issues for the hearing (by the Communications, Energy, and Paperworkers Union of Canada).

Keystone Reasons for Decision - OH-1-2007

The NEB appears to have forgotten the regulatory jurisdiction it embraced with the GSX Pipeline proceeding, with respect to downstream effects of a pipeline. In May 2001, the Joint Review Panel made a (it was hoped) precedent-setting decision to include consideration of these downstream effects, including greenhouse gas emissions. In this case, it considered one of the unbuilt gas-fired generation plants on Vancouver Island - the infamous VIGP, later to be known as Duke Point Power - that would be built as a consequence of the GSX Pipeline. The precedent was used later to argue successfully in the Sumas Energy 2 transmission line hearing that the upstream effects of the SE2 generation plant should be considered in the review of the transmission line.

In its decision approving the GSX, the Panel said,

"Regarding GHG, the Panel considers climate change an important Canadian and global issue and recognizes the Government of Canada’s effort in this regard by the ratification of the Kyoto Protocol and the development of the Climate Change Plan for Canada. Consideration of GHG emissions associated with a proposed project allows applicants, the public and governments to evaluate proposals and actions in the context of existing and developing policies and plans for managing GHG emissions (i.e., the Climate Change Plan for Canada)." (p32)GSX Reasons for Decision - GH-4-2001

Perhaps it's the change in federal government, or perhaps the NEB believes that what it decides in British Columbia doesn't really apply where the big continental oil and gas infrastructure is at play... Whatever, greenhouse gas emissions didn't get even a cursory nod in the NEB's Keystone decision.

See also Environmentalists target airline customers about other campaigns focussing on oilsands and GHGs.

Pipeline is an environmental risk, below, is just one of many letters to North Dakota newspapers expressing other concerns about the Keystone project, mainly about more local issues to do with leaks, health, and safety.

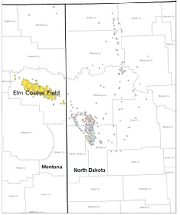

Elsewhere in North Dakota, concerns about pipelines appear lost in excitement over the state's own oil boom. See Dunn County residents learn more about oil at Killdeer meeting, also below. The Bakken Formation which underlies eastern Montana, western North Dakota, and southwestern Saskatchewan could contain as much as 500 billion cubic feet of oil. In an industry always overexcited at the size of a man's oilfield, the big numbers bandied about Bakken are to be expected, but take them with a cold shower. The economically producible oil will be substantially less.

But IF new work in Bakken proves that there's a lot of oil there, you can also expect promised oilsands investment to ooze right out of Alberta and into Bakken. Not all oil production has the same ecological footprint. Bakken is sweet crude and produces gas as well as oil.

See the Wikipedia entry on the Bakken Formation

Janell Cole

N.D. Capitol Bureau

Thursday, February 14, 2008

BISMARCK — The TransCanada Keystone Pipeline shouldn’t have a final go-ahead yet because a federal environmental study failed to heed the increased global warming caused by the “dirty” tar sands oil the line would carry, environmental groups said Wednesday.

The groups, including the Dickinson–based Dakota Resource Council, also charge that the proposed pipe strength isn’t good enough to ensure groundwater safety and that the federal study neglected to consider protection of American Indian cultural resources.

The 30-inch pipeline, set for construction beginning this spring, is to run from Alberta through Saskatchewan, Manitoba, the Dakotas, Nebraska, Missouri, Kansas and Illinois. It will carry oil extracted from the northern Alberta tar sands to Illinois refineries, with a future branch extending to a crude oil hub in Oklahoma.

DRC joined with the Natural Resources Defense Council, headquartered in New York, and the Iowa-based Plains Justice to comment on the final federal environmental impact statement.

The groups said they “found that the final (EIS) failed to address the impacts of expansion in refineries for the dirty tar sands oil, and the local impacts of the pipeline.” And, they said, the study fails to show how “promoting and catalyzing expansion of tar sands oil” is in the national interest. Processing tar sands oil causes three times as much global warming per barrel compared to conventional oil, they said.

The State Department is eventually expected to issue a “record of decision” giving the federal approval for the construction. Meanwhile, the North Dakota Public Service Commission is also in the final stages of approving the route through the state, from near Walhalla to near Cogswell. The PSC meets again this morning to work on its draft order.

TransCanada spokesman Jeff Rauh said Wednesday, “The EIS is adequate.” He said it covers all the pertinent issues and “we look forward to starting on the project.”

Pipeline critic Janie Clapp of Lankin said Wednesday, as she and other opponents have said before, that the federal government’s approval of a slightly thinner pipe in sections of the line “may contaminate our drinking and agricultural water.”

But Rauh said the federal pipeline safety agency that has permitted the slightly thinner pipe determined it will be as safe as or safer than other pipelines. Its approval includes 17 pages – more than 50 special conditions – that the company must meet in order to use the slightly thinner pipe, he said.

Rauh also said the EIS contains 35 pages of detail about the consultation done with Indian tribes and the State Department regarding the line’s possible affect on native resources.

Janell Cole works for Forum Communications Co., which owns The Dickinson Press.

Pipeline is an environmental risk

By GEORGE MAGNUS JOHNSON

Fargo, ND

Bismarck (ND) Tribune

Jan 15, 2008

Once again North Dakota's beleaguered environment and protesting citizens are being swept aside by a big business juggernaut, the Canadian Keystone pipeline. If this pipeline is so essential for our never-ending gas guzzling habits, why can't it be built along the I-29 corridor? This siting would lessen environmental despoilation, the threat of an accident (remember Clear Brook, Minn.), and the inevitable risks of water contamination.

But no, Keystone says it will build where it wants to. The company apparently can get by with arrogant threats to resistant landowners and disdain for environmental concerns. They say they cannot change their plans because it would cost too much. Have we heard that argument before?

The next question to ask is, where is the North Dakota Public Service Commission? Are they in place to serve the interests of corporations or to protect North Dakota's environment and citizens? An excellent letter on the subject appeared in a newspaper in September 2007, pointing out the near-certainty that this pipeline - indeed any pipeline - will sooner or later leak.

Now is the time to contact the PSC. I understand that they will make the final decision in mid-February. The phone number is 328-2400 and the e-mail address is ndpsc@nd.gov.

Dunn County residents learn more about oil at Killdeer meeting

By LAUREN DONOVAN

Bismarck Tribune

Feb 14, 2008

KILLDEER - Cathy Trampe, of Dunn Center, said she made a deal with her husband, Ernest: If they got an oil well out in one of their grazing pastures, they'd sell the cows.

The well came and the cows got sold, though they're still waiting for their first royalty check in the mail.

The Trampes and more than 130 others from the Dunn County area were in Killdeer on Tuesday night for a town hall meeting that was all about oil, though first and afterward it was about visiting over chips, beer and beef sandwiches in the commodious Buckskin banquet room.

There's a lot to talk about in Dunn County these days, with 13 oil rigs lighting up the night like prairie skyscrapers out there.

A lineup of speakers made it clear the well on the Trampes' land is just the tip of what could be the most sustained and lucrative oil "iceberg" in state history.

That deep iceberg of oil in the Bakken formation is situated like a horseshoe, dropped irregularly on the northwest quadrant of the state and covering more than 24,000 square miles. The Bakken's oil reserve could contain as much as 200 billion to 400 billion barrels of oil, which makes the 1.6 billion barrels produced in all of state history so far seem like a proverbial drop in the bucket.

The size of the reserve is under study by both the North Dakota Department of Mineral Resources and the U.S. Geological Survey, with the new numbers expected out in the next two months. But records for state oil production and number of new wells permitted are teetering now.

Lynn Helms, director of the mineral division, told the packed house that daily oil production will likely surpass the state's record set in 1985 by mid-year.

North Dakota, long ranked ninth among states in total oil production, is now ranked eighth ahead of Montana and could move into fifth or sixth place, he said. This year could breech the record for new well permits. That record is 1,098 permits issued in 1981.

The Bakken may take another 40 to 50 years to fully develop making it an extremely sustained oil event. Helms said the micro-porosity of the rock may make it a good candidate for enhanced recovery using carbon dioxide, rather than a water flood, when that stage comes.

Dunn County is in the heart of the best of the Bakken production so far, along with wells in Mountrail County.

Helms said the oil industry expected good production from the Bakken to spill over from Montana closer to the state line, but the surprise has been to find it further afield. That could put Mercer County in a good position for oil development as evidenced by strong interest in Mercer County when the State Land Department auctioned 21,000 mineral acres in the county two weeks ago.

"It's the march to the lake (Sakakawea)," Helms said of the oil rigs' path. "The industry believes there's Bakken potential all the way to mid-Mercer County."

Helms said oil production in Dunn and Mountrail counties is "shooting straight up." A fairly steady increase of daily oil production at around 2,000 barrels jumped up to 7,000 barrels when wells in those counties came in recent months, he said.

He said Bakken formation produces a sweet crude oil that's being "gobbled up" by Tesoro's Mandan refinery. "It's the best oil in the world," Helms said.

Mark Makelky, director of the state's Pipeline Authority, said crude oil pipelines - particularly the east-west Enbridge pipeline - are expanding capacity.

"It's not enough yet," Makelky said. Enbridge will go from 110,000 barrels capacity to 160,000 in its next expansion phase. That phase will max out the pipeline, and the next step is to build another line, he said.

All the natural gas coming off the oil wells and flaring now in Dunn and Mountrail will be eventually gathered, though there are some constraints on the smaller pipelines that feed into the main 42-inch Northern Border Pipeline that exports much of the state's gas production, Makelky said.

Ron Ness, who directs the North Dakota Petroleum Council, said the boom is back, especially in view of oil tax revenue. The state's share of oil taxes could amount to more than $600 million this biennium alone, he said.

A proposed constitutional measure will divert some of that revenue into a trust that could eventually yield $75 million a year in interest, Ness said.

Like pipelines constrain product, North Dakota's available workforce could constrain the boom. Ness said the industry needs 12,000 new and replacement workers over the next four years "to get the job done."

The North Dakota Association of Oil and Gas Producing Counties coordinated the Dunn County meeting and others still to be held.

They're scheduled at noon Feb. 22 in Bowman at the Sweetwater Golf Course Clubhouse; at noon Feb. 25 at the Farm Festival building in Tioga; at 6 p.m. Feb. 25 at the Two Way Steakhouse in Stanley; and at noon Feb. 26 at the 4 Bears Casino at New Town.

Vicky Steiner, director of the county association, said each meeting will be tailored with information for each oil location.

February 08, 2008

Proportionality

Energy Bulletin

7 Feb 2008

There is a strange clause in the North American Free Trade Agreement (NAFTA) that applies to only one country, Canada. The clause states that Canada must continue to supply the same proportion of its oil and gas resources to the US in future years as it does now. That’s rather a good deal for the US: it formalizes Canada’s status as a resource satellite of its imperial hub to the south.

From a Canadian perspective there are some problems with the arrangement, though. First is the fact that Canada’s production of natural gas and conventional oil is declining. Second is that Canada uses lots of oil and gas domestically: 70 percent of Canadians heat their homes with gas, and Canadians drive cars more and further than just about anyone else. The problem is likely to come first with natural gas; as production declines, there will come a point when there isn’t enough to fill domestic needs and continue to export (roughly 60 percent of Canada’s gas now goes to the US).

That point is not decades in the future, it is fairly imminent.

Then there is the problem of Climate Change. Canada is committed by treaty to reducing domestic emissions of carbon dioxide. But most of Canada’s emissions come not from consuming fossil fuels, but producing them. Increasingly, from producing synthetic diesel fuel from the tar sands of Alberta.

Even if Canadians decide to drive less and turn down their thermostats, those efforts will do little or nothing to change energy production rates (hence emissions rates), because any extra amounts of fuel produced but not used domestically will simply be exported south; in fact, they virtually must be by the terms of NAFTA.

So Canada’s energy security and global climate security are both held hostage by a provision within a trade agreement, a provision that is unique in all of the world’s treaties. Canada has every reason to repudiate the proportionality clause, and to do so unilaterally and immediately.

Of course, the current Canadian government will not do so. Nor will the main opposition party. Both are securely bound to do the will of their puppeteers in Washington. But what about the NDP, Canada’s other main (center-left) party? Couldn’t it make the abolition of the proportionality clause a key campaign issue? Surely Canadians care about energy security and simple fairness. By raising the question, the NDP would educate Canadians about the links between fossil fuel depletion, globalization, and climate change, while forcing the other parties to either identify themselves with, or abandon, a policy that imperils their nation’s future.

Party leaders might be wary of the US response, but the latter would be fascinating to see. Of course the US would threaten all sorts of trade punishments. However, the domestic US political fallout is delicious to contemplate: in this case, US motives would require no speculation, as do the nation’s real goals in Iraq or elsewhere in the oil-rich Middle East. Americans wouldn’t be using economic muscle against demonized Arabs on the other side of the world, but against people who are culturally just like themselves who happen to live north of an imaginary line. The unfairness of the proportionality clause would be apparent to everyone and the idiocy of US energy and climate policy would also be plainnot just to Canadians, but to the rest of the world and (crucially) to US citizens as well.

With so much at stake, and with current policy leading inevitably toward crisis, isn’t it time for a bold move such as this?

February 06, 2008

When oil crisis hits, fantasyland will become nightmare

Freezing in the Dark: Why Canada Needs Strategic Petroleum Reserves

Freezing in the Dark: Why Canada Needs Strategic Petroleum ReservesGordon Laxer Parkland Institute & Polaris Institute January 31, 2008 Download report |

Oil Shockwave

Oil ShockwaveNational Commission on Energy Security June 23, 2005 Download report |

Frances Russell

Winnipeg Free Press

Wed Feb 6 2008

IN 1980, furious Albertans slapped bumper stickers on their cars stating "Let the eastern bastards freeze in the dark" to protest Ottawa's "Canada First" National Energy Program. Every federal government since has ceded national energy policy to the provinces and, by proxy, to the North American marketplace.

This appalling abdication of leadership leaves Canada completely exposed to the supply crisis experts predict is inevitable once the world enters the dark and uncertain time of Peak Oil.

Here are some of the reasons why:

Canada exports 67 per cent of its oil to the U.S. yet 40 per cent of Canadians are totally reliant on offshore, mostly Middle Eastern, oil. The three leading Middle Eastern countries upon whom 36 per cent of Ontarians and 90 per cent of Quebecers and Atlantic Canadians depend are Algeria, Iraq and Saudi Arabia.

Before the North American Free Trade Agreement, 30 per cent of Canada's oil was exported to the U.S. NAFTA has more than doubled Canada's oil exports south.

The five proposed new pipelines from Alberta's tar sands to the U.S. will commit 75 to 80 per cent of Canada's oil to the American market. Yet it is the taxpayers of Alberta and Canada who will pay the staggering environmental costs and subsidize the extraction bills.

NAFTA's proportionality clause prohibits Canada's government from reducing energy exports even in times of crisis unless Canada cuts its consumption by the same amount.

No new east-west oil pipeline has been built in Canada since the Trudeau era. Until 1999, there was a steady flow of 250,000 barrels of western oil east to Montreal through the Montreal-Sarnia pipeline. Since 1999, that same pipeline brings 250,000 barrels of offshore oil west to Sarnia. Industry, not government, reversed the flow, no questions asked by government.

If a crisis hits, there is not enough east-west pipeline capacity to transport western oil to eastern Canadians.

Not only are there no new east-west pipelines on the drawing board, none is even being contemplated. No statistics are kept so no one knows where Newfoundland's daily 370,000 barrels of oil go.

Canada is the only oil-producing country -- and the only western industrialized country -- not to have a Strategic Petroleum Reserve (SPR). The International Energy Agency (IEA) requires net import nations to maintain emergency 90-day oil reserves. Net export nations are not obliged to keep SPRs because the IEA sensibly assumes no country exports without ensuring domestic needs first. The IEA has no mechanism for a nation that doesn't control its own resources.

Peak Oil is coming fast. The U.S. Department of Energy predicts it no later than 2010. The drop-off will be steep and rapid, throwing the world into crisis upon any war, terror attack or natural disaster. "Government intervention will be required, otherwise economic and social implications would be too chaotic," says the USDE.

Oil Shockwave, a 2005 U.S. National Commission on Energy Policy report, warns that a fairly minor disruption to world oil supplies would create a 177 per cent price spike. If the U.S. bombs Iran and the Strait of Hormuz is closed, global supply could be cut by one-fifth, or 17 million barrels a day.

As oil supply tightens, nations are moving away from free markets. About 80 per cent of global oil reserves are controlled by state-owned oil companies. Most have a nationalist orientation; domestic needs come first.

Canada's energy policy -- or lack thereof -- is unique across the globe. Again, it has no SPR, although nearly half its citizens are totally dependent on foreign oil. It ranks its own domestic needs and security inferior to those of its neighbour. Central and Atlantic Canadians are left without energy security and dependent on Middle East oil so that the U.S. can have greater energy security and less dependence on Middle East oil.

These sobering realities -- and more -- are laid out in a new report by the University of Alberta's Parkland Institute and Ottawa's Polaris Institute. Entitled Freezing In The Dark: Why Canada Needs Strategic Petroleum Reserves, its author is University of Alberta political economist Gordon Laxer, Parkland's founding director.

Laxer finds the curtain of silence around Canada's lack of energy security "unbelievable. We are as dependent on Middle East oil as the Americans. Every other country is talking about its security of supply -- India, China, the U.S. They are locking up long-term contracts with oil-producing countries. But here, nothing. We are so focused on our exports that nobody in Ottawa seems to think about security of supply for Canadians."

Laxer is shocked at the disinterest he encountered at the National Energy Board and Natural Resources Canada. "There's resource nationalism rising around the world, but the NEB and NRC just say they can't see a problem: 'We have all this oil and we can go to spot markets.' They're off in fantasyland."

When the oil crisis hits, Canadians will find the fantasyland a nightmare. They shouldn't forget who to blame.