July 29, 2009

A flurry of upbeat news from Enbridge

A trio of news items about Enbridge, reprinted in Rigzone:

Enbridge on Track for 20% Plus Growth in 2009, 10% Plus Through 2013

Enbridge Inc., Rigzone, 29-Jul-2009

Enbridge Proposes $500MM Walker Ridge Gathering System for GOM

Enbridge Inc., Rigzone, 29-Jul-2009

Enbridge to Start Multibillion-Dollar Pipeline Project in August

Brad Swenson, Bemidji Pioneer, 27-Jul-2009

Enbridge on Track for 20% Plus Growth in 2009, 10% Plus Through 2013

Enbridge Inc.Rigzone

Wednesday, July 29, 2009

"Through the second quarter of 2009, Enbridge continued to deliver favorable operating performance across our liquids and natural gas businesses, highlighted by significant progress on our projects under construction, and the announcement of a major new oil sands project," said Patrick D. Daniel, President and Chief Executive Officer. "With adjusted earnings per share of $1.28 for the first six months of the year, we are ahead of where we had expected to be. We are now on track to achieve the upper half of our $2.18 to $2.32 per share full year adjusted earnings guidance range, for an annual growth rate greater than 20%.

"Looking further out, and affirmed through our annual review and update of our strategic plan, we expect to sustain a 10% plus average annual earnings per share growth rate from 2008 through 2013," continued Mr. Daniel.

In June 2009, Enbridge announced an agreement with Imperial Oil Resources Ventures Limited and ExxonMobil Canada Properties to provide for the transportation of blended bitumen from the Kearl project in the Athabasca Oil Sands region of northern Alberta to the Edmonton, Alberta area. The first phase of the new pipeline system is a 140-kilometre pipeline from Kearl Lake to Enbridge's Cheecham Terminal.

Enbridge Proposes $500MM Walker Ridge Gathering System for GOM

Enbridge Inc.

Enbridge Inc.Rigzone

29-Jul-2009

Walker Ridge & Green Canyon Fields |

Enbridge has entered into Letters of Intent with Chevron USA, Inc. which could result in the expansion of its central Gulf of Mexico offshore pipeline system. Under the terms of the LOI, Enbridge proposes to construct, own and operate the Walker Ridge Gathering System (WRGS) to provide natural gas gathering services to the potential Jack, St. Malo and Big Foot ultra-deepwater developments. The estimated cost of the WRGS is approximately US $500 million, subject to finalization of scope and definitive cost estimates.

"The Gulf of Mexico has long been a major producing region for North American oil and gas, and there is a significant trend towards ultra deepwater developments in the Gulf of Mexico," said Patrick D. Daniel, President and Chief Executive Officer, Enbridge Inc. "The Walker Ridge Gathering System will tie in a new supply source for Enbridge's Manta Ray and Nautilus offshore pipeline systems, enhancing Enbridge's existing offshore pipeline business and establishing a strategic base for future growth opportunities in the ultra-deep Gulf of Mexico. In addition, the development of the new gathering system represents an attractive investment opportunity itself, with risk and return characteristics comparable to Enbridge's normal business model."

Daniel continued, "This latest addition to our portfolio of commercially secured projects is indicative of a variety of growth opportunities which are currently under development, supporting our expectation that we will be able to extend our 10% plus 2008-2013 average growth rate at a similar rate well beyond 2013. Enbridge has ample financial capacity to fund the equity component of this investment from internally generated cash flow and surplus balance sheet equity."

The WRGS is expected to include approximately 190 miles of 8-inch,10-inch and/or 12-inch diameter pipeline at depths of up to 7,000 feet and will have a capacity of 100 million cubic feet per day (mmcf/d).

Enbridge offshore pipelines currently transport about 40 percent of all deepwater Gulf of Mexico natural gas production and include the UTOS, Stingray, Garden Banks, Nautilus, Manta Ray, Mississippi Canyon, Okeanos and Destin systems. Enbridge offshore assets include joint venture interests in 12 transmission and gathering pipelines in six major pipeline corridors in Louisiana, Mississippi and Alabama offshore waters of the Gulf of Mexico. The system moves on average approximately 30 percent of the Gulf of Mexico natural gas production at a rate of 2.5 billion cubic feet per day (bcf/d).

Enbridge to Start Multibillion-Dollar Pipeline Project in August

by Brad SwensonBemidji Pioneer, Minnesota

McClatchy-Tribune Information Services

Reprinted in Rigzone

Monday, July 27, 2009

A 1,000-mile crude oil pipeline project costing $3.4 billion begins in mid-August, say Enbridge Inc. officials.

Workers unload a 36-inch pipe from a rail car to a semi Saturday east of Bemidji in preparation to start a $3.4 billion Enbridge Inc. crude oil pipeline project in mid-August. Bemidji is one of six staging points for the 1,000-mile project, with 326 miles in the United States. (Pioneer Photo/ Brad Swenson) |

"We've got pipe coming in and yards are filling up, equipment is rolling in," Lorraine Grymala, Enbridge manager of community affairs/major projects, said last week. "We're just waiting on a few remaining permits and then we'll set a firm kick-off date, but August ... we should be ready to go."

Locally, it will mean up to 500 jobs.

Enbridge is burying 36-inch pipe from northern Canada to Superior, Wis., called the Alberta Clipper. It involves 1,000 miles of new pipeline, with 326 miles in the United States.

Running parallel to that is another 20-inch pipeline, called Southern Lights, with 188 miles constructed in 2009.

"It's a significant increase in capacity," she said of the 36-inch line, which will carry an additional 450,000 barrels of crude oil daily, with a U.S. route from Neche, N.D., to Superior.

Four existing pipelines ship about 1.6 million barrels per day of crude oil and liquid natural gas, Grymala said.

"This area will actually be constructing two pipelines," she said of the Alberta Clipper crude oil line and the Southern Lights diluents pipeline which originates in Chicago and flows north.

"It carries a product called diluents which is still in the petroleum spectrum, but on the lighter end," Grymala said. "It's a product that's produced by the refining process ... It goes up north to the Alberta oil sands and is used in the crude to use it better."

Diluents are a thinning agent that allows the crude oil to flow easier through the pipeline, she said.

The line is being built in segments, with the line now completed from Chicago to Superior, she said. This year's 188-mile segment will take it to the Canadian border, where it is done to the north. In all, Southern Lights is a $2.2 billion project with a capacity of 180,000 barrels a day.

The Alberta Clipper project's 326 miles in the United States is a $1.2 billion project, Grymala said.

"Up and down the line, for the 326-mile segment, we expect to employ about 3,000 workers," she said. "We're doing the construction in six spreads and each spread has its own crew, which is 350 to 500 people per crew."

Two crews, or spreads, will operate out of Bemidji for the two pipelines, she said. "You will see a pretty significant number of people here."

The contractor for the Bemidji area is U.S. Pipeline of Houston, Texas. The contractor north of Clearbrook is Michaels of Wisconsin, and from Deer River to Superior is Precision Pipeline of Wisconsin.

"Each of those contractors brings with them a core crew of people who go all over with their respective companies and build pipelines all over the United States, so they're construction experts," Grymala said. "They are about 50 percent of the workforce. The other 50 percent is hired through the local union halls."

Pre-job meetings have been held with the unions, she said, so the unions are aware of the workforce needs and types of skills needed. "The purpose of the core crew is to train people."

Union crews will be hired locally at prevailing wage standards, she said. "The laborers will be the bulk of the workforce, and operating engineers are another significant chunk; the Teamsters and the plumbers and pipe fitters and the welders will be the rest."

There will be 23 miles of pipeline constructed in Beltrami County, or 46 miles with the two separate but parallel pipelines, said Sheila Dunn of Natural Resource Group, an Enbridge consultant.

"That will generate $1.9 million in additional tax revenue for the county, and that's above and beyond what Enbridge is already paying," Dunn said.

That additionally revenue would nearly replace the $2.1 million the county now faces losing through state aid reductions this legislative session.

The state assesses the value of the pipe once it is in the ground, and informs the county of the tax value, Dunn said. "That value will change over time, but right now it will be $1.9 million (in taxes)."

"Spending up and down the line in terms of wages paid is $276 million," Grymala said. "In terms of extra construction-related spending, there's another $110 million, for things like fuel, tires or replacement parts for equipment that breaks down.

"The workers themselves need lodging and food, groceries, those kinds of things," she added. "That's another $60 million. It's a pretty good economic shot in the arm with people spending their money and the project spending money."

Contractors are encouraged to spend locally when practical to do so, Dunn said. "A lot of the communities along the route have the potential to see a real economic boost from this project, because the workers need places to stay and restaurants to eat in and laundry facilities to wash their clothes in, and those types of things."

An area near Bemidji High School will serve as a staging area, Grymala said. Workers will arrive each morning and be taken by bus to the work site. They will typically work six days a week, 10 hours a day.

"They need that to get as much done as possible, between August and December," she said. The project is to be completed in December, and the land restored early next year. Work in wetlands will take place in January and February.

The line is scheduled to be in service by this time next year, Grymala said.

A full Environmental Impact Statement has been prepared for the project, involving the U.S. State Department as the line crosses an international border, and permits secured or in the process of being secured. Rights-of-way have been secured, although a petition filed last week on the Leech Lake Reservation seeks a tribal court decision to stop construction.

"First and foremost, we have agreements with both of the tribal councils (Leech Lake and Fond du Lac) signed and ready to go," Dunn said. "We have good relationships with the councils. Our understanding up until now is that any opposition was limited to a few band members, and mainly only Leech Lake."

More than 30 public meetings were held to gain public input, she said.

The group also sought to stop the project through the Minnesota Public Utilities Commission, Grymala said, but the PUC granted Enbridge its certificate of need for the project and a route permit.

"We're ready to go," she said.

Copyright (C) 2009, The Bemidji Pioneer, Minn.

July 27, 2009

Hydropower boom may not be a bust for salmon

Kim Murphy

Los Angeles Times

July 27, 2009

Darrell Gouldin, managing director of the generation division of the public utility department of Chelan County in Washington state, near the large juvenile fish passage tunnel constructed to help young salmon safely pass Rocky Reach Dam on the Columbia River. (Credit: Scott Eklund / Red Box Pictures for The Times.) |

With the big push for renewable energy, hydropower is getting a new lease on life. The Chelan County Public Utility District in Washington state is trying to get more power out of the Columbia River without harming endangered salmon. How will this change the dialogue about dams and fish?

Giving dam-generated electricity a big new lease on life under the mantle of clean energy has proved problematic for environmentalists, who have long seen dams as fish-killers. But more of them are coming to see the benefits of so-called incremental power, done in conservation-smart ways.

John Seebach, director of the Hydropower Reform Initiative launched by the conservation group American Rivers, said his organization has elected to support “green” credentials for incremental power generated at existing dams as long as it provides protections for fish and other wildlife values.

“Hydropower does have pretty significant and serious impacts on rivers. We know that. The industry knows that. It also provides some pretty significant benefits in terms of power production. So it’s a tricky balance to get those benefits while trying to minimize those impacts,” he said.

One organization that has tried to set standards for what can be considered “green” hydropower is the Low-Impact Hydropower Institute, based in Maine, which certifies hydropower projects, much like an organic food label. It looks at protections for such things as water quality, fish protection, recreation and cultural resources protection.

Fred Ayer, executive director, said the institute has certified about 110 dams, from Maine to Alaska, with a capacity of about 2,000 megawatts. This has been possible because of a dramatic change in the hydropower industry itself, which now has far more managers with resource protection backgrounds.

“When I entered this business 35 years ago, the people running the show were pretty much engineers and accountants — and their lawyers,” he said. “Today, if you go to a big hydropower conference, half the people in the room will be women. I mean, that was unheard of before.”

Still, some conservationists are wary of jumping on board the hydropower bandwagon without more proof. Sure, juvenile fish may be making it safely past the Rocky Reach Dam in Chelan County, says Natalie Brandon of the group Save Our Wild Salmon, but how stressed are they, and how does that affect their long-term survival?

"In the Columbia/Snake [rivers], a lot of salmon and steelhead survive passing through the dams and make it out to the ocean, but they don't make it back," Brandon said. "We think that the accumulated stress of going over eight dams stresses the immune systems of the fish, making them more vulnerable to parasites, disease and predators once they're out in the ocean."

In Chelan County, officials believe that providing more power with the same amount of water is good for the environment, and good for fish.

“We’re saying, let’s skip the new facilities, skip the regulatory issues associated with new dams and go to our existing facilities and get more value from them," said Tracy Yount, the Chelan County PUD's external affairs director.

“The regulatory landscapes are completely changing right now .We are realizing that whatever issues we’ve had to deal with in the past with the Clean Water Act and the Endangered Species Act, they’re probably going to pale in comparison to the credit market and climate change."

Boom in hydropower pits fish against climate

By Kim MurphyLos Angeles Times

July 27, 2009

The renewable energy could ease global warming, but the dams and turbines could result in mass killings..

Reporting from Wenatchee, Wash. -- The Rocky Reach Dam has straddled the wide, slow Columbia River since the 1950s. It generates enough electricity to supply homes and industries across Washington and Oregon.

But the dam in recent years hasn't produced as much power as it might: Its massive turbines act as deadly blender blades to young salmon, and engineers often have had to let the river flow over the spillway to halt the slaughter, wasting the water's energy potential.

The ability of the nation's aging hydroelectric dams to produce energy free of the curse of greenhouse gas emissions and Middle Eastern politics has suddenly made them financially attractive -- thanks to the new economics of climate change. Armed with the possibility of powerful new cap-and-trade financial bonuses, the National Hydropower Assn. has set a goal of doubling the nation's hydropower capacity by 2025.

Expanding hydropower is fraught with controversy, much of it stemming from the industry's history of turning wild rivers into industrialized reservoirs struggling to support their remaining fish. The emerging boom in hydroelectric power pits two competing ecological perils against each other: widespread fish extinctions and a warming planet.

The issue has been particularly contentious in the Pacific Northwest, where some are calling for actually breaching dams on the Snake River in an effort to bring back the declining salmon and steelhead.

"Hydropower does have pretty significant and serious impacts on rivers. We know that. The industry knows that," said John Seebach, director of the Hydropower Reform Initiative launched by the conservation group American Rivers. "It also provides some pretty significant benefits in terms of power production. So it's a tricky balance to get those benefits while trying to minimize those impacts."

Across the country, there are about 82,600 dams, but only about 3% of them are used to generate electricity. Hydropower produces about 6% of the nation's electricity, and nearly 75% of all renewable electric power.

The increasing mandates for power utilities to expand their portfolios of renewable energy are prompting dam operators to take a second look at thousands of dams now used for flood control, irrigation, navigation, recreation and industrial water supply that might also be used to generate electricity without further harm to fish.

"Most of the bang for the buck is at existing dams and reservoirs without hydropower facilities, and hydropower facilities that need to be upgraded for additional capacity," said Norman Bishop, vice president of MWH Americas Inc., which designed the dam improvements in Chelan County, Wash., home to the Rocky Reach facility.

The U.S. Department of Energy estimated that there are up to 30,000 megawatts of potential energy at 5,677 undeveloped sites across the nation, more than half of which already have dams.

Newly added to the equation is the emerging market for so-called carbon credits. The credits are part of a strategy to place "caps" on damaging greenhouse gas emissions while allowing companies that can't meet the restriction to buy credits from ones that achieve significant savings. The cap would be gradually lowered to reduce overall emission levels.

Hydroelectric power is a prime candidate to sell credits because it is largely emission-free. The credits typically would be granted only for new or additional power.

The market for the credits is tiny now, but legislation is moving forward that would create caps and a national market that could ultimately reach $120 billion a year.

Even without a national cap-and-trade law, markets such as the Chicago Climate Exchange now allow companies to voluntarily limit their carbon emissions and lower their carbon footprint by purchasing credits, traded on the market like stock.

This added incentive has made building or upgrading hydroelectric facilities a more alluring prospect.

The small rural Chelan County Public Utility District last year became the first hydropower facility in the U.S. to begin trading carbon credits on the Chicago Climate Exchange.

The money the district has made from selling credits -- about $1.6 million so far -- is going back to Chelan County and its customers for new investments in carbon-free electricity. The district has invested heavily in making sure its new electricity results have no net harm to salmon -- a key requirement for trading on the Chicago exchange.

But the possibility of more hydroelectric construction around the world has set off alarm bells among some groups of environmentalists.

"Rivers in the U.S. have been seriously impacted by dam construction," the conservation group International Rivers said in urging California authorities to disqualify hydropower projects producing more than 10 megawatts of power from receiving carbon credits.

"Fortunately, some of this damage is now starting to be reversed by dam removals," the group said. "California climate action should not act as an incentive to increase damage to rivers and prevent efforts to restore them."

California gets about 9.6% of its power from large hydro generators. The state has said it will consider as renewable energy only those hydro projects smaller than 30 megawatts that do not require the diversion of any new water.

Climate-change activists particularly balk at the idea of offering carbon credits in the U.S. for large hydropower projects in developing countries, such as Chile, Peru, Uganda and elsewhere, where environmental protections may be lax and the overall contribution to global welfare dubious.

But here at Rocky Reach Dam, engineers say they believe there is a way to reduce emissions, increase power output and save fish at the same time -- although at a cost.

The Chelan County utility district spent $292 million overhauling Rocky Reach's 11 aging generators and installing new, more efficient turbines and an expensive mile-long safe-passage tunnel for up to 3.5 million young salmon and steelhead that navigate the dam each year. [More info here]

With the juvenile-fish passage facilities -- along with commitments to improve habitat and expand hatchery production for salmon -- the district could meet its targets for healthy fish and allow much less water to spill over the dam.

Five years ago Rocky Reach had to spill up to a quarter of its water over a 31-day period during the height of the spring salmon juvenile migration, but last spring it got permission to spill no water at all.

Yet more than 90% of the young salmon and 94% of the steelhead are surviving their trip past Rocky Reach Dam, according to district records.

The result is that the dam has been able to produce an additional 1.75 million more megawatt-hours of electricity over a recent three-year period, the equivalent of 702,204 metric tons of carbon if the electricity were generated at a natural-gas-fired power plant.

"What we have been able to do is provide more power with the same amount of water," said Tracy Yount, the Chelan County utility district's external affairs director. "We're saying, let's skip the new facilities, skip the regulatory issues associated with new dams and go to our existing facilities and get more value from them."

Desertec: an energy, CO2, water and food solution

The Problem: 10 billion people on Earth by 2050, and a demand for resources equivalent to three Earths.

The Solution: The DESERTEC Concept. "It simultaneously tackles efficiently all the global challenges of the upcoming decades: shortage of energy, water and food as well as excessive emissions of CO2. At the same time, this concept offers new options for the prosperity and development of regions that have so far, from an economic point of view, been scarcely developed.

"CLEAN ENERGY IS AVAILABLE IN ABUNDANCE THE EARTH‘S DESERT BELT

"North and south of the equator, deserts span the Earth. Over 90% of the world‘s population could be supplied with clean power from deserts by using technologies that are available today."

Download the Desertec Red Paper

Whew. That's no small thinking. But the world has enjoyed, or has had to suffer, many technological "visionaries" with big ideas that will solve everything, yadda, yadda, yadda.

So is Desertec any different? Is it credible? Can it be done? Should it be attempted?

What is Desertec?

The specific plan is to generate electricity in desert regions of the Middle East and North Africa (MENA) using Concentrating Solar Thermal (CSP) plants. Then wheel that power primarily to Europe, using High Voltage Direct Current (HVDC) transmission cables buried underground and submerged beneath the Mediterranean Sea.

CSP entails a number of large solar reflectors aimed at a single tube in which is a working fluid, which, when heated, is used as an energy source for a power generation station. Wikipedia has an introduction to CSP:

http://en.wikipedia.org/wiki/Concentrating_solar_power.

HVDC is an established transmission technology which has three advantages over AC transmission: no electromagnetic effects ("electro smog"), fewer transmission losses, and reduced cost over long distances. Wikipedia again:

http://en.wikipedia.org/wiki/High-voltage_direct_current

Click here for larger map |

Desertec arose out of a feasibility study commissioned by the German Ministry of the Environment, and it is still very much a German project with Deutsche-Bank, RWE, E-ON, Munich-RE, Siemens all apparently on-board. The €400 billion project may provide 20 percent of European energy needs by 2050.

You can read more about it at http://www.desertec.org.

At the top we quoted the Desertec red paper saying the project will tackle shortage of energy, water, food, and CO2 emissions. The energy and CO2 factors are obvious. Desalination plants would also use the energy. Food? The red paper doesn't explain that - maybe by irrigation using the desalinated water?

U.S. clean energy stimulus both a boon and a threat to B.C. companies

By Gordon Hamilton

The Vancouver Sun

July 25, 2009

The Obama administration's $70-billion commitment to renewable energy is creating eye-popping opportunities in the U.S. that threaten B.C. clean-energy companies as much as it opens doors.

Corporate leaders and investors say that the sheer size of the U.S. program has shifted the centre of gravity for clean energy south of the border. B.C. companies with offices or connections in the U.S. will prosper while those with little access to the cash will be challenged to raise capital or get into the market.

"Renewable energy initiatives implemented south of the border certainly have the potential to benefit those companies currently leading B.C.'s renewable energy sector," said Dean Rockwell, chief executive officers of the B.C. Innovation Council.

However, he said, "massive investment underway in the U.S., Europe and Asia, and the subsequent growth of competitors from those regions, threaten to swamp fledgling B.C. companies."

The U.S. administration has set aside nearly $70 billion US in tax and spending incentives for energy-related programs as part of its larger $787-billion economic stimulus package.

Jonathan Rhone, chief executive officer of Nexterra Energy, a company that specializes in converting biomass to synthetic gas, said the energy incentives in the U.S. "have created an absolutely uneven playing field."

"We do not have a comparable federal stimulus package in clean energy in any way shape or form," Rhone said. "I think it's a gap."

He said Canada could fall behind in innovation in clean energy.

"Why would you locate in Canada? All the money is somewhere else."

Nexterra has solid connections in the U.S. that will help it get a piece of the cash pie. It partnered with energy giant GE and energy services provider Johnson Controls long before the stimulus package was announced. It is not interested in relocating south of the border, but the lure for B.C. companies is strong, Rhone said.

"States and cities actively want green energy jobs. They want the companies located in their cities because they want the innovation to happen there. They want to attract the venture capital. They want to have the manufacturing."

Rhone, a member of an association of clean-tech chief executive officers in Vancouver, said he knows U.S. jurisdictions are approaching B.C. companies to move south.

"We've been approached, as have other companies," he said.

There's nothing new in American cities trying to attract Canadian businesses, said Jock Finlayson, executive vice-president of the Business Council of BC. State and civic subsidies and incentives are part of the American business landscape, he said. In Canada, Quebec and Ontario do the same. B.C. doesn't, instead offering incentives for research instead, such as the Innovative Clean Energy fund.

What is new in the U.S., he said, is the overlay of billions of federal dollars showering down on top of existing incentive programs.

However, the Buy American provisions in the U.S. program, as well as a focus on energy security and job creation, mean Canadian companies will be at the end of the money line, said Wal van Lierop, president of Chrysalyx Energy Venture Capital. Chrysalyx has five B.C. clean-tech companies in its investment portfolio of 25 companies.

Van Lierop said B.C. companies with a foothold in the U.S. will be able to benefit when most of the money starts flowing this fall. The big danger for Canada is that it will create significant leverage for venture capital investments in the U.S. that don't exist here, he said.

"Canadian companies will just have to work much harder to get some of that money."

Van Lierop said American legislators are as concerned about energy security and job creation as they are about clean energy technologies, creating an additional hurdle for Canadian companies.

The U.S. energy bill has already passed the House of Representatives, but van Lierop believes the jobs issue will have to be played up even more if it is to pass in the U.S. Senate.

Jack Saddler, dean of forestry at the University of B.C. and a specialist in forest-products biotechnology, said the Americans are funnelling money into shovel-ready projects that Vancouver companies like Nexterra or Westport Innovations -- which refits buses and trucks for natural gas -- can take advantage of.

He said the U.S. Department of Energy is putting huge sums of money into what he termed "Star Trek"-like searches for new sources of renewable energy that may not come on stream for 25 years.

"What the U.S. is doing in this whole area is incredibly impressive," Saddler said. "There is enough money to try to lure away some of the companies."

The incentives are so lucrative that an American law firm, Stoel Rives, used the markedly un-businesslike header "Show Me the Money!" in an e-mail to clients explaining how the dozens of programs work.

Saddler said that against such a wall of cash, Canada's best option is to form energy alliances with the U.S. He is part of a new Environment Canada-U.S. Department of Energy clean-energy dialogue, which he would like to see as the first step in establishing a formal clean-energy agreement with the U.S.

Saddler said the billions being spent in the U.S. will make that country the world leader in renewable energy and it would be in Canada's interests to have a formalized agreement, similar to trade agreements. Canada has enough bioenergy locked in our forests as well as fossil fuel reserves to make North America not only green but also energy-independent, he said.

Despite the barriers to getting a piece of the money, some B.C. companies are seeing increased sales and increased interest in their products already.

At Lignol Energy, a B.C. company producing cellulosic ethanol from wood chips, CEO Ross MacLachlan said his company is actively involved in the U.S. -- it has a subsidiary in Philadelphia -- and has plans to build a $100-million to $200-million commercial cellulosic ethanol plant.

Lignol already has a pilot plant in Burnaby and a $30-million grant from the U.S. Department of Energy to build the commercial plant. That grant could be increased thanks to the stimulus package.

MacLachlan said Canada has renewable programs of its own. However, unlike the wide-open U.S. stimulus program, much of the Canadian aid is targeted at specific sectors, such as the $1-billion federal green-energy plan announced in June for the Canadian pulp sector.

Smaller established companies like Pulse Energy, a Vancouver energy management company, and Endurance Wind Turbines are also landing U.S. contracts.

Pulse Energy's David Helliwell points to a contract at the Lawrence Berkeley National Laboratory in California for Pulse's energy-efficiency software, and energy credit programs in the U.S. are boosting sales of Endurance's Surrey-made products. Endurance turbines are distributed by U.S.-based John Deere.

"Back orders for our 50-kilowatt units are in the double digits and growing daily," said Endurance sales manager Brennan McLean.

ghamilton@vancouversun.com

SHOW ME THE MONEY!

Among the energy-related provisions in the $787-billion American Recovery and Reinvestment Act are these funding initiatives:

- $13 billion to extend tax credits for renewable energy production

- $11 billion for an electricity 'smart grid'

- $6.3 billion for state and local governments to make investments in energy efficiency

- $6 billion for renewable energy and electric transmission technologies

- $5 billion for weatherizing modest-income homes

- $4 billion for the wastewater treatment infrastructure

- $3.4 billion for carbon capture experiments

- $3.25 billion for power transmission system upgrades

- $2.5 billion for energy efficiency research

- $2 billion for advanced car battery systems

- $500 million for training of 'green collar' workers

- $400 million for electric vehicle technologies

- $400 million for the Geothermal Technologies Program

- $300 million for reducing diesel fuel emissions

© (c) CanWest MediaWorks Publications Inc.

July 25, 2009

Teck resurrects plans to expand coal output

Andy Hoffman

Globe and Mail

Friday, Jul. 24, 2009

Mining company scrambling to fill dramatic increase in orders from Asian buyers |

Teck Resources Ltd. (TCK.B-T26.450.451.73%) is dusting off plans to expand its coal operations and meet a sudden increase in demand, marking yet another milestone in the dramatic resurrection of Canada's largest base metals miner.

Less than six months ago, a debt-laden Teck was forced to reduce coking coal production by 20 per cent as steel makers shuttered mills in response to the global recession.

But an abrupt upswing in buying from China and other Asian customers in recent weeks now has the Vancouver company scrambling to fill orders.

“There is no question demand has picked up strongly. The issue, actually, is trying to fill that demand. We're finding it is more and more difficult to increase production,” Teck chief executive officer Don Lindsay said on a conference call to discuss the company's second-quarter profit report.

Teck's desire to augment coal production offers fresh evidence of a stunning turnaround for both the company and the commodity itself.

While it is maintaining its previous coal production guidance of between 18 million and 20 million tonnes in 2009, Mr. Lindsay has asked executives to revive once-shelved expansion plans that would boost Teck's production to 28 million tonnes by 2012 and 30 million by 2014.

The cost of increasing output at the company's coal mines in British Columbia and northern Alberta was previously pegged at between $400-million (U.S.) and $500-million.

“We don't think it is a temporary phenomenon and I have asked our coal management team to get those plans out again and refreshed,” Mr. Lindsay said.

The ill-timed $14-billion (Canadian) acquisition of Fording Canadian Coal Trust in 2008 that was consummated just weeks before the market crash last fall saddled Teck with nearly $10-billion (U.S.) in debt. It left the miner, which also produces copper, zinc and lead, heavily exposed to coal as demand for the key ingredient in steel making fell off a cliff.

While coal prices had surged to a record $300 a tonne in 2008, many analysts feared they would plunge to about $100 a tonne for the 2009 coal year contract, which is negotiated annually with customers.

Teck was forced to sell assets, issue debt securities and sell a 17-per-cent interest in its class B shares to China's sovereign wealth fund China Investment Corp. to get its balance sheet in order.

But the company has also benefited from a better-than-expected recovery in the coking coal sector.

Teck has settled the bulk of its 2009 coal sales for $128 a tonne, a far better price than most experts had been forecasting.

While coal demand in North America and Europe has remained weak as steel production has dropped by about 40 per cent, a spate of buying by China and more recently, Brazil, has left coal producers struggling to fill orders and pushed spot market prices to about $140 a tonne.

Teck's rationalization for the costly Fording deal, which gave it full control of the Elk Valley coal operations, was a belief that the consolidation of China's steel industry and a shift in production to supersized mills on the coast would boost demand for its seaborne coking coal.

The bet appears to be paying off. While China bought just 3.2 million tonnes of seaborne coking or metallurgical coal in 2008, it is on track to purchase about 20 million tonnes this year.

“We do believe the demand will be there. There is no doubt the plans for building very large steel plants on the coast of China are continuing and that will have a significant effect on long-term demand for seaborne met coal,” Mr. Lindsay said.

Plans shelved for new Saint John refinery

Shawn McCarthy

Globe and Mail

Saturday, Jul. 25, 2009

Irving, BP decision based on forecast that gasoline consumption in North America has peaked |

Irving Oil Ltd. and partner BP PLC (BP-N50.65-0.05-0.10%) have shelved plans for an $8-billion refinery in Saint John, based on a stunning 30-year forecast that North American gasoline consumption has peaked for the foreseeable future.

Many refiners in the U.S. and Canada have re-evaluated expansion plans after last year's record oil prices and the recession have driven down demand.

A number of analysts now believe gasoline consumption in North America reached a high-water mark last year, and will remain weak even when the economy recovers.

An Irving executive said the partners concluded they simply wouldn't make a reasonable return on their proposed multibillion-dollar investment.

The family-owned oil company unveiled a proposal three years ago to build a 300,000-barrel-a-day facility to serve the northeast United States.

As refinery margins continued to grow, Irving took the next step 18 months ago and brought in BP as a high-profile partner to help shoulder the enormous capital costs.

But the market soured as rising crude costs ate into refinery profits, and then motorists cut back their driving as a result of record pump prices and the recession.

“Over the past year, some of the challenges have continued to grow and we've actually seen demand for our product fall off for the first time in many years,” Kevin Scott, Irving Oil's director of refining growth, said in an interview.

“We're looking at forecasts from 2015 to 2040, and we continue to see gasoline coming under pressure.”

He said an aging population, improvements in auto efficiency and a return of high oil prices will combine to rein in consumption.

At the same time, new refineries are coming on stream in India, China, Africa and the Middle East that will export gasoline and diesel fuel to North America and further undercut the profitability of domestic refiners, he said.

The Irving-BP decision is a blow for New Brunswick's dream of becoming an “energy hub” for eastern North America.

Irving is proceeding with the permitting of the refinery, which was planned for the Saint John waterfront next to the company's new liquefied natural gas facility. But Mr. Scott said there is only an “outside chance” that petroleum product markets would rebound sufficiently to allow the company to proceed.

The U.S. industry has roughly one million barrels a day of idle refining capacity, while the amount of gasoline in storage tanks in the U.S. has risen to a 24-year high.

“I expect – and I have been suggesting for some time – that we've likely seen a peak in North American demand,” said Michael Ervin, an independent, Calgary-based petroleum analyst.

“I think we're going to see a lot of initiatives and technology that will result in a long-term decline in demand for motor fuels. And given that there is ample spare refining capacity in North America already, I think [Irving and BP] made the right decision.”

Earlier this month, Royal Dutch Shell PLC (RDS.A-N52.240.250.48%) announced it is conducting a strategic review of some of its global refining operations, including its 130,000-barrel-a-day refinery in Montreal. Options for the 75-year-old plant include continuing its operation, selling it or closing it and transforming the property into a terminal to receive imported petroleum products.

A year ago Shell abandoned plans to build a refinery near Sarnia, Ont., to handle production from Alberta's oil sands.

Shell and its partner, Saudi Refining, have also delayed by nearly two years the expansion of their jointly-owned plant in Texas. Other U.S. companies, including Valero Energy Corp., Marathon Oil Co. and ConocoPhillips Co., have also recently announced plans to delay or suspend expansion or upgrading of refineries.

The investment pullback has prompted complaints in U.S. Congress that the oil industry is deliberately restraining capacity to maintain high prices.

But Mr. Ervin said the new refinery investments don't offer a sufficient rate of return.

Until recently, refineries operated on thin margins, while oil industry profits were generated from the extraction and sale of the crude itself.

“The refining industry certainly added to corporate profitability over the past 10 to 15 years. Prior to that, refining had never been a particularly profitable business and I think we're seeing a return to that era,” the analyst said.

He expects to see some closings of smaller refineries in the United States, particularly those that have to make investments to meet environmental goals, including low-sulphur fuel mandates and greenhouse-gas emission targets.

While the current consensus is that North American gasoline demand has peaked, that could quickly change, said Spencer Knipping, a petroleum markets analyst for the Ontario government.

If the North American economy grows more strongly than expected, if governments back off environmental demands or if crude prices stay lower than forecast, consumption of gasoline and other petroleum products could outpace expectations.

July 24, 2009

California Legislature plan falls short of closing entire deficit

COMMENT: The California budget plan was passed by the state assembly, but without two significant bills:

- the first, rejected, would have opened the coast off Santa Barbara to new offshore drilling and would have brought $100 million to the state in its first year

- the second, tabled, would have clawed back $900 million in gas-tax money from counties

This is the good news. The bad news is that an array of social programs have been sacrificed to reduce expenditures.

Earlier today, the plan in its entirety had been approved by the state senate.

Matthew Yi, Carla Marinucci, Richard Procter

San Francisco Chronicle

Friday, July 24, 2009

The Legislature passed a plan today that fell short of closing the state's gaping $26.3 billion deficit in part because lawmakers did not approve two controversial bills - one for new oil drilling off the Santa Barbara coast and the other a plan to take gas-tax funds away from counties.

Gov. Arnold Schwarzenegger indicated he would sign the deal, despite the fact that lawmakers did not include a $920 million reserve he had demanded. The governor said he intends to use his line-item veto power to reinstate the reserve.

Exhausted legislative leaders in both houses - who stayed up all night voting on the deal - pronounced the plan flawed, but also said they desperately needed to save the state from continuing to issue millions of dollars in embarrassing IOUs and from potential insolvency.

"This particular budget will be very, very difficult for a lot of people," said Senate President Pro Tem Darrell Steinberg, D-Sacramento, referring to deep spending cuts that will certainly result in larger class sizes, higher college tuitions, and loss of health and welfare benefits to the poor, the elderly and the disabled.

Earlier today, the Senate passed all 30-plus bills in the package. The Assembly, however, did not approve two the following two bills:

A bill tabled by the Assembly would have allowed the state to take about $900 million in gas-tax revenue away from counties that rely on those funds to repair local roads.

A bill rejected by the Assembly would have raised $100 million in the current fiscal year from new oil drilling off the Santa Barbara coast.

The package approved by the Legislature included $15.6 billion in spending cuts and nearly $9 billion in borrowing and accounting revisions.

Voting in both houses of the Legislature occurred during a grueling marathon session that began Thursday night and didn't end until this afternoon when the Assembly wrapped up its session.

Speaker Karen Bass, D-Baldwin Vista (Los Angeles County), said that "we were worried there for a while, but we got through it. We made our deal."

During the oil-drilling debate, Assemblyman Chuck DeVore, R-Irvine, running for U.S. Senate against incumbent Democrat Barbara Boxer, urged passage because he said it could bring $1.4 billion to the state coffers over the next two decades as well as hundreds of jobs to the state. He was countered by a passionate Assemblyman Pedro Nava, the Democrat whose district represents Santa Barbara, who reminded legislators of devastating oil spills in the region 40 years ago, and urged opposition.

In the end, the Senate approved that proposal, but it was rejected by the Assembly on a 43-28 vote.

Members in both houses also felt the heat from big city mayors who loudly denounced the proposal to grab billions in combined gas tax revenues, redevelopment funding and Prop. 1A monies from local governments - a move they said was unfair and unconstitutional. In the end, the compromise deal allows the state to use funding - about $200 million a year - as a loan that will be repaid over 10 years starting in 2011.

As their 24-hour session wore on, the growing pressure on Assembly legislators especially became evident. With the session dragging and legislators exhausted, Bass - facing recalcitrant lawmakers holding out on some measures - became increasingly impatient. At one point, making the traditional roll call for votes - a usually staid announcement of "all those vote who desire to vote" - she added pointedly to the holdouts, "Even those who don't desire to vote - vote."

Even after approving the stack of bills, legislative leaders said there was little to celebrate at the close with a plan that guarantees pain around California with slashing cuts to education, health and welfare programs, while grabbing needed funding from local governments.

"The only good news," said Steinberg, exhausted by the close of the Senate's grueling all-nighter which began Thursday afternoon, was "may it be the last."

In February, the Legislature pulled a similar all-night session to close a $42 billion deficit. That action relied on tax hikes, cuts and borrowing.

Steinberg said that legislators on both sides of the aisle deserved congratulations "for hanging in there and finding a way, in some ways against the odds, to get this done."

"We're a bit of a beleaguered institution," Steinberg said, but said legislators could "take pride in the fact that...we have now resolved a $60 billion plus deficit - and California is still standing."

Still, he warned that while Democrats who hold the majority in both legislative houses were willing to make painful slashes in the state's social safety net, they would hold the line on future cuts - and expect Republicans to be more willing to talk about raising revenue and taxes.

But Senate Republican leader Dennis Hollingsworth of Murrieta (Riverside County), said lawmakers should be applauded for solving the entire deficit that includes government reforms such as rooting out fraud in welfare programs and consolidating state agencies without raising new taxes.

Schwarzenegger had a higher deficit estimate - of $26.3 billion - because it partly assumed on lost savings from the missed June 30 deadline to pass a deal. But the losses turned out not to be as high as expected, budget experts said this morning. In addition, Schwarzenegger initially wanted a deeper reserve - around $2 billion, a figure that was built into the estimated deficit. But in the end, the Legislature eliminated the reserve.

Still, lawmakers were keenly aware of the increasing pressures and growing criticism regarding the budget package's many complex facets.

On Thursday, the mayors, led by Los Angeles' Antonio Villaraigosa, angrily charged that the proposed deal constituted "highway robbery" that illegally raids billions of dollars in cities' share of gas taxes and redevelopment funding. "We want to be part of the solution ... but we're not going to allow this proposal to be balanced on the backs of our cities," Villaraigosa said.

As of Thursday, 188 cities across the state - including San Francisco and Oakland - had signed resolutions indicating their support for a lawsuit that is expected to be filed by the League of California Cities and the California State Association of Counties as soon as the budget is approved by the Legislature, said the league's executive director, Chris McKenzie.

"I've never seen a reaction like this. They are livid," said McKenzie of the local leaders.

With the state's bond ratings plummeting, hundreds of millions of dollars in IOUs going out and the day fast approaching when the state's coffers are completely bare, the mayors were only the start of what appeared to be growing anger and efforts to block the budget's passage.

State Insurance Commissioner Steve Poizner, a Republican running for governor, said in a radio interview that he is considering a lawsuit over the provision in the budget that would sell a portion of the State Compensation Insurance Fund for $1 billion.

Leaders representing the 95,000 state workers who belong to the Service Employees International Union protested in the state Capitol Thursday, threatening to sue the state over the furloughs of three days per month - which are to last through June 2010.

E-mail the writers at cmarinucci@sfchronicle.com and myi@sfchronicle.com.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/07/24/BACE18UH4P.DTL

California Coast Spared by Vote of Assembly

by David M. Greenwald, EditorCalifornia Progress Report

July 24, 2009

By a vote of 43-28, the California Assembly defeated a proposal that would have allowed the first first new oil drilling lease in California State waters since the 1969 Santa Barbara oil spill.

“The Governor made Santa Barbara a target for new oil drilling. I am proud that we rejected this insidious proposal,” said Assemblymember Pedro Nava. “The plan would have unraveled critical environmental protections, put the coast at risk, and set a terrible precedent while the federal government is considering their 5 year drilling plan for the outer continental shelf.”

It was a proposal that every major environmental organization in the state opposed. As Assemblymember Nava put it, “This bill has only two supporters, the Governor and the oil company.”

Under the proposal, the Governor would submit his oil drilling plan to an ad hoc committee where he is assured approval. The three member committee would include two appointees from the Governor (Secraties of Resources Agency and Cal EPA) along with the Attorney General.

“This is a sham. Other than the Attorney General, the Governor controls the ad hoc committee and there is little doubt that two of the three votes will quench the Governor’s thirst for more oil,” said Assemblymember Nava. “If your child’s little league team tried this kind of do-over, they would be disqualified and kicked out of the league. “

In a letter from 53 environmental organizations published Friday on the California Progress Report [see below]:

“While the precise language has not been released for legislative or public review, and may not be in time for any legitimate discussion, it is our understanding that it overrides the State Lands Commission’s legitimate denial of this project, creates an ad-hoc commission dominated by gubernatorial appointments, instructs this commission to find that the lease is in the best interest of the state, extends the duration of drilling operations, gives the public a mere five days of notice prior to a hearing, and fails to include any specifics on royalty payments that are supposed to be the rationale for approving this lease in this most unprecedented manner.”

The State Lands Commission report stated in part: ““The goals of the agreement could not be reliably enforced and the legal context for the public benefit requirements of the agreement prevented staff from devising mechanisms to improve enforceability. The Commission cannot reliably require PXP to stop and close production on federal leases.”

Victoria Rome of the Natural Resources Defense Council said, "I think it should be very troubling to the public that a decision that was made through a public process in the light of day can be overturned by a few leaders behind closed doors."

Speaking on the Assembly floor Assemblymember Nava, “The Governor’s proposal implies that when times are tough we ignore long established public policy, set aside our values, and if the state needs money it is acceptable to put our environment at risk.” He continued, “I strongly oppose this approach to development of environmental policy.”

Lieutenant Governor John Garamendi said earlier this week, “The Governor just put California's coastline up for sale when he had other options that don't put our natural resources at risk. He refused to approve a plan to tax oil companies that now extract oil in California to fund health care services, children's programs and education. California is the only oil producing state without an oil severance tax, and it would generate $1.2 billion dollars annually for our state,” Lieutenant Governor John Garamendi said.

“Instead, we are taking dirty money. Big Oil has offered to California $100 million dollars to seduce the state into granting the first new oil drilling lease in California since the Santa Barbara oil spill 41 years ago. The loan must be repaid by forgiving future royalty payments to California. This is an incredibly reckless fiscal policy.”

“This individual project off the Santa Barbara coast simply is not a Budget issue,” said Willie Pelote, California Political & Legislative Director, American Federation of State, County and Municipal Employees. “If the Governor really wants to generate more revenues he should charge oil companies for extraction just like they do in Texas, Alaska, and other oil producing states.”

Richard Charter, of Defenders of Wildlife, has 35 years of experience in coastal drilling issues. “The Administration has triggered the political equivalent of the Santa Barbara Blowout, rolling the State Lands Commission and the Democrats in the Legislature, while punching a big hole in the 40-year precedent that has protected California's own nearshore coastal waters from new offshore drilling.”

“The oil lobby, reaping tens of billions in taxpayer dollars from this scam, is laughing all the way to the bank, confident that any removal of rigs or facilities cannot be enforceable without congressional legislation they know is not even pending. If this deal goes forward, the driller's next stops are Malibu, Santa Monica Bay, and La Jolla,” said Charter.

“The enduring image of nearly every oil spill is a dead or dying bird lying on a blackened beach, its feathers covered with oil,” said Graham Chisholm, executive director of Audubon California. “Californians have stated many times that they don’t want to see any more of that destruction, and yet the budget crisis is prompting our leadership to risk exactly that. Our shorelines are too precious to take those kinds of chances.”

Assemblymember Nava concluded his remarks Friday, “This is a historic moment. How we deal with this issue will affect generations of Californians. Long time residents of Santa Barbara still clearly remember the 1969spill. Washington is looking to California to see how we handle this issue. If we approve this bill, we are sending the Obama Administration a strong message that we want more drilling.”

53 Environmental Groups Oppose Use of Budget Process To Approve New Offshore Oil Drilling Project

California Progress Report

July 24, 2009

On July 22 and 23, 53 leading California environmental organizations sent letters to Governor Schwarzenegger to express their united opposition to the reported budget deal that would overturn the recent decision by the independent State Lands Commission denying the Tranquillon Ridge project proposal based on legitimate substantive reasons including concerns over a lack of enforceability. This proposal, if approved, will represent the first new offshore oil lease in California waters in over 40 years, and a major reversal of the Governor’s past assurances that there would be no new oil drilling off California’s coast. Please visit: http://www.youtube.com/watch?v=HpdegV6g1WY

While the precise language has not been released for legislative or public review, and may not be in time for any legitimate discussion, it is our understanding that it overrides the State Lands Commission’s legitimate denial of this project, creates an ad-hoc commission dominated by gubernatorial appointments, instructs this commission to find that the lease is in the best interest of the state, extends the duration of drilling operations, gives the public a mere five days of notice prior to a hearing, and fails to include any specifics on royalty payments that are supposed to be the rationale for approving this lease in this most unprecedented manner.

Victoria Rome of the Natural Resources Defense Council said, "I think it should be very troubling to the public that a decision that was made through a public process in the light of day can be overturned by a few leaders behind closed doors." Approval of this project via the budget fails to take into account the consequences of reversing 40 years of long-standing state policy in opposition to new federal leasing and additional leasing in state waters. Further, the proposal is contrary to the principle of independence of California’s system of independent boards and commissions and their right to take action. It would weaken the State Lands Commission and establish the precedent that controversial decisions of this agency or any other State agency could potentially be reversed by creating case-by-case mechanisms for appeal and automatic approvals

Michael Endicott of Sierra Club California said, “We do not see how the Governor’s reversal on offshore oil drilling can really be in the best interest of the state, especially when there is a superior alternative that: 1) does not pose the risk of opening up new oil drilling off California’s coast, 2) does not send the message to the federal government that we want to encourage more offshore drilling activity at a time that it is reviewing its offshore drilling policies, and 3) would raise substantially more money for the people of California.”

Instead, we ask the Governor, and legislative leaders to withdraw this proposal and replace it with a much better alternative – the severance tax. The severance tax would generate much more revenue for the state. The PXP proposal would only generate with certainty a single $100 million payment that is really just an advance on royalties which would be credited to PXP’s benefit to reduce future royalty payments. A severance tax would raise up to 8 times more on an annual basis.

Dan Jacobson of Environment California observed, “Even Texas, Alaska and Oklahoma collect on the volume of oil extracted/severed from their territories. This alternative would indeed be in the short and long term best interest of the state because it would raise more revenue (not borrow against future revenue), use existing operations as its basis, and not set a bad precedent for federal regulatory activity which is reviewing offshore drilling policies as we speak.”

We stand united in our opposition to this attack on the independence of the State Lands Commission and the approval of new off shore oil drilling and urge the Governor to allow the established process to proceed.

American Cetacean Society Monterey Bay- Carol Maehr

Amigos de Bolsa Chica- Dave Carlberg

Audubon California-Dan Taylor

Beacon Foundation- Vickie Finan

Bolsa Chica Land Trust- Paul Arms

Buena Vista Audubon- Joan Horowitz

Cabrillo Wetlands Conservancy- Mary Jo Baretich

California Coastal Network- Steve Asceti

California Coastal Protection Network- Susan Jordan

Citizens for the Preservation of Parks & Beaches- Shari Mackin & Carolyn Kramer

Clean Water Action- Miriam Gordon

CLEAN-Marcia Hanscom

Coast Action Group- Point Arena- Alan Levine

Coastal Environmental Rights Foundation- Marco Gozales

Coastwalk California- Fran Gibson

Committee for Green Foothills- Lennie Roberts

Defenders of Wildlife- Richard Charter

Ecoslo-Morgan Rafferty

El Dorado Audubon- Mary Parsell

Endangered Habitats League- Dan Silver

Environment California- Dan Jacobson

Environmental Action Committee of W. Marin

Environmental Health Coalition- Laura Hunter

Friends of Harbors, Beaches and Parks- Jean Watt

Heal the Bay- Sonia Diaz

Humboldt Baykeeper- Pete Nichols

Inland Empire Waterkeeper- Autumn De Woody

League for Coastal Protection- Mel Nutter

League for Coastide Protection- Scott Boyd

Madrone Audubon- Diane Hichwa

Malibu Coast Land Conservancy- Steve Uhring

Natural Resources Defense Council- Victoria Rome

North Coast Environmental Center- Jennifer Kalt

Ocean Outfall Group- Jan D. Vaandersloot

Orange County Coastkeeper- Garry Brown

Pelican Network- Jack Ellwanger

Residents for Responsible Desalination- Merle Moshiri

San Diego Audubon- Jim Peugh

San Diego Coastkeeper- Bruce Reznik

San Luis Obispo Coastkeeper- Gordon Hensley

Santa Monica Baykeeper- Tom Ford

Save or Shore- Lauren Gilligan

Sea and Sage Audubon- Scot Thomas

Sierra Club California – Michael Endicott

South Laguna Civic Association-Bill Rihn

Surfer’s Environmental Alliance- Douglas Ardley

Urban Wildlands-Catherine Rich

Vote the Coast- Sara Wan

Western Alliance for Nature- Larry Wan

Wild Heritage Planners- Jack Eidt

Wildcoast- Serge Dedina

July 23, 2009

Climate and CCS debate: Coal can’t have it both ways

by Ken Ward Jr.

Charleston Gazette

July 23, 2009

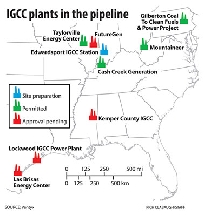

|

Yesterday, I wrote a story for the Gazette print edition about a new Harvard study that purports to detail the Realistic Costs of Carbon Capture from coal-fired power plants.

In a nutshell, the study puts the costs of capturing and storing greenhouse gas emissions from coal-fired power plants much higher than previous studies. Harvard researchers projected first-generation plants with CCS might double the cost of electricity. The costs might drop as the technology matures, but could still increase power production rates by as much as 50 percent.

This study also got some attention from The Wall Street Journal’s Environmental Capital blog, which called it a “reality check for clean coal.”

That’s probably right. But what kind of reality check? As I thought about this, it became clear that, in the national discussion over the American Clean Energy and Security Act, the coal industry is trying to have it both ways. Coal lobbyists want to argue that “clean coal” is here, but then also demand that the climate legislation working its way through Congress be further watered down, to give them more time to perfect and deploy carbon capture and storage technology.

First, let’s look at what coal is doing to trick the public into thinking that CCS technology is here, ready to go …

The other day, I tweeted and blogged about some comments singer/songwriter Steve Earle made in introducing his song “The Mountain” during a Mountain Stage radio show. I got a quick Twitter response from the folks at an industry front group called the American Coalition for Clean Coal Energy, who tweet under the name of their blog, AmericasPower:

@Kenwardjr Actually, the Edwardsport IGCC plant will reduce CO2 by up to 45%

http://sn.im/factuality5

That’s what these industry folks are doing. If anyone in the media dares to point out questions or problems with their scheme to capture carbon dioxide emissions and pump them underground, coal’s mouthpieces sprinkle the PR equivalent of pixie dust, to make it sound like CCS is some kinda magic potion to save us all.

Just take a look at the group’s blog, Behind the Plug, which is basically a collection of press releases aimed at showing that CCS will work, is working, and is going to be a huge part of our energy future.

Contrast that to the statements being made by coal industry officials in opposition to the current climate change bill:

– The National Mining Association, complains the bill “mandates near-term emission reductions before [CCS] technologies can be deployed.”

– CONSOL Energy vice president Steve Winberg, testifying to Congress last week, said CCS technologies “may be commercially viable by 2020, [but] they will not yet be deployed to a sufficient extent to avoid a serious impact on electricity prices and reliability.” He added:

Coal is our most abundant domestic energy resource and we need sustained investment in CCS technology and the time to develop, demonstrate and commercialize it. Emissions targets and timetables must be aligned with the pace of technology development.

– Friend of Coal skydiver Congressman Nick J. Rahall, explaining his vote in the House against the climate change bill, said the emissions reductions requirements are “still too high and too soon to incentivize rapid development and deployment of carbon capture and sequestration technologies so as to ensure coal-mining jobs in the future.”

– The United Mine Workers union, admitting that “the future of coal is intact” because of billions of dollars in CCS subsidies, still refusing to support the legislation and seeking more changes to benefit the industry.

– And don’t even get me started on my buddy, West Virginia Coal Association President Bill Raney, who fooled the Bluefield paper into writing this in an editorial:

According to Raney, the Obama administration is attempting to penalize the public — and coal producing regions such as southern West Virginia — based on a science that no one has a consensus on. Raney argues there are still differences of opinion regarding climate change and global warming.

Coal operators and coal-fired utilities (not to mention the mine workers union) want us to believe that CCS will work — and in fact is working — so that the public won’t demand a tougher climate bill, or tougher restrictions (or abolition) of mountaintop removal coal mining, toxic coal-ash impoundments, etc. That’s why they lure the media into writing glowing reports about CCS projects, without ever making it clear that they are very small, experimental efforts.

But, they also want us to believe that any really tough climate bill with a strong near-term emissions reductions requirement is just too much, too soon.

That doesn’t make for an honest debate.

The truth is, even experts don’t know if — let alone when — CCS is going to be ready to be installed on hundreds of coal-fired power plants across the country (and indeed, across the planet).

As I’ve pointed out before on Coal Tattoo, quoting Andrew Revkin’s New York Times’ Dot Earth blog:

Vaclav Smil, an energy expert at the University of Manitoba, has estimated that capturing and burying just 10 percent of the carbon dioxide emitted over a year from coal-fire plants at current rates would require moving volumes of compressed carbon dioxide greater than the total annual flow of oil worldwide — a massive undertaking requiring decades and trillions of dollars. “Beware of the scale,” he stressed.

You can read the paper in which Smil makes this argument here.

The new Harvard study I wrote about this week is yet another indication of the huge challenge that faces coalfield communities if coal is going to remain a viable energy source in a carbon-constrained world. Other previous major studies by MIT and the Union of Concerned Scientists drew similar conclusions and spelled out similar concerns.

There have been a lot of cheesy comparisons made between efforts to rework out energy system and the Apollo space program that put men on the Moon. But one area that seems worth thinking about is the plain talk President Kennedy gave the country about how going to the Moon was going to be hard, and that was part of why it was worth doing:

We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win, and the others, too.

Cleaning up coal — if it can be done — might be an even bigger challenge. Can’t we at least be clear about that?

Blogs @ The Charleston Gazette

Realistic Costs of Carbon Capture

COMMENT: The Belfer Center at Harvard has just published a study of carbon capture and storage (CCS). It has determined that the early technology ("first-of-a-kind" or FOAK) implementations will cost in the range of $120-$180 per tonne of CO2 "avoided". On first take, it suggests that a CCS requirement will put the coal business out of business.

Expect plenty of media attention to this discussion paper in coming days. We will add some of them to this post.

CCS, like corn ethanol, and the hydrogen highway, looks like another of those business-as-usual panaceas that government so seems to love - that costs a fortune and doesn't do what it's supposed to do or certainly can't do it in any useful timeframe.

Discussion Paper

July 2009

Authors: Mohammed Al-Juaied, Former Visiting Scholar, Energy Technology Innovation Policy research group, 2008-2009, Adam Whitmore

Belfer Center for Science and International Affairs, John F. Kennedy School of Government, Harvard University

ABSTRACT

There is a growing interest in carbon capture and storage (CCS) as a means of reducing carbon dioxide (CO2) emissions. However there are substantial uncertainties about the costs of CCS. Costs for pre-combustion capture with compression (i.e. excluding costs of transport and storage and any revenue from EOR associated with storage) are examined in this discussion paper for First-of-a-Kind (FOAK) plant and for more mature technologies, or Nth-of-a-Kind plant (NOAK).

For FOAK plant using solid fuels the levelised cost of electricity on a 2008 basis is approximately 10¢/kWh higher with capture than for conventional plants (with a range of 8-12 ¢/kWh). Costs of abatement are found typically to be approximately $150/tCO2 avoided (with a range of $120-180/tCO2 avoided). For NOAK plants the additional cost of electricity with capture is approximately 2-5¢/kWh, with costs of the range of $35-70/tCO2 avoided. Costs of abatement with carbon capture for other fuels and technologies are also estimated for NOAK plants. The costs of abatement are calculated with reference to conventional SCPC plant for both emissions and costs of electricity.

Estimates for both FOAK and NOAK are mainly based on cost data from 2008, which was at the end of a period of sustained escalation in the costs of power generation plant and other large capital projects. There are now indications of costs falling from these levels. This may reduce the costs of abatement and costs presented here may be "peak of the market" estimates.

If general cost levels return, for example, to those prevailing in 2005 to 2006 (by which time significant cost escalation had already occurred from previous levels), then costs of capture and compression for FOAK plants are expected to be $110/tCO2 avoided (with a range of $90-135/tCO2 avoided). For NOAK plants costs are expected to be $25-50/tCO2.

Based on these considerations a likely representative range of costs of abatement from CCS excluding transport and storage costs appears to be $100-150/tCO2 for first-of-a-kind plants and perhaps $30-50/tCO2 for nth-of-a-kind plants.

The estimates for FOAK and NOAK costs appear to be broadly consistent in the light of estimates of the potential for cost reductions with increased experience. Cost reductions are expected from increasing scale, learning on individual components, and technological innovation including improved plant integration. Innovation and integration can both lower costs and increase net output with a given cost base. These factors are expected to reduce abatement costs by approximately 65% by 2030.

The range of estimated costs for NOAK plants is within the range of plausible future carbon prices, implying that mature technology would be competitive with conventional fossil fuel plants at prevailing carbon prices.

2009_AlJuaied_Whitmore_Realistic_Costs_of_Carbon_Capture_web.pdf (454K PDF)

For more information about this publication please contact the ETIP Coordinator at 617-495-7961.

For Academic Citation:

Al-Juaied, Mohammed and Adam Whitmore. "Realistic Costs of Carbon Capture." Discussion Paper 2009-08, Energy Technology Innovation Research Group, Belfer Center for Science and International Affairs, Harvard Kennedy School, July 2009

http://belfercenter.ksg.harvard.edu/publication/19185/realistic_costs_of_carbon_capture.html

July 21, 2009

Carbon capture for coal costly, study finds

By Ken Ward Jr.Charleston Gazette

July 21, 2009

To read the study, click here:

Read more in Coal Tattoo

CHARLESTON, W.Va. -- Harvard University researchers have issued a new report that confirms what many experts already feared: Stopping greenhouse gas emissions from coal-fired power plants is going to cost a lot of money.

Electricity costs could double at a first-generation plant that captures and stores carbon dioxide emissions, according to the report from energy researchers at the Harvard Kennedy School's Belfer Center.

Costs would drop as the technology matures, but could still amount to an increase of 22 to 55 percent, according to the report, "Realistic Costs of Carbon Capture," issued this week.

These projections "are higher than many published estimates," but reflect capital project inflation and "greater knowledge of project costs," wrote researchers Mohammed Al-Juaied and Adam Whitmore.

Coal is the nation's largest source of global warming pollution, representing about a third of U.S. greenhouse emissions, equal to the combined output of all cars, trucks, buses, trains and boats.

In the U.S., coal provides half of the nation's electricity. Many experts believe that, because of vast supplies, coal will continue to generate much of the nation's power for many years to come.

Climate scientists, though, recommend that the nation swiftly cut carbon dioxide emissions and ultimately reduce them by at least 80 percent below 2000 levels by mid-century to avoid the worst consequences of climate change.

Industry supporters say the key is for scientists to perfect technology to capture carbon dioxide emissions from coal-fired power plants and pump those gases safely underground. But such technology has never been deployed on a commercial scale. Critics worry about the expense, safety and a host of technical hurdles.

Previous studies have found that carbon capture and storage, or CCS, might cost in the neighborhood of $30 to $50 per ton of carbon dioxide that is captured and stored.

But in a major report last October, the Union of Concerned Scientists warned that such estimates might be overly optimistic. Among other problems, the group said, previous studies did not reflect rising construction, material and labor costs.

The new Harvard study tried to account for such issues. As a result, it projected CCS costs at between $120 and $180 per ton of carbon dioxide captured and stored.

That's for a first-of-its kind, new generation of coal-fired plant that eliminates most carbon dioxide emissions.

The cost translates to an increased cost of electricity of about 10 cents per kilowatt-hour. Nationally, the average electricity cost is about 9 cents per kilowatt-hour, according to the U.S. Department of Energy.

In West Virginia, costs are much lower, an average of 5.3 cents per kilowatt-hour, according to the DOE.

Typically, the state Public Service Commission's Consumer Advocate Division uses the figure of 600 kilowatt-hours per month as an average usage in West Virginia. Using that number, the CCS projections would increase an average power bill by about $60 per month, or $720 per year.

The Harvard study projected that, as technology improves, CCS costs would drop. Later-generation plants would cost between $30 and $50 for every ton of carbon dioxide they capture.

That amounts to between 2 and 5 cents more per kilowatt-hour of power, according to the study. On average, that's between $12 and $30 per month more for electricity.

Reach Ken Ward Jr. at kward@wvgazette.com or 304-348-1702.

Clean Coal: Competitive Someday, Just Not Today

Keith JohnsonWall Street Journal

July 20, 2009

The cavalry’s coming–maybe |