September 30, 2009

Greenpeace takes action again, blocking Suncor tar sands operations International activists join Canadians in saying no to tar sands

Greenpeace Canada

September 30, 2009

|

Fort McMurray, Canada — Greenpeace activists are disrupting Suncor operations today in the heart of the tar sands north of Fort McMurray by stopping two bitumen conveyor belts to highlight the climate crime of tar sands operations.

The 23 activists from Canada, France, Brazil and Germany entered the site early this morning. A team went to the open-pit mine and is stopping the conveyor belts that carry bitumen from the mine across the river to the upgrader. The activists are joined by Greenpeace Canada executive director Bruce Cox.

Live streaming video is at www.greenpeace.org/stoptarsands

Today’s action comes two weeks after Greenpeace successfully stopped a mining operation at Shell and just a week after Rajendra Pachauri, head of the Intergovernmental Panel on Climate Change (IPCC), the world’s leading body on climate science, said that Canada is failing on climate action, and should consider putting the tar sands on hold.

“Greenpeace has taken action here today in the heart of climate destruction to drive the message home to world leaders that we need urgent climate leadership, and that means stopping the tar sands,” said Bruce Cox, Greenpeace Canada Executive Director. “We are here to drive the message home to world governments that we need urgent climate leadership, and that means stopping the tar sands.” —Bruce Cox, Greenpeace Canada Executive Director from the bridge blockade.

“Greenhouse gas emissions are just one element of the crimes happening in the tar sands. Around 11 million litres of toxic chemicals, including carcinogens and other deadly poisons are leaking into groundwater and the Athabasca and poisoning entire communities. Their food is contaminated, their water unsafe to swim in, let alone drink. This is not what the world expects from Canada, but it’s the grim reality.”—Mike Hudema, Greenpeace climate and energy campaigner.

See also:

Tar sands action 1: Activists block tar sands mining operation to send message to Obama and Harper: Climate leaders don’t buy tar sands

September 28, 2009

As Oil Enriches Australia, Spill Is Seen as a Warning

COMMENT: Some statements from this article:

By MERAIAH FOLEY

New York Times

September 27, 2009

SYDNEY, Australia — Visitors hoping to peek at Australia’s exotic marine life usually head straight for the Great Barrier Reef. But conservationists say that an equally remarkable, but lesser known, marine environment is under threat from the booming oil and gas exploration taking place among the reefs and atolls off Australia’s northwest coast.

Oil and gas leaking from a well in the Timor Sea, about 155 miles off the northwestern coast of Australia, on Sept. 12. (Environs Kimberly, via Reuters) |

A damaged oil well in the region has been spewing thousands of gallons of crude oil into the Timor Sea since Aug. 21, when a blowout forced the evacuation of all 69 workers on the platform. Emergency crews have been working overtime to contain the spill, but officials say it could take about three more weeks to plug the leak.

The platform is above the Montara oil field, about 155 miles northwest of Mungalalu Truscott Airbase in the remote Kimberley region of Australia. The leaking well head is owned by Thailand’s national petroleum company, PTT Exploration and Production, one of many energy companies that have set up operations in western Australia to feed Asia’s growing appetite for oil and gas.

In the first half of this year, more than 50 wells were drilled in the tropical waters off western Australia, adding to hundreds of other recent projects. Last month, the government gave Chevron the green light to expand its exploration of the huge Gorgon gas field, a $40 billion project that was opposed by conservationists because of its potential environmental impact.

Economists credit the booming trade in petroleum and other mineral resources for helping Australia escape the brunt of the global economic downturn, but environmentalists say this prosperity comes at a price. They say the Montara oil spill is merely a sign of things to come unless greater protections are extended to vast stretches of tropical reefs off northwestern Australia.

“It’s a classic conflict between development and the ecological values of the region,” said John Carey, manager of the Kimberley Conservation Program with the Pew Environment Group. “We need to get the balance right. But the balance at the moment is that less than 1 percent of this globally significant area is under any form of protection.”

The Thai oil company said it was still investigating what had caused the blowout. To stop the spill, the company has hired a specialist rig to drill 1.6 miles below the seabed and flood the area with heavy mud.

But such highly specialized equipment is not easy to come by. It took three weeks to tow the rig from Singapore.

The company has declined to estimate how much oil has spilled into the sea, saying it is too dangerous to take accurate measurements from the damaged rig. The company and Australian maritime officials, who are helping to clean up the spill, say that the slick is around 25 miles wide and 85 miles long, but that the leakage appears to be slowing.

The federal environment minister, Peter Garrett, said this month that the government believed that 300 to 400 barrels of oil were leaking into the sea each day. That amounts to more than 450,000 gallons of oil, and unknown quantities of gas and condensate, since the blowout began. By that count, the Montara leak is relatively small. The Exxon Valdez, by comparison, dumped around 11 million gallons when it ran aground off the Alaskan coast in 1989.

The oil slick has not reached any coastlines, thanks in part to mild weather conditions and efforts by the Australian government to break up the slick by spraying it with chemical dispersant. But conservationists worry that the spill could take a heavy toll on marine animals that feed and travel on or close to the ocean’s surface.

“We need to shatter the myth that an oil spill is only a problem when it washes up on beaches,” said Gilly Llewellyn, the manager of conservation programs with WWF-Australia.

PTT, the Thai company, has said it is committed to helping clean up the spill and plans to conduct environmental monitoring of the region to assess the damage. Australia’s energy minister, Martin Ferguson, has announced plans for a thorough investigation into the cause.

Mr. Ferguson and the Australian Petroleum Production and Exploration Association, which represents 98 percent of oil and gas operators in the country, have defended the industry’s record, saying the Montara well head leak is the first offshore blowout since 1984.

Marine researchers and conservation groups say they are realistic about the economic drive to continue developing the region, but want the government to designate more marine sanctuaries and to enact stronger environmental regulations in western Australia. The government is expected to release a strategy for the region next year.

“You can’t stop production; this is a huge area of future exploration,” said Nic Bax, the principal investigator of the Marine Biodiversity Research Hub. “We need to make sure we’re working cooperatively with industry to work out what is the best and safest way to do this.”

Past spills and ongoing risks of oil companies are omens

By BOB SHAVELSON

Anchorage Daily News

September 24th, 2009

Bob Shavelson is Executive Director of Cook Inlet Keeper, a citizen-based nonprofit organization with offices in Anchorage and Homer. |

Now, we're seeing the very same historical shape-shifting with the Drift River Oil Terminal incident.

Chevron operates the Drift River Oil Terminal at the base of the Mount Redoubt volcano in Cook Inlet. When Mount Redoubt awoke in late 2008, Chevron refused to disclose how much oil remained in its storage tanks.

Why?

The Homeland Security Act -- al-Qaida apparently posed a greater threat to our fisheries than a simmering volcano. When Redoubt's massive eruption on March 22 sent trees, mud and debris through the facility, Chevron finally revealed the truth: More than 6 million gallons of oil remained perched above our salmon, cod and halibut fisheries.

Chevron knew the risks. The same scenario unfolded during the 1989-90 Redoubt eruption. They reinforced protective dikes, but reinforced dikes can only do so much against the forces of nature. In fact, volcanic floods this year over-topped the dikes, showing the dikes had no safety margin for a slightly larger eruption.

Despite months of warning, there was no actionable plan in place to address a catastrophic spill from the facility. The spill plan required by laws passed after the Exxon Valdez didn't address a 6 million gallon spill, and it didn't even envision oil from the tank farm hitting open water.

In what should have been a day, it took more than a week to activate a Unified Command to coordinate spill prevention and response. And most disturbingly, the initial response priorities were not to protect our invaluable fisheries, but instead to ensure the continued flow of oil.

Chevron also had no plan to address significant economic losses when the facility went offline. Aside from contractor layoffs and their debilitating effects on local families, Alaska lost up to $2 million a month in revenues while the facility remained closed, according to state figures.

Finally, Chevron repeatedly put workers in harm's way at Drift River, and in some cases left them stranded on the ground while eruptions, lightning and lahars raged around the facility. Oil field work is dangerous enough, and the bravery of those who went back into Drift River at the peak of seismic activity was exceptional.

Had Chevron truly been concerned about worker safety, it would have reconfigured the facility to bypass the tank farm prior to the latest eruption. That way, the size of the eruption would not have been a risk factor, operations would not have been so drastically disrupted, and fewer people would have been put at risk.

Chevron Corp. knew all this, but its only plan was to hunker down and hope for the best. Hoping for the best, however, is not a lesson we learned from the Exxon Valdez.

So, we dodged a bullet at Drift River. Yet to hear the corporate public relations machine recount the story, you would think the Drift River response was flawless. No oil spilled, no injuries. No harm, no foul.

We appreciate all the incredible work done to help avoid a catastrophe, but whitewashing this incident prevents us from learning from our mistakes and having better preparedness and worker safety in the future.

The fact remains the Drift River Oil Terminal incident stands as the most significant breakdown in spill prevention and response in Alaska since the Exxon Valdez. That breakdown put our fisherman, workers and countless families and businesses around Cook Inlet at extreme risk. And know that what we see in Cook Inlet will invariably unfold in Bristol Bay and the Beaufort and Chukchi Seas if we allow our governments and the corporations to push into those frontier waters.

Bob Shavelson is Executive Director of Cook Inletkeeper, a citizen-based nonprofit organization with offices in Homer and Anchorage that is dedicated to clean water and healthy salmon.

COMMENT: Mt. Redoubt eruptions took place overnight, in the dark, so the only photographic images of the event are from preceding days and the day after. This YouTube video gives time-elapsed images of steam venting on March 15, seven days before the event. More information and a large collection of images of Mt. Redoubt are available at the Alaska Volcano Observatory. March 23, 2009 are the first images after the major eruptions on the night of March 22.

Location of Redoubt volcano, in relationship to surrounding towns, roads, and other volcanoes. Picture Date: September 26, 2008; Image Creator: Schaefer, Janet; Image courtesy of the AVO/ADGGS.; Source |

Redoubt - Hut webcam image from March 23, 2009 at 20:43:47; Picture Date: March 23, 2009 20:43:47; Image Creator: Redoubt Hut webcam; Image courtesy of AVO/USGS.; Source |

Massive flooding in Drift Valley from the eruption of Redoubt Volcano. High-water marks on the valley walls estimated to be about 6-8 meters (20-25 ft.). View is up-valley from about mid-way up valley to the Drift Glacier. Picture Date: March 23, 2009; Image Creator: McGimsey, Game; Image courtesy of AVO/USGS; Source |

Photos of the flooding in Drift Valley and tephra deposits from the eruption of Redoubt Volcano. Picture Date: March 23, 2009; Image Creator: Read, Cyrus; Image courtesy of AVO/USGS; Source |

Will the Electric Car Ever Make It to the Mass Market?

By Christian Wüst

Der Spiegel

September 16, 2009

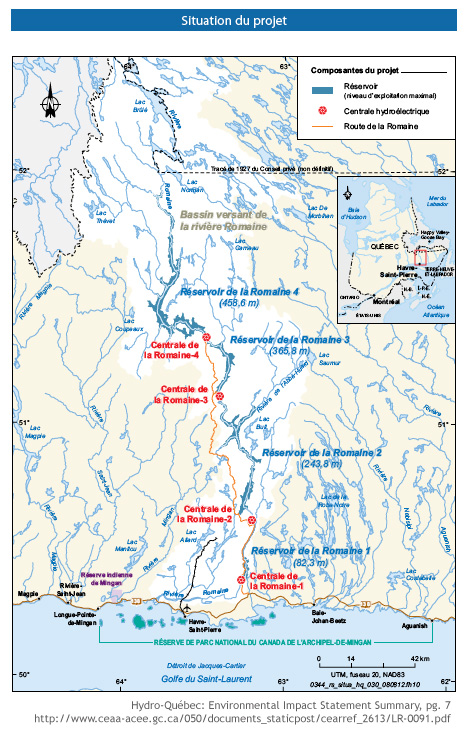

From internal combustion to electric (Der Spiegel) |

Part 1: Will the Electric Car Ever Make It to the Mass Market?

Not Much Will to Power

Germany's automakers are proudly showing off their concept electric cars at the Frankfurt motor show, which opens to the public Thursday. But the shiny new designs on display are just a pipe dream. It's still not clear when, or even if, viable electric cars will make it onto the mass market.

Amid widespread concerns about global warming, it's practically official policy at the European Commission these days to see electricity consumption as a sin. The bureaucrats in Brussels have recently gone so far as to ban the production of 100-watt incandescent light bulbs.

So far, however, there have been no limits set on a much bigger consumer of electricity -- the automobile. When the 63rd International Motor Show (IAA) opens to the public this Thursday in Frankfurt, visitors can check out designs for electric cars whose power rating will exceed that of the banned bulb by a factor of many thousands.

Mercedes-Benz will be showing a 392-kilowatt concept electric sports car, while Audi is presenting a similarly powerful electric version of its top-of-the-range R8 model. BMW will demonstrate alternative engine systems with its "Vision Efficient Dynamics," a hybrid composed of a three-cylinder diesel engine flanked by two electric motors, which is supposed to have a top speed of 250 kilometers per hour (155 miles per hour). "Economizing is getting sexy!" is the verdict of the German car magazine Auto Bild.

But before environmental organizations show up to point out the real carbon footprint of such energy guzzlers, the manufacturers would do well to point out an important fact up front, namely that such high horsepower electric cars are not market-ready, and not a serious option even in the long run. Even the best batteries would run out within a few minutes of being driven at full power.

Pure Fantasy

And so the first IAA to take place in the age of the electric car proves one thing above all -- that giving up gasoline, which can still provide energy in abundance, won't be easy. The desire to create similarly powerful engines using electricity is, for the time being, pure fantasy.

Nonetheless, a conviction seems to have spread throughout the industry that there will be a mass market for electric cars, and that it will probably happen in the decade between 2020 and 2030. Developers estimate that by then storage capacity will have increased two- or three-fold. That could be enough, at least for a car with a small engine.

Electrochemical parameters still set rather narrow limits on the potential of electric cars. The best lithium-ion batteries currently weigh slightly less than 10 kilograms (22 pounds) per kilowatt hour. The first small-series production cars, such as those from Smart or Mitsubishi, have a capacity of 16 to 20 kilowatt hours. That's the equivalent of the energy content of about two liters (0.5 gallons) of gas.

Manufacturers calculate this can provide a driving distance of 100 kilometers (62 miles) or more. But these consumption measurements use extremely slow standard driving cycles as their basis -- the ideal conditions for an electric motor.

Short Range

In practice, these figures could shrink by as much as half when higher speed driving is combined with further sources of energy consumption such as heating or air conditioning. And who wants to buy a car whose range is so small that even a short trip to the outskirts of town would entail constant worries that the batteries might die? One BMW manager sneers that "people won't be able to think about anything but electrical outlets."

In addition, this extremely limited mobility comes with a very high price tag. Lithium batteries with a capacity of 20 kilowatt hours cost around €20,000 ($29,000). That price should sink by about a third when the batteries one day go into mass production. This is the manufacturers' second big hope -- the batteries eventually need to be three times as good and three times as cheap as those available today. Then things start looking more promising for the electric car.

Until electric cars really do hit the streets en masse, so-called plug-in hybrids present a practical interim solution. These are cars that include a conventional internal combustion engine along with the electric motor. Toyota, the pioneer in hybrid technology, has followed precisely this pragmatic path, and will be showing the plug-in version of its Prius model at the IAA.

This partially electric vehicle has a comparatively small battery pack, which is charged from an electrical outlet and can power the car for about 20 kilometers (12 miles). Once the charge is used up, the gasoline-powered motor kicks in, and the ride continues with an economical hybrid system that continues to switch between the electric and combustion engines.

Daimler too will present an S-Class model with a plug-in hybrid system in Frankfurt. The car's energy consumption, fuelled by both gasoline and the power grid, is supposed to be equivalent to a conventional vehicle with a fuel efficiency of three liters of gas per 100 kilometers (78 miles per gallon). This constellation should be ready for series production with the next generation of the company's luxury model in 2013.

Gradual Evolution

This approach -- using a gradual evolution of hybrid technology to eventually reach purely electric-powered vehicles -- is the only plausible strategy. But Western manufacturers are perceptibly lagging behind. The previous IAA, in September 2005, marked a turning point. At the time, car companies in Europe and the US admitted to having missed the boat. Without exception, they all announced their own hybrid systems.

The gap, however, is still enormous. Toyota has already sold more than a million hybrid cars. Volkswagen dealerships, meanwhile, have yet to see a single one. It's the same with Opel, Peugeot, Fiat and Renault. Mercedes is currently producing a very limited number of S-Class hybrids, about 40 a day. They have a so-called "mild hybrid" engine -- a simpler variation following Honda's example, in which the electric engine can only act as support, not power the car alone.

The far more ambitious full hybrid system has been presenting developers with formidable hurdles. Mercedes, BMW and General Motors spent four years on a project called "Two Mode." It outdid Toyota's system considerably in terms of complexity -- and also ended up being far too expensive. The elaborate electromechanical systems created in the project will be used in a few hefty sport utility vehicles and then disappear off the market again. All the participating companies have agreed not to continuing developing the system.

Volkswagen together with its new subsidiary Porsche wanted to present the hybrid versions of their Touareg and Cayenne models at this year's Frankfurt motor show, but they still haven't got the project under control. Integrating a full hybrid system into a traditional powertrain requires a very complicated control system. Both vehicles won't be released until next year, and they'll also be sold at a very high price -- to which the manufacturers are apparently still adding. "We can congratulate any customer who decides against the Touareg hybrid," one VW manager admits.

There is a certain bitter humor in the fact that the same companies which are delivering such pitiful results when it comes to relatively basic electric car technology also want to make IAA visitors believe they already have electric sports cars in the works.

Part 2: German Companies Play Catch-Up

In any case, the arduous pursuit of the electric car has created centers of expertise, albeit less with the car manufacturers than with their suppliers. While Toyota develops nearly all its electrical motor components in house, down to semiconductors and batteries, its Western counterparts outsource this area.

Many car companies and suppliers have now forged relationships with battery manufacturers. The field is largely dominated by Japanese and South Korean producers. German auto parts producer Bosch relies on Samsung, VW gets components from Toshiba, among others, while Opel works with LG Chem in South Korea. Only Daimler gets its electronics locally, from an Evonic subsidiary in eastern Germany called Li-Tec.

"Three to four major battery producers will prevail in the end," estimates Bernd Bohr, the head of Bosch's automotive group. He believes that large system suppliers like Bosch will dominate the market when it comes to the integration of electric engine components, especially the development of the power electronics that control the flow of electrical current.

Stuttgart-based Bosch was long considered Germany's champion as far as automobile electronics were concerned -- even if the focus was previously on the combustion engine. After all, the company logo even features an armature from a magneto ignition.

However Bohr admits that Bosch underestimated the hybrid and electric engine business for too long and entered the field too late. But he believes his company is catching up. "Bosch has always had considerable stamina when it has to sprint," he says. He adds that order volume for hybrid and electric engines is now looking good.

Bold Plans

Noticeably better positioned is a competitor usually associated more with rubber tires, although more recently it gained a doleful prominence as the object of a corporate takeover which ended in tears. Continental, of all companies, is Germany's pivotal technology company in the field of hybrid and electric engines.

The company was already producing the first hybrid components for GM five years ago, and so far Continental has invested more than €500 million in the segment. About 800 employees -- around twice as many as Bosch employs in the sector -- work here on more than 20 projects related to electric motors, including Mercedes' S-Class hybrid, the electric Smart, and the Opel Ampera.

The most spectacular electric car project to be announced so far will apparently also take to the streets with Continental technology. The French-Japanese alliance of Renault and Nissan has signaled that it will soon be manufacturing 100,000 electric cars a year -- a bold plan.

In the run-up to the IAA, Continental was planning to reveal that it has started to develop the central engine components for an electric vehicle which will be launched on the market in large-scale production in 2011. The supplier isn't at liberty to say which manufacturer is involved in this project, but in this case the point is moot -- aside from Renault/Nissan, no other company has comparable plans.

Revolutionary Concept?

The mass-produced electric car is supposed to help Shai Agassi's "Better Place" project to get off the ground. A former board member at the software giant SAP, Agassi was a shooting star in the IT industry and now seems to be taking over the media role that the entrepreneur Nicolas Hayek, a co-founder of the watch company Swatch, occupied in the 1990's. Hayek seduced the industry's major players with his vision of an ultra-ecological "Swatch car," ultimately winning over VW and later Daimler as partners. The end result was the Smart car, a purely Daimler product with some memorable birth defects.

A similar development is foreseeable with Renault and Better Place. Agassi has taken on the role of the virtuoso public speaker, calling his company "the leading electric vehicle services provider," without much substance to show for it. The battery switch stations that are supposed to be Better Place's great idea will for the time being only be available in limited numbers in Agassi's native Israel. And the project's revolutionary concept still relies on the time-tested electrical outlet.

In the end, all car companies are going to have to tackle this problem. It's not the infrastructure for electric cars that's missing, but practical and affordable storage technology.

Renault and Nissan are risking the leap to series production using batteries from the Japanese manufacturer NEC. The goal is an impressive capacity of 24 kilowatt hours. But the prototypes shown so far have had little over half of that.

September 27, 2009

Study shows high level of potentially toxic air pollution in DISH

COMMENT: This is the second article from Fort Worth we've posted recently. Three days ago, it was about Quicksilver Resources, a Texan company, and its stunningly productive new well from the Horn River shales in northeast BC.

Texas & BC, the Barnett shale and BC's Horn River and Montney shale plays.

This article is about pollution from the compression and processing facilities which handle the gas from the Barnett shale.

Hello. Little observed fact: all the gas in northeast BC also needs to be compressed and processed. Don't think it doesn't emit the same nasty stuff that is reported in this study from Texas.

Encana is building the huge Cabin Gas Plant in 60 km northeast of Fort Nelson. The first phase alone, twice the size of the largest gas processing facility in the province, is estimated to cost $400 - $500 million and will process 400 million cubic feet per day (BC's total production is about three times that, and we're already producing 600 mcf from shale). At full build-out the plant will handle 800 mcf daily.

But heck, the provincial government has no monitoring capability, and has no desire to obstruct or deter the big gas investment. Out of sight, out of mind. Animals of other species might suffer the toxic consequences.

And the greenhouse gas emissions? Well, they'll just be vented - all 2 million plus tonnes per year. If suitable nearby disposal areas are proven up, and IF suitable federal and provincial subsidies are made available, the company may be able to sequester and reinject the CO2 (and the H2S) from the plant. Otherwise? It becomes the biggest single source of greenhouse has emissions in the province.

So pay some attention to this report from Texas where a heck of a lot more people live near the Barnett shale plays. If this is what industry gets away with there, just think of what it can get away with 60 km northeast of Fort Nelson.

As to who is paying attention, the answer is virtually no-one - other than government and industry. The public comment period on the Environmental Assessment expired on August 21. Four, that's FOUR, comments were received. Ignace Burke made the point that he and his family live only 5 km from the plant site, but that "nobody mentions that to you people." Karen Campbell and Matt Horne of Pembina Institute submitted the only substantial comment, demanding in effect that all carbon emissions be sequestered and that the downstream carbon emissions from end-use of the gas also be attributed to the project. Yea. Nice try. Fat chance.

This is not an accusation, but it has been proved countless times that the government will not serve as a watchdog for citizens, so citizen watchdogs are essential to protection of our health, our communities, and our environment. What can we do where the citizen watchdogs are non-existent, or unable to take on the work?

Project site at the Environmental Assessment Office

See also:

Gas plant must curb emissions, watchdog says

Multibillion-dollar gas plant planned in B.C.

Huge gas project set for 2011

Curious about the unusual spelling - all capitals - of DISH?

Wikipedia says:

DISH is a town in Denton County, Texas, United States. The town had an estimated population of 181 as of July 1, 2008, according to the United States Census Bureau. Formerly called Clark, the town was officially renamed DISH (all capital letters) on November 16, 2005.The municipality was previously named after its founder, Landis Clark, who incorporated it in June 2000 and served as its first mayor. Clark was beaten by one vote in the Spring 2005 election by Bill Merritt.

In exchange for renaming the town, all residents of the town have received free basic television service for ten years and a free DVR from DISH Network. There was no formal opposition to renaming Clark; twelve citizens attended the council meeting to support the measure.

Dish Network Corporation is a direct broadcast satellite service provider that ... serves approximately 13.58 million subscribers.

Imagine that. Are you ready for Encana BC?

By MIKE LEE

Star-Telegram (Fort Worth)

Saturday, Sep. 26, 2009

A new study shows high level of potentially harmful air pollution in the town of DISH in Denton County.

DISH sits next to several large compressor stations, which process natural gas from the Barnett Shale and pressurize it for shipment across the country. Residents have complained for years about the smell and the noise.

The study, done by Wolf Eagle Environmental and paid for by the Town Council, found high levels of 15 chemicals, including benzene, xylene, naphthalene and carbon disulfide at five of seven test sites. In some cases the levels were 10 times the recommended level for short-term exposure, and some levels were high enough to be an immediate danger, according to the study. It said, however, that the results were only a one-time snapshot.

Mayor Calvin Tillman, who has been fighting the pipeline companies for about a year, said the study proves that state regulators need to take action.

"I don’t believe this was a one-day event," he said. And even if it was, "you still broke some thresholds for short-term exposure to these chemicals."

Terry Clawson, a spokesman for the Texas Commission on Environmental Quality, said the agency was already planning testing for airborne toxins in Denton County.

The companies that run the compressor stations, including Atmos Energy, Chesapeake Energy, Enbridge, Energy Transfer Partners and Crosstex Energy, paid for a study in DISH this year that concluded that gas levels in the air weren’t high enough to be dangerous.

However, that study didn’t check for toxic chemicals, said Scott McLAren of Apogee Scientific, who conducted the survey.

"We were only looking for leaks in natural gas pipelines," he said.

Still, two of the companies referred to the previous study when asked about the latest study.

"We believe we’ve taken ample steps to communicate the details of our investigation to the mayor and will continue to monitor our operations in the area," said Jill McMillan of Crosstex Energy.

Justin Bond of Chesapeake Energy said, "The last time several operators spoke with Mayor Tillman and presented this information, he complimented our efforts."

Mike Lee, 817-390-7539, mikelee@star-telegram.com

Read the DISH, Texas, air study (pdf)

September 25, 2009

Canada and climate change: Nothing gets done, fingers get pointed

Jeffrey Simpson

Globe and Mail

September 25, 2009

Global warming simply is not an issue on which Prime Minister Stephen Harper wants to expend one ounce of political capital. (REUTERS) |

The Liberals' lame record doesn't excuse the Conservatives' part in our national shame

The “tragedy of the commons” occurs when something – a pasture, a lake, a fish stock, the atmosphere – becomes degraded by the actions of all.

No single action by a person, property owner or government causes the degradation, and no single action will materially reverse the negative trend. So nothing gets done, fingers get pointed and the “commons” degradation continues.

The world faces its greatest tragedy of the commons with the warming of the planet's atmosphere that is overwhelmingly caused by human activities, especially emissions of carbon dioxide and methane. Crank scientists and their dwindling band of supporters contest this warming, but the overwhelming majority of scientists have declared it to be a fact. Indeed, the latest scientific evidence suggests an acceleration of warming trends.

Although some are far more than others, no one industry or country is responsible. So, for example, in Canada, which produces roughly 2 per cent of the world's emissions, it is easy for those who want little or nothing done at home to point fingers at others.

Creating 2 per cent of the world's emissions is actually a terrible record for a country with a population of just 33 million. On a per capita basis, Canada is one of the worst emitters on the planet.

Canada's emissions record is the worst in the industrialized world, because since a previous government signed the Kyoto accord, the country's emissions have grown by 27 per cent, instead of declining the promised 6 per cent. The latest government report has shown Canada's emissions rising again after a slight decline in the previous two years.

You might think that for a country bathing in its own moral superiority, believing “the world needs more Canada,” this record would be a source of national shame, such that citizens would demand the government take a leading role in reversing the domestic record while urging the world to do much more to reverse the ominous trends.

If so, you would be wrong.

The Liberals' record on this file while in office was appalling. Never forget this. But the Liberals' dreadful record of empty rhetoric, failed plans and false targets does not excuse the Conservatives' lame efforts since arriving in office.

Global warming simply is not an issue on which Prime Minister Stephen Harper wants to expend one ounce of political capital. Earlier this week, while other world leaders took the podium for a special United Nations session on climate change, he preferred a meeting and photo opportunity with the mayor of New York. He did attend a private leaders' dinner, but then rushed back to Canada for another of his patented economic “announcements” at a Tim Hortons facility.

Mr. Harper sent Environment Minister Jim Prentice to the UN, where he criticized the Chinese and Americans for not presenting carbon reduction targets, despite the fact that every expert in Canada (and many overseas) knows that Mr. Harper's own government's target – a 20-per-cent reduction by 2020 – cannot possibly be met under current policies.

Not for Mr. Harper the kind of carbon tax being imposed in France by President Nicolas Sarkozy. Not for him the urgency with which Britain's Gordon Brown, Germany's Angela Merkel and Australia's Kevin Rudd approach climate change. Not for him the moral imperative that infuses President Barack Obama's speeches on the subject, although congressional politics will ultimately dilute his actions.

No, climate change is something Mr. Harper has been forced to tackle with the greatest reluctance. He was long a skeptic about the science, and he has always feared the economic fallout of serious action.

Politically, he has calculated that action on climate change doesn't have any upside for his party, since few voters associate the Conservatives with environmentalism. He certainly does not want to upset anyone in the fossil-fuel-producing provinces of Alberta and Saskatchewan, which are the core of his party's political base. He wants his own reputation to be associated with economic management and lower taxes, not climate change.

After all, those Tim Hortons voters are quite literally the bull's eye of Conservative political ambitions, and they don't seem terribly worried about climate change. So Mr. Harper isn't going to spend an ounce of political capital being associated with the issue, or providing serious leadership at home and abroad.

September 24, 2009

Carbon capture plan 'sheer folly'

Nathan VanderKlippe

Globe and Mail

Thursday, Sep. 24, 2009

Production foreman Ron Toly visually inspects the carbon capturing research facility near Redwater, Alberta, June 26, 2009. (John Ulan/The Canadian Press) |

Main pillar of climate-change plan too risky for Canada to pursue, policy paper says

A major prong of Canada's climate change plan is so flawed that to pursue it now – with neither the proper science nor proper laws in place – would be “sheer folly,” concludes a new report.

The risks of building a system to capture and store carbon dioxide underground include arsenic leaching into groundwater, unforeseen leaks, cross-border disputes and spiralling costs, according to a paper that will be released by the Munk Centre for International Studies Wednesday.

“Given the paucity of groundwater information in Canada and lack of national water standards, the push to accelerate [carbon capture and storage] could pose real risks to our groundwater resources,” argues Graham Thomson, the Edmonton Journal columnist who authored the 63-page document. The research compendium draws from published reports and expert interviews.

“In sum, the marriage of a brave new technology with a political fix for an immediate climate problem could have negative long-term consequences for Canadian taxpayers and water drinkers without stabilizing the climate.”

| Read the Munk Centre for International Studies paper: Burying Carbon Dioxide in Underground Saline Aquifers: Political Folly or Climate Change Fix? Download this file (.pdf) |

Carbon capture and storage, or CCS, involves siphoning off, then pumping underground, carbon dioxide from emissions coal-fired power plants and oil refineries. It has become a key element of Canada – and the world's— strategy to beat emissions.

The United Nations believes 55 per cent of emission reductions can come from CCS. U.S. President Barack Obama has pointed to the technology as an area where Canada and the U.S. can collaborate. Ottawa has put up to $140-million into funding eight projects. And the Alberta government, despite plunging into a nearly $7-billion deficit, has steadfastly defended the $2-billion it committed to building three CCS pilot plants.

The problem, Mr. Thomson finds, is that Canada has yet to draft the regulations, create the oversight regimes or lay the proper scientific groundwork to launch a project that could see vast quantities of carbon dioxide buried kilometres beneath the earth in saltwater aquifers.

Moving forward without any of those things in place, he writes, “would be sheer folly.”

The findings rankled some in Alberta, who argued that it is unfair to point to flaws in a system that has yet to be developed.

Jerry Bellikka, the director of communications with Alberta Energy, questioned Mr. Thomson's scientific credentials – he is a journalist, and the report presents no new findings – and argued that Alberta's long experience in regulating industry's underground injections of poisonous gas makes it fit to properly manage CCS.

“I don't think it should be alarming to everybody that we don't have everything mapped out ahead of time, because we're just starting the process,” he said.

But even the sheer scale of what's required for CCS is worrisome, Mr. Thomson writes. For example, sequestering just 25 per cent of global carbon emissions will mean erecting an infrastructure twice the size of what today's entire oil and gas industry has built in the past century, according to one estimate.

That would use such a vast amount of resources “that it would be a colossal diversion of energy and actually a real waste of time,” said Andrew Miall, a University of Toronto geology professor who has reviewed the paper, and agrees with many of its conclusions. “How much CO2 are you going to generate to make the steel [pipelines] to transmit the CO2? It just gets plain silly.”

Prof. Miall, along with representatives of the U.S. Environmental Protection Agency, Natural Resources Canada and environmental groups will debate the paper's findings today in Toronto.

Among those: Pumping compressed carbon dioxide into an earth pin-pricked with holes is inherently risky. In Alberta alone, 400,000 wells have been drilled – and those that have been forgotten or poorly built present a potential carbon escape route. Huge volumes of carbon dioxide pumped into saline aquifers could displace some of that briny water into drinking supplies – exactly what happened with underground wastewater injections in Florida.

Badly designed projects may cause arsenic and lead to leach into drinking water. And massive injections of high-pressure gas into the ground can create micro-earthquakes, fracturing rock and leading to even more possible leakage points.

The costs, too, could rise, as they have with technology like nuclear power generation, making an already-expensive solution even pricier.

Still, others say industrial experience in capturing sulphur emissions has shown that costs can fall dramatically with time. And the Intergovernmental Panel on Climate Change has concluded that leakage risks are minor, especially from aquifers thousands of metres below groundwater supplies.

“There are always doubters and people that have fears,” said Jim Carter, who chairs Alberta's Carbon Capture Council. “But CCS has the most promise of anything out there. And I think we'd be irresponsible if we didn't really begin to develop in a meaningful way the opportunity to implement this technology.”

Oil sands: The muddied message

COMMENT: Environmentalist campaigns against tar sands exploitation appear to have fostered a growth opportunity - and the advertising industry is pouncing on it with all the tools in its arsenal. But this article suggests the tar sands producers aren't falling for it.

Nathan VanderKlippe and Katherine O'Neill

Globe and Mail

Thursday, Sep. 24, 2009

A Syncrude oil sands facility in Alberta (AFP/Getty Images) |

Recent Greenpeace stunt reveals need for industry to tackle its ‘dirty oil' image problem head on, observers say

Alberta's former energy minister warned the oil sands industry to “wake up” and start fighting an aggressive public relations battle, telling producers they should be embarrassed that 25 protesters were able to sneak into and temporarily shut down a major mine last week.

In a passionate call for the oil patch to more fiercely fight the public image battle it is waging – and, by some accounts, losing – Pat Nelson called a Greenpeace stunt a moment of shame in an address to the Oil Sands Trade Show and Conference in Edmonton Wednesday.

“Wake up, people! It's no wonder what we are getting [out are] the wrong messages,” said Ms. Nelson, who left office in 2004 and is now the vice-chairman of an industry group called the In Situ Oil Sands Alliance. “Every other country in the world would have stopped them at the gates, even if it meant using force. What a message to send.”

For an industry that has faced a growing line of opponents, the Greenpeace stunt reveals a dire need for a concerted campaign to tackle its “dirty oil” image problem head on, observers say.

The protest serves as evidence that efforts to counter the environmentalist message have been far too passive, Ms. Nelson said, showing conference-goers images of a huge “Tar Sands: Climate Crime” banner that Greenpeace unfurled inside the Albian Sands mine, owned by Royal Dutch Shell. The protest succeeded in closing down the mine north of Fort McMurray, Alta., for several hours.

Pictures of that banner were sent across the world. For industry to undo the damage they have done, it needs to show the public “the real pictures of the oil sands,” she said.

It is an argument that strikes at the heart of the oil patch's response to its growing chorus of critics. Rather than strike back with a broad-based marketing campaign, aimed at putting its message before large swaths of the public, the industry has relied instead on websites and conversations with smaller audiences. Its rationale has been that it can be more influential by making a stronger connection with fewer people.

Marketers, however, say that's a mistake. By failing to push back more aggressively, they say, the campaign against oil sands is going largely unchallenged. In part, that may be because the oil industry simply has not been wired to fight back in public, said Russell Stedman, the managing director at the Calgary office of ad firm Taxi Canada Inc.

“Most of these companies have been successful in spite of their marketing,” he said.

But, he said, an effective response may require that those attitudes change. “[Better marketing is] going to have to play a role,” Mr. Stedman said.

The industry could highlight some progress it's made in reducing emissions, oil extraction technologies that step more lightly on the boreal forest, and ongoing efforts to reclaim exploited lands. Critics, of course, say an image overhaul is impossible because the industry is inherently environmentally destructive.

Industry has done some mass marketing – including ads in several smaller U.S. publications such as the Washington Times, and The Hill, last week.

But rather than spend on big-budget advertising, companies have instead worked to stir up a “conversation” on oil sands. The Canadian Association of Petroleum Producers launched a Twitter feed this summer, and spends the bulk of its advertising budget on Google ad buys, which for $10,000 a month have delivered 10,000 monthly hits to its website. It has worked to build up canadasoilsands.ca, where it lays out industry positions on issues like water use and emissions. And it has tendered favoured numbers-heavy slideshow presentations to get its message out.

But the volume of that response appears to be outmatched by critics, who have taken out ads in some of the biggest U.S. newspapers, launched a satirical oil sands travel website (inviting guests to mornings that start with a “propane cannon wake-up call”) and greeted both travelling senators and President Barack Obama with published anti-tar sands messages.

Industry itself admits it has been slow to respond.

“We have to a large degree neglected the broader NGO communities, and some of the concerns that have related to our operations,” said Janet Annesley, Shell's senior manager of external relations. “We do know we need to do better. That's the bottom line. Industry has been on the back foot.”

Damaged reputations aren't the only danger of unchallenged criticism. Public opposition could also hurt the “social licence” of oil sands companies to operate, and potentially affect policy.

But industry hasn't yet seen evidence of that – U.S. leaders, in fact, have made recent statements supporting oil sands in the name of energy security. And the oil patch believes firing back with a mass market salvo won't work. For one, there's the question of whether anyone would actually believe them. “We don't have the credibility to tell our story in a one-way medium,” said CAPP spokesman Travis Davies, who acknowledges the PR battle will likely become more strident in the months ahead of the Copenhagen climate talks in December.

Still, rather than fight fire with fire, he believes industry first needs to build a base of believable supporters.

“We need to build some advocates on both the media side and the public side that will engage us in a bigger conversation, and then maybe we'll have some legs to stand on in terms of traditional messaging,” he said. “But until we do that, we just don't have the luxury of sloganeering.”

Oil sands under attack on environment

Shawn McCarthyGlobe and Mail

Tuesday, Sep. 15, 2009

Oil sands emissions (Nathan VanderKlippe/The Globe and Mail) |

The industry is accustomed to defending its image in North America, but it now faces a multifront war, with opposition growing from Norway to Washington

The environmental battle over Alberta's oil sands is going global, forcing the industry to respond to new attacks on its record and putting fresh pressure on Ottawa.

The Calgary-based industry is accustomed to defending its image in North America, but it now faces a multifront war. That growing global opposition is highlighted by its role in today's federal election in Norway, where the state-owned oil company's plans for the oil sands have sparked controversy.

As well, a documentary that premiered in Switzerland and is now playing at the Toronto International Film Festival depicts the projects' devastating environmental impact; and a delegation of Chinese journalists is planning a visit to the scarred landscape of northeastern Alberta.

At the same time, U.S. activists are continuing their attacks in Washington, scheduling a news conference this week ahead of Prime Minister Stephen Harper's visit with President Barack Obama to highlight the dramatic increase in emissions that would occur if oil sands production is expanded as planned.

The industry expects the anti-oil sands campaigns will heighten in the runup to the international climate change conference in Copenhagen in December, which aims to replace the Kyoto Protocol with a new, binding international treaty to control emissions.

“We're not surprised that the discussion has migrated overseas to some extent, and we would expect that certainly in the lead-up to the international meeting in Copenhagen, we may see more of that,” said David Collyer, president of the Canadian Association of Petroleum Producers.

Critics are seeking to discourage foreign investment and force Canada to make more-aggressive commitments on climate change by targeting what has become a symbol of Canada's failure to cut emissions: Alberta's massive, open-pit bitumen mines.

The backlash goes beyond some adverse publicity.

Global companies such StatoilHydro ASA or Royal Dutch Shell PLC are encountering growing pressure in their home countries to revisit plans to invest in the oil sands, while Ottawa will have to table a credible climate-change plan – including real limits on oil sands emissions – or face international censure and perhaps even barriers to trade.

The industry is responding. Statoil chief executive officer Helge Lund wrote an op-ed piece in a Norwegian newspaper defending the company's role in the oil sands, while companies are themselves inviting international journalists to visit the Fort McMurray region.

Mr. Collyer expressed optimism that Canadian governments will balance environmental needs with economic development and energy security, and expects the U.S. government to take a similarly “balanced” approach. But he acknowledged there will be mounting pressure on Canada – and on the oil sands – in some international capitals.

The industry executive said oil sands represent only 5 per cent of Canadian emissions, and the country produces a mere 2 per cent of global greenhouse gases.

He said the typical oil-sands project produces 5- to 15-per-cent more carbon dioxide per barrel of oil than conventional oil supplies on a so-called “wells to wheels basis,” which calculates emissions from the production, refining and consumption of the petroleum.

Later this month, Mr. Harper will travel to Pittsburgh to attend a meeting of the Group of 20 nations, where leaders will attempt to narrow the gaping divisions between developing and developed countries, and Europe and North America, in hopes of reaching a climate treaty in Copenhagen.

Mr. Harper has insisted developing countries like China and India must accept some commitment to reduce greenhouse-gas emissions.

But Canada's credibility is undermined by its own modest targets and its failure to even come close to meeting its commitments under the Kyoto Protocol, said Andrei Marcu, a climate-change adviser with Calgary-based law firm Bennett Jones LLP.

The federal government is slated to release a revised climate-change strategy this fall that is expected to force companies to further reduce their emissions per barrel of oil produced, but not include absolute caps that would limit expansion of oil sands projects.

Environmentalists argue the oil sands represent one of the fastest-growing sources of emissions in the world.

They say that in order to protect its domestic oil industry, Canada has been a laggard in the international climate-change debate.

In a report to be released today, Greenpeace calculates total emissions from the oil sands region will triple by 2020 if proposed projects come on-stream.

Environmental writer Andrew Nikiforuk, who wrote the report, said the oils sands will have larger emissions than some mid-sized European countries, including Belgium, Ireland and Denmark.

That prospect has prompted politicians in Norway to assail Statoil for its plans to expand in the oil sands. In fact, Greenpeace has helped instigate the backlash in the Nordic country, hosting Norwegian journalists visiting northeastern Alberta, and sending a delegation, including Mr. Nikiforuk, to Oslo prior to Statoil's annual meeting in May.

In advance of today's vote, virtually every party in the country's multiparty system has said it will review the state-owned company's Canadian strategy after the election. Minister of Environment Erik Solheim is a member of the Socialist Left Party, a member of the governing coalition led by the Labour Party.

He said his party will demand new environmental laws that “will make it impossible for a company like Statoil to enter such [oil sands] projects,” he told the Norwegian daily Aftenposten.

Statoil moved aggressively into Alberta in 2007, when it paid $2.2-billion for North American Oil Sands Corp.

The company says it is committed to reducing emissions in the oil sands, including possible adoption of carbon capture and storage (CCS) technology.

Though many in the oil industry tout CCS has a key to improving its carbon footprint, the technology remains untried and prohibitively expensive without major government subsidies.

With a file by The Canadian Press

Quicksilver Resources stock jumps on news of Canadian well output

COMMENT: Quicksilver is not just producing natural gas from BC's shales, but is also Canada's largest producer of coalbed methane.

By JACK Z. SMITH

Star-Telegram.com (Fort Worth, TX)

Posted Tuesday, Sep. 22, 2009

The stock of Fort Worth-based Quicksilver Resources soared to a yearly high Tuesday, buoyed by an announcement of strong results from a Canadian natural gas well.

Quicksilver (ticker: KWK) closed at $14.43 a share, up $1.31, or 10 percent.

The stock vaulted as high as $15.10 in heavy early morning trading, after a company announcement late Monday that a Quicksilver horizontal well in the remote Horn River Basin of northeast British Columbia had an impressive initial production rate of 13 million cubic feet of natural gas a day and an average daily yield of 10 million cubic feet in its first month of production.

The stock’s trading volume topped 7.1 million shares Tuesday, more than quadruple its daily average of about 1.69 million shares traded over the past five years, according to Bloomberg data.

Quicksilver CEO Glenn Darden said Monday that he is "very pleased" with the well and hopes to realize "even greater production volumes per well" in future drilling there.

Quicksilver has a substantial lease holding of 127,000 net contiguous acres in the basin, which has some geological characteristics similar to the Barnett Shale of North Texas, where Quicksilver is a significant player and has a projected 10-year drilling inventory on its lease holdings of 192,000 net acres.

Quicksilver’s stock price gains since March have been especially substantial given that it is predominantly a natural gas producer. Gas prices, which have spiked recently, are still at less than one-third of their July 2008 peak of more than $13 per million British thermal units. In futures trading Tuesday on the New York Mercantile Exchange, gas for October delivery settled at $3.61 per million BTUs.

Quicksilver’s stock was exceptionally volatile in 2008, trading as high as $44.98 on May 7 and as low as $3.74 on Dec. 5. The stock rose and fell largely in sync with natural gas prices, as did stocks of other independent gas producers.

On Monday in a briefing at company headquarters before a drilling site tour for three state legislators, Darden said that the gas glut should eventually dissipate, with prices likely to rebound to a "more reasonable" level of $6 to $8 per million BTUs. If that price can be sustained, drilling activity should rebound significantly, energy analysts have forecast.

Jack Z. Smith, 817-390-7724, jzsmith@star-telegram.com

Extended OCS comment period produces 350,000 comments, Salazar says

Nick Snow

OGJ Washington Editor

Oil and Gas Journal

Sep 22, 2009

WASHINGTON, DC, Sept. 22 -- The US government received more than 350,000 public comments on possible Outer Continental Shelf resource development strategies during the 6-month comment period that expired Sept. 21, US Interior Secretary Ken Salazar said on Sept. 22.

Many of the comments came from public meetings he hosted in New Jersey, Louisiana, Alaska, and California, he said. “I heard broad agreement that we must confront our dangerous dependence on foreign oil, build a clean energy future, and make use of the limited resources we have while protecting our land, water, and wildlife,” he said.

Salazar said the US Minerals Management Service is reviewing all of the comments, which will take several weeks. Once that is complete, it will initiate environmental analysis and what he termed “public scoping opportunities” associated with the 5-Year Plan for oil and gas development on the OCS.

“The offshore energy program we are developing must address our nation’s energy security challenges, deliver a fair return to the taxpayers who own the resources, and account for the views of local communities, states, and tribal nations,” the secretary said.

It also must take several key considerations into account, including ocean areas critical to military training and the national defense; other economic benefits of the oceans including fishing, tourism, and subsistence uses; environmental considerations; existing oil and gas infrastructure; interest from the oil and gas industry; and the availability of seismic and scientific data, he said.

“I am confident that we will be able to expand our nation’s offshore energy portfolio by focusing on development in the right way in the right places,” Salazar said.

Move aggressively

Meanwhile, oil and gas industry groups urged MMS to move ahead aggressively on developing more OCS energy resources the 6-month public comment period on a draft proposed 5-year OCS plan expired.

“In about a week’s time, we will mark the 1-year anniversary of the end of the moratoria for new oil and natural gas leasing in federal waters off our Atlantic and Pacific coasts,” noted American Petroleum Institute Pres. Jack N. Gerard. “Despite the public’s clear desire for more domestic energy development and the industry’s years of experience operating offshore in an environmentally sensitive way, this administration repeatedly has slow-pedaled this plan which would benefit all Americans, especially in these tough economic times.”

Gerard said new oil and gas development could create thousands of jobs, add more than $1 trillion to government coffers, strengthen US energy security, and encourage a domestic economic recovery. “It’s time to end the delays. The administration now has comments in hand. It knows that oil and natural gas will be integral to the nation’s economy for decades to come. It must act now to ensure that America has the energy it needs today, and in the future,” he said on Sept. 21.

In comments submitted to MMS on Sept. 15, Independent Petroleum Association of American Pres. Barry Russell warned: “As our nation’s energy demand continues to increase, a failure to provide needed access to the OCS will increase domestic energy prices, slow US economic growth, and create hardships for consumers.”

“The next 5-Year Plan will define the shape and scope of domestic offshore energy development. It is essential that MMS develop a leasing program that provides maximum flexibility for our nation to address its energy needs,” Russell said.

Prompt review

National Ocean Industries Association Pres. Tom Fry urged US Interior Secretary Ken Salazar to review the comments promptly and analyze all OCS planning areas now that the 6-month comment period extension the secretary imposed on Feb. 10 has expired.

“Today’s volatile energy prices and supplies have created many problems for ordinary Americans. In part, this is because the government has denied access to energy resources owned by the American people,” Fry said on Sept. 21. “The energy resources on the OCS are vital to the nation’s economic prosperity, and safety records show that they can be produced in an environmentally responsible manner.”

Jenny Fordham, energy markets and government affairs director at the Natural Gas Supply Association, said the draft proposed plan (DPP) was a step in the right direction “and industry supports a robust plan as a foundation to our future domestic energy supply.” She said, “MMS should not delay the 5-Year Plan process, but should move forward quickly after the close of the comment period to develop the proposed plan and complete the necessary environmental work.”

In comments submitted to Renee Orr, MMS’s 5-Year Plan program director on Sept. 21, Fordham said NGSA was pleased that MMS added areas not included in previous 5-year OCS plans to this one’s DPP, including lease sales in the eastern Gulf of Mexico “which is known to contain vast resources of natural gas.” The industry association supports the proposal of 31 lease sales with no restrictions, such as buffer zones, and encourages MMS to prioritize the schedule of lease sales to be held in those areas known to have the highest resource potential, she said.

The federal government locked up OCS areas believed to contain 18 billion bbl of oil and 77 tcf of gas for more than 20 years, Doug Morris, API’s upstream and industry operations group director, noted in comments that API submitted to MMS on Sept. 21.

‘May be conservative’

“These resource estimates may be conservative since the areas in question are largely unexplored,” Morris said. “But if given access to them, the industry could use today’s highly sophisticated technology to locate and tap new domestic resources in an environmentally responsible manner as it has in other areas for decades.”

Past decisions to restrict OCS acreage available for exploration compelled the oil and gas industry to “pick over the bones” in search of commercial hydrocarbon quantities, Morris said. He cited expenditures of $2.2 billion for leases in 1996-97, with only 6% of the tracts eventually producing oil and gas and the remainder returned to the government. “Over 50% of the leases were eventually resold in subsequent sales for an additional $6.2 billion as the industry continued to search for the ‘needle in the haystack’ in a limited geographic area using new exploration technologies,” he said.

Morris conceded that successive exploration over some of the same areas led to new discoveries because new geologic concepts were tested, aided by the evolution of exploration and production technologies. “Nevertheless, over the period that moratoria restricted access to as much as 80% of the OCS, other opportunities for discovery went unexplored and untested,” he said.

Access to areas where technologies and concepts can be tested, and where lessons learned from exploration elsewhere in the world can be applied, will increase the likelihood that new domestic offshore oil and gas resources will be discovered and domestic energy security improved, Morris said. “We will continue to rely on oil and gas in the long term, so we need to make decisions now that provide us with the resource in the long term,” he said.

Include all areas

In IPAA’s comments, Russell urged MMS to keep all areas, including the eastern Gulf of Mexico, Alaska, and the entire Atlantic and Pacific OCS under consideration during the planning process’s next phase. Doing so would mean that “essential preparatory work will have been completed enabling that area to be offered for leasing more quickly should Congress mandate a sale,” he said.

Russell also suggested that MMS use area-wide lease sales wherever possible, and focused leasing for places where it is not. “Area-wide leasing allows IPAA members, the smaller independent companies, to actively acquire, explore, and produce low-risk fields. It also encourages innovative exploration strategies and is consistent with maintaining financially sound geophysical contracting and processing industries,” he said.

Fordham said in NGSA’s comment that the association also was encouraged by MMS’s including areas previously off-limits in the DPP. NGSA and API separately expressed in their submissions to MMS their opposition to the idea of coastal buffer zones and support for sharing new federal OCS oil and gas revenues with states directly feeling the impacts of development.

Morris and Fordham each noted that in August 2008, when MMS requested comments as then-Interior Secretary Dirk A. Kempthorne accelerated the OCS planning process to produce a 5-Year Plan for the 2010-15 period, some 60% of the responses said that the agency should “new program to provide some level of expanded access to domestic sources of oil and natural gas.” It was a significant indication that the general public understood the importance of developing more domestic oil and gas supplies, the API and NGSA officials separately said.

Contact Nick Snow at nicks@pennwell.com.

September 22, 2009

Poop-to-power plant now online

By JOHN STANG

Seattle Post Intelligencer

September 21, 2009

It takes slightly more than three gallons of liquid cow manure to create one kilowatt-hour of electricity.

A lot of poop. A small amount of electricity. A big environmental boost to a dairy farmer.

A fledgling anaerobic manure digester is now running at roughly 80 percent capacity near Rexville in southwestern Skagit County. The plant produced its first power on Aug. 30 and will host Gov. Chris Gregoire at a ceremony next Monday.

The digester accepts the liquid manure in a big holding tank, where it gives off methane gas that is then burned to produce electricity.

It is the first or fourth of its kind in Washington -- depending on how you catalog the device. Ferndale-based Andgar Corp. built all four.

Washington already has three conventional poop-to-methane-to-power digesters near Lynden, Monroe and Sunnyside. However, they essentially accept manure from one dairy farm each.

The Rexville operation -- built and run by Farm Power -- is different in a couple ways.

It is set up to accept manure from two or more dairy farms -- enabling smaller operations to participate.

And it is designed to accept and extract methane from icky, slop-like wastes from seafood and chicken processing -- as well as other food wastes. Farm Power had to get a bill passed in the Legislature this past spring to make combining the food and cattle wastes easier from a regulatory aspect.

Dairy farms produce huge amounts of manure that can ooze into groundwater and eventually into streams and rivers to cause pollution problems.

Farmers take many measures to deal with this problem, but digesters are a more cost-efficient way to tackle the matter, said Daryl Maas, one of two brothers behind the Rexville operation.

Kevin and Daryl Maas -- who grew up around Skagit County dairy operations -- saw Washington's first digester built near Lynden in 2004 and became fascinated by its potential.

But they saw that very few farmers could afford to build similar digesters, Daryl Maas said.

The brothers created Farm Power in 2007, which raised $3.5 million -- including $1 million in federal and state grants -- to build the Rexville facility that is currently taking manure from two nearby dairy farms. The site has the capability to expand to accept manure from additional farms.

At full capacity, the Rexville site can handle 55,000 gallons of liquid manure a day. That translates to 750 kilowatt-hours -- enough to power about 500 homes.

That's one-tenth of 1 percent of the roughly 500,000 homes served by Puget Sound Energy (PSE).

The Rexville facility adds to what PSE can offer in "Green Power," a program in which utility customers can request to have their electricity partly or totally supplied by renewable sources such as wind, solar and biomass facilties.

Roughly 24,000 of PSE's 1.1 million overall customers have signed up for Green Power sources, said utility spokesman Andy Wappler.

"Now farmers have a brand-new product to sell -- renewable energy," Wappler said. Maas said the brothers have three more digesters on the drawing board

-- two in Whatcom County and one near Enumclaw. They hope to build an average of one per year.

Meanwhile, Maas said the manure can be returned to the farmers in better shape after the methane is extracted.

The returned manure has its nutrients broken down, which makes it a better fertilizer. Without going through the digester, the same manure would take longer to break down into essential nutrients for fertilizer.

Also, the process produces a mulch that can be used for livestock bedding.

John Stang can be reached at 206-448-8030 or johnstang@seattlepi.com.

September 21, 2009

Renewable power decisions create a tangled web

David R. Baker

San Francisco Chronicle

Monday, September 21, 2009

More big solar power plants in the Mojave Desert. Fewer solar panels on homes and businesses. More hydroelectric dams in British Columbia.

Gov. Arnold Schwarzenegger passes a solar energy field to sign an executive order he signed giving California the nation's most aggressive energy standards, during ceremonies held at a solar energy field in Rancho Cordova, Calif., Tuesday, Sept. 15, 2009. The order requires utilities to get a third of their power from renewable sources by 2020.(AP Photo/Rich Pedroncelli) |

The flurry of recent renewable power decisions in Sacramento could have far-reaching - even contradictory - results.

Gov. Arnold Schwarzenegger last week signed an executive order forcing California utilities to get 33 percent of their electricity from renewable sources by 2020. At the same time, he promised to veto two bills passed by the Legislature days earlier that would have done the same thing, but with far more restrictions on how those goals could be met.

Meanwhile, a bill to increase the amount of electricity that utilities get from home solar systems never reached a final vote. Its backers must wait for the next legislative session and try again.

Gov. Arnold Schwarzenegger signs an executive order California the nation's most aggressive energy standards, during ceremonies held at a solar energy field in Rancho Cordova, Calif., Tuesday, Sept. 15, 2009. The order requires utilities to get a third of their power from renewable sources by 2020. (AP Photo/Rich Pedroncelli) |

"It's kind of a best-of-times, worst-of-times story," said Adam Browning, executive director of the Vote Solar Initiative advocacy group. "There are some things that didn't happen, but still, there really is a lot of development going on."

Renewable power advocates are still trying to assess the effects of all the things that Sacramento did and didn't do. But they see several likely results.

-- California's renewable power industry will grow, but it also will spill over into neighboring states. Many of the solar and wind farms built to help utilities meet California's new renewable power targets will be in Nevada, Oregon or Washington.

-- Companies planning large solar power plants in the Southern California desert won't need to jump through a new bureaucratic hoop to do it. One of the bills Schwarzenegger vowed to veto would have forced those projects to get an additional government permit - from the state's Department of Fish and Game - on top of the permits already required.

-- Companies that install solar systems on homes and businesses may see their sales drop next year because the Legislature didn't pass a key bill on "net metering."

Under current law, homeowners and businesses with solar systems can get credit from the utilities for generating excess electricity and sending it to the state's electrical grid. But the utilities are only required to take so much of it - up to 2.5 percent of each utility's total electrical load - and Pacific Gas and Electric Co. will reach that level next year. The failed bill would have expanded the amount to 5 percent.

Solar impact

"I'm not a person who usually goes around saying 'The sky is falling,' but this is really going to impact solar starting next year," said Angiolo Laviziano, chief executive officer of REC Solar in San Luis Obispo.

The bill's failure means that once PG&E hits the 2.5 percent limit, the utility's customers will no longer have as much financial incentive to go solar. Although REC Solar operates in other states, cushioning the potential blow, Laviziano said he could be forced to cut as many as 120 jobs if business in California dries up as much as he fears.

"Even for us, it would be an extremely painful hit," he said. "For companies that are focused solely on California, it would put their whole operations at risk."

As the California Legislature neared the end of its session, most of the attention focused on a pair of bills that would have dramatically expanded the amount of renewable power used in the state. California law now requires the utilities to get 20 percent of their electricity from renewable sources by the end of 2010, a deadline they are almost certain to miss. The bills would have raised that requirement to 33 percent by 2020.

But the bills rankled the utilities and large-scale solar developers. The developers didn't want to face another bureaucratic hurdle - the proposed fish and game permit - that would have slowed them down. In order to qualify for federal stimulus grants, they need to start construction by the end of 2010. "They were already running behind, and adding another layer of siting permits wouldn't help," said Jan Smutny-Jones, executive director of the Independent Energy Producers Association.

The utilities wanted more flexibility to buy power from outside California. Under the bills, out-of-state wind farms and solar plants could only make up 30 percent of each utility's renewable energy supply. The limit was designed to keep new renewable power projects and jobs here in California, rather than letting them go to neighboring states.

Schwarzenegger, however, sided with the utilities, saying the limit smacked of protectionism. As a result of his decision to veto the bills, renewable energy experts say states such as Nevada and Oregon will see more solar and wind projects.

Some people fear his executive order will open California to types of renewable power that current laws discourage.

Changes considered

The California Air Resources Board has the responsibility of drafting rules to carry out Schwarzenegger's order, and a spokesman for the board said the panel will consider changing the types of alternative energy that could count toward the 33 percent goal. Nuclear power and large hydroelectric dams won't be considered, said spokesman Stanley Young, but other types of generation will.

That worries Lannie Keller, who lives near Bute Inlet on the coast of British Columbia. Canadian companies have proposed building "run of the river" hydroelectric projects on 18 rivers that feed into the inlet, and opponents fear the electricity could be sent south to meet California's demand for renewable power.

Such projects don't use large dams, but they do divert part of each river's flow to run through a turbine. They don't pass muster with California's current renewable power law, but that could change. PG&E, for example, has already expressed interest in buying hydropower from British Columbia.

"It will create a viable market for what's proposed up here," said Keller, an organizer with Friends of Bute Inlet, which opposes the hydropower projects. "The so-called green energy down there will be coming at a significant environmental cost in British Columbia."

E-mail David R. Baker at dbaker@sfchronicle.com.

New gas supplies 'could eat Arctic gas's lunch'

Rena Delbridge

Alaska Dispatch

Sep 19, 2009

For decades, Alaskans have dreamed of another pipeline boom, hoping for a giant natural gas project to generate tens of billions of dollars in tax revenue and put thousands of people to work.

Even people who didn't live here in the 1970s, when the trans-Alaska oil pipeline transformed Alaska from a poor, struggling state to one with a multibillion-dollar savings account that hands out checks to people just for living here, have heard the stories. And those handed-down memories of healthy economic times are enough to make plenty of Alaskans bullish on the long-sought-after natural gas pipeline.

Proponents of two separate pipeline proposals say they're moving along as intended, with a near-term goal of an open season in 2010. But as much as Alaskans pin their future on one of the projects, there are no guarantees either will be built.