January 31, 2008

Suncor presses ahead with Voyageur expansion

Royalty deal paved way, says CEO

Shaun Polczer

Calgary Herald

Thursday, January 31, 2008

Barely hours after reaching an agreement with the province on royalties, Suncor Energy Inc. on Wednesday pushed ahead with its $20.6-billion Voyageur oilsands expansion.

The project, which will add 200,000 barrels per day (bpd), will take Suncor's oilsands production past 550,000 bpd by 2012, making it the largest oilsands producer in Canada and, indeed, the world.

On Wednesday, company president and CEO Rick George said Tuesday's royalty deal was the catalyst to formally sanction the massive undertaking.

"Was it a factor? Absolutely," he said. "It's fair to both sides and enabled us to move forward overall.

"We do want to be the developer of choice and we do also want to be the developer that's here for the 50- to 100-year run, not just the short term."

Voyageur becomes the latest in a backlog of more than $100 billion worth of oilsands projects on the books slated for the Fort McMurray area.

Suncor joins Shell and Canadian Natural Resources Ltd. among operators that have committed to building multibillion-dollar expansions to extract oil from the gooey sands and send it to U.S. refiners.

More than half of the project's estimated budget -- about $11.6 billion -- is earmarked for the construction of a third upgrader that will convert 245,000 bpd of bitumen into 200,000 bpd of synthetic crude oil.

Another $9 billion will go to expanding the company's Firebag in-situ project, which will be built in four subsequent phases.

At its peak, the project will see 7,800 workers onsite.

Voyageur has been in the works since 2003, but was put on hold while Suncor reviewed costs that were pegged at $10 billion as recently as 2005.

George estimated that some $2.5 billion has been spent to date on front-end engineering and project scope work. "We only have $18 billion to go," he quipped.

George said Suncor took pains to reduce environmental impacts such as water use and said the door is open for applying new technologies, such as coke gasification to minimize the use of natural gas to make oil.

Suncor said the project would generate a 15 per cent return on capital at oil prices of $60 US a barrel, although UBS analyst Andrew Potter estimated an after-tax gain of 12 per cent at oil prices of $70 -- a rate he termed "reasonable."

Oil prices rose 69 cents in New York on Wednesday, to close at $92.33 US.

"(It's) a return that is competitive with full cycle global oil exploration," he noted.

Along with the Voyageur expansion, Suncor announced a $7.5-billion capital budget for 2008, including $6 billion earmarked for oilsands.

"We continue to believe that Suncor represents a best-in-class story from an execution and growth standpoint," said Raymond James analyst Justin Bouchard.

spolczer@theherald.canwest.com

Suncor project overview

- The $20.6-billion investment is expected to deliver an integrated expansion to boost production to 550,000 bpd in 2012.

- About $9 billion is to be spent to construct four stages of in-situ production, with each stage to produce an average of 68,000 bpd of bitumen.

- About $11.6 billion will go toward construction of an upgrader designed to process 245,000 bpd of bitumen into 200,000 bpd of crude oil. The product slate is to consist of approximately 85 per cent sweet crude oil and diesel, and 15 per cent sour crude oil.

- The cost estimates include investments in infrastructure, including pipelines, camps, administration facilities, cogeneration, tank farms and an interchange on Highway 63 to enable safe traffic flow.

- At peak construction in 2009 to 2010, the expansion is expected to employ 7,800 people. On completion, the expansion is expected to create 800 permanent new jobs.

© The Calgary Herald 2008

B.C. firm gets U.S. funds for ethanol plant

Gordon Hamilton

Vancouver Sun

Thursday, January 31, 2008

A Vancouver bioenergy company has been awarded up to $30 million by the U.S. Department of Energy to build a small-scale biorefinery in Colorado.

The grant to Lignol Innovations Inc., the U.S. subsidiary of Vancouver-based Lignol Energy Corp., is part of a $114-million funding commitment by the U.S. to four different companies. Each is to build refineries that can commercially produce ethanol from cellulose, part of a U.S. government commitment to produce 30 billion gallons of ethanol a year from a variety of sources by 2020.

The Department of Energy said the government grants will cover about a third of the cost of the projects.

"This is a major, major injection of cash into new technologies," said Lignol CEO Ross MacLachlan of the award.

Lignol is to build a plant in Colorado, which MacLachlan said will have a total cost of $88 million.

The plant is to be operated by Suncor Energy, which operates a refinery in Commerce City, Colo. Suncor is to buy all of the ethanol produced.

A condition of the U.S. funding is that the plant must be completed by 2012. Once completed, it is expected to produce 2.8 million gallons of cellulosic ethanol a year, MacLachlan said.

Cellulosic ethanol is essentially alcohol distilled from the natural sugars in trees. It takes far less energy to produce ethanol from wood than from corn, but it is more costly.

Lignol has a pilot plant that uses a pulp digester to cook wood chips to remove the lignin, the binder in wood that holds the fibres together.

The pulp is broken down by enzymes into sugars which are then fermented and distilled. MacLachlan said the enzymes are what makes the process expensive, but Lignol's process uses fewer enzymes and extracts other chemicals from the wood that have added value, making the process more feasible.

© The Vancouver Sun 2008

January 19, 2008

Oil Demand, the Climate and the Energy Ladder

By JAD MOUAWAD

New York Times

Published: January 19, 2008

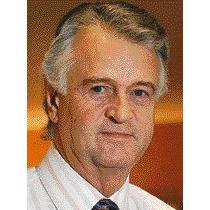

Energy demand is expected to grow in coming decades. Jeroen van der Veer, 60, Royal Dutch Shell’s chief executive, recently offered his views on the energy challenge facing the world and the challenge posed by global warming. He spoke of the need for governments to set limits on carbon emissions. He also lifted the veil on Shell’s latest long-term energy scenarios, titled Scramble and Blueprints, which he will make public next week at the World Economic Forum in Davos, Switzerland. Following are excerpts from the interview:

Dave Olecko/Bloomberg News

Jeroen van der Veer

Q. What are the main findings of Shell’s two scenarios?

A. Scramble is where key actors, like governments, make it their primary focus to do a good job for their own country. So they look after their self-interest and try to optimize within their own boundaries what they try to do. Blueprints is basically all the international initiatives, like Kyoto, like Bali, or like a future Copenhagen. They start very slowly but before not too long they become relatively successful. This is a model of international cooperation.

Q. Your first scenario looks very similar to today’s world, with energy nationalism, competition for resources and little attention to consumption.

A. It depends where you live. I realize there are different opinions about Kyoto in the world. But if you think about Bali, Bali is a good outcome if people can agree how to have useful discussion in the coming two years and the United States, China and India are on board. The Blueprints world is maybe a world that starts slowly and is not that easily feasible, but you see some early indicators that it is a realistic possibility.

Q. The world seems to be at some form of inflection point with a big shift in demand.

A. The basic drivers are pretty easy and they are twofold. You go from six billion people to nine billion people basically in 2050. This combination of many more people climbing the energy ladder, which is basically welfare for a lot of people who live in poverty, creates that enormous demand for energy.

Q. How will the demand be fulfilled?

A. Many politicians think we have to make a choice between fossil fuels and renewables. We have to grow both fossil fuels and renewables. And that will be a huge effort for both.

Q. More energy means more carbon emissions. How do you deal with that?

A. That is absolutely the crux of the matter. The principal way we see is that in the very short term, man-made carbon emissions will increase. But over time people will figure out ways — and we work very hard on that — that while using fossil fuels you try to find carbon dioxide solutions. For instance, carbon sequestration. The problem is that many of the renewables, if you take the subsidies out, are still too expensive. That is the dilemma we face now.

Q. Fossil fuels are still going to represent the lion’s share of the energy mix in the next century?

A. First, there is no lack in itself of oil or gas, or coal for that matter. But the problem is that the easy-to-produce oil or easy-to-produce gas will be depleted or with difficult access. But if you look at difficult oil or difficult gas, which we in the industry call the unconventionals, such as oil sands or shales, they may be exploitable. But per barrel, you need a lot more technology and a lot more investments, and per barrel you need a lot more brain to produce it. It’s much more expensive.

Q. What kind of alternatives can compete?

A. The competition is partly true competition — markets, inventions — and part of it is governments. I think if you can price carbon dioxide, probably you can stimulate carbon capture and sequestration. If you tax a certain form of energy, over time it gets more expensive and you may use less of it.

Q. It still seems there is a gap that is hard to bridge.

A. If carbon is the real bottleneck, as a world it makes sense that we use our money where we get the biggest reduction for the lowest cost. You get more carbon reduction for less money by tackling the power sector and maybe the building sector.

Q. It is still hard to see that people are willing to pay more for greener energy.

A. I am a strong believer and strong advocate of free enterprise. If you would like to solve the carbon problem in the world, free enterprise has to work in close cooperation with governments to form the right framework. How you tackled the sulfur dioxide problem in the United States was the basic inspiration for the European trading system of carbon. So there are examples from the past we can apply to overcome that problem. But we can’t do it on our own as an industry. We need cooperation from governments.

Q. How close are we to an understanding globally that climate policy and energy policy are all interrelated issues?

A. Thanks to Al Gore, and many others, the awareness is there. There is a kind of sense of urgency. Secondly, there is a preparedness to do things. Thirdly, do we agree who has to take what action? I think that is still a huge problem.

Q. There was a lot of disagreement at the Bali climate conference.

A. That is correct. I realize that Bali is still very difficult. I am not a pessimist. I see it as a very difficult start-up. The crux of the matter is, if the people say, “Hang on, we are really concerned about the climate and we’d better do something on carbon emissions,” that is in the end the powerful force which politicians and companies cannot ignore. And I think we are past that point.

---

Pipeline rivals race to U.S. Gulf Coast

TransCanada, upstart Altex aim for Texas

Shaun Polczer

Calgary Herald

Saturday, January 19, 2008

The race is on to the U.S. Gulf Coast to ship Alberta oilsands to Texas, but it could be a case of pride coming up the backstretch for two old rivals.

A decade ago, Jack Crawford was rattling the cages of TransCanada Corp. with a bold proposal to build the Alliance natural gas bullet line to Chicago.

Alliance, a direct challenge to TransCanada's entrenched gas shipping monopoly, shook up the industry and set the stage for a decade-long restructuring of Canada's largest pipeline company.

Ten years later, Crawford is doing the same thing as the CEO of Altex Energy Ltd., which is aiming to build a $5.3-billion bullet bitumen line to the largest refining market in the world.

The stakes are high and Crawford once again finds himself brushing up against TransCanada -- this time with its Keystone heavy oil pipeline to the Texas Gulf.

"It's somewhat reminiscent of Alliance," Bob Hastings, a pipeline analyst with Canaccord Adams in Vancouver, says of Altex. "You know, done on the back of a napkin at the P-Club."

But the rules of the game are not the same as they were a decade ago and the outcome is even less certain.

TransCanada is no longer a monopoly, having diversified into power generation, nuclear facilities, oil pipelines and liquefied natural gas.

CEO Hal Kvisle acknowledged Alliance forced the company to restructure, transforming it into the much larger entity it has become today.

In addition, the field has grown much wider as other competitors seek to diversify their own businesses.

"It's a little different. This time you've got Kinder (Morgan), Enbridge, TransCanada and a bunch of other guys down there," Hastings adds.

As a rule, Altex, a privately owned company backed by one large mystery investor and a couple of U.S. private equity firms [Kern Partners], is tight-lipped about its activities.

But by using a combination of proprietary technologies, the company hopes to shave the cost of shipping bitumen by one-third to half compared with a similar conventional system like Keystone.

Altex hopes to achieve the ambitious target by reducing the amount of natural gas liquids, or "diluent," needed to thin the bitumen to make it flow.

The cost of diluting the heavy oil can often exceed the price of shipping it, Crawford said in a presentation to the summit.

"They're a direct competitor, you know, a head-to-head competitor," Crawford told reporters following the conference. "Having said that, we think our technology from an economic perspective blows away the competition."

Even Kvisle concedes the biggest competitive advantage goes to the pipeline that can deliver the most direct route. On that mark, Altex has the clear lead. "There's no patent on route selection," he quipped. "People can build wherever they want."

By contrast, TransCanada has to ship oil from Hardisty to Winnipeg on reconfigured gas pipe -- the original No. 1 mainline -- before it can start feeding it to Oklahoma, Illinois and eventually to Texas.

"This is the same pipeline C.D. Howe caused to be built and brought down the Canadian government," he said.

But TransCanada's advantage lies in its ability to reconvert depreciated natural gas pipe to carry oil at a substantially lower cost than building a greenfield project.

"They've got free pipe," adds Hastings. "If you've already got pipe in the ground, why would you build another one? I think it's pretty innovative."

In addition, Keystone has substantially more flexibility over the kinds of products it can carry, which include synthetic crude oil that can also be mixed with bitumen to form a product called "syn-bit."

If the Alberta government eventually decides to mandate more upgrading in the province, it could negate Altex's diluent advantage, Kvisle said.

"If the world moves in that direction and there is significantly more upgrading in Alberta that does not create a problem for us," he said. "That's an upside."

If approved, Altex could begin shipping 250,000 barrels a day starting in 2012, while Keystone would move about 600,000 barrels a day starting in 2010.

Keystone in September received National Energy Board approval to convert and construct the Canadian facilities, and in January of this year got the preliminary green light from U.S. authorities to begin construction later in 2008.

TransCanada says it already has firm contracts for 495,000 barrels a day, while Altex, in typically low-key fashion, will only say it is talking to "major" shippers.

Both Kvisle and Crawford deny there is a race to the Gulf, claiming both pipelines will be needed.

The Canadian Association of Petroleum Producers forecasts some 1.8 million barrels per day of incremental heavy oil and bitumen production in Alberta will be added over the next 10 years.

Greg Stringham, the association's vice-president of markets and fiscal policy, noted that figure is greater than the combined capacity of all the pipelines planned to date.

"There are a lot of proposals," he said. "It's still only about half of the growth that we see."

However, it's unlikely all that oil will make it to Texas; some will wind up in Oklahoma, Illinois and eventually California, provided the environmental issues are sorted out.

"We're probably going to need more capacity. We just don't know where."

spolczer@theherald.canwest.com

© The Calgary Herald 2008

Elk Valley Coal pleads for competitive freight rates

COMMENT: One might note that Elk Valley Coal Corp is complaining that it is constrained in its negotiating room because it has no options other than CP to move its coal to port. Put that situation in the mirror and waddyaget? CP has only one customer. Seems like a standoff. Or a perfect opportunity for a mutually satisfactory deal. An imperfect but balanced market, sort of.

For those who don't have a clue what triggered this news item, a "Competition Policy Review Panel" was convened in July 2007. Here is what it is tasked to do:

The Competition Policy Review Panel

* The Competition Policy Review Panel was announced on July 12, 2007, following a pledge in Budget 2007 to review Canada’s competition policies and its framework for foreign investment policy.

* The Panel is chaired by L. R. Wilson. Other members are Murray Edwards, Isabelle Hudon, Thomas Jenkins and Brian Levitt.

* The Panel is targeting to report to the Minister of Industry and the Government of Canada by June 30, 2008.

Objectives

With increased global competition and national governments competing to attract global capital, the Panel believes there are two goals for Canada’s economic performance:

1. To promote Canadian direct investment abroad, and create the domestic conditions to foster the development of Canadian businesses.

2. To maximize Canada’s attractiveness as a destination for talent, capital and innovation.

Mandate

* The task of the Panel is to provide recommendations to the government on how to enhance Canadian competitiveness.

Read more here.

Download the Panel's consultation paper, Sharpening Canada's Competitive Edge.

The Panel's website, www.competitionreview.ca

Teck Cominco was responding to the request for submissions, the deadline for which closed on January 11. Submissions will be posted on the website "within a few days."

"The Panel will [also] hold a series of regional and thematic consultations in selected cities across Canada with interested parties in January and February 2008." But it's January 19th now, and there's nothing on the website about these meetings - perhaps it's an invitation-only deal which will tend to skew mightily the demographic the Panel talks to.

Elk Valley Coal pleads for competitive freight rates

By Scott Simpson

Vancouver Sun

Friday, January 18, 2008

VANCOUVER - British Columbia's biggest mining operation is describing itself as a railway monopoly "captive" in need of freight rate relief in a new submission to a federal competition review panel.

Elk Valley Coal Corporation is asking the Competition Policy Review Panel to scrutinize national rail transport policies with an eye to compelling railways - primarily Canadian Pacific - to offer more competitive pricing for their services.

At the very least, it asks, railways should be obliged to price freight service "on the basis of cost" rather than market advantage.

The Elk Valley operation, a series of five southeast B.C. mines operated and co-owned by Vancouver's Teck Cominco, is worried that it's at a competitive disadvantage to rival Australian producers of metallurgical coal used for steelmaking - some Australian mines have a choice of railways to move their product.

Coal is the number one commodity transported by rail in Canada and accounts for 30 per cent of annual tonnage through the Port of Vancouver.

But a submission to the panel says lack of rail competition means overall costs are so high that a downturn in global coal prices would render some Elk Valley mines unprofitable.

"There is no competition for rail services at any of Elk Valley's mines," said president and CEO Boyd Payne in a press statement. "Each mine is captive to the carrier that serves it."

In its submission to the panel, Elk Valley says it is competitive with Australia on mine operation costs "but excessive transportation costs push the company into the fourth quartile of overall cost for the steelmaking coal industry and makes it vulnerable to volatile prices.

"Elk Valley pays far more for transportation than its competitors in Australia even after adjusting for Elk Valley's greater distance to tidewater."

The submission calls on the panel to effect what it calls "structural changes" in the negotiating relationship between railways and their shipper-customers - principally through the imposition of freight pricing schemes that reflect the true cost of rail operations.

On a year-by-year basis, railways and shippers have recourse to a Transportation Act mechanism called final offer arbitration in which a neutral third party determines if freight rates are fair.

But Greg Waller, Teck Cominco investor relations vice-president, said in an interview on Friday that it's a temporary, short-term solution "that only provides you with one year at a time."

"And in this business we need to make investments for the long term. We need to have the assurance of a cost structure for a period of time longer than one year.

"Whether the price goes up or down, the fact is that our costs are very high in terms of making an investment for the long term."

Canadian Pacific communications director Mark Seland said the railway was "surprised" by the Elk Valley submission and noted that there are no active arbitrations about its pricing schedules.

He said it would not be in CP's best interest to render its customers uncompetitive, because their distress would contribute to a decline in the railway's own revenue.

He also noted that CP's present contract with Elk Valley expires in 2009 and suggested that "it's not coincidental" that that criticism of the current arrangement is surfacing.

© Vancouver Sun

January 17, 2008

The great coal hole

By David Strahan

New Scientist

17 January 2008

There used to be a joke about taking coal to Newcastle but these days the laughing stock is getting the stuff out. Newcastle in New South Wales, Australia, may be the biggest coal export terminal in the world’s biggest coal-exporting country, but even it is having trouble keeping up with demand. The line of ships waiting to load coal can stretch almost to Sydney, 150 kilometres to the south. At its peak last year, there were 80 vessels in the queue, each forced to lie idle for up to a month.

The delays have been lengthening since 2003 – and not just because of the port’s limited capacity in the face of soaring demand. Gnawing doubts are also beginning to emerge about supply, not just in Australia but worldwide, and not only because of logistics but also because of geology. In other words, coal may soon be running short.

Ask most energy analysts how much coal we have left, and the answer will be a variant on “plenty”. It is commonly agreed that supplies of coal will last for well over a century; coal is generally seen as our safety net in a world of dwindling oil. But is it? A number of recent reports suggest that coal reserves may be hugely inflated, a possibility that has profound implications for both global energy supply and climate change.

The latest “official” statistics from the World Energy Council, published in 2007, put global coal reserves at a staggering 847 billion tonnes. Since world coal production that year was just under 6 billion tonnes, the reserves appear at first glance to be ample to sustain output for at least a century – well beyond even the most distant planning horizon.

Mine below the surface, however, and the numbers are not so reassuring. Over the past 20 years, official reserves have fallen by more than 170 billion tonnes, even though we have consumed nothing like that much. What’s more, by a measure known as the reserves-to-production (R/P) ratio – the number of years the reserves would last at the current rate of consumption – coal has declined even more dramatically. In February 2007, the European Commission’s Institute for Energy reported that the R/P ratio had dropped by more than a third between 2000 and 2005, from 277 years to just 155. If this rate of decline were to continue, the institute warns, “the world could run out of economically recoverable …reserves of coal much earlier than widely anticipated”. In 2006, according to figures from the BP Statistical Review of World Energy, the R/P fell again, to 144 years. So why are estimates of coal reserves falling so fast – and why now?

One reason is clear: consumption is soaring, particularly in the developing world. Global coal consumption rose 35 per cent between 2000 and 2006. In 2006, China alone added 102 gigawatts of coal-fired generating capacity, enough to produce three times as much electricity as California consumed that year. China is by far the world’s largest producer of coal, but such is its appetite for the fuel that in 2007 it became a net importer. According to the International Energy Agency, coal consumption is likely to grow ever faster in both China and India.

Another less noticed reason is that in recent years many countries have revised their official coal reserves downwards, in some cases massively, and often by far more than had been mined since the previous assessment. For instance, the UK and Germany have cut their reserves by more than 90 per cent and Poland by 50 per cent. Declared global reserves of high-quality “hard coal” have fallen by 25 per cent since 1990, from almost 640 billion tonnes to less than 480 billion – again more than could be accounted for by consumption.

At the same time, however, many countries including China and Vietnam have left their official reserves suspiciously unchanged for decades even though they have mined billions of tonnes of coal over that period.

Taken together, dramatic falls in some countries’ reserves coupled with the stubborn refusal of others to revise their figures down in the face of massive production suggest that figures for global coal reserves figures are not to be relied on. Is it possible that the sturdy pit prop of unlimited coal is actually a flimsy stick?

That is certainly the conclusion of Energy Watch, a group of scientists led by the German renewable energy consultancy Ludwig Bölkow Systemtechnik (LBST). In a report published in 2007, the group argues that official coal reserves are likely to be biased on the high side. “As scientists we were surprised to find that so-called proven reserves were anything but proven,” says lead author Werner Zittel. “It is a clear sign that something is seriously wrong.”

Since it is widely accepted that major new discoveries of coal are unlikely, Energy Watch forecast that global coal output will peak as early as 2025 and then fall into terminal decline. That’s a lot earlier than is generally assumed by policy-makers, who look to the much higher forecasts of the International Energy Agency, which are based on official reserves. “The perception that coal is the fossil resource of last resort that you can come back to when you run into problems with all the others is probably an illusion,” says Jörg Schindler of LBST.

![]()

According to the Energy Watch analysis, world coal production will peak in around 2025. In that case output would undershoot official forecasts from the International Energy Agency’s World Energy Outlook (WEO) by a substantial margin. Source: Energy Watch Group

A look at how official global reserves are calculated does little to bolster confidence. The figures, compiled by a husband-and-wife energy consultancy called Energy Data Associates based in Dorset, UK, are gathered principally by sending out a questionnaire to the governments of 100 coal-producing countries. Officials are asked to supply figures under clearly defined guidelines, but many do not. “About two-thirds of the countries reply,” says Alan Clarke of Energy Data Associates, “And maybe 50 are usable.”

Top ten holders of proved recoverable reserves. Source: World Energy Council Survey of Energy Resources 2007

Some countries have been known to make elementary errors filling in the forms, often with the effect of massively increasing their reserves. Undoing these apparently innocent mistakes has led to some of the major downward revisions of recent years.

Although Clarke defends his data as the best available, he is also the first to admit that there are shortcomings. “It’s no secret that the result is a bit of a ragbag. It ranges from well-established estimates for some countries to others that are fairly airy-fairy, and some that are highly political and not to be believed.”

Figures for two of the world’s biggest coal producers are particularly hard to glean. Russia has failed to update its numbers since 1996, China since 1990. “There is really nothing very certain or clear-cut about reserves figures anywhere,” Clarke says. Even senior officials in the coal industry admit that the figures are unreliable. “We don’t have good reserves numbers in the coal business,” says David Brewer of CoalPro, the UK mine owners’ association.

Annual production in the top ten coal producers. Source: World Energy Council Survey of Energy Resources 2007

Even so, the industry consensus rejects thoughts of an imminent shortage, or “peak coal. Milton Catelin of the World Coal Institute, the international producers’ trade body, admits that he does not understand what has led to the reductions in quoted figures for reserves, but insists that it is not down to a lack of coal. “With regard to coal the world is not resource limited,” he says. “It’s limited only by the economics of recovery and environmental concerns.”

The industry position is born of the traditional view that “reserves” is essentially an economic concept – the amount of coal that could be produced at today’s prices using existing technology. This is not the same as “resources” – the total amount of coal that exists. Seen in this light reserves are, to some extent, replenishable. If shortage bites and prices rise, uneconomic resources – seams that are too thin, too deep or too remote from markets – become economic and can be reclassified as reserves. And because global resources are vastly greater than global reserves, the industry argues there can be no imminent shortage. “It’s there if the price is high enough,” Brewer says. “It’s all a matter of price.”

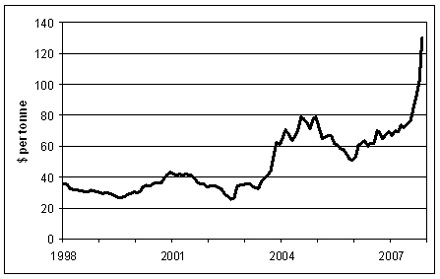

Northwest Europe Steam Coal Marker Price. Source: McCloskey Group

Problem is, the real world seems to have forgotten this piece of economic lore. Although the price of coal has quintupled since 2002, reserves have still fallen. This is similar to what is happening with oil, where fresh reserves have not been forthcoming despite soaring prices. To a growing number of oil industry commentators this is because we have reached, or are just about to reach, peak oil – the point at which oil production hits an all time high then goes into terminal decline.

Some experts are starting to reach a similar conclusion about coal. “Normally when prices go up, mine managers ramp up production as fast as possible and shortage quickly turns to glut,” says coal geologist Graham Chapman of the consultancy Energy Edge in Richmond, Surrey, UK. “This time it hasn’t happened.”

He concludes that the industry has already produced most of the easily mined coal and “from now on it’s going to be a significant challenge”. In China, for example, much of the remaining coal is more than 1000 metres below the surface, Chapman says, while in South Africa the geology is extremely complex. Elsewhere, flooding and subsidence may have “sterilised” significant reserves: the coal is there, but will almost certainly never be mined. As a result, Chapman agrees that true reserves are probably much lower than the official figure.

David Rutledge, chair of Engineering and Applied Science at the California Institute of Technology, shares this view. He became interested in coal after attending a presentation on climate change at which the levels of carbon emissions from fossil fuels were thought too uncertain to be specified. Although the issue was not strictly on his patch, Caltech has a healthy interdisciplinary tradition and early in 2007 Rutledge decided to have a go at solving the uncertainty. The results are even more dramatic than those of Energy Watch.

To forecast coal production Rutledge borrowed a statistical technique developed for oil forecasting known as Hubbert linearisation. M. King Hubbert, after whom the method is named, was a the Shell geologist who founded the peak oil school of thought. In 1956 Hubbert famously predicted that US oil production would peak within 15 years and go into terminal decline. He was vindicated in 1970.

Although accurate, Hubbert’s original forecast depended on the idea that oil peaks when half has been consumed, and half is still underground. So the date of the peak can only be predicted if you have a reasonably accurate estimate of the total oil that will ever be produced. Such estimates can be unreliable – and are worse in the case of coal. Hubbert linearisation, published in 1982, solves this problem by presenting the numbers in a different way.

Linearisation works by plotting annual production as a percentage of total production up to that point (on the vertical axis), against total production on the horizontal axis. This produces a graph showing how the percentage growth rate of total production changes as the resource is extracted (see graphs below). For oil, this percentage generally declines from almost the earliest days of production, even when annual output is still rising, and soon settles into a roughly straight downward-sloping line. By extending the line to the bottom of the graph, you can deduce the total amount that will ever be produced. “Once you have a straight line,” says Rutledge, “you’re off to the races.”

Top: UK coal production since 1855. Bottom: Hubbert linearization of UK coal production since 1855. Source: Prof Dave Rutledge, Caltech

To test the linearisation technique for coal, Rutledge applied it to historical data for UK production, which peaked in 1913. He says it provides a better model of the decline since then than traditional economics, which tends to blame factors such as foreign competition and Winston Churchill’s decision to switch the navy to oil, and later the displacement of coal by natural gas. Because the straight-line decline in the growth rate of total production starts long before the peak and continues long after, for Rutledge this suggests the cause is fundamentally geological, reflecting the increasing difficulty of expanding production while exploiting resources of progressively poorer quality. “Had you known this method in the 1920s,” Rutledge says, “you could have predicted accurately where British coal output is today.”

He has also applied it to today’s major coal-producing countries, including the US, China, Russia, India, Australia and South Africa – with startling results. Hubbert linearisation suggests that future coal production will amount to around 450 billion tonnes – little more than half the current official reserves.

The idea of an imminent coal peak is very new and has so far made little impact on mainstream coal geology or economics, and it could be wrong. Most academics and officials reject the idea out of hand. Yet in doing so they tend to fall back on the traditional argument that higher coal prices will transform resources into reserves – something that is clearly not happening this time.

So what if coal does peak much sooner than most people expect? According to the International Energy Agency’s latest long-term forecast, economic growth will require global coal production to rise by more than 70 per cent by 2030, so if Rutledge is right, the world is heading for an energy crisis even worse than many already predict. Hopes that coal-derived liquid fuels will be able to step in as oil runs out will also be dashed.

The sliver lining to this gloomy scenario is its effect on climate. Forecasts by the Intergovernmental Panel on Climate Change assume more or less infinite replenishment of coal reserves, in line with traditional economic theory. Less coal means less carbon dioxide, so the impact on emissions could be enormous. Using one of the IPCC’s simpler climate models, Rutledge forecasts that total CO2 emissions from fossil fuel will be lower than any of the IPCC scenarios. He found that atmospheric concentration of CO2 will peak in 2070 at 460 parts per million, fractionally above what many scientists believe is the threshold for runaway climate change. “In some sense this is good news,” Rutledge says. “Production limits mean we are likely to hit the general target without any policy intervention.”

C02 emissions and peak concentration are lower Rutledge’s producer-limited profile than all 40 IPCC SRES scenarios. Source: Professor Dave Rutledge, Caltech

Neither Energy Watch nor Rutledge could remotely be described as climate-change deniers – quite the opposite – but their findings worry many climate scientists, including Pushker Kharecha at the NASA Goddard Institute for Space Studies in New York. He agrees that coal reserves are probably overstated, but insists that curtailment of coal emissions is still essential to combat climate change. He gives a simple reason for this view: “What are the risks if the low-coal people are wrong?” To pin our hopes on low coal would be dangerously complacent, he argues, because if it is only marginally wrong the additional emissions could ensure catastrophe.

Whoever turns out right, the good news is that the imperatives of climate change and peak coal are identical. “In the long run, economies that rely on depletable resources are doomed to fail,” says Zittel. “The coal peak makes it even more urgent to switch to renewable energy without delay.”

Pipeline to B.C. back on track

Asian demand for Alberta crude makes 1,300-km route to B.C. port feasible, Enbridge president says

Gordon Jaremko

The Edmonton Journal

Saturday, December 29, 2007

Enbridge president Pat Daniel

CREDIT: Reuters, File

Courses are being charted for supertankers to fetch Alberta oil for Asia from a new British Columbia terminal planned for Kitimat.

Engineers are designing tunnels to put a new pipeline beneath the mountains between Edmonton and the Pacific Ocean without scarring alpine scenery or wildlife habitat.

A mobile training camp is touring aboriginal settlements along the proposed 1,300-kilometre route to recruit candidates for project jobs as welders, electricians, plumbers, pipefitters, steamfitters and millwrights.

"We have had strong general support for the concept of broadening out markets for Alberta crude," Enbridge Inc. president Pat Daniel said in an interview.

A year after suspending regulatory review of its Gateway Pipeline proposal to focus on higher priority construction of links to the United States, Enbridge is stepping up preparations for laying the new ocean export route.

"We still feel the line will be built," Daniel said. "It's not just for China," he added.

As consumption in developing countries grows, pushing up prices for limited conventional oil towards $100 a barrel, Daniel said interest in the oilsands is on the rise among overseas refiners.

A partnership with PetroChina, to sell Gateway delivery contracts, is lining up a new market for Alberta that spans Southeast Asia, including Japan, Korea and Singapore, he said. California, a Canada-sized oil market currently not served by Alberta export pipelines, is also a sales target, Daniel added.

Oilsands developers have a strong interest in tapping into emerging overseas destinations for growing output, the Enbridge president said.

Adding Asian outlets would inject a favourable element of "pricing tension" into mainstay export markets in the U.S., Daniel said.

American refineries would compete for Alberta supplies by paying full international prices and ending a tradition of commanding discounts in exchange for taking production that has no buyers outside North America, he predicted.

By setting a flexible target date of "the 2012 to 2014 time frame" for completing Gateway, Daniel said Enbridge is matching projected acceleration of oilsands production to about three million barrels per day or nearly triple current average volumes.

The new pipeline is being designed to ship all varieties of Alberta output, from asphalt-like bitumen with coarse impurities to premium "upgraded" synthetic oil ready for refining into fuels up to the latest anti-pollution standards for sulphur-free gas and diesel.

Current Enbridge work on Gateway is preparing the project for federal engineering, safety and environmental reviews expected to be long and intense.

The Alberta firm hired Danish marine traffic specialist Force Technology to chart detailed courses in B.C. coastal waters for giant ships known as VLCCs, or very large crude carriers.

With lengths of about 340 metres and 60 metres beams, and deep hulls drawing 23 metres of water when loaded with 2.3-million-barrel cargoes, the tankers are built on the proportions of a jumbo West Edmonton Mall.

But B.C. tugboat masters and coastal navigation pilots, using Danish ship simulators akin to mock cockpits used to train jet airliner crews, demonstrated VLCCs can sail safely along every kilometre of an identified, detailed route past B.C.'s rugged northwest coast up to the proposed Kitimat oil terminal, Enbridge reported.

Engineering advances are also harnessed for laying the most environmentally sensitive legs of the pipeline route.

Gateway plans include two tunnels through mountains that will set new standards for an industry that traditionally lays pipe at shallow depths by digging trenches in all terrain.

"We want to do whatever we can to minimize environmental impact," Daniel said.

Except for short river crossings, Enbridge has yet to use tunnels in its 13,500-kilometre oil pipeline network between Norman Wells in the Northwest Territories and Chicago, but is confident the new method can work.

The proposed Gateway route runs northwest from Edmonton to Grande Prairie along Highway 43, enters the Rocky Mountains in B.C. wilderness south of Tumbler Ridge, then crosses mostly Crown land west to Kitimat.

More than five years of courting aboriginal support continues in frequent contacts with B.C. native communities and an employment preparation program. A mobile school dubbed Trade Routes is touring up to 20 northern B.C. communities, seeking candidates for 18-month training programs in skilled trades that will be required by the pipeline project.

Construction is expected to take nearly three years and employ more than 5,000 workers.

The last estimate for building the 400,000-barrels-daily pipeline, $4 billion, was up 60 per cent from initial estimates but was made in 2005 before steep cost increases hit oil and gas industry developments.

gjaremko@thejournal.canwest.com

© The Edmonton Journal 2007

January 12, 2008

How coal can power your portfolio in 2008

“Coal-fired power plants are being built from Shanghai to Berlin to Wichita, Kan. The International Energy Agency expects demand for thermal coal to rise by 2.2 per cent a year – more than either oil or natural gas. The reason is simple. Coal is cheap – it can generate a million British thermal units (Btu’s) of energy at less than a third the cost of natural gas, and less than a sixth of the cost of fuel oil."By Conor McCreery Globe Investor Magazine Online January 2, 2008

Coal companies had a huge year in 2007. The Stowe Global Coal Index, which includes firms that source over half of their revenue from the coal industry, jumped by 104 per cent this year. Compare that to the 4 per cent the S&P 500 returned.

To some this big move in coal stocks means the party is already over. But don’t bet on it.

There are two ways to look at coal: as a feedstock for the steel industry, so-called coking coal, and therefore a play on infrastructure; and as a source of cheap power. Thermal coal is what is burned in coal-fired electricity plants.

Patricia Mohr, commodities market specialist at Bank of Nova Scotia is calling for coking coal prices to jump by 49 per cent in 2008. UBS sees a similar gain. That’s because of problems getting the coal used in steelmaking out of Australia and into Japanese and Chinese furnaces.

On the other side of the coal ledger Ms. Mohr expects thermal prices to climb too.

“They’ll probably be up by double digits,” she said. That’s largely because coal-fired power plants are being built from Shanghai to Berlin to Wichita, Kan. The International Energy Agency expects demand for thermal coal to rise by 2.2 per cent a year – more than either oil or natural gas.

The reason is simple. Coal is cheap – it can generate a million British thermal units (Btu’s) of energy at less than a third the cost of natural gas, and less than a sixth of the cost of fuel oil.

Of course if you are going to play some of the names below you have to be comfortable with the environmental cost of the black stuff – even the most efficient coal-fired plants produce twice as much carbon dioxide as natural gas.

Consol Energy Inc (US$44.61/CSX–NYSE)

One of the giants of the space. The coal miner’s stock has already doubled in the past 12 months, but it’s still the top pick of analyst David Khani of Virginia-based brokerage Friedman, Billings Ramsey & Co. “Consol has one of the highest margins in Northern Appalachia, and it’s only getting better.” The high-sulphur, and therefore, cheaper coal from that area is now back in vogue as tighter environmental standards mean most plants now have scrubbers. Mr. Khani also likes the fact Consol owns its own terminal in Baltimore, giving it a leg up on competitors in taking advantage of demand in Europe and Asia.

Foundation Coal (US$53.25/FCL-NYSE)

Analyst Pearce Hammond of Houston-based brokerage Simmons & Co. likes Consol, but for his money FCL is a better play because of its cheaper price-to-earnings ratio. FCL trades at 8.5 times and seven times 2008 and 2009 earnings before interest tax depreciation and amortization, while Consol is up at 10.2 times and 7.9 times, respectively.

FCL also mines in Northern Appalachia and Mr. Hammond says stockpiles of Northern Appalachia (NAPP) coal are below average for utilities – he expects that to change. Mr. Hammond also likes FCL’s mining presence at Powder River. Rio Tinto is selling assets in the Wyoming basin, and Hammond believes those will fetch a higher price than many expect, “showing the value of the space.”

Massey Energy Co. (US$34.38/MEE-NYSE)

Of the big U.S. coal plays, Massey is benefiting from demand from steel makers and the expected rise in coking prices. Massey has about a quarter of the domestic market and recently inked a deal with Essar group, which has steel operations in India and Latin America.

Massey is the top pick of Ann Kohler analyst at New York brokerage Caris & Company, “The upward pricing pressure on coking coal could certainly be a long-term trend,” she said.

China Shenhua Energy (63.94 yuan/Shanghai - 601088)

With China undergoing a massive expansion of its coal-fired electricity capacity – some reports claim the nation is building a plant a week – China Shenhua is an intriguing opportunity for the adventurous investor.

The stock is one of UBS’ top-two Asian mining picks. UBS likes Shenhua’s strong presence in the domestic thermal market, its ownership of transportation infrastructure and its coal-liquefaction project, which UBS expects will generate 6.8 million barrels of oil equivalent by the end of the year.

FreightCar America (US$34.98/RAIL-Nasdaq)

The few bears on coal all point to one problem – the rising cost of getting the black-stuff above ground. Analyst Michael Gallo of New York–based brokerage CL King says one way to make money on coal, even if the miners don’t, is to try RAIL.

The company is the largest manufacturer of coal-carrying freight cars in the U.S. – with about 80 per cent of the market.

With more than 150 coal-fired plants due to come on-line in the U.S. between 2009-2012 Mr. Gallo expects 26,000 new coal-cars will be needed. He also says half of the 269,000 cars in use are older models and need to be replaced.

“This could make FreightCar a good second-half story”.

MarketVectors Coal ETF

And, finally, coming in the new year a new exchange traded fund will provide investors with yet another way to play the commodity thanks to Van Eck Global. The ETF will aim to replicate the return of the Stowe Coal Index and is expected to hit the market in the first two months of 2008. The fees and the expense ratios have yet to be set. Van Eck is still working on a ticker symbol – here’s hoping it’s as much fun as “MOO” – the ticker for Van Eck’s agribusiness ETF.

Special to The Globe and Mail

January 11, 2008

TransCanada's Keystone pipeline reaches milestone in U.S.

COMMENT: Oblivious so far to the NRDC campaign to target the North American airlines which are buying fuel produced from oilsands bitumen (see Environmentalists target oilsands customers), TransCanada Corp's Keystone pipeline project not surprisingly leaps another regulatory hurdle.

Globe and Mail

January 11, 2008

CALGARY — TransCanada Corp. says its Keystone pipeline partnership has received a favourable assessment from U.S. regulators that asserts the project will have “limited” negative effect on the environment.

A final environmental impact statement from the U.S. Department of State has found the pipeline project and its Cushing extension “would result in limited adverse environmental impacts,” TransCanada said Friday.

Keystone is slated to transport crude oil along a 3,456-kilometre system from Hardisty, Alta., to U.S. Midwest markets in Illinois and to Cushing, Okla.

“This outcome is another significant milestone in advancing the Keystone Pipeline project,” TransCanada president and chief executive Hal Kvisle said in a statement.

“We plan to begin construction in second quarter 2008 to achieve an in-service date of fourth quarter 2009 in order to move the growing supply of Canadian crude oil to key U.S. markets.”

TransCanada expects to receive a presidential permit that will authorize construction and operation of facilities at the U.S.-Canada border crossing in mid-February.

Applications for other U.S. regulatory approvals are expected in the first quarter of 2008.

The $5.2-billion (U.S.) project will see main pipeline facilities in Canada converted from natural gas to crude oil transmission and the construction of about 2,200 kilometres of pipeline and pump stations in the United States.

TransCanada has said the system will be capable of delivering 435,000 barrels per day initially, expanding to 590,000 barrels per day on completion of the Cushing extension in 2010.

Shares in the company were down 11 cents at $39.95 in early morning trading on the Toronto Stock Exchange.

Environmentalists target oilsands customers

U.S.-based lobby group goes after fuel made from heavy oil

By Gordon Hamilton

Vancouver Sun

Thursday, January 10, 2008

VANCOUVER - A powerful American environmental lobby group launched a campaign Thursday against airlines using fuel derived from the Alberta tar sands, using the same tactics that proved so successful in limiting clearcut logging in B.C. rainforests.

The Washington D.C.-based Natural Resources Defense Council said it is pressuring 15 major U.S. and Canadian airlines to publicly oppose the use of jet fuel made from the tar sands, liquefied coal and oil shale.

Eco-groups in the U.S. and B.C. developed their markets campaign model on the B.C. Coast. American purchasers of B.C. lumber and paper products, such as Home Depot and Victoria's Secret, were pressured to alter their buying strategies through campaigns targeting them as environmentally unfriendly.

Forest companies here changed their practices when purchasers complained they were tired of buying truckloads of two-by-fours that came with a protester hanging off the back.

NRDC claims that some of the aviation fuel used by airlines like United, is derived from tar sands oil. The production of tar sands oil generates more heat-trapping global warming pollution compared with conventional oil, the eco-group claims.

In an interview Thursday, Liz Barratt-Brown, senior attorney for the organization, said the marketing campaign is focusing first on airlines in the Chicago and Denver areas. Those two U.S. cities are prime markets for aviation fuel derived from Alberta's tar sands, she said.

"The government of Alberta and especially the industry there may not have time to listen to U.S. environmentalists. But when their customers start asking them questions, then they respond," she said.

"Part of our effort here is to start engaging in the debate over the future of tar sands development and the use of fuels by the aviation industry."

EDMONTON - All but one of 10 Alberta oilsands mines received a failing grade on environmental performance in a report released Thursday by the Pembina Institute and the World Wildlife Fund.

The report says the mines have substantial room for improvement in their environmental practices. They need to "step up and work together to solve these environmental challenges," a news release from the study's authors said.

Pembina and WWF graded 10 mines in areas such as environmental management, land impacts, air pollution, water use and management of greenhouse gases, using information provided by the companies.

The average score among the mines assessed was 33 per cent. Albian Sands Muskeg River mine scored the highest, with 56 per cent, while Syncrude and the proposed Synenco Northern Lights Mine had the weakest scores, both with 18 per cent.

"The poor environmental performance reflects badly on the oilsands mining companies, which include the largest and most profitable major oil companies in the world," said WWF Canada's Rob Powell in the release. "These companies have both the expertise and the resources to do much better.

"Government must establish limits to curb impacts on fresh water, the global atmosphere, wildlife and public health."

Syncrude rejected the report's findings.

"We obviously don't agree with their findings," said company spokesman Alain Moore. "In fact, we consider ourselves a leader in sustainability in the oilsands."

Moore said the company is the most efficient user of water in the industry. And the company has an emissions-reduction project worth $772 million that will bring down sulphur pollution in phases between 2009 and 2011, he said.

The study found that while the majority of oilsands operations have environmental policies in place, only two provided evidence of having an independently-accredited environmental management system.

In addition, no operation, except Albian Muskeg River Mine, has voluntary targets to limit greenhouse gases and no mine has publicly reported targets to reduce water usage from the region's Athabasca River, the report said.

The 10 companies reviewed, in order of ranking, are Albian Muskeg River Mine (existing), Total E&P, Petro-Canada Oil Sands, Shell Canada, Imperial Oil, Suncor, Canadian Natural, Albian Muskeg River Mine (expansion), Syncrude and Synenco.

Alberta Environment spokesman Jim Law said that as companies come into the oilsands business and as technology improves, the department does require that the new technology be implemented. As for the older companies, the department does require continuous improvement in environmental performance, he said.

CanWest News Service

© Vancouver Sun

Seeking Friendlier Skies

Natural Resources Defense Council

January 10, 2008

Under-Mining the Environment

The Oil Sands Report Card

Pembina Institute & WWF

January 10, 2008

January 08, 2008

Nova Scotia to create test centre for tidal power

Nova Scotia to create test centre for tidal power

Globe and Mail, 08-Jan-2008

N.S. to harness Fundy tide power

The Chronicle Herald, 08-Jan-2008

Parrsboro mayor hopes to turn tide

Tom McCoag, Chronicle Herald, 08-Jan-2008

Nova Scotia to create test centre for tidal power

Globe and Mail

January 8, 2008

PARRSBORO, N.S. — Nova Scotia is creating a centre to test tidal power projects in the Bay of Fundy.

Premier Rodney MacDonald announced $4.7-million in provincial government funding Tuesday, along with a $3-million interest-free loan from EnCana, to set up the centre.

“This facility can become a landmark centre of excellence in our efforts to provide cleaner sources of energy,” MacDonald said.

“The more we move away from coal-based electricity, the more we protect our environment — a key priority for this government.”

Three companies will put test turbines on the floor of the bay, spending between $10-million and $15-million each on their projects.

Nova Scotia Power is teaming up with Ireland's Open Hydro on its turbine project, while Minas Basin Pulp and Power Co. is joining with UEK Hydrokinetic. The third company to test in the area is Clean Current of British Columbia.

The companies hope to have test turbines in the water by early 2009 and will supply power to the province's electricity grid once the projects are in operation.

Mr. MacDonald made Tuesday's announcement in Parrsboro on the Bay of Fundy and has said he believes tidal power can supply about 15 per cent of Nova Scotia's electricity needs.

Gerry Protti, president of EnCana Corp.'s offshore and international division, said the company thinks tidal power is “a promising and untapped energy resource here in Nova Scotia.

“Unlocking the unconventional power of the tides requires innovative thinking and the kind of creative partnerships that will be generated at this centre.”

N.S. to harness Fundy tide power

The Chronicle Herald - Halifax

The Canadian Press

08-Jan-2008

Nova Scotia hopes to harness the power of

the Bay of Fundy tides to provide cleaner power

for the province. (LEN WAGG/Staff/File)

PARRSBORO — Nova Scotia is creating a centre to test tidal power projects in the Bay of Fundy.

Premier Rodney MacDonald announced $4.7 million in provincial government funding Tuesday, along with a $3-million interest-free loan from EnCana, to set up the centre.

``This facility can become a landmark centre of excellence in our efforts to provide cleaner sources of energy,'' MacDonald said.

``The more we move away from coal-based electricity, the more we protect our environment — a key priority for this government.''

Three companies will put test turbines on the floor of the bay, spending between $10 million and $15 million each on their projects.

Nova Scotia Power is teaming up with Ireland's Open Hydro on its turbine project, while Minas Basin Pulp and Power Co. is joining with UEK Hydrokinetic. The third company to test in the area is Clean Current of British Columbia.

The companies hope to have test turbines in the water by early 2009 and will supply power to the province's electricity grid once the projects are in operation.

MacDonald made Tuesday's announcement in Parrsboro on the Bay of Fundy and has said he believes tidal power can supply about 15 per cent of Nova Scotia's electricity needs.

Gerry Protti, president of EnCana Corp.'s offshore and international division, said the company thinks tidal power is ``a promising and untapped energy resource here in Nova Scotia.

``Unlocking the unconventional power of the tides requires innovative thinking and the kind of creative partnerships that will be generated at this centre

Parrsboro mayor hopes to turn tide

Area may host trial tidal power project

By TOM McCOAG

Amherst Bureau

Chronicle Herald

Tue. Jan 8

PARRSBORO — Mayor Doug Robinson hopes Premier Rodney MacDonald will be in Parrsboro today to announce that the Cape Sharp area has been selected as the site for a trial tidal power project.

"What I’m hearing is that the premier and (Energy Minister Richard) Hurlburt won’t be here to announce which company will be doing the project but that they will be announcing the project site," the mayor said Monday.

"Since they’re holding the meeting, I’m assuming and hoping they’ll be telling us that the site we’ve been supporting for about two years, which is just off Cape Sharp, has been selected."

Cape Sharp is a spit of land that juts out into the Minas Channel 10 to 20 kilometres west of Parrsboro opposite Cape Split at the narrowest part of the Bay of Fundy.

"I certainly hope it is being located at Cape Sharp because having it there would mean more activity for our harbour," the mayor said.

"The town could also benefit because the location for where the electricity comes ashore could be built here, as well as buildings required to support the operation of the project."

The president of the Heavy Current Fishing Association of Halls Harbour, which represents about 30 fishermen, wasn’t quite as enthused.

"Cape Sharp is a very important fishing area for us," Mark Taylor said. "I’ve fished lobster there for 30 years. It’s an important migratory route for them as well. We just don’t know what impact having these (tidal energy) machines in the water will have on that fishery.

"If it is there, we will lose some important fishing area that can’t be replaced unless you moved in on someone else’s territory, which wouldn’t be a good idea."

Mr. Taylor’s association has had three of six promised meetings with proponents of the project, which he said include the province and Nova Scotia Power. But many questions still have to be answered, he said.

"We’d like to see the science for it. We’d like to know what impact it will have on the migration of lobster. We’d even like to know how close we can set our pots to these machines. Until they can answer questions like those, we really don’t know what we could lose."

Mr. Taylor admitted the answers may not be known until the test site is built. But if the tests prove the project is viable, then "200 machines in that area could mean that fishery is lost to us," he said. "And if it isn’t viable, we wonder if they will be required to clean up the site so that it remains a good spot to fish."

An American group, the Electric Power Research Institute, has indicated that the Bay of Fundy in the Cape Split area has the potential to be the best site in North America for large-scale, grid-connected tidal energy generation.

Last year, the province called for a pilot tidal power project for the Bay of Fundy, and in November the government shortlisted seven bidders. They include Maritime Tidal Energy Corp. of Halifax and partner Marine Current Turbines of Britain, Arnold Systems LLC of New York, Clean Current Power Systems Inc. of Vancouver, Lucid Energy Technologies of Indiana and Nova Tidal Power Inc. of Tatamagouche.

Minas Basin Pulp and Power Co. of Hantsport and Nova Scotia Power, owned by Emera Inc., have submitted bids to build a tidal energy test facility, a part of the project that includes designing and operating a structure to collect electricity from the turbines and processing scientific data.

No device is expected to go into the bay before next year.

Nuclear watchdog president blasts Lunn over letter

Globe and Mail

January 8, 2008

The president of the Nuclear Safety Commission is accusing Natural Resources Minister Gary Lunn of improper interference with the agency.

And in a letter to Mr. Lunn, Linda Keen warns that she'll fight in the courts any attempt by the minister to have her fired.

Ms. Keen says Mr. Lunn's letter threatening her termination for refusing to follow a ministerial directive will send a “chill” through quasi-judicial agencies that are supposed to be at arm's-length from government.

The nuclear watchdog says she has asked the privacy commissioner and the RCMP to investigate how Mr. Lunn's letter came to be leaked to the media.

Linda Keen

Linda Keen

Related Articles

Recent

* AECL waits anxiously as Britain considers its nuclear future

* We like minority governments, poll shows

From the archives

* Firm knew of isotope crisis before Ottawa

* Clement promises answers on shutdown

* Simpson: A headache for many and a black eye for AECL

The Globe and Mail

Ms. Keen came under fire late last year when she insisted the 50-year-old nuclear reactor at Chalk River, Ont., remain closed until a backup safety system was installed.

Mr. Lunn, and the Prime Minister, pressured the agency to reopen the reactor, eventually bringing in emergency legislation to overturn the watchdog's decision and restart the reactor.

Meanwhile, the Sierra Club of Canada wants Parliament to protect the Commission from political interference.

Citing the leaked letter, the environmental group says the nuclear safety commission must be granted protection similar to that given superior court judges and the auditor general.

Sierra Club director Stephen Hazell says the safety of Canadians is put at risk when the nuclear watchdog faces the kind of bullying Mr. Lunn has demonstrated since the medical isotope scare at Chalk River.

The Office of the Privacy Commissioner of Canada is looking into the matter, to determine whether the leak constitutes a breach of privacy.

AECL waits anxiously as Britain considers its nuclear future

RICHARD BLACKWELL

Globe and Mail

January 7, 2008

Britain's government is expected this week to give the go-ahead for new nuclear reactors in that country, a move that could boost the fortunes of beleaguered Atomic Energy of Canada Ltd.

Prime Minister Gordon Brown won't name a builder for the reactors when his plans are outlined in Parliament, but the government is expected to defy environmentalists in approving a new generation of power stations to replace the country's aging reactors.

AECL's Candu reactor is already on the short list of technologies being considered for the new construction, so a thumb's up from Britain could potentially lead to a huge contract for the Canadian nuclear agency.

"There's a lot of speculation that they will support a new build [of nuclear plants]," said Jerry Hopwood, vice-president of reactor development at AECL.

At the same time, he said, the government "may announce a process of selecting the technologies that go forward into the next stage of pre-licensing." In other words, it could outline how the short list of suppliers will be cut down to an even smaller group.

Last July, AECL's next generation ACR-1000 nuclear reactor was chosen as one of four technologies that will be considered for Britain's expansion. The country's nuclear regulatory agency also said reactor technologies from General Electric Co., Westinghouse Electric Co. LLC and Areva Group would qualify.

If everything moves forward in a timely manner, the final selection of a builder could be made in a couple of years, with a contract signed some time after 2010, and the reactors up and running by 2017 or 2018.

AECL is hoping its European experience - it recently commissioned a new Candu nuclear plant in Romania - and its reputation for delivering projects on time and on budget, will give it a leg up on its competition, Mr. Hopwood said.

But AECL wouldn't handle a British project on its own. It would likely work in a consortium that includes engineering firm SNC-Lavalin Group Inc., manufacturer GE-Hitachi Global Nuclear Canada Ltd., and component builder Babcock & Wilcox Canada.

This "Team Candu" is the same group that is bidding to build new nuclear reactors in Ontario. The consortium would also include local suppliers in Britain. Last summer, AECL told unions there that more than 70 per cent of the manufacturing for new Candu reactors could take place in that country.

Still, companies that supply the nuclear industry in Canada could expect significant spinoff benefits, were AECL to land a British contract.

"It would obviously be a good thing for the Canadian industry," which is already busy with nuclear refurbishment projects, said Murray Elston, president and chief executive of the Canadian Nuclear Association.

At the same time, the expected vote of confidence from the British government will help the nuclear industry over all, he said. "It just confirms what everybody has been saying recently, [which is] if you want to have a positive impact on the issue of climate change and air pollution, then you're going to have to have nuclear power as part of your mix."

Nuclear critics, however, say the chances of AECL getting the British contract are slim.

Britain was not keen on Candu heavy-water technology in the past and wouldn't likely go for it this time, said Norm Rubin, director of nuclear research at Toronto-based Energy Probe.

In addition, he said, AECL's new ACR-1000 reactor is still unproven, and the company's reputation has been damaged by the recent shut-down of its Chalk River reactor that produces medical isotopes.

On top of all that, the British government has said it wants private utilities to develop any new nuclear plants, and Mr. Rubin said he's not convinced there is any way new nuclear plants can be built without heavy government involvement or subsidies.

Nuclear power just isn't competitive when costs and financial risks are taken into account, he said.

January 07, 2008

The $100 prize

Daniel Yergin, one of the world's leading energy experts, weighs in on crude oil's march into uncharted territory

Geoffrey Scotton

Calgary Herald

Sunday, January 06, 2008

As one of the world's foremost experts on energy, particularly oil and gas, along with geopolitics, Daniel Yergin is sought out for his insight on the dynamics of world crude and natural gas markets and their impact on the economic and political sphere.

Yergin is the chairman and co-founder of Cambridge Energy Research Associates, arguably the world's leading energy consultancy. During his career, Yergin has been the recipient of the Pulitzer Prize for his 1990 No. 1 bestselling book, The Prize: The Epic Quest for Oil, Money and Power. The work was subsequently made into an eight-hour PBS/BBC series viewed by more than 20 million people and translated into 12 languages. His 1998 followup Commanding Heights: The Battle for the World Economy, co-written with Cambridge Energy colleague Joseph Stanislaw, received a similar treatment.

Cambridge, Mass-based Yergin has chaired the U.S. Department of Energy's Task Force on Strategic Energy Research and Development, and is a board member of the United States Energy Association and a member of the U.S. National Petroleum Council. He is also the only foreign member of the Russian Academy of Oil and Gas and a "Wise Man" of the International Gas Union. Yergin is a distinguished visiting fellow at Yale University's centre for globalization, a trustee of the Brookings Institution, a board member of the New America Foundation, a director of the U.S.-Russia Business Council and an adviser to the International Institute for Economics.

Herald economics reporter Geoffrey Scotton spoke recently with Yergin about the recent breaching of the $100 US per barrel level for crude oil, which Yergin describes as "a very strong psychological measure." All figures are in U.S. dollars.

Question: What does $100 oil mean?

Answer: At one level, it's a record and it's a score. But really, if you dissected that price, it tells a lot of what's going on in the world. It's telling us about the strength of the global economy, in particular Asia and particularly in China. It's telling us about mounting geopolitical fear of risk of disruption, in terms of, particularly, Iran and Iraq. It's certainly telling a story about the weakening of the (U.S.) dollar and the continuing weakening of the dollar. It's telling us that there is a series of small disruptions, interruptions.

The other thing that it's telling us, that I think is important that gets overlooked, is how rapidly costs have gone up in oil and gas development. That's maybe the great overlooked factor here, because the public and politicians focus, of course, on the price, but what the industry deals with is the reality of these costs that have gone up so dramatically.

In a way, $100 oil tells a pretty dramatic story of how much things have changed in just three or four years.

Q: Does it stand out less when one considers it in the context of sharply increased, and rising, costs?

A: I suppose. The $100 is really part of a trend and embedded in it is how rapidly costs have risen.

Upstream costs -- we created this thing that's called the IHS/CERA Upstream Capital Cost Index and the newest one shows that costs continue to go up dramatically. Basically, since 2000, costs have doubled and most of that doubling has been in the past three years.

Among other things, what that has done is lead to delays and postponements, and scaling back and re-prioritizing projects. So all of that means that there is a noticeable lag in responding to this, what is really a global commodity boom.

Q: Do high oil prices mean the world economy is going to grind to a halt?

A: It's striking to me that there was more anxiety when oil was hitting $50, $60 or $70 and more concern when it's hitting $100, although it's completely obvious that $100 is higher than $70. When we were at $50 or $60, we were nowhere near the $99.04 record April 1980 -- we're now above it, so we're now in uncharted territory -- and price tells a story. It also provides a lot of information. There will be an inevitable response, but there's always a lag. If we stay in this kind of a range, we'll see more of an impact. We've created this scenario we call breakpoint, where oil averages $120 and spikes as high as $150. Six or eight months ago, it seemed like the twilight zone and now it kind of has a reality to it. The idea is that when you get up to the breakpoint, at some point oil starts to lose its traction in the transportation sector.

Q: Is $100 oil based on reasonable fundamentals?

A: In our view, the current price is somewhat de-coupled from the fundamentals of supply and demand. The market is tight, but we think without these other factors at work, particularly the dollar, the fear of disruption and the rapid acceleration of costs, we wouldn't see prices where they are now. There's one other factor that's brought us there -- it's just the momentum. There's this kind of excitement about it in international markets. People expected it to happen. So, to some degree, there's been a self-fulfilling prophecy in this.

Q: So, there's psychological momentum at work?

A: There's no question that all these factors come together and ramp into psychology and people piling in. When the Fed cuts interest rates, it not only affects interest rates, it affects the price of oil and I think that a lot of people have been betting on the Fed, and that means going long on oil as a hedge against the dollar.

Q: What does $100 oil mean for Canada and for Alberta, and for our place in the world's economic echelon?

A: We did a scenario that touched on this last week. I find that most Americans do not realize that by far the most important source is Canada; they don't realize the role Canada plays in terms of natural gas and how tied together our economies are. Obviously, Canada, and Alberta in particular, has been a big beneficiary of this. When we do our analysis of where the major growth is going to be over the next 10 years in terms of oil production, Canada is right up there near the top of the list. I think that in general that $100 oil is a symbol of the age, but so is the relationship of the Canadian loonie to the U.S. dollar. These prices are all telling us about change in the global economy.

Q: How about Alberta and the oilsands? There's been an awful lot of interest in the oilsands in recent years. Presumably, $100 oil is going to make the attention paid to the oilsands even stronger.

A: It certainly heightens the interest, it heightens the interest in energy security and that's beneficial to the oilsands. But the oilsands is having to cope with the same rising costs. This is a capital-intensive industry, so it certainly should give a boost to the oilsands, but this high-cost environment is also a challenge for the oilsands.

Q: Is it fair to characterize $100 oil as a concrete sign that energy has taken on a new importance in the world?

A: One hundred dollar oil is a very clear sign that energy is at the top of the global agenda once again and that there's worldwide recognition of its importance. It's also why people are talking so much, wherever I go in the world -- whether it's Russia, China, western Europe, the Mideast as well as North America, people are talking about energy security in one form or another. It's a sign of the times.

Q: In terms of high crude prices, along with high finding and production costs, analysts also cite a security premium or a fear premium. What other factors are being felt?