October 31, 2009

Get ready for triple-digit oil again soon

Jeff Rubin

Jeff Rubin's Smaller World Blog

Globe and Mail

Friday, October 30, 2009

Oil tanker |

Nothing is shrinking faster these days than global trade. For the first time in decades, world trade volume, the lifeblood of the global economy, is actually falling. And chances are that downsizing is here to stay.

One reason global trade is shrinking is that most major economies have been contracting. Recession-scarred economies will of course recover. They always do. The Chinese economy is already on the mend and in time other economies will also get back on their feet. But unfortunately for an oil-hungry global economy, so too will crude prices — which is not only the real reason the economy tanked in the first place, but also the reason the economy coming out of this recession will be very different than the one that went into it.

Whether we move goods by air, ship, rail or truck, the global economy runs on oil.

And soon that oil is going to cost more than we can afford. Long distance transoceanic trade is about to go the way of the gas-guzzling SUV. Both are relics of an age of cheap oil that no longer exists.

Oil prices are already trading at around $80 per barrel when the red ink hasn’t even dried yet on the deepest postwar recession in the largest oil-consuming economy in the world. If oil is trading at this level when world oil demand has actually fallen this year, where do you think oil prices will be when the world’s energy appetite recovers?

Everyone, from OPEC to the International Energy Agency to the US Department of Energy, now expects that to happen by early next year.

If so, you can expect to see the return of triple-digit oil prices by next spring. And that means that the armada of empty container ships anchored off Southeast Asia are likely to stay exactly where they are.

In tomorrow’s economy, distance will cost money. Globalization was the product of cheap energy. Deglobalization is the economic face of triple-digit oil prices. The whole notion of sourcing supply from halfway around the world to save on labor costs will no longer make any commercial sense. From making our own steel to building our own furniture to growing our own food, the soaring cost of oil-fired transport will bring production back home to the local markets it once served.

I’m Jeff Rubin, and I believe your world is about to get a whole lot smaller.

October 30, 2009

Suzuki & Pembina: Climate Leadership, Economic Prosperity

COMMENT: On the publication of Climate Leadership, Economic Prosperity, the editors and columnists at the Globe and Mail, and National Post, as well as the Premiers of Alberta and Saskatchewan, went apeshit. Each outdoing the other with hyperbole and invective. All quite predictable.

An excellent assessment of the report is by George Hoberg and Stephanie Taylor at Hoberg's blog site, Green Policy Prof. It is copied below, after the news release about the report.

Media Release

David Suzuki Foundation

October 29, 2009

New study shows Canada can meet global-warming reduction targets while growing jobs and economy

OTTAWA— Canada can succeed economically while meeting targets to reduce global warming pollution, according to an economic modelling study commissioned by the Pembina Institute and the David Suzuki Foundation. Climate Leadership, Economic Prosperity is the first Canadian study of its kind to show regional impacts on employment and gross domestic product, and the first to comprehensively examine how Canada can meet a greenhouse gas reduction target for 2020 that goes beyond the federal government’s target.

Leading economic modelling firm M.K. Jaccard and Associates, on behalf of the Pembina Institute and the David Suzuki Foundation, conducted an in-depth study of federal and provincial policies needed for Canada to meet two targets to reduce its greenhouse gas emissions. The firm modelled how Canada can achieve both the federal government’s current target (20 per cent below the 2006 level by 2020) as well as a more ambitious target (25 per cent below the 1990 level by 2020). The second target is derived from analysis of the emission reductions needed to limit average global warming to 2° C — a limit supported by a broad scientific consensus.

“This new analysis shows that with strong policies, Canada can meet a 2° C target in 2020 and have a strong, growing economy, a quality of life higher than Canadians enjoy today, and continued steady job creation across the country,” says Dale Marshall, climate change policy analyst with the David Suzuki Foundation.

Far stronger policies than the federal government has proposed to date must be implemented, according to the modelling study. “Meeting either target requires governments to put a significant price on global warming emissions broadly across the economy, and to back this up with strong complementary regulations and public investments,” says Matthew Bramley, director of climate change for the Pembina Institute. “The study indicates that Canada can implement much stronger climate policies than the U.S. and still prosper economically.”

Key findings of the Jaccard study include:

• Canada’s gross domestic product would continue to grow at 2.1 per cent per year on average between 2010 and 2020 while meeting the 2° C target, compared to 2.2 per cent for the government’s target and 2.4 per cent under business as usual.

• Canada’s total number of jobs would grow by 11 per cent between 2010 and 2020 while meeting either target — essentially the same rate as under business as usual.

• The urgent need to address very high emissions in Alberta and Saskatchewan would significantly reduce projected growth rates in these provinces. However, Alberta’s per capita GDP would continue to be much higher than that of any other region, and Saskatchewan’s per capita GDP would stay close to the Canadian average.

• To meet the 2° C target, a carbon price would start at $50 per tonne in 2010 and reach $200 per tonne by 2020. To meet the government’s target, the carbon price would need to reach $100 per tonne by 2020, or $145 per tonne if Canada does not purchase any international credits.

• Almost half of carbon price revenue can be returned to Canadians through reductions in income tax. Revenue from carbon pricing can also fund major public investments to reduce greenhouse gas emissions, such as building smart grids and transit infrastructure.

• Technological approaches to achieve major reductions in Canada’s greenhouse gas emissions range from increased energy efficiency and renewable energy to carbon capture and storage.

The Pembina Institute and David Suzuki Foundation view the study as an important contribution to current public policy dialogue on greenhouse gas reductions in the lead up to the December UN climate summit in Copenhagen.

For further information: The report and full study are available at: http://www.davidsuzuki.org/Publications/Climate_Leadership.asp

For media and interview opportunities please contact:

Dale Marshall

dmarshall@davidsuzuki.org

Climate policy cost report casts light on the coming reckoning for the Canadian federation

George Hoberg and Stephanie TaylorGreen Policy Prof

October 30th, 2009

This week the Pembina Institute and the David Suzuki Foundation jointly released a report that finds that Canada can meet its greenhouse gas emissions reduction target – and even more stringent goals – without bringing the economy to a halt. While acknowledging that the policies necessitated by emissions reduction targets will have different effects for different provinces, the report emphasizes that the impact on economic growth for even the most carbon-intensive provinces will be relatively modest.

As expected, the report has prompted hyperbolic responses from the defenders of Canada’s fossil energy establishment: several Western provinces, federal Minister of the Environment Jim Prentice, and the Globe and Mail editorial board. Prentice characterized the report’s findings as “irresponsible” and stressed that Canada could meet its targets through other means, namely by harmonizing its climate change plan with the United States’ as-yet-unfinalized plan. He also made it clear that the costs of any emissions reduction plan must be acceptable to all regions of the country. Such agreement over an effective climate action plan is all but impossible as long as Alberta refuses to “touch the brake” on its oil sands operations. And even before factoring in provincial reactions, such hyperbole coming from the federal Minister of the Environment casts doubt on the sincerity of Canada’s commitment to its own greenhouse gas emission reduction target by 2020.

Politicians from Alberta and Saskatchewan were even more vocal in their opposition to the report. Alberta premier Ed Stelmach denounced the report’s recommendations as nothing more than a wealth transfer to other parts of the country: “There won’t be another wealth transfer to Ottawa under my watch. There is already one wealth transfer program and that’s equalization.” Saskatchewan Energy Minister Bill Boyd echoed Stelmach’s “wealth transfer” theme, adding that technology is the key to combating climate change. Alberta and Saskatchewan have placed large amounts of faith and money in carbon capture and storage (CCS) technology, despite questions surrounding its reliability and cost-effectiveness. Recently the federal government has joined in, pumping $343-million into a CCS-equipped coal-fired generation plant in Wabamun, Alberta while declaring that “Carbon capture and storage has the potential to help us balance our need for energy with our duty to protect the environment.”

This dismissive and defiant rhetoric is part of a long history of resistance and denial that at some point Canada, and especially Alberta, would need to reconcile its energy and climate policies with modern notions of sustainability and, especially, an evolving international climate regime. The ghost of the National Energy Program has given Western provinces a de facto veto over national climate change policy.

National newspapers joined the condemnation. The lead Globe and Mail editorial yesterday denounced the report: “its all-out attack on the oil and gas sector is politically and economically unacceptable, and would euthanize a vital Canadian industry.” It says the report’s policy recommendations are “unsaleable and dangerous.” In its most extreme rhetoric, it proclaims “Canada cannot take its national unity for granted and must not, in the service of international obligations, allow itself to be immolated by a government policy of such wrenching dislocation.” The National Post editorial board joined in the hyperbole, rejecting the report because it “would shake the very pillars of Confederation.” A National Post commentary joined the editorial excess, claiming “there will be blood.” Reactions from farther west are not so shrill. Vancouver Sun columnist Craig McInnes claims the report demonstrates that “with a political will, there’s a way.”

The Report

Pembina and DSF enlisted MK Jaccard and Associates (MKJA) to consider the feasibility and cost of two greenhouse gas emissions reduction targets: 1) a 25 percent reduction below 1990 levels by 2020, as proposed by environmental NGOs (ENGOs), and 2) a 20 percent reduction below 2006 levels by 2020, the Canadian government’s proposed target. Both scenarios were found to be feasible, though only with significantly stricter policy packages than those proposed thus far by the provincial and federal governments. Of particular interest are the carbon dioxide equivalent emissions prices under each scenario: $50/tonne in 2010 rising to $200/tonne in 2020 under the ENGO scenario, and $40/tonne in 2010 with an increase to $100/tonne in 2020 given the government’s target.

Unfortunately, even the stringent policy packages proposed by MKJA (including carbon pricing) are not enough to reach the emissions reduction targets in either scenario. Thus, the policy package examined by the authors includes purchasing of international offsets, pursuit of carbon capture and storage (for the environmental option), and a number of other policy responses to close the gap.

Economic Impacts: National and Regional

Under both scenarios, the report projects that Canada will experience significant economic growth, but not quite as much as it would under the “business as usual” (BAU) scenario of no new controls. Under the BAU scenario, Canadian GDP is projected to grow 27% by 2020. Under the scenario implementing the Government of Canada’s target, GDP would grow 25% by 2020, and under the environmental group target scenario, GDP would grow 22%. The changes in GDP growth are projected to have different affects on different provinces. Growth will be less than projected under BAU in all regions except Manitoba and Ontario. The gap between GDP under both policy scenarios and under BAU is by far the largest in Alberta at 8% under the government scenario and 12 percent under the ENGO scenario.

The number of jobs will increase between 2010 and 2020 in all provinces. Interestingly, job growth will exceed business as usual (BAU) levels under both scenarios in BC, Manitoba, Ontario and Quebec. Alberta is the sole province to whose job growth is less than BAU levels under both scenarios, though it is important not to confuse reduced job growth with negative job growth. Pre-tax salaries in 2020 will also continue to grow under both scenarios, but at a slower rate than under BAU in all regions except Manitoba, which grows faster than under BAU.

GDP per capita will continue to grow in all regions under both climate policy scenarios, though the change from BAU levels will be greatest under the ENGO scenario. Under BAU, Alberta would see per capita GDP growth of 42%, as opposed to 25% under the ENGO scenarios and 31% under the government scenario. As the authors point out, this model does not account for the effects of population growth on GDP per capita. Specifically, population growth in Alberta is likely to be lower under both policy scenarios than under BAU (due to a relative decrease in expected energy sector jobs), which will lead to higher GDP per capita numbers than those projected under the policy scenarios.

Conclusion

As the report clearly shows, effective climate action is possible in Canada without plunging the country, or even the Western provinces, into economic chaos. The report’s authors should be congratulated for advancing the climate policy debate in Canada. By conducting serious economic policy analysis on what needs to be done to significantly reduce Canada’s greenhouse gas emissions, they have spoken truth to power. In so doing, however, they’ve exposed the hypocrisy of Canada’s persistent claims that it is committed to emission reduction targets without having a plan or the political will to do meet those targets. By being transparent about the regional impacts of climate policies, the report also challenges the foundation of political-economic power in the West, and provoked a formidable rhetorical backlash.

If Canada wants to be a responsible member of the international community, it will need to reduce its greenhouse gas emissions, and do so significantly and relatively quickly. This cannot be done without significantly raising the cost of energy production from fossil fuels, including the oil sands as well as coal and natural gas. The Canadian economy will need to adjust to these changes, and the impacts of these costs will have differential impact on regions, just as the regional endowment of fossil energy and the wealth generated from that has had differential impacts on regions. The fact that some areas in Western Canada will not grow as much as they might otherwise cannot be used as a justification for failing to act on our generation’s greatest challenge.

www.greenpolicyprof.org/wordpress/

October 29, 2009

Quebec, N.B. strike $4.8B deal for NB Power

COMMENT: The increasing role of private generation in BC is one thing. Selling BC Hydro and the heritage assets is something else. (Though some would say the role of IPPs is just an incrementalist shift in the same direction.)

This is quite the move on Hydro-Quebec's part - corporatist, hegemonist, imperialist. Interesting to watch unfold. The popular opposition in New Brunswick and other Atlantic provinces is mounting.

CBC News

October 29, 2009

New Brunswick Premier Shawn Graham explains why his government wants to sell a majority of NB Power's assets to Hydro-Québec. (CBC) |

New Brunswick Premier Shawn Graham and Quebec Premier Jean Charest announced the historic deal in Fredericton on Thursday, concluding a week of speculation.

The deal is contingent on legislative approval in New Brunswick.

It stipulates that Hydro-Québec would take over the majority of New Brunswick's generating stations for $4.8 billion, which represents the equivalent of NB Power's debt.

Additionally, Hydro-Québec would freeze residential power rates in New Brunswick for five years. During the same time, large industrial rates would be lowered to the power prices offered to the same customers in Quebec, but they would not be frozen. That component of the deal is worth an estimated $5 billion to NB Power customers.

'Big winners'

Quebec Premier Jean Charest says his province's interest in purchasing NB Power is to gain better access to the lucrative U.S. electricity market. (CBC) |

"And ratepayers would see reduced rates to an extent that would have been impossible for NB Power as a stand-alone entity."

Charest said at the news conference that the region's geography made the deal make sense considering the desire to tap into the power-starved U.S. market.

Both premiers used the news conference to address the criticism of Newfoundland and Labrador Premier Danny Williams, who said the deal could hinder his province's ability to transmit its hydro power into the United States.

Charest said he supports open markets and Quebec is eager to work with other provinces.

"The real question for Canadians is this, it isn't whether or not one [province] is succeeding better than the other," he said. "The real issue, if we have our eyes on the ball, is to the south of us, that is where things are going to happen.

"The Americans need clean, renewable energy and they need a lot of it. And guess what? We in Canada are the ones that can supply it. And by doing that, we can make our environment better and we can enrich our respective societies by doing so. There is a condition though: We have to learn to work together."

Now that the proposed deal with New Brunswick has been struck, Charest said his province is negotiating with Prince Edward Island to sign a similar agreement.

Charest said there is no timeline on obtaining a deal with P.E.I.

No impact on Quebec power rates

After the five-year rate freeze is lifted, rates would rise based on New Brunswick's consumer price index. However, the price of any new generation needed in the province could be added by Hydro-Québec.

Under the agreement, Hydro-Québec gains access to more than 370,000 customers and expects a return on equity of more than 10 per cent starting in the first year. The proposed deal will not have any impact on Quebec's power rates.

The proposed deal will wipe out NB Power's $4.8-billion debt, which is 40 per cent of the province's total debt. That debt will stand at $8.2 billion after the deal is approved.

New Brunswick will have to make legislative changes early in the new year as the agreement is designed to take effect on March 31, 2010.

Graham said if the deal is not concluded by March 31, 2010, then NB Power will boost electricity rates by three per cent as originally planned.

Opposition Leader David Alward is demanding Graham call an election over the proposed NB Power sale.

3 stations retained by NB Power

Hydro-Québec will not buy Coleson Cove or two other thermal generating stations as part of the tentative deal with New Brunswick. The three plants will continue to be owned by NB Power, which will sell the electricity back to the Quebec utility. (CBC) |

The Dalhousie Generating Station will be shut down next year under the agreement, a decision that will be another blow to the northern town that has been reeling after a series of other closures in recent years.

"It's also very important for me to speak to the community of Dalhousie, which will see its generating station phased out," Graham said.

"We will stand by your community and we are already hard at work to find a variety of new opportunities for you."

David Hay, the president and chief executive officer of NB Power, is expected to be in Dalhousie later on Thursday to discuss the impact of the deal with workers in the northern community.

New Brunswick will retain control of Coleson Cove and Belledune, and will sell the power back to Hydro-Québec.

Under the proposed agreement, the Point Lepreau nuclear generating station, Atlantic Canada's only nuclear reactor, will remain under NB Power's control until its $1.4-billion refurbishment project is concluded in February 2011.

The reactor refurbishment project is 16 months behind schedule. However, if the energy pact is approved, it could lessen the financial burden.

Instead of purchasing replacement power on the open market, Hydro-Québec will supply cheaper hydro power to the province.

Also under the proposed agreement, New Brunswick's Independent System Operation will be rolled into Hydro-Québec. That will give control over the transmission lines in New Brunswick to Hydro-Québec.

However, any utility or company that wants to use the transmission lines must bid for it in an open auction.

Hydro-Québec eyes N.B. as 'energy hub'

Bertrand MarotteGlobe and Mail

Thursday, Oct. 29, 2009

Montreal — Hydro-Québec is committed to making New Brunswick into an “energy hub” with the acquisition of most of the assets of New Brunswick Power Corp., says the head of Quebec's giant hydroelectric utility.

“We want to turn New Brunswick into an energy hub and add value to the assets,” Thierry Vandal, president and chief executive officer of Hydro-Québec, said in an interview.

New Brunswick is strategically located as a transmission gateway between Eastern Canada and the northeastern United States, he said.

And Hydro-Québec is open to doing deals with other provinces, including Newfoundland and Labrador, that would allow them to use its transmission corridors to export to the U.S., he added.

“Hydro-Québec is proposing to acquire [New Brunswick Power's] assets, but the network remains open. It's not because we're acquiring it that we're going to close [access to the network],” he said.

Newfoundland and Labrador Premier Danny Williams has voiced his concerns that Hydro-Québec is only out to secure a stranglehold over access to electricity markets in the U.S.

“From a business perspective, Hydro-Québec will exploit those assets, but through a subsidiary that will continue to be called New Brunswick Power,” said Thierry Vandal, the president and chief executive officer of Hydro-Québec.

“There is a lot of continuity that we want to maintain,” Mr. Vandal said in an interview before the formal announcement to be made Thursday morning in Fredericton.

Industrial, commercial and residential customers of debt-laden New Brunswick Power will get a break on their electricity rates and Hydro-Québec will be able to expand its access to the major markets in the northeastern U.S. markets, he said.

Under terms of the memorandum of understanding between the two power companies, New Brunswick's residential and commercial rates will be frozen for five years, while industrial prices will be rolled back, he said.

At the same time, Hydro-Québec will be in a position to invest in and upgrade New Brunswick Power facilities, help shift it to more environmentally friendly power generation and make the province a strategic location for the export of electricity to the U.S., Mr. Vandal said.

“It's a transaction in which New Brunswick's geography is very interesting for us. Strategically, it opens an additional route to those markets.”

He brushed aside suggestions that Hydro-Québec will have an unfair advantage over rivals, such as Newfoundland and Labrador.

Newfoundland and Labrador Premier Danny Williams has warned that the proposed deal between Quebec and New Brunswick would essentially give Hydro-Québec control of electricity transmission corridors between Atlantic Canada and the U.S. markets.

Mr. Williams has reiterated his threat to take his case to the federal Competition Bureau if a deal between the two provinces goes ahead.

Mr. Williams said in a letter to New Brunswick Premier Shawn Graham – made public yesterday – that Hydro-Québec has a track record of “obstruction and delay” and unfair treatment of third parties that deal with it.

Newfoundland has for decades insisted it was shortchanged in a 1960s deal signed with Quebec to build the Upper Churchill River hydro project. Forced to send the power through Quebec to markets, Newfoundland agreed to fixed prices that are now far below market value, a situation that has been a boon for Hydro-Québec.

Newfoundland Hydro now has plans for a massive hydroelectric project on the Lower Churchill, which includes options for a transmission route bypassing Quebec.

Newfoundland Hydro has also had talks with Nova Scotia and New Brunswick over possible electricity export partnerships. It has, as well, applied for access through Quebec's network for exports. Newfoundland has complained in the past that Hydro-Québec doesn't respect requirements from the U.S. regulator that exporters to the American market provide rivals with “open access” through their systems.

Mr. Vandal said in an interview with The Globe and Mail that Hydro-Québec has always made it a point of pride to keep its system open.

And that will be the case in New Brunswick as well, he added.

“The New Brunswick network will remain absolutely open,” he said.

“All transmission requests will be handled on the basis of absolute respect for the rules of the market and of the regulatory framework.”

The proposed acquisition of New Brunswick Power assets – including seven generating stations producing a total of 950 megawatts of electricity – is valued at $4.75-billion.

Several coal-fired and diesel-powered facilities will be phased out and there are plans to install clean energy such as wind power, Mr. Vandal said.

In a second phase, the Point Lepreau nuclear power station will be taken over, but only after Atomic Energy Canada completes a refurbishment project, expected some time in 2011, he said.

If the acquisition goes ahead as planned, Hydro-Québec will gain about 380,000 new customers or about 10 per cent of its existing customer base, said Mr. Vandal.

October 28, 2009

Alberta-Superior pipeline takes center stage in world climate debate

Richard Thomas

Business North

October 27, 2009

(Photo courtesy of Enbridge.) |

On Aug. 20, the U.S. State Department granted a Presidential permit for the 1,000-mile “Alberta Clipper” pipeline from Canada’s Alberta oil sands to Superior, due for completion in mid-2010.

On Sept. 2 Enbridge (U.S.) Inc., the partner of Canada-based Enbridge, celebrated in Carlton County, where the company had stacks of pipes ready for construction.

The project will result in 3,000 construction jobs. The influx of workers already has created a shortage of rental housing in Bemidji.

On Sept. 3 a coalition including the Minnesota Center for Environmental Advocacy and Bemidji-based Indigenous Environmental Network filed a lawsuit in U.S. District Court in San Francisco to stop the pipeline.

“The projects would spur refinery expansions and modifications in the United States, leading to increased air and water pollution for residents of the Midwest and other states,” the complaint stated.

It also claims the state department failed “to assess all reasonably foreseeable environmental impacts” and did not “take a hard look at the Alberta Clipper project’s stated purpose and need or to adequately consider a reasonable range of alternatives.”

The state department concluded the current plan is environmentally preferable to the alternatives. The other options included different routes and “no action,” declining to issue the permit.

In the case of no action, “Refiners would seek other means of obtaining the heavy Canadian crude oil, or attempt to obtain additional supplies from less stable and less reliable sources,” said the State Department's environmental impact statement.

It also cited “strategic interests” as reason for approval: reducing American dependence on OPEC (Organization of Petroleum Exporting Countries) oil “in a time of considerable political tension in other major oil producing countries and regions.” The department noted the need to send “a positive economic signal, in a difficult economic period.”

Enbridge also is constructing a $2.2 billion return pipeline, called Southern Lights, to ship diluent (diluting agents) from the Chicago area through Superior to Clearbrook, MN. From there an existing pipeline will be used, with the flow reversed, to carry the diluent to Edmonton, Alberta, Canada.

Enbridge also is expanding its terminal in Superior, adding five new storage tanks to the existing 37. Each new tank has a 250,000-barrel capacity.

Other non-Enbridge pipelines under construction from Alberta are the 2,000-mile TransCanada Keystone I to Illinois and the 3,200 Keystone Expansion to the Gulf of Mexico.

Murphy Oil has weighed potential expanding its Superior refinery to cash in on Canada’s oil boom. It wants to expand its refining capacity from 35,000 to 235,000 barrels per day and expand the refinery’s grounds from 200 to more than 600 acres. So far, “there is no commercial arrangement to provide additional heavy crude to Murphy Oil,” said the U.S. State Department. “No formal application have been submitted to federal or state regulatory agencies.”

Oil sands controversy

The tapping of Canada’s oil sands, also known as tar sands, is often cited as the world’s largest industrial project. It’s been an economic boon but arguably an environmental disaster and unquestionably a public relations fiasco.

The extraction process creates more carbon dioxide than regular oil production. (Estimates as to how much more vary, ranging from 15 percent to triple the amount.) Huge swathes of remote forested land must be strip-mined to extract a tar-like substance called bitumen. Steam plants literally melt oil out the ground.

The water used in the process ultimately flows into toxic tailings ponds miles long. In a much-publicized April 2008 event, 500 ducks died after landing on such a lake.

The extraction process also uses four times more natural gas than mining operations and already accounts for 20 percent of Canada’s natural gas usage. As an alternative, some groups are proposing to build as many as 25 nuclear reactors.

In September the environmental group Greenpeace, which has been staging protest actions at oil sands operations, released “Dirty Oil,” a report carrying apocalyptic predictions for the oil sands: “The rapid development of unconventional hydrocarbons such as Canada’s tar sands could tip the scales toward dangerous and uncontrollable climate change.”

Speaking in defense of the oil sands in Edmonton on Sept. 23, Enbridge (Canada) CEO Patrick Daniel said opposition to the pipeline “has not led to opposition to energy consumption, which is where the vast majority of CO2 (carbon dioxide) emissions are produced.”

Daniel continued, “I would love to see an energy strategy for this country that we can rally the country around, and agree that this is the generally the direction we are going to take and not oppose everything in energy development while still moving toward renewables.”

On the pro-industry website oilsandsreview.com, editor Deborah Jaremko writes, “The oil sands is a massive resource, and undeniably presents some pretty hefty environmental challenges, but I think for Greenpeace it represents the low-hanging fruit of protest potential. Perhaps they should consider consumption-related action, with the understanding that riding bikes everywhere and ditching our jobs and lives to wander the world is simply not feasible (or desirable) for the vast majority of people. Diversifying energy sources is crucial, but it will happen slowly, and it will not happen by ‘stopping the tar sands.’”

Meanwhile, President Obama maintains he is committed to reducing overall greenhouse gas emissions. The massive American Clean Energy and Security Act of 2009, which passed the House in June, promotes low-carbon fuels, conservation and efficiency. A similar bill was introduced into the Senate Oct. 1.

On the same day Duluth Mayor Don Ness, flanked by labor and environmental representatives, held a press conference to express support.

Because they create jobs, the pipelines propose an awkward issue for pro-environmental labor groups such as the Blue Green Alliance, which was represented at the press conference. The Minnesota-based coalition of environmental groups, co-founded by the Sierra Club and United Steelworkers, support clean energy legislation but have not taken a position on the oil sands or the pipelines.

The steelworkers union has objected only to the TransCanada Keystone line citing its use of imported pipes from India, which the union asserts is made of thin material and poses a safety hazard.

The 2008 drop in oil prices slowed but did not stop tar sands development. The number of camp-dwelling workers dropped from 27,000 a year ago to 23,000 now.

“Keeping oil-sands projects ticking along once they are on stream now requires a price of around $35 a barrel,” stated Petroleum Economist magazine in September. “About $80 (per barrel) is necessary for new investments, although in light of a softening of some costs, others put the figure much lower.”

Oil sold at $66.95 per barrel on Sept. 28, according to Bloomberg.com. With oil becoming scarcer, prices only can go up.

Pipeline safety

The Alberta Clipper will cross 162 water bodies in Minnesota and 14 in Wisconsin. Seventeen are within the St. Louis River Estuary that feeds into Lake Superior. The Wisconsin Department of Natural Resources determined the project would produce no significant impact.

“Over the operational life of the Alberta Clipper Project, there would be a very low likelihood of a crude oil release from the pipelines,” concludes the U.S. State Department’s environmental impact statement. The report cites high maintenance standards and leak detection methods. The report also based its conclusion on the assumption that “Enbridge would comply with all applicable laws and regulations.”

Its Web site, www.enbridge.com, encourages that assumption.

“Pipelines are the safest and only practical transportation mode to move large quantities of petroleum,” it states.

But the industry’s safety record shows that “safest” and “practical” doesn’t translate to accident-free.

Enbridge already operates one of the world’s longest pipelines, the 3,100 mile Lakehead system. The first section from Alberta to Superior was built in 1950 when the Canadian region had its first oil boom. Today the Lakehead system transports 1.4 million barrels per day. Over the decades the company has had its share of spills. (Enbridge pipeline accidents, below.)

The safety of pipelines operated by all companies has been a source of contention. There are 168,900 miles of onshore and offshore hazardous liquid pipeline in the United States.

In the 1990s accidents resulted in 200 deaths, and 3,000 injuries (both gas and liquid pipelines) and 1.5 million barrels of spilled liquid.

Enforcement was strengthened when President Bush signed the Pipeline Safety Improvement Act of 2002. (Rep. James Oberstar, D-MN, was a primary House author.) Some pipeline reformers praised the bill as an important step while others criticized it as weak. The act is due for reauthorization in 2010.

According to the U.S. Office on Pipeline Safety, the overall number of “serious” pipeline accidents — involving fatalities and injuries requiring hospitalization — declined from 87 in 1989 to 42 in 2008.

But the number of “significant” incidents (including spills, fatalities and injuries) has increased (277 in 1989 to 292 in 2008). A 2005 spike resulted from the New Orleans flooding.

Between 2003 and 2008 there were 13 fatalities, 39 injuries and $633 million in property damage as a result of pipeline accidents involving hazardous liquid.

1973: Lakehead PipeLine Co. of Superior (now Enbridge) break releases 31,000 barrels of oil near Argyle, the largest spill in Minnesota until 1991.

August 1979: Lakehead pipeline rupture near Bemidji leaks 10,700 barrels. Company initially recovers 60 percent. Later in 1988 the Minnesota Pollution Control Agency requires Lakehead to extract more oil using new technology; removal continues through 2004.

March 1991: The welded seam of a Lakehead pipeline in Grand Rapids ruptures, releasing 40,476 barrels, more than 7,000 of which goes into Prairie River.

September 1998: 8,810 barrels spill from a Lakehead pipeline near Plummer in Northwestern Minnesota.

July 2002: Pipeline rupture spills 6,000 barrels in marsh west of Cohasset.

January 2007: Enbridge pipeline crack spills 1,190 barrels near Whitewater, WI.

February 2007: Construction crew strikes Enbridge pipeline in Rusk County, spilling 3,000 barrels. In January 2009 Enbridge agrees to pay a $1.1 million settlement to the state of Wisconsin for 545 environmental violations.

April 2007: Enbridge Line 3 (From Alberta to Superior) ruptures in Saskatchewan, spilling more than 3,700 barrels.

November 2007: Line 3 leak near Clearbrook in northern Minnesota explodes, killing welders Steve Arnovich and Dave Mussatti Jr. of Superior. U.S. Department of Transportation levies $2.4 million in fines. Enbridge is appealing the amount.

March 2008: Henri St. Pierre dies in an electrical incident at Enbridge’s Kerrobert, Saskatchewan station.

September 2009: Drilling for Alberta Clipper pipeline causes section of U.S. 2 near Bemidji to collapse.

(Related editorial here.)

Scraping bottom

EditorialBusiness News

10/27/2009

|

In Isaac Asimov’s 1972 science-fiction novel "The Gods Themselves," scientists discover the seemingly perfect clean energy source. (Don’t ask— it involves pumping matter from a parallel universe.)

Of course there’s an unfortunate side effect: Eventually it’ll cause the sun, and maybe a good chunk of the galaxy, to blow up. But by the time this tidbit is discovered, the economic and scientific forces behind the pump are firmly in place and the information is buried. Hence the title, lifted from 18th century poet Friedrich Schiller: “Against stupidity the gods themselves contend in vain.”

Fortunately the story provides a solution: another pump that draws matter from yet a third parallel universe, counteracting the destructive effect of the first source.

Asimov was optimistic that technology can solve a problem that technology created. There’s no known way to counteract the effect of carbon output, other than, “Stop putting out carbon.” One modern proposal is “sequestration,” which involves separating carbon from emission and injecting it underground, but it’s unproven. Growing more trees helps, because trees consume carbon dioxide and emit oxygen. But it’s doubtful we can plant enough to absorb the carbon produced by all those cars, industries and flatulent livestock.

Finally, the world’s business and political establishments acknowledge the need to reduce carbon output. But we’re still a heavily oil-based economy in the middle of a recession and in need of weaning from Middle East oil. So the exploitation of especially dirty oil in Canada and thousands of miles of new pipeline carrying it to the United States continues.

The Obama administration’s strategy is to treat the oil sands as a temporary fix while we transition to a cleaner, more sustainable energy sources. Meanwhile Congress is hashing over legislation that will support such a direction. The Climate Conference in Copenhagen, Dec. 6-18, is a crucial step to getting the world on the same page regarding carbon output.

Is this all moving fast enough to avoid catastrophe? Whether or not you believe global warming is real, it’s clear we can’t keep pumping pollutants into the environment. The mere fact that we’re extracting tar sands oil is evidence that we’re scraping the bottom of the world’s oil supply. It’s no longer a question whether we have to go green, but when . . . and the sooner, the better. Smart businesses aren’t waiting for federal laws to tell them to embrace green methods.

New book outlines the PR effort behind climate-change skeptics

Stephen Hume

Vancouver Sun

October 28, 2009

Public relations specialist and former Sun writer help dismantle the 'denial machine' that argues against global warming

Climate change skeptics regularly denounce me as a disgrace to journalism for declining to accept their dogma, which is mostly received wisdom from sources that I'd trust to evaluate the published science about as much as I'd trust a plumber to perform open heart surgery.

Nothing against plumbers, mind you. They're just not heart surgeons. And the economists, statisticians and agenda-driven politicians routinely cited by the skeptics aren't glaciologists, botanists, biologists, oceanographers, atmospheric physicists or computer modelling specialists.

In the world of climate skeptics, skepticism is apparently acceptable only when it agrees with the climate change skeptics' point of view. Show skepticism toward their own implausible theory of a vast scientific conspiracy at leading universities to deceive the world about global warming with fraudulent "junk science" and it's just unworthy scoffing from a lazy, dishonest hack.

However, I take heart from a fascinating new book by public relations specialist James Hoggan, written in collaboration with former Vancouver Sun writer Richard Littlemore.

Over 25 years, Hoggan has built his Vancouver firm into an international PR powerhouse with clients in North America, Europe and Asia, so I take what he says quite seriously when it comes to the world of public perception, image-management and strategic communications.

Climate Cover-up: The Crusade to Deny Global Warming is a remarkable deconstruction of what he argues is a carefully orchestrated propaganda campaign whose goal is to set the agenda in climate policy by discrediting legitimate science and manipulating public perceptions of the scientific evidence.

This isn't a book about the science behind global warming scenarios, it's an analysis by a well-informed insider of how the debate was skilfully framed by public relations experts to call that science into question, exploit the media's weakness for a good controversy and ultimately to sow confusion and doubt in the public's mind.

It began, the book says, with fossil fuel industry associations, which had the most to lose financially from any serious attempts to reduce greenhouse gas emissions by curbing the burning of coal, oil and natural gas.

These interests, says Hoggan, deployed strategies developed in Big Tobacco's campaign against the anti-smoking movement. Purported research documents were commissioned with the aim of raising questions about climate change science even though their own scientific advisers knew that science to be sound. Meanwhile, he says, a select group of free-market think tanks implemented the strategy and in the process deliberately polluted public discourse on the subject.

"Reputable newspapers and magazines are today acting in a confused and confusing manner," Hoggan argues, "because a great number of people have worked very hard and spent a great deal of money in an effort to establish and spread that confusion."

Chapter by relentless chapter, Hoggan dismantles what some have called the denial machine.

He begins with an outline of the origins of propaganda and how mercenary spin doctors employed the techniques devised by fascist dictators -- and later refined for war and Cold War by Allies and Axis, capitalists and communists alike -- to deftly frame a broad and benign scientific consensus as a fiercely partisan debate over doubts as to whether or not global warming is actually occurring.

There's a chapter on "astroturfing," the strategy of setting up what appear to be grassroots citizens' groups which are actually fronts for special interests, a process with which British Columbians are already intimately familiar from the erstwhile "War in the Woods" during the 1990s.

There's a chapter on the strategic whitewash and a chapter on the tactical use of lawsuits to silence critics. Another addresses the use of charged language to distort and polarize discussion -- the term "junk science,"

for example.

"Junk science" is often used by non-scientists to imply that work by scientists is false or incompetent, although the term is an oxymoron since if it's "junk" it can't, by definition, be science. And if it is genuine science, it can't, by definition, be junk.

Particularly interesting for me is a chapter dissecting the mass media.

Manipulating the journalistic principle of balance in coverage -- get both sides and let readers decide -- and the media's appetite for conflict -- the more vigorous the better -- provided spin doctors with a mechanism for creating the perception that there's actually a scientific argument over global warming, Hoggan argues. The mass media, he says, became unwitting pawns in a game to enhance the credibility of the incredible and discredit credible experts, sometimes publishing arguments by climate change skeptics that cynically misrepresented scientific experts by quoting them out of context to imply that they doubted global warming was occurring when, in fact, the opposite was true.

I have no doubt that Climate Cover-up is going to stir up controversy, particularly in the United States where many of these strategies were deployed and fine-tuned.

Good. It's about time we all started thinking about what are facts, what are opinions, what is meant by scientific consensus and what is merely self-interested spin-doctoring intended to manipulate a discussion about the future of humanity that's far too important to be left to politicians, corporations, pundits and public relations machines.

Shale gas could delay Alaska pipeline plans

COMMENT: Yesterday it was the Mackenzie Gas Project, today, Alaska Gas Pipeline. What is that? 60-70 billion dollars in pipeline projects kaput in two days? That shale gas is potent stuff. Well, not kaput, exactly, but back on the drawing board to be hauled out again in another twenty years.

Or am I getting ahead of myself - there's an awful vested interest in seeing these projects come to fruition. If industry investment ain't gonna make them happen, perhaps an intensified lobbying effort to get governments, we the people, pick up the tab for these lame or dead ducks can pull them off? Maybe along with bailouts to banks and car makers, it can be wrapped up in the twenty-first century's new deal for Americans (and Canadians).

Rena Delbridge

Alaska Dispatch, Anchorage

Oct 27, 2009

The more abundant Lower 48 shale gas reserves become, the more likely a delay for a natural gas pipeline between Alaska's North Slope and North American markets, a federal energy analyst says.

According to a new report by the Energy Information Administration, the high costs, high risks and long lead times to develop Arctic natural gas supplies don't stack up well against the huge reserves of natural gas in the Lower 48, close to strong markets.

The report isn't necessarily a black mark against a natural gas pipeline connecting the North Slope resource with markets in Alberta and the Midwest. But its author, Philip Budzik, an operations research analyst with EIA, expects the huge quantities of shale gas to push an Alaska gas pipeline to the back burner, at least for awhile.

"The Alaska gas pipeline has been a gleam in the eye of producers and the State of Alaska ever since the 1970s," Budzik said in a phone interview. "But no one anticipated that the shale gas formations would be viable production possibilities."

The Lower 48 may be awash in shale gas in known fields, but that's only the start, Budzik said. There's more shale gas to be defined in any basin that produces oil, and it's all a couple thousand miles closer to markets than Arctic gas from Alaska's North Slope.

"The resource base is clearly very large (for shale gas)," the analyst said. "How large, I don't even want to begin to speculate."

In a shale formation, thin slices of rock are packed tightly together, almost like a stack of potato chips, with gas trapped between the rocks. By fracturing the tight shale structure (breaking apart the tight stacks of rock), producers can free the gas. Shale production wasn't considered economical until technologies like horizontal drilling and fracturing methods developed. By some counts, shale gas reserves in the U.S. hold more than 2,000 trillion cubic feet of gas. As a comparison, Alaska may be home to 193 trillion cubic feet, according to estimates by the nonprofit Potential Gas Committee in Colorado. The figures represent proven gas reserves as well as those considered probable, possible and speculative.

Some industry professionals question whether shale gas will produce anywhere close to the reserve estimates, while others say that if wells turn out even a fraction of the total, the U.S. will be rich in gas for a long time.

The proximity of shale gas prospects to major markets -- and to an existing or expanding network of distribution pipelines -- offers a financial incentive for producers that's lacking in the $26 billion to $30 billion, 2,000-plus mile Alaska pipeline planned by two separate entities. Those are TransCanada with partner Exxon Mobil Corp., with a state license and $500 million, and North Slope producers BP and ConocoPhillips.

The state's Alaska Gasline Inducement Act coordinator, Mark Myers, says shale gas shouldn't be seen as a deal-breaker for a pipeline. Instead, it's good news, he says. Fast and furious shale gas development will prompt greater demand, particularly from power generation plants and other large-scale users, that shale gas probably won't be able to keep supplying long-term, opening a market door for Alaska's resource.

But that assessment runs contrary to the EIA's take. Alaska's gas will still come into play, but probably not within the next 10 years, which is about how long pipeline proponents say it will take for their projects to begin operation.

"Eventually, we're going to need hydrocarbons that are in the Arctic, including those in Prudhoe Bay," Budzik said. "When does that day arrive? It may be later than we thought three or four years ago. The producers on the North Slope have a much better sense of the economics associated with North Slope gas than I'll ever have."

He expects an open season in 2010 to reveal producers' positions. That's when a pipeline project lays its terms on the table and producers can make commitments to buy space in a line.

The EIA publishes outlooks on U.S. energy, and analysts have been steadily bumping up the estimated shale gas resource as reserves are firmed up in more and more fields across the country. A new estimate is due out at the end of the year.

"That has a tendency to push the Alaska gas pipeline further out into the future," Budzik said. "How far out into the future, I don't know."

Budzik also cautioned that the growth in estimated shale gas reserves probably won't taper off anytime soon. Where there's an oil basin, there are shale beds. Not all are likely producers, of course -- various factors like oil field maturation and pressure affect commercial qualities, and some basins have lots of clay, which makes hydraulic fracturing less effective.

Prices received for natural gas at key North American hubs will also affect shale gas development. While prices have gyrated in recent months, the gas futures market is busy.

"Even though spot prices have been pretty low, in the $4 (per million Btu) range, a lot of producers have been selling much of their production into the futures market, which in fact has a much higher price," Budzik said, warning that the futures market is unpredictable and could trip up some investors. An EIA survey of four futures contracts shows prices between $5.16 and $6.27 as of Oct. 20.

"I'm not gambling," Budzik said.

Prices don't have far to go to hit $6 per million Btu -- that magical threshold at which companies in producing oil basins see value in also turning out natural gas for market, Budzik explained.

However, as gas prices rise, companies that have slowed or even stopped production could release a flood of gas into the U.S. system, possibly triggering another price lull.

A recent report by consultant ICF International for a consortium of North American natural gas pipeline companies agreed that an Alaska gas pipeline faces economic uncertainty related to shale gas.

"What is uncertain is whether the natural gas can be brought to the U.S. Lower 48 at a cost that is competitive with other domestic, Canadian import, and LNG supply alternatives," the report on pipeline and storage infrastructure projections through 2030 states.

Contact Rena Delbridge at rena_alaskadispatch.com

October 27, 2009

Pipeline dream in peril

COMMENT: What's next? Alaska Gas Pipeline? See tomorrow's post.

John Ivison and Carrie Tait,

National Post

October 27, 2009

Mackenzie Valley plan too costly, sources say

Ottawa has decided not to proceed with its investment in the $16.2-billion Mackenzie Valley Pipeline, sources said, throwing the future of Canada's largest construction proposal into doubt.

Sources said that Jim Prentice, the Environment Minister, took a major financial assistance package proposal to a Cabinet committee last week and it was turned down over concerns about the project's price tag.

When asked whether a decision had been taken not to proceed with the project, Mr. Prentice said: "There has been no decision made."

Mr. Prentice said that he was not prepared to discuss any Cabinet discussions relating to the pipeline. He said that work is carrying on with the project's fiscal framework and with an environmental review by a quasi-judicial Joint Review Panel, which is due to complete its work by the end of the year.

However, the suggestion that the government may be re-assessing its position comes as news to its potential partners in the project.

Pius Rolheiser, a spokesman for Imperial Oil, the lead partner on the project, said he has not heard of any changes to Ottawa's intentions.

Fred Carmichael, the chairman of the Aboriginal Pipeline Group, another partner on the project, said he has not heard a word from Ottawa.

To this point, the government has been a firm supporter of the project. In the last budget, the government allocated $38-million to government departments to carry out environmental work and regulatory co-ordination.

A 1,220-kilometre pipeline from the Beaufort Sea in the Northwest Territories to markets in Alberta has been the dream of many northerners for 40 years. This year, Mr. Prentice told a business audience in Calgary that the dream "has never been closer."

The Environment Minister has looked after the pipeline file through three Cabinet posts -- Indian and Northern Affairs, Industry and in his current portfolio -- and has described the project as "one of the most important in Canada's economic history" because of its potential to open up Canada's Far North.

However, market analysts continue to question the viability of the multi-billion-dollar project, which would involve building infrastructure such as roads and waterways, and come at a significant cost at a time when gas prices are sagging and the fossil fuel can be found in abundance in Canada and the lower 48 states.

Bob Hastings, an analyst at Canaccord Adams, who has been following the pipeline saga for decades, does not think it will be built.

"The price of gas isn't fantastic and the only thing that has really happened in the last year or so is that we've found a heck of a lot of shale gas close to consumer markets," he said. "And what would you rather do? Buy gas from up in the Northwest Territories, a long, long, long, long, long, long ways away at a very high cost, or get the gas that is just next door?"

"They killed it the last time ... [in the 1970s because] it wasn't economic. The gas price came down, and the same thing is happening today."

While there is an estimated seven trillion cubic feet of gas in the Beaufort Sea, there are also estimates of 1,000 trillion cubic feet of gas shale deposits in Texas, Louisiana, British Columbia and Eastern North America that are more accessible.

Analysts suggest that a number of the partners involved in the project -- Imperial Oil Resources Ventures Limited Partnership, ConocoPhillips Canada (North) Limited, Exxon Mobil Canada Properties, Shell Canada and Mackenzie Valley Aboriginal Pipeline Limited Partnership -- may have come to the conclusion that the numbers do not add up.

"We can get all the regulatory approvals in place, and all that stuff done, but at the end of the day, it is going to be the producers that make these projects move forward or not," said Lanny Pendill, a senior energy analyst with Edward Jones in St. Louis, who also doubts the prospects for a rival Alaskan gasline. "I think they have better opportunities elsewhere right now."

Mr. Carmichael, chairman of the APG, said he believes natural gas from all sources, not just the prolific shale plays, will be necessary to replace "dirty" sources of energy such as coal.

"I would think the government would do an in-depth study of the need" for all sources of the cleaner-burning natural gas before yanking support for the project, he said.

October 22, 2009

America's dirty little secret

Jeffrey Sachs

Globe and Mail

Thursday, Oct. 22, 2009

The United Nations Climate Change Treaty, signed in 1992, committed the world to “avoiding dangerous anthropogenic interference in the climate system.” Yet, since that time, greenhouse-gas emissions have continued to soar.

The United States has proved to be the biggest laggard, refusing to sign the 1997 Kyoto Protocol or to adopt any effective domestic emissions controls. As we head into the global summit in Copenhagen in December to negotiate a successor to the Kyoto Protocol, the U.S. is once again the focus of concern. Even now, American politics remain strongly divided over climate change – though President Barack Obama has new opportunities to break the logjam.

A year after the 1992 treaty, Bill Clinton tried to pass an energy tax that would have helped the U.S. to begin reducing its dependence on fossil fuels. The proposal not only failed, but triggered a political backlash.

When the Kyoto Protocol was adopted in 1997, Mr. Clinton did not even send it to the Senate for ratification, knowing that it would be rejected.

President George W. Bush repudiated Kyoto in 2001 and did essentially nothing on climate change during his presidency.

There are several reasons for U.S. inaction – including ideology and scientific ignorance – but a lot comes down to one word: coal. No fewer than 25 states produce coal, which not only generates income, jobs and tax revenue, but provides a disproportionately large share of their energy.

Per capita carbon emissions in U.S. coal states tend to be much higher than the national average. Since addressing climate change is first and foremost directed at reduced emissions from coal – the most carbon-intensive of all fuels – America's coal states are especially fearful about the economic implications of any controls (though the oil and automobile industries are not far behind).

The U.S. political system poses special problems as well. To ratify a treaty requires the support of 67 of the Senate's 100 members, a nearly impossible hurdle. The Republican Party, with its 40 Senate seats, is simply filled with too many ideologues – and, indeed, too many senators intent on derailing any Obama initiative – to offer enough votes to reach the 67-vote threshold.

Moreover, the Democratic Party includes senators from coal and oil states who are unlikely to support decisive action.

The idea this time around is to avoid the need for 67 votes, at least at the start, by focusing on domestic legislation rather than a treaty. Under the U.S. Constitution, domestic legislation (as opposed to international

treaties) requires a simple majority in Congress and the Senate to be sent to the President for signature. Getting 50 votes for a climate-change bill (with a tie vote broken by the vice-president) is almost certain.

But opponents of legislation can threaten to filibuster (speak for an indefinite period and thereby paralyze Senate business), which can be ended only if 60 senators support bringing the legislation to a vote.

Otherwise, proposed legislation can be killed, even if it has the support of a simple majority. That will certainly be true of domestic climate-change legislation. Securing 60 votes is a steep hill to climb.

Political analysts know that the votes will depend on individual senators'

ideologies, states' voting patterns and states' dependence on coal relative to other energy sources. Based on these factors, one analysis counts 50 likely Democratic “Yes” votes and 34 Republican “No” votes, leaving 16 votes still in play. Ten of the swing votes are Democrats, mainly from coal states; the other six are Republicans who conceivably could vote with the President and the Democratic majority.

Until recently, many believed that China and India would be the real holdouts in the global climate-change negotiations. Yet, China has announced a set of major initiatives – in solar, wind, nuclear and carbon-capture technologies – to reduce its economy's greenhouse-gas intensity.

India, long feared to be a spoiler, has said that it is ready to adopt a significant national action plan to move toward a trajectory of sustainable energy. These actions put the U.S. under growing pressure to act. With developing countries displaying their readiness to reach a global deal, could the U.S. Senate really prove to be the world's last great holdout?

Mr. Obama has tools at his command to bring the U.S. into the global mainstream on climate change. First, he is negotiating side deals with holdout senators to cushion the economic impact on coal states and to increase U.S. investments in the research and development, and eventually adoption, of clean-coal technologies.

Second, he can command the Environmental Protection Agency to impose administrative controls on coal plants and automobile producers, even if the Congress does not pass new legislation. The administrative route might turn out to be even more important than the legislative route.

The politics of the U.S. Senate should not obscure the larger point:

America has acted irresponsibly since signing the climate treaty in 1992.

It is the world's largest and most powerful country, and the one most responsible for climate change to this point; it has behaved without any sense of duty – to its own citizens, to the world and to future generations.

Even coal-state senators should be ashamed. Sure, their states need some extra help, but narrow interests should not be permitted to endanger our planet's future. It is time for the U.S. to rejoin the global family.

Jeffrey Sachs is a professor of economics and director of the Earth Institute at Columbia University.

On a cost basis, carbon-capture projects are madness

Jeffrey Simpson

The Globe and Mail

Monday, Oct. 19, 2009

The small reductions gained by staggering per-tonne costs illustrate what every independent analyst knows: The Harper government's 20-per-cent reduction target will not be met

Prime Minister Stephen Harper makes so many spending announcements, flying like Mary Poppins on speed around the country to distribute billions of dollars, that the news media have given up analyzing any of them.

For the heck of it, let's look back to last week, when Mr. Harper dropped into Edmonton to announce $343-million of federal money for a coal-fired TransAlta Corp. carbon-capture and storage (CCS) project. Simultaneously, Alberta Premier Ed Stelmach announced a contribution of $436-million, for a total investment of $774-million of taxpayers' cash.

That Harper-Stelmach announcement followed an earlier Ottawa-Alberta one for a coal-fired Shell carbon storage project. In that case, the combined federal and provincial contribution was $865-million.

The two announcements – both for coal-fired facilities, the oil sands therefore remaining untouched – mean about $1.6-billion in taxpayer money in the years ahead, or about $220 for a family of four.

What do we get for that sum?

We get, at best, a reduction in greenhouse-gas emissions of 2.1 million tonnes. "At best" because the announcements were tempered with hedging words such as "could" achieve and "up to one million tonnes." Therefore, something less than 2.1 million tonnes might actually be captured.

Let's be generous and assume the two projects costing $1.6-billion do in fact bury 2.1 million tonnes of carbon dioxide, the most-prevalent gas contributing to global warming. Such a reduction would mean a per-tonne carbon-reduction cost of about $761 – staggeringly, wildly, mind-blowingly higher than any other conceivable measure designed to cut greenhouse-gas emissions. Want a contrast? Alberta has a piddling carbon tax on emissions over a certain level that companies can avoid by paying $15 a tonne into an technology fund.

What does 2.1 million tonnes mean in pan-Canadian terms? Canada emits about 720 million tonnes of CO2. Mr. Harper has pledged by 2020 to lower that amount by 20 per cent, or about 144 million tones. The two carbon-capture projects just announced, by lowering emissions 2.1 million tonnes, will therefore achieve about 1.4 per cent of the reductions the Harper government has pledged at a cost, remember, of $1.6-billion. At this rate, achieving the 20-per-cent reduction would cost almost $110-billion between now and 2020.

For Alberta? The province, with 11 per cent of Canada's population, is responsible for about 30 per cent of the country's emissions. Taking 2.1 million tonnes from Alberta's emissions will represent about 1 per cent of the province's total emissions. As the province's emissions rise, courtesy of further development of the oil sands, the predicted carbon-capture and storage gains will necessarily represent less than 1 per cent of total emissions.

But wait. After these announcements, Alberta has more money left in its $2-billion fund for encouraging capture and storage. This is the fund the province whips out to show critics that it is serious about global warming.

There remains about $800-million in the fund, but if future projects are like the two just announced, once the entire $2-billion is spent, Alberta might have lowered its emissions by maybe 2 per cent.

On a cost-benefit basis, these carbon-capture and storage projects are madness, leaving aside the fact that taxpayers are picking up the bill. They are wildly expensive for the small amount of carbon they will (might?) prevent from entering the atmosphere. They are most definitely not a substitute for a serious climate-change policy that, however structured, must put a price on carbon emissions by those who produce them – either upstream emitters such as industrial concerns and/or downstream consumers.

The small reductions gained by such large sums also illustrate what every independent analyst has concluded: The Harper government's 20-per-cent reduction target will not be met; indeed, it is increasingly being seen as a joke.

Can anything good be said for these announcements, apart from the nice public relations they brought Mr. Harper and Mr. Stelmach?

At a stretch, these projects will test technologies that, if successful, could eventually bring unit costs down and perhaps be exported overseas, although plenty of other companies and jurisdictions are now in the race to develop carbon-capture and storage technologies.

CCS will be part of the long-term effort to reduce greenhouse-gas emissions, but the possibilities of its contribution have been hyped by promoters and political actors beyond what is reasonable to expect. And the initial costs, as these projects show, lead to staggeringly expensive per-tonne reductions.

October 16, 2009

Gas shale may be next bubble to burst

By JUDITH KOHLER

Houston Chronicle

Oct. 12, 2009

DENVER — The promise of enough natural gas to last the United States more than 100 years based on discoveries of vast shale formations could be the country's next speculative bubble to burst, a speaker warned Monday at a conference exploring the notion that the world's oil and gas are diminishing rapidly.

Arthur Berman, a Texas-based geological consultant, likened the optimistic projections for production from gas shale fields across the country to banks buying into mortgage securitizations, which spurred the housing market crisis and economic meltdown.

“In the midst of a boom or a bubble, it's hard to sit on the sidelines,” Berman said during the Association for the Study of Peak Oil and Gas conference. “If you're not in one of these plays, then Wall Street says, ‘Well, what's the matter with you guys?'”

That was the psychology leading into the current financial crunch, Berman said. Analyses show that gas shale fields in Texas and elsewhere aren't as profitable and likely don't contain as much retrievable gas as the industry and others portray, he added.

Based on the experience in the Barnett Shale in Texas, Berman said he doesn't expect the yields from the wells to be high enough or last long enough to make the gas shales that profitable, even when current low gas prices rise.

His view contrasts with that of other analysts and the industry who see natural gas as playing a key role in the face of concerns about declining oil supplies and climate change. The Potential Gas Committee at the Colorado School of Mines in Golden said in June that the U.S. natural gas reserves total nearly 2,000 trillion cubic feet, up about 35 percent from 2006 estimates and mostly due to such unconventional gas fields as shale and the Rockies' sandstone formations.

Peter Dea, chief executive of Denver-based Cirque Resources, said the abundance of natural gas “truly is an American treasure.” He called the vast layers of rock containing gas in Texas, the Northeast and elsewhere game-changers.

“It really gives us surety of this 100-plus-year supply that we now have in America,” Dea said.

New technology and hydraulic fracturing — injecting liquids, sands and chemicals underground to open pathways for gas — have increased the efficiency and decreased production costs, Dea said. Natural gas, he added, has the potential to replace coal as the country's main source of electricity and fuel the nation's vehicles.

Natural gas is “truly a win-win-win” for the economy, environment and national security, because it's a domestic energy source, Dea said. Natural gas is 60 percent to 75 percent cleaner than coal, he said.

Energy analyst Randy Udall said after the panel discussion that the peak-oil group, which he co-founded, is studying the implications of discovery of the gas shales.

“The increase in production would suggest that natural gas will play a larger role in the future,” Udall said.

But to boost the role of gas to the levels promoted by Dea and others would require a significant increase in development, Udall said. The U.S. gas production peaked 35 years ago, Udall said, and the roughly 10 percent jump in production over the last four years required doubling the drilling rate.

“It would have big impacts on the Rocky Mountain West,” Udall said.

Subscribers of the peak oil theory believe the world is at or near its maximum oil production and that demand will soon eclipse supply levels. Most of the big oil companies disagree and point to the federal Energy Information Administration's projection that the world's oil production peak could be as far as 40 years away.

The peak oil conference runs through Tuesday.

Curbing Emissions by Sealing Gas Leaks

COMMENT: 30% of atmospheric methane comes from the production, processing, storage and movement of fossil fuels. It comes from equipment leaks, venting and flaring, evaporation losses, disposal of waste gas streams, and accidents and equipment failures.

In British Columbia, with relatively low oil production, virtually all methane emissions come from natural gas production.

BC’s natural gas industry could be responsible for up to half a million tonnes (MT) of methane annually.

That’s NOT a half million tonnes of carbon dioxide equivalent (CO2e). At the 100 year greenhouse intensity figure of 25 the methane represents 12.5 MT of carbon dioxide. At the more realistic 20 year intensity of 72, it is 36 MT of CO2e – more than half the provincial GHG total of 66 MT.

Enough gas escapes that it begs the question – isn't the cost of arresting the fugitive gas less than the value of the lost gas? This article suggests so. Perhaps it doesn't matter, since a policy decision by the provincial government, backed up with appropriate penalties, could ensure that it is a good bottom line decision for industry to put an end to fugitive methane.*

*These comments are taken from an unpublished Watershed Sentinel article on fugitive methane emissions

By ANDREW C. REVKIN and CLIFFORD KRAUSS

New York Times

October 14, 2009

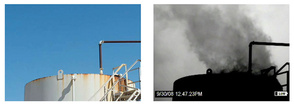

To the naked eye, no emissions from an oil storage tank are visible. But viewed with an infrared lens, escaping methane is evident. (Photographs by the U.S. Environmental Protection Agency) |

To the naked eye, there was nothing to be seen at a natural gas well in eastern Texas but beige pipes and tanks baking in the sun.

But in the viewfinder of Terry Gosney’s infrared camera, three black plumes of gas gushed through leaks that were otherwise invisible.

Terry Gosney uses an infrared camera to check for leaks in natural gas pipes in eastern Texas. (Scott Dalton for The New York Times) |

“Holy smoke, it’s blowing like mad,” said Mr. Gosney, an environmental field coordinator for EnCana, the Canadian gas producer that operates the year-old well near Franklin, Tex. “It does look nasty.”

Within a few days the leaks had been sealed by workers.

Efforts like EnCana’s save energy and money. Yet they are also a cheap, effective way of blunting climate change that could potentially be replicated thousands of times over, from Wyoming to Siberia, energy experts say. Natural gas consists almost entirely of methane, a potent heat-trapping gas that scientists say accounts for as much as a third of the human contribution to global warming.

“This for me is an absolute no-brainer, even more so than putting in those compact fluorescent bulbs in your house,” said Al Armendariz, an engineer at Southern Methodist University who studies pollutants from oil and gas fields.

Acting quickly to stanch the loss of methane could substantially cut warming in the short run, even as countries tackle the tougher challenge of cutting the dominant greenhouse emission, carbon dioxide, studies by researchers at the Massachusetts Institute of Technology suggest.

Unlike carbon dioxide, which can remain in the atmosphere a century or more once released, methane persists in the air for about 10 years. So aggressively reining in emissions now would mean that far less of the gas would be warming the earth in a decade or so.

Methane is also a valuable target because while it is far rarer and more fleeting than carbon dioxide, ton for ton, it traps 25 times as much heat, researchers say.

Yet while federal and international programs have encouraged companies to seek and curb methane emissions from gas and oil wells, pipelines and tanks, aggressive efforts like EnCana’s are still far from the industry norm.

|

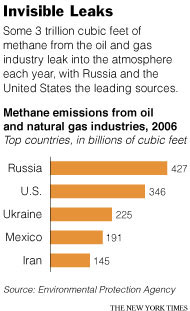

As a result, some three trillion cubic feet of methane leak into the air every year, with Russia and the United States the leading sources, according to the Environmental Protection Agency’s official estimate. (This amount has the warming power of emissions from over half the coal plants in the United States.) And government scientists and industry officials caution that the real figure is almost certainly higher.

Unless monitoring is greatly expanded, they say, such emissions could soar as global production of natural gas increases over the next few decades.

The Energy Department projects that gas production could rise nearly 50 percent over the next 20 years as companies race to discover and tap new sources. In the United States, 4,000 miles of new pipeline was laid last year alone.

But the industry has been largely resistant to an aggressive cleanup.

The Bush administration, which opposed mandatory limits on greenhouse gas emissions, expanded an existing voluntary domestic program for capturing methane emissions and began a related international program — with both aimed at promoting profitable ways for businesses to cut methane emissions as a relatively easy first step to combat climate change.

In April the Obama administration signaled that it could adopt rules requiring the biggest American companies to report all of their greenhouse gas emissions. Oil and gas industry groups countered that the cost and complexity of dealing with some 700,000 wells were too great.