May 30, 2009

Energy supply crunch brewing

By Deborah Yedlin

Calgary Herald

May 28, 2009

Brent Light Sweet Crude 12 month to May 2009 |

Forget low oil prices. The worry of the moment is a spike in oil prices and how long it will take before a supply crunch sends prices soaring.

And if one subscribes to the views of former CIBC World Markets economist Jeff Rubin and University of California, San Diego economics professor James Hamilton, a spike in prices could send the world tumbling back into recessionary territory, just as it is about to climb out of it.

Both Rubin and Hamilton hold the view that the current recession is the result of a spike in oil prices and not the collapse in the U. S. housing market.

So what's the deal with the about-face in sentiment on oil prices?

It doesn't get much simpler than the basic economic principles of supply and demand.

Ever since the bottom dropped out of the economy -- and the oil market -- last fall, there has been a single-minded focus on the weekly demand numbers released by the various energy agencies around the world. The conclusion drawn was that oil prices were going to remain weak for the foreseeable future because of the huge drop in consumption.

This, despite other compelling information that has long determined the decline rates of existing fields, even with steady demand, is going to push the world toward an oil shortage.

Now, all of a sudden, the tide has turned and the focus is on the supply side.

What's interesting is the mix of organizations on the supply-shortage bandwagon.

In recent weeks, the International Energy Agency has weighed in on the subject, saying in a recent report the lack of investment by countries that are not members of the Organization of Petroleum Exporting Countries has cost the world two million barrels a day. Of this, 1.7 million barrels are related to the slowdown in the development of Alberta's oilsands.

But the IEA doesn't stop there. It goes on to say an additional 4.2 million barrels a day have been put on hold for at least 18 months as a result of the drop in capital expenditures.

Moreover, the drop in production could be even higher if national oil companies -- whose agendas often lie outside their control -- see dollars diverted to other government priorities and away from energy-related activities.

The IEA also points out the lag between investment decisions and the time it takes to bring production on stream.

Reading between the lines, the IEA is suggesting companies and countries need to be investing in new production, even as prices have slumped.

"There is a real danger that sustained lower investment in supply in the coming months and years could lead to a shortage of capacity and another spike in energy prices in several years' time, when the economy is on the road to recovery."

And if the recovery happens faster than some expect, the shortage could manifest itself sooner rather than later.

The IEA has company in the form of OPEC, which called for increased levels of investment following a meeting of the G-8 ministers in Rome. Its position is simply that without investment, prices are headed back to the $150 US per barrel level within the three years.

While OPEC might be right on this, the hypocrisy of this statement is glaring. It's no secret OPEC members aren't exactly known for reinvesting their petrodollars looking for oil and natural gas reserves; the modus operandi in that part of the world has more to do with subsidizing political agendas--primarily keeping gasoline prices dirt cheap--than it does with finding new sources of hydrocarbons or investing in social infrastructure such as schools and health care.

To this can be added the views of the International Monetary Fund and investment firm Merrill Lynch, both of which are warning of the consequences of a lack of investment and the impact of prices above $70 per barrel on the economies of the Organization for Economic Co-operation and Development.

Consulting firm McKinsey &Co. also weighed in with its analysis this week, which showed supplies could begin to tighten as early as next year, even if economic growth is on the weak side.

All this should make Albertans happy. A higher oil price is good for the economy--though not as good as higher natural gas prices --and there is the distinct possibility that if prices stabilize in the $60 range, the oilsands projects that were put on hold might be put back on the active roster.

What's surprising is that not everyone looks at this as being good news. A number of players on the investment side of the business --whether buy-side (investors) or sell-side (investment firms) --believe the sector needs to go through what is being seen as a period of cleansing;a higher oil price will effectively negate this process, which is now underway. It's not unlike forests regenerating after a fire.

The reasoning goes something like this: times like these season management teams and teach the valuable lesson that everyone looks like a hero when times are good. But it's the challenging times that mint the next generation of individuals who learn from the lessons of a downturn and apply them to the problems of the future. Look no further than the demise of Dome Petroleum-- and the experience that has been put to good use these past few months--for evidence of this.

Of course, no one really knows where oil prices are headed long term, but it's getting harder to ignore the growing body of analysis pointing to a supply crunch as a result of the 15 per cent drop in investment and continued declines in the big fields around the world.

The smart money looks like it's on prices going up, not down.

© Copyright (c) The Calgary Herald

Natural gas in Arctic mostly Russian

Anchorage Daily News

May 28th, 2009

STUDY: By comparing geological conditions with other parts of the world, Alaska could fare well too.

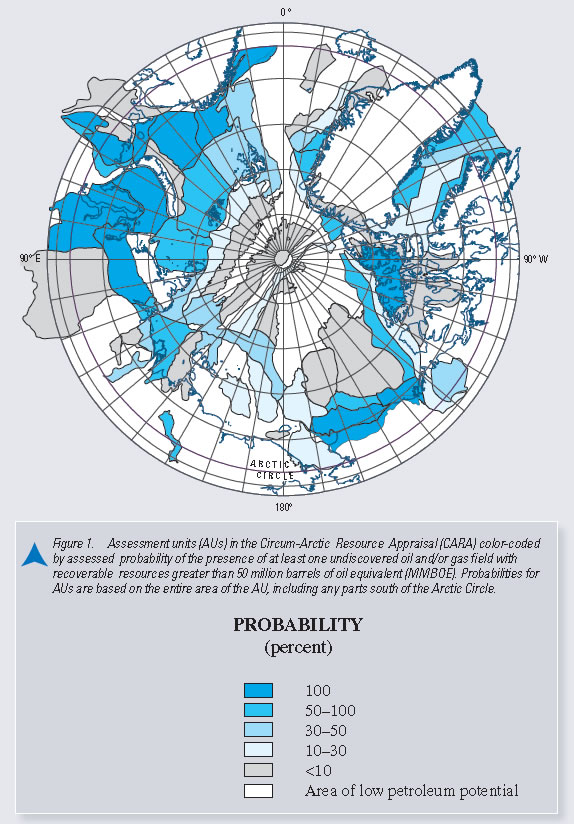

Nearly one-third of the natural gas yet to be discovered in the world is north of the Arctic Circle and most of it is in Russian territory, according to a new analysis led by researchers at the U.S. Geological Survey. Alaska also is believed to hold a significant storehouse.

"These findings suggest that in the future the ... pre-eminence of Russian strategic control of gas resources in particular is likely to be accentuated and extended," said Donald L. Gautier, lead author of the study published in Friday's edition of the journal Science.

Russia is already the world's leading natural gas producer, noted Gautier, of the Geological Survey's office in Menlo Park, Calif.

The report, by an international scientific team, estimated that the Arctic also contains 3 percent to 4 percent of the world's oil resources remaining to be discovered.

Two-thirds of the undiscovered gas is in just four areas -- the South Kara Sea, North Barents Basin, South Barents Basin and the Alaska Platform -- the report said.

Indeed, the South Kara Sea off Siberia contains 39 percent of the Arctic's undiscovered gas, the researchers said.

The Alaska Platform extends from the central North Slope to offshore waters in the Beaufort and Chukchi seas. The report says this swath of Alaska offshore and onshore:

• Contains an estimated 8 percent of the Arctic gas, or an estimated 38 trillion cubic feet -- about as much as has been discovered in the Prudhoe Bay area.

• Contains more than 31 percent of the Arctic region's undiscovered oil, or an estimated 28 billion barrels -- not quite twice as much as has been produced from the North Slope since 1977.

The report shows that Alaska is "heads and shoulders over the other regions for undiscovered oil; but even on the gas side, we are in the top four," said Marilyn Crockett, executive director of the Alaska Oil and Gas Association, an industry group.

Oil companies have been pushing into frontier areas of Alaska's Arctic.

Onshore oil exploration has been stretching from the main cluster of North Slope oil fields west into the National Petroleum Reserve Alaska and south toward the Brooks Range.

Off Alaska's northern coast, at least two major oil companies -- Shell and Conoco Phillips -- have been eager to explore for offshore oil and gas but some of their efforts have been opposed by Native communities and environmentalists and blocked by courts for now.

WHO OWNS THE ARCTIC

Russia has been active in asserting its claim to parts of the Arctic. It first submitted a claim to the United Nations in 2001 but was rejected for lack of evidence. The United States, Canada, Denmark and Norway have also sought to assert jurisdiction over parts of the Arctic.

Now Russia is working to prove that an underwater mountain range crossing the polar region is part of its continental shelf. In 2007, two Russian civilian mini-submarines descended to the seabed to collect geological and water samples and drop a titanium canister containing the Russian flag.

Arctic oil reserves are much smaller than those of natural gas and are unlikely to lead to any shift in world oil balance, Gautier said in a recorded briefing provided by Science.

But they could be of importance locally if developed by individual countries, he said, citing in particular the United States and Greenland, which is governed by Denmark.

"New discoveries (off Alaska's coast) could maintain the flow of Alaskan oil for many years to come," according to the report.

However, Gautier added, the study looked only at the geological setting and the chance that energy resources are present.

"If these resources were to be found they would not be found all at once; they would be found incrementally and they would be produced incrementally," he said, urging caution about assuming that the oil might extend world production significantly.

MANY UNKNOWNS

Conservationists have advocated against drilling in the Arctic, citing possible environmental damage and concerns about continued reliance on fossil fuels that are linked to global warming. Native groups in Alaska have challenged how well the federal government has assessed the potential damage to their whaling and other subsistence food gathering if oil development happens in federal Arctic waters.

Gautier said the study focused on geological conditions in the Arctic and how they compared to other parts of the world where oil and gas have been found.

Because so much of this territory is unexplored and data are so limited, the researchers had to develop a new method to do assessments, Gautier said.

They collected the best information they could for the region and then subdivided it into geological areas. Those areas were compared with other geological regions around the world where gas or oil have been found in order to produce their assessment of where more resources are likely to be located.

Gas and oil tend to be found in sedimentary basins, he said, and "each one of these basins has a story, a geologic story."

"As new data become available our understanding of the resources in the Arctic will change," he added.

Circum-Arctic Resource Appraisal: Estimates of

Undiscovered Oil and Gas North of the Arctic Circle

Donald L. Gautier (CARA Project Chief) et al, US Geological Survey

|

May 27, 2009

Recession benefit: Alberta can pause and rethink the oil sands

COMMENT: Jeffrey Simpson argues that Alberta (and the companies) should use this opportunity to clean-up tar sands production. Not for moral or environmental reasons, but because if they don't do it, the US will impose carbon charges on tar sands bitumen anyway.

But will China? Or does Enbridge's Northern Gateway (and Kinder Morgan's Trans Mountain Expansion) find itself with a new "business case" whereby tar sands producers, Alberta, and Canada can duck carbon liabilities and still find a market for the stuff without cleaning up their act at all?

BC, too. Gordon Campbell's "energy corridor" which is essentially the Northern Gateway pipeline route to the west coast, is being heavily promoted by his government, most egregiously being government purchases of equity in these projects for first nations (which not surprisingly were announced mid-election).

This shouldn't be a provincial decision. It belongs in Ottawa, the only place where national energy policy and national environmental policies can be harmonized.

Simpson asks whether anyone in government or industry will seize the day. Not willingly. With Harper, and before long, Ignatieff, at the helm, this ship of state appears destined to avoid real carbon action for some years to come. Obama's carbon policies may be the only force great enough to make us behave.

See also:

Kitimat project could be worth more than $1b to first nations

The Waxman - Markey Bill - Will the US and Canada go Head to Head?

China's environmental hot air and hypocrisy

Jeffrey Simpson

Globe and Mail

Wednesday, May 27, 2009

Any new approach should be based on the simple premise that reducing emissions is the cost of doing business

Alberta has an extraordinary opportunity, one it did not wish or seek, but one that could revolutionize the province's future.

The opportunity, paradoxically, is being provided because the recession has slowed down, or halted, oil-sands projects, previously the fastest-growing source of greenhouse-gas emissions in Canada.

Instead of rushing toward exploiting the sands as quickly as possible, with all the attendant environmental problems, Alberta can now reconsider the pace of development and, more important, establish a new set of rules that will reduce emissions.

When former premier Peter Lougheed suggested a go-slow approach several years ago, the industry and government paid him no heed. It turns out he was customarily prescient. The recession is giving the government the chance to do what he recommended: pause and rethink.

If Alberta takes this unexpected opportunity, the province can shield itself from the various threatening environmental measures now being developed in the United States. Instead of responding belatedly to U.S. actions, the province can get in front of those actions and be a leader, rather than a follower, in the fight against global warming.

At the moment, Alberta's principal policies against greenhouse-gas emissions are a $2-billion investment in carbon capture and storage (CCS) and a $15-a-tonne tax paid into an investment fund by emitters of more than 100,000 tonnes of greenhouse gases a year. (There are also incentives for renewable energy.)

These two policies are inadequate for the province with the most emissions in Canada. The CCS projects, the first of which will be announced shortly, will not soak up many emissions, and the per-tonne cost will be sky-high. The $15-a-tonne tax is far too low, because companies would rather pay it than reduce emissions.

The result, pre-recession, was that Alberta's emissions were set to rise 14 per cent by 2020, while everybody else's in the Western world were set to decline. The province would be a sitting duck for retribution under those circumstances, even if the government didn't believe it, preferring to waste $25-million on a public-relations campaign in the United States.

Alberta's new approach should be based on a simple premise: Reducing emissions is the cost of doing business. It's not an afterthought or what economists call an externality, but a bottom-line cost to companies that will be passed on to consumers. Put another way, the afterthought becomes a bottom-line cost of production. If Alberta (and Canada) doesn't do it, the Americans will, through carbon tariffs, a cap-and-trade system or barriers to selling oil from the sands.

The aim should be what the Canadian Energy Research Institute, based in Calgary, calls “green bitumen.” CERI is not a wild-eyed environmental group, but rather an institute funded by private companies and governments.

The CERI report is both simple and complex. The simple part says the status quo is not sustainable. The oil sands cannot continue to be developed as they have been, and as they were going to be developed pre-recession. The environmental costs of business-as-usual are too high; the disincentives to pollute are so low.

The complex part is setting a price for carbon that will make it more economical for companies to comply with regulations (or carbon caps) than avoid them by putting money into a technology fund. That will certainly mean a per-tonne price above $15, rather something like $60.

And it will mean using technology, much of it expensive, to provide power for oil-sands development, including small nuclear plants, more carbon capture and storage and other technologies. The costs for these technologies will be high, but no higher than the cost of reducing emissions, if those emissions are properly priced as a cost of doing business.

Maybe CERI's cost estimates are too optimistic; maybe its modelling is based on shifting, and therefore unreliable, assumptions; maybe by mentioning the word nuclear the report will wax ears.

But the objective is right: to revolutionize policy so that emissions become a real cost of doing business, a bottom-line factor, with the objective of bringing about real reductions, not slowing down increased emissions, the premise of existing policy that leaves Alberta so exposed.

The cliché saying that from crisis - in this case, the recession - comes opportunity was never more true than today in Alberta. Will anybody in government and the industry seize the day?

Fearing water pollution, NWT towns call for oil sands slowdown

Mark Hume

Globe and Mail

Tuesday, May. 26, 2009

Oil sands mining operations in Fort McMurray, Alta. |

33 communities ask for moratorium on developments until environmental issues can be worked out

With growing evidence that pollutants are causing fish deformities in the Athabasca River and one native village struggling to understand its elevated cancer rates, 33 communities in the Northwest Territories have called for a moratorium on oil sands developments because of fears about water quality.

At a conference in Inuvik, the NWT Association of Communities passed a resolution expressing “widespread concern” that the governments of Canada and Alberta have not managed the oil sands in a way that protects the environment.

“This is no longer just an issue for Albertans, and now poses a risk to all downstream communities in the Mackenzie Basin … in terms of risks to water quality in the Athabasca River posed by leaks from, and even possible failure of, oil sands tailings ponds,” states the resolution.

The resolution calls for a halt to new oil sands development until a trans-boundary agreement is in place “that ensures water flowing into the Northwest Territories is clean.”

Kevin Kennedy, a Yellowknife city councillor and delegate at the conference, said Tuesday all the communities in the NWT voted in support of the motion.

“Everyone is concerned.…we are hearing all kinds of stories from Fort Chipewyan about human health problems and are concerned with the health of the Northwest Territories as a whole,” he said. “We are all downstream from the oil sands.”

Yellowknife, on the northern shore of Great Slave Lake, is about 600 kilometres from the oil sands development, near Fort McMurray, in northeastern Alberta.

But Mr. Kennedy said people are worried a tailings pond could fail, sending millions of litres of heavily polluted water into the north-flowing Athabasca River.

Water is used to extract bitumen from the oil sands. In the process, it is contaminated with heavy metals. Tailing ponds at the site now hold 720 billion litres of wastewater.

“There is a major concern that there could be a disaster,” Mr. Kennedy said.

One of the events that raised alarms in the NWT was a study, released by Alberta health officials in February, that confirmed a higher-than-expected rate of biliary cancer among residents of the small community of Fort Chipewyan, Alta.

The village is located on Athabasca Lake, 260 kilometres downstream from the oil sands site. The health study did not find a cause for the high levels and did not link the cancer to the environment, or to the oil sands.

But George Poitras, head of government consultations for the Mikisew Cree First Nation, in Fort Chipewyan, said residents fear there is a connection. Mr. Poitras said people have stopped eating fish from Athabasca River, after catching some that had lesions, and many don't trust the water to drink.

“The water that flows from the oil sands past Fort Chipewyan runs on into the NWT. We are the precursor of what they can expect,” he said. “I think they are right to be worried.”

But Cara Van Marck, a spokesperson for Alberta Environment, said the government has been carefully monitoring water quality near the oil sands since the 1970s.

There have been some pollution discharges, she said, but they have been isolated events and monitoring has not indicated any long-term issues.

“There are no chronic problems,” she said. “We haven't found any trends.”

She said Alberta hopes to sit down with the Northwest Territories and work out a trans-boundary water agreement this fall.

Ms. Van Marck said companies have a zero tolerance of discharging wastewater into the environment, but there are natural seeps in the area that leak oil into the Athabasca River.

David Schindler, a professor of ecology at the University of Alberta, told the Parliamentary Standing Committee on the Environment this month that ongoing studies have raised some pollution concerns, however.

“There is accumulating evidence that the concentrations of polycyclic aromatics… are causing deformities in fish,” he said.

China's environmental hot air and hypocrisy

Editorial

Calgary Herald

May 24, 2009

China's call last week for developed nations to cut their greenhouse gas emissions by 40 per cent could have been a sign that the soon-to-be superpower is taking environmental issues seriously, but closer inspection reveals naked self-interest is still dominating its calculations. China, which surpassed the United States last year as the world's largest emitter of greenhouse gases, exempted itself from its proposed reductions which would see First World nations cut emissions by at least 40 per cent below 1990 levels by 2020. Such an aggressive posture does not bode well for progress in the crucial round of climate talks in Copenhagen scheduled for December.

The Chinese insist that they and other developing nations ought to be allowed to balance pollution reduction with the economic growth required to pull their inhabitants out of poverty and develop to First World standards. This is a laudable goal, but China is exhibiting disingenuous modesty in classifying itself among this group, especially considering its sharply rising power and soaring ambitions of recent years.

There is no denying that China needs further development. Its gross domestic product by purchasing power parity is roughly eight times less than Canada's despite having 40 times the population. However, the ruling Communist party's spending priorities do not really reflect this. Instead, the Chinese government has lofty plans for the near future including a space station and a moon landing. Meanwhile, it has been raising its military spending by double-digit percentages annually in recent years despite facing no real threats other than a low-level insurgency among ethnic Uighurs in a far western province.

Even China's insistence that western countries help the developing world combat global warming through economic and technological aid is more than a little self-serving. Although already in possession of a booming research sector, China is widely believed to maintain an industrial espionage program designed to uncover trade secrets and emerging technologies in a variety of fields across the globe.

Contrary to its public position, China has plenty of room for improvement without seriously affecting growth. For instance, Chinese industry is notoriously inefficient and dirty, making Chinese cities among the world's most polluted. The entire country would benefit hugely from even basic upgrades to industrial infrastructure and manufacturing processes. Tighter regulation and enforcement in the country's famously loose business environment would work wonders, too.

Until then, China should refrain from the absurd hypocrisy of telling other countries what emission standards they should aspire to achieve.

The Waxman - Markey Bill - Will the US and Canada go Head to Head?

GLOBE-Net

globe-net.com

May 26, 2009

A U.S. House of Representatives committee passed the draft American Clean Energy and Security Act on May 21st (the Waxman - Markey Bill) sparking a flood of commentary and speculation on its potential impacts at home and abroad. Of particular interest to many was the potential impact on Canada’s planned climate change legislation and on the proposed national cap and trade system to reduce greenhouse gas emissions.

Canada’s Environment Minister, Jim Prentice was quoted in a Bloomberg news article as suggesting Canada likely would follow the U.S. lead in trying to stem global warming by passing legislation to limit greenhouse gases that would be similar in scope and focus to that in the U.S., including the linking of trading systems under any ’cap and trade’ system that eventually emerged from Washington.

The draft U.S. legislation, which still needs a full House of Representatives vote and consideration in the U.S. Senate, is a massive document - almost 1,000 pages long - and every page appears to have some elements that could give pause for concern to those seeking to safeguard Canadian interests, particularly to Michael Martin, Canada’s Climate Change Ambassador.

Ambassador Martin and his advisors are pouring over the draft legislation and preparing advice to Environment Minister Prentice and Prime Minister Harper for use in upcoming international discussions leading to the December U.N. meetings in Copenhagen when a new international climate change accord will be concluded - hopefully.

There has been considerable press commentary on one aspect of the draft legislation, namely the power it confers upon the U.S. President to impose on a case-by-case basis ’border adjustments’ (i.e. a tariff) on foreign manufacturers and importers to cover carbon contained in U.S.-bound products. Alberta’s oil sands have been singled out by some commentators as a potential case in point.

The issue goes far beyond the oil sands debate however, and there are many questions yet to be answered in a variety of other economic areas. As noted by Elizabeth deMarco, a member of Ontario Premier Dalton McGuinty’s Climate Change Advisory Panel, "How are we going to measure whether or not we have a comparable compliance system with the U.S.?

"Because in sections 4.12 to 4.16 in Waxman-Markey, it says very clearly the U.S. has complete authority to impose border tariff adjustments on exporters that are exporting products to the U.S. that do not have a comparable compliance system. How are we going to measure that? Based on your cap? Based on the rules of your cap and trade system? Based on GHG emissions per capita?"

The spectre of a softwood lumber type of conflict over carbon issues is not something that can be easily dismissed.

Canada’s Jim Prentice has already expressed his views about this concern. See GLOBE-Net article "Green Protectionism should be the road not taken." And despite the fact that Canada and the United States are engaged in discussions with respect to the harmonization of energy and environmental policies (Clean Energy Dialogue), the realities of American politics have always been that American interest come first when it comes to the allocation of benefits and sanctions.

This is more than evident in the draft legislation itself, within which have been buried enormous subsidies for corporations and regions that are in need of government (i.e. tax payer) largess to finance the development and deployment of emission reducing technologies or to acquire offsets that would soften or delay their transition to a lower carbon future. Already there are efforts underway in many sectors of American industry to find the loopholes, potential subsidies and other provisions of the legislation that can be used to advantage.

As for the harmonization of environmental policies, it is only logical that we do so; the border does not separate the environment, only those who can and will do something to harm or protect it. But there will be no free ride involved; American interests will always be the foremost consideration of U.S. law makers and the ’integration’ of Canada’s climate change strategy with that of the U.S. will not change that fundamental fact.

The key point to note is that we are still in the early days of the debate. The U.S. Bill has several more stops to make before it reaches the White House. But one message is coming through loud and clear: America is back in the climate game.

May 26, 2009

Imperial gives Kearl project green light

Nathan VanderKlippe

Globe and Mail

Tuesday, May. 26, 2009

Battered oil sands industry welcomes decision to proceed with mine's $8-billion Phase 1 |

Imperial Oil Ltd.'s (IMO-T43.501.273.01%) approval of a major new $8-billion project is sparking optimism for a revival in the oil sands after months of project delays due to low crude prices and high costs.

By the time it starts pumping bitumen in 2012, the first phase of the Kearl oil sands mine, which was approved Monday by Imperial's board, will produce 110,000 barrels a day. It's a project that chief executive officer Bruce March has called “the biggest single investment our company has ever made in a pretty volatile market period.”

Yet even before that investment is fully made, Kearl is already providing a spark of confidence in a province that has spent the past six months watching its primary industry stage a full-scale retreat.

Among construction leaders, financial analysts and even competitors, the decision to build Kearl comes as an important symbol that despite continued low crude prices, tight financial markets and the threat of costly new greenhouse gas regulations, the oil sands remain viable.

“Are the oil sands back?” said Robin Mann, CEO of Calgary-based AJM Petroleum Consultants.

“Not yet. But I think we're just on the cusp.”

The decision by Imperial, which is 70-per-cent owned by Exxon Mobil Corp., serves as a notice that some of the industry's most successful minds continue to believe in the viability of the oil sands, which contain the Earth's second-largest oil reserves but face an increasingly difficult slate of problems.

“The death of the oil sands has been greatly exaggerated,” said Brad Bellows, spokesman at Suncor Energy Inc. (SU-T36.210.541.51%) Industry observers are looking to Suncor as the next sign that the oil sands truly are resuming growth plans.

Suncor has said it expects to revive some of its own stalled projects – it has already partly built its Voyageur upgrader and the third phase of its Firebag in situ project – but is waiting to complete its proposed merger with Petro-Canada before making any further decision.

“It's a matter of when, not if,” Mr. Bellows said.

The hefty cost of developing the oil sands makes them ripe for consolidation by the world's major energy producers but, with the exception of Total SA, the threat of costly environmental regulations – especially in the United States – has made these companies leery of pursuing further acquisitions, Calgary investment bankers say.

Watching Imperial move forward is a signal that those issues should be manageable, said Will Roach, CEO of UTS Energy Corp., which owns 20 per cent of Fort Hills, another proposed oil sands mine.

“The fundamental message is that a big company that's pretty well connected in the U.S. is committing to a project of this nature because it believes it will give them financial returns,” Mr. Roach said in an interview.

“Exxon has a huge portfolio of opportunities and this ranks highly among them. I think that's good news for the oil sands.”

The decision is a bet that crude will rebound to above $80 (U.S.) a barrel, the price analysts say Kearl will need to turn a 10-per-cent after-tax profit.

Located 70 kilometres northeast of Fort McMurray, Kearl has long been contemplated by Imperial, which produced its first $5-billion to $8-billion cost estimate for the project in 2004.

Imperial expects Kearl to eventually produce 345,000 barrels a day, but has not released cost estimates for full construction of the project, which is expected to last a half-century as the company mines out 4.6 billion barrels of recoverable bitumen.

The company initially expected to make a decision on building Kearl last year, but delayed in an effort to bring its costs down.

Construction of the first phase will employ up to 5,000 people – a shot in the arm for a province whose construction work force has fallen from 160,000 to about 120,000.

Still, Alberta Federation of Labour president Gil McGowan said Kearl is a mixed blessing. Without an upgrader on site, the project is designed to ship unprocessed bitumen out of province, a fact that could bring future harm, Mr. McGowan said.

“In the long term, it will actually be part of the problem rather than part of the solution because it will contribute to shipping more processing jobs down the pipeline from Alberta to refineries primarily in the American Gulf Coast,” he said.

May 23, 2009

Gas explosion details kept under wraps

COMMENT: Varanus Island is off the northwest coast of Australia, so this may seem a little esoteric. But it is not. Oil and gas is a global industry and the companies will get away with whatever they can wherever they can. A bit more latitude to cut costs and cut corners in South America or Africa, a somewhat higher level of performance in Europe and North America. And Australia.

It is only regulation, and government's will to enforce it, that makes the difference.

So what happens in Australia is watched closely in Canada, and in British Columbia. Apache is a gas producer in northeast BC, with conventional and shale gas plays, and boasts of being Canada's largest producer of coalbed methane. The information lockup that the courts permitted Apache Energy in Australia, is an approach to doing business, and it could happen here.

But maybe it wouldn't need to, given how little timeliness and real disclosure there is already with oil and gas incidents. How much do we know, even today, about these incidents: BC Ferries' Queen of the North, the LeRoy Trucking barge, the Kinder Morgan oil pipeline spill in Burnaby, or the bombings of EnCana's pipeline facilities?

That lack of transparency is without any court orders at all.

ABC News

Sat May 23, 2009

The Varanus Island gas explosion cut WA's gas supply by a third. (Map: Perth 6000) |

Apache Energy has had a legal win to restrict the release of information about the Varanus Island gas explosion.

The explosion off the Karratha coast happened almost a year ago and cut Western Australia's gas supplies by a third.

Yesterday the Federal Court restricted a joint state and federal inquiry from using documents provided by Apache Energy in its final report.

Apache claimed the information was commercially sensitive.

The Mines Minister Norman Moore says the court action is only delaying information which will eventually come out.

"The state has just appointed inspectors under the Petroleum Pipeline Act which will enable them to have access to that information and they can then report to me as inspectors under that act," he said.

Apache has been contacted for comment.

May 19, 2009

All eyes on renewables as Sen. Bingaman sprints to finish markup

By KATHERINE LING

Greenwire

New York Times

May 18, 2009

The Senate Energy and Natural Resources Committee will attempt to finish marking up comprehensive energy legislation this week, including a renewable electricity standard, if Chairman Jeff Bingaman (D-N.M.) and panel members can work out an agreement by Thursday.

Tomorrow, the committee will mark up provisions on nuclear waste, cybersecurity and a refined petroleum products reserve. Thursday, the panel could take up the renewable electricity standard, or RES, as well as remaining provisions on building efficiency, oil and gas development on public lands, carbon capture and sequestration, and energy market regulations.

Last week, Bingaman said that he had reached a "general agreement" on a RES, which requires utilities to supply increasing amounts of power from sources like wind, solar and biomass, but added he was not ready for an official announcement.

According to a committee aide, senators have agreed to a 15 percent standard with about 4 percent that could be met by energy efficiency. But it appears options like an "off ramp" if prices get too high and other details such as what sources for biomass are eligible are still on the negotiating table.

Whether the RES will show up on Thursday's schedule depends on Bingaman getting three votes, most likely from Democrats Sens. Blanche Lincoln of Louisiana, Evan Bayh of Indiana and Debbie Stabenow of Michigan. If Bingaman could get a Republican to sign on, he would only need two of the three Democrats to support the final bill.

If the committee cannot find a compromise on an RES, the matter is likely to be taken up on the floor, according to Bingaman.

The House Energy and Commerce Committee negotiated a compromise of 15 percent by 2020 and utilities must provide an additional 5 percent energy savings from efficiency measures. But the renewable energy target could fall to 12 percent for a state if the governor rules that utilities cannot meet the mandate, much to the disappointment of many environmental groups.

Earlier this month and in March, the committee marked up provisions on appliance efficiency; energy and water nexus; the manufacturing sector's efficiency; workforce training; a clean energy bank administration; and transmission siting, planning and financing.

Tuesday

The committee's first battle this week will be on nuclear waste, and panel Republicans are keen on expanding the role of nuclear power in the comprehensive energy measure.

"I think it is imperative that we offer more in terms of a policy statement on where we go with nuclear in this country," ranking member Lisa Murkowski (R-Alaska) said earlier this month. "We want to advance something that states very clearly that nuclear is a part of that policy, and we need to be up-front and rational about how we deal with the waste issues."

Murkowski plans to offer an alternative nuclear amendment that would increase incentives for the construction of new nuclear units by expanding the production tax credit offered in the 2005 Energy Policy Act from 6,000 megawatts to 12,000 megawatts. The expansion would allow about 10 more reactors to benefit from the incentive. It would also create a 10 percent tax credit for construction expenditures for advanced nuclear reactors and setup a public-private cost-share program for two commercial reprocessing centers.

The Republican plan would also place stricter timetables and targets for a blue ribbon commission, which is the main focus of Bingaman's draft bill.

Bingaman's 11-member commission would have two years to study alternative solutions for the nation's nuclear waste, including permanent disposal in a repository, long-term storage on-site, long-term storage in one or more regional sites, reprocessing or a combination of them. The commission would also review and identify mistakes made in the repository project at Yucca Mountain, Nev.

Perhaps courting more Republican votes, Bingaman also added language directing the commission to study all aspects of opening a commercialized reprocessing facility -- including waste forms, environmental and health impact and cost, whether nuclear waste management may best be handled by a private corporation or other federal entity, and an examination of the management of funding nuclear waste solutions.

With President Obama's budget proposal cutting almost all funding for the Yucca Mountain repository, Sen. John McCain of Arizona and other Republicans have pushed for the government to give back the more than $20 billion in fees nuclear energy consumers have paid to fund the repository. McCain has said he may offer an amendment requiring such refunds.

For the refined petroleum products reserve, Bingaman's draft bill would empower the Energy Department to decide what type of products and storage location would be most useful and least costly. The 30-million-gallon reserve could only be used in times of severe supply disruption, such as the gasoline shortage that traumatized the Southeast last fall after Hurricanes Gustav and Ike.

Murkowski said she is still not convinced the reserve is necessary given the expense and logistics of keeping the products that must be rotated much more often than crude oil. "This may be an idea whose time hasn't come," she told reporters last week.

But Sen. Bob Corker (R-Tenn.), whose region has been especially affected by refined product shortages, said the idea may have merit but also does not account for "panic" buying, which may use up supplies before the reserves can reach the problematic region.

As for cybersecurity, it appears the real debate is between regulators and industry about how far the Federal Energy Regulatory Commission's authority should reach into the grid, and whether the committee acquiesces to industry's request that emergency and interim rulemaking authority lie within one authority, preferably FERC.

The Bingaman cybersecurity draft would give DOE 90-day emergency authority to order utilities to enact certain measures to protect their systems from an attack. It would also give FERC authority to order interim rules -- with or without public hearings -- to protect the grid from vulnerabilities, which are identified to be a problem in the short term.

Calls for enhanced protection for the nation's critical electric infrastructure have increased recently as reports of cyber attacks on the system from Russia, China and other foreign entities have increased and the grid is becoming more digitized to take advantage of efficient and intelligent management of electricity, also known as the "smart grid." The White House and industry officials will hold a meeting today on the plan to develop smart grid standards, including cybersecurity.

Thursday

The schedule has not been finalized yet for the provisions that will be marked up Thursday, but Bingaman said last week building efficiency codes would be on the schedule.

The committee released a new building efficiency draft bill (pdf) last week that would require a review of building codes at least every three years to reach a 30 percent energy savings through 2010, based on 2006 standards, and 50 percent by a yet determined time. DOE would provide technical assistance for creating the new model codes and the draft provides an exception if federal funding is less than $50 million per year.

Bingaman's draft would also create a grant to improve building efficiency in multifamily units and manufactured housing constructed before 1976. DOE's weatherization assistance program would receive $1.7 billion and $250 million would be allocated for the state energy program, both for fiscal 2011 through 2015. It would also provide grants linked to set levels of efficiency savings in residential and commercial buildings achieved through retrofits made available through the state energy efficiency grant programs.

Also included in the draft is a framework for voluntary advanced model codes, building labeling programs and federal efficiency, renewable energy and performance contracts. The draft says the goal is to achieve 2.5 percent per year efficiency improvement of overall energy productivity each year to 2012 and to maintain that rate to 2030.

The rest of Thursday's schedule is more uncertain, but Bingaman has introduced a bill on carbon capture and sequestration (CCS), draft bills for energy market transparency and "cease and desist" authority for FERC in the natural gas markets that have yet to be marked up.

Bingaman held a hearing on the bipartisan CCS bill last week, but the measure has yet to convince Murkowski, who questions the precedence for such a policy and the financial risk for undertaking liability for 10 large-scale demonstration projects. The bill would authorize DOE to indemnify parties and provide financial and technical assistance for the demonstration projects, which aim to show the commercial application for "integrated" systems for capture, injection, monitoring and long-term geologic storage.

Corker said he was skeptical that transportation and sequestration of carbon emissions on a large scale would ever be possible, given the siting problems for transmission and to some-extent natural gas pipelines. "Are we talking 'when pigs fly' scenario?" Corker asked last week. The senator said he would rather see more focus given to projects that utilize carbon emissions, such as growing algae to make biofuel or to capture it in concrete.

Under Bingaman's draft energy market transparency bill, the Energy Information Administration -- DOE's statistical arm -- would incorporate activities in the energy commodity futures market under its purview for the first time. Under the bill, if an entity owns energy futures contracts or swaps over a level to be determined by the DOE secretary, EIA would assess the amount of physical product and storage the company owns and the quantity of contracts it is buying and selling.

EIA would also collect company data identifying the ownership of all commercial inventories of oil and natural gas, the volumes of the product, and the storage and transportation capacity. The draft bill would also create a working group on energy markets led by the secretary of Energy and include the heads of FERC, the Commodity Futures Regulatory Commission, the EIA and others that would investigate how the investment in energy commodities has affected energy prices and energy security, including the price formation of crude oil and refined petroleum products, the status of relevant international regulatory regimes and market transparency. A final report on their review and recommendations would be due to the committee in one year.

But EIA's acting administrator, Howard Gruenspecht, said in a hearing in March it would be difficult for the agency to undertake such data collection and oversight of the markets. And if the data is intended to be used for regulatory purposes, EIA may not be the best choice. "We are not a regulator," he said.

Finally, Bingaman has a draft bill that allows FERC to issue a temporary "cease and desist" authority to prevent actions that would inflict "significant harm" on the natural gas market or the public and allows the commission to temporarily freeze or cancel electricity rates in the case of an emergency to ensure continued reliability of service or to protect customers from potential abuse of market power or market manipulation in wholesale markets. Both emergency authorities could be given with or without a public hearing. They build on expanded enforcement authority given to FERC in the 2005 Energy Policy Act after the 2000-01 California energy crisis.

Sen. Maria Cantwell (D-Wash.) said she would like additional provisions that would allow FERC to retroactively change natural gas rates if the commission finds them to be unjust or unreasonable anytime starting from the time a complaint was submitted until 150 days after it was submitted -- a provision the natural gas pipeline industry does not favor.

Oil and gas provisions

Bingaman has yet to release any drafts on the issue of oil and gas drilling on public lands. But Bingaman has said there needs to be better information about the energy potential of the outer continental shelf (OCS) and an undated draft obtained by E&E earlier this month would authorize funds to inventory offshore petroleum reserves, the potential alternative energy resources and an assessment of navigation and fisheries. A committee spokesman had no comment on the draft (E&ENews PM May 8).

The draft would give two years and $400 million for the inventory, which would focus on areas thought to have the greatest resources that have not been leased and are not scheduled to be leased soon. Recreation, habitat, conservation and military use would also be analyzed. It would also lower barriers to the "co-production" of geothermal energy at oil and gas sites and make the head of the Minerals Management Service a Senate-confirmed position.

Also considered by the draft would be land and resource rights, to create a lease and permit processing office for Alaska's OCS region, and to extend funding past 2015 for a program to streamline and coordinate the onshore oil and gas permit program created by the 2005 EPAct. The draft would authorize $20 million annually for fiscal 2016 through 2020.

Taking up the oil and gas provision would also provide an opening for Republicans and some Democrats to renew discussions on expanding domestic drilling -- a topic that heated up during last year's high gasoline prices.

Murkowski has also noted her interest in having more coastal states share in federal leasing and royalty revenues, but Bingaman opposes such a plan.

Schedule: The nuclear, cybersecurity, refined product markup is tomorrow at 2:15 pm in 366 Dirksen.

Schedule: The second TBA markup is Thursday at 10 a.m. in 366 Dirksen.

Reporter Peter Behr contributed.

Copyright 2009 E&E Publishing. All Rights Reserved.

For more news on energy and the environment, visit www.greenwire.com.

Blue gold? Not likely

Robert Silver

Globe and Mail

May 19, 2009

This is a big week for Canada's made-in-Washington energy and climate policy. The U.S. Senate is likely to finalize comprehensive energy legislation that will have a significant impact on our economy and environment.

As a Globe editorial pointed out today, there are some troubling protectionist measures contained in the current draft of the legislation.

One protectionist measure that has not received as much attention as of yet are the rules surrounding the proposed National Renewable Electricity Standard (RES) that will require all U.S. utilities to purchase 15 per cent of their electricity from renewable sources by 2020 (the exact percentage covered by the RES is something a moving target).

The move by the U.S. federal government towards a national RES is seen in some quarters as a significant opportunity for Canadian provinces such as British Columbia, Manitoba and most importantly Quebec that have significant hydro reserves.

Premier Jean Charest said earlier this year that "today the richest societies in the world are those which have oil. Tomorrow, the richest societies will be those that will have clean, renewable energy." He added that he wants Quebec to be the "Alberta of hydro-electricity."

The only problem? The proposed RES only recognizes a very limited amount of incremental "hydro" as "renewable energy" (ie - most hydro is NOT considered renewable energy under the act) and does not contemplate allowing imported hydro to qualify towards meeting the obligations of utilities under the RES.

The American Wind Energy Association is blunt about why they lobby to exclude Canadian hydro.

"It is necessary to exclude large hydropower from the RPS [Note: a "RPS" and a RES are for all meaningful purpose synonyms] for several reasons. Though hydro brings public benefits in terms of avoiding the air emissions and wastes associated with conventional power plants, hydro is technologically mature, is fully commercialized (representing a significant share of the electricity market), and has limited development potential. Most importantly, including hydro in the RPS would create several intractable practical problems: (a) output from the large base of Canadian hydro projects could potentially be rerouted into the U.S. market and "flood" that market, depressing prices to levels too low to support non-hydro renewables; (b) the large year-to-year fluctuations in hydro output would make it difficult to meet a fixed standard each year and at the same time provide a predictable market for renewables; and (c) many hydro facilities have more than one use and have been built with the aid of large government subsidies."

It's not that their arguments are wrong (though obviously hypocritical given the "large government subsidies" that the wind industry is almost entirely dependant on). They do lay out the challenge facing the Canadian industry.

Realizing the problem at hand, the Quebec Natural Resources Minister is off to Hartford to lobby east coast governors to consider hydro as renewable energy. His timing is a bit odd - I'm not sure why he is lobbying governors who have already rejected his argument when their climate change scheme is very quickly being surplanted by federal legislation.

In the past, Quebec and Ontario have mused about a NAFTA challenge of these restrictions. I'm not a trade lawyer but one problem I see with these challenges is that neither province has anything even close to "free trade" in electricity domestically (no province really does). How do we insist that our utilities have a right under NAFTA to have their "renewable" energy included in the U.S. scheme when no Canadian province would allow U.S. based generators to bid their renewable energy into any of our programs?

Which means that this is likely to be added to a long, and growing, list of political issues that Canada will need to muddle through until we struggle to develop a coherant policy of our own.

May 15, 2009

Ecotrust Canada, First Nations launch green energy fund

COMMENT: This certainly isn't the first example of government buying equity in projects for First Nations. The Mackenzie Gas Pipeline is an example - though it still hasn't got much traction.

In April, the BC government put up $32 million for First Nations' equity in the Kitimat - Summit Lake pipeline, and another $3 million to cover the FN's costs to review the project. (link)

It's a device that's working - government provides funds specifically for First Nations to acquire equity in projects which they would otherwise resist and obstruct. It distills aboriginal title and rights down to a dollar figure, but heck, that's the value of everything these days.

But why is government rolling out all this dough that goes directly to the private, for-profit, owners of these projects? Who benefits? The shareholders of the companies, first. The First Nations. Everyone else? Effectively shut out of the deal, yet the ones paying for it.

It's not just a payoff, it's also a subsidy.

The proponents should be offering the equity to First Nations and shareholders should be picking up the tab.

See also:

Kitimat project could be worth more than $1b to first nations

Kitimat LNG pipeline takes another step forward

News Release, Ecotrust Canada, May 15, 2009

Ottawa - The Honourable Chuck Strahl, Minister of Indian Affairs and Northern Development, today announced a contribution to the Aboriginal Energy Partnership to establish a new fund that will support Aboriginal involvement in renewable energy hydro projects in BC.

“Our Government is committed to encouraging Aboriginal participation in resource and energy projects across Canada,” said Minister Strahl. “Through this unique approach, we are maximizing the benefits of our investment in Aboriginal economic development by leveraging capital from the private sector and other partners.”

The Aboriginal Energy Partnership will work with Ecotrust Canada to establish the First Nation Regeneration Fund. This new fund will provide financing to Aboriginal businesses and communities in British Columbia to purchase an equity stake in run-of-river hydro projects, which produce renewable energy.

The Aboriginal Energy Partnership is a new partnership between two Aboriginal capital corporations, Tale’awtxw Aboriginal Capital Corporation and Tribal Resources Investment Corporation. Ecotrust Canada Capital, a subsidiary corporation of Ecotrust Canada, will manage the new $7-million fund. The Aboriginal Energy Partnership and Ecotrust Canada will each contribute $2 million to the new fund, with the remaining $3 million being provided by the Government of Canada.

“The Regeneration Fund is going to provide access to much needed capital for First Nations,” says Sandy Wong, General Manager of the Tale’awtxw Aboriginal Capital Corporation. ”The $7 million fund will help First Nations finance equity in independent power projects in B.C. It will help grow Aboriginal ownership in this critical sector of our economy.”

”We have two goals in launching the First Nation Regeneration Fund today,” says Ian Gill, President of Ecotrust Canada. “By investing in run-of-river hydro-electric projects, we want to generate green energy to help meet B.C.’s carbon reduction targets and we want to regenerate Aboriginal economies which are suffering from high unemployment and stagnation.”

“Run-of-river hydro power generation is one area where First Nations clearly have a competitive advantage,” says Peter Lantin, Chief Operating Officer of Tribal Resources Investment Corporation.”Our traditional territorities, especially on the coast, have an abundance of clean energy. In fact, the first project we are helping to finance is a two-megawatt run-of-river hydro project owned by the Taku River Tlingit First Nation near Atlin in northern British Columbia.”

The Government of Canada is providing support to the new fund through the Major Resource and Energy Development (MRED) Investments Initiative, a pilot program run by Indian and Northern Affairs Canada. These investments are designed to help Aboriginal businesses to partner in some of the most important economic developments and energy projects in the country.

Ecotrust Canada is an enterprising non-profit organization whose purpose is to build the conservation economy in coastal B.C. The organization works at the intersection of conservation and community economic development, promoting innovation and providing services for communities, First Nations and enterprises to green and grow their local economies. For more information, visit www.ecotrust.ca

Tale’awtxw Aboriginal Capital Corporation (TACC) supports the success of Aboriginal businesses within the Coast Salish Traditional Territories through business financing and support services. Its mission is to support, encourage and build Aboriginal economies that create sustainable self-sufficiency. For more information, visit www.tacc.ca.

Tribal Resources Investment Corporation (TRICORP) provides business consulting and financial services to First Nations entrepreneurs in north-western British Columbia. TRICORP’s mandate is to increase the number of permanent jobs, reduce unemployment and facilitate business ownership among First Nations people. For more information, visit www.tricorp.ca.

Through the MRED Investments Initiative and other Aboriginal economic development measures, the Government of Canada is demonstrating its continued commitment to increasing Aboriginal participation in the Canadian economy.

For more information on the First Nation Regeneration Fund, visit www.regenerationfund.ca.

New fund to give First Nations equity in power projects

By Colleen KimmettThe Tyee.ca

May 19, 2009

Ecotrust Canada and two aboriginal capital corporations have partnered to help First Nations take ownership of power projects on their traditional territories.

Today they launched the $7 million First Nation Regeneration Fund, to give First Nations and band councils money to purchase equity shares in run-of-river projects.

Ecotrust Canada, the Tribal Resource Investment Corporation and the Tale'awtxw Aboriginal Capital Corporation provided $4 million altogether and the federal Ministry of Indian Affairs and Northern Development provided $3 million.

The two aboriginal corporations deal with First Nations in Vancouver and northwestern B.C.

Peter Lantin, chief operating officer with the Tribal Resources Investment Corporation, said many bands they talked to have been approached by independent power producers (IPPs).

"Most [developers] have come with a royalty agreement in hand," said Lantin. "When we asked, why bands don't take some ownership of these projects, the answer was, 'we don't have any money.'"

"We're looking at the energy source, the river, as being an asset of the First Nation. They can put it to work."

Lantin said the fund could realistically provide funding for four to five small-scale projects. The first project it will finance is a 2 MW run-of-river project wholly owned by the Taku River Tlingit First Nation. The focus right now is on run-of-river projects in communities that are currently using diesel power, Lantin said.

"We're not just going to be handing out money to any project...it's going to have to pass environmental criteria."

Ecotrust Canada president Ian Gill said they are in the middle of developing the environmental criteria with which projects will be evaluated.

"The project we have already supported is a very good illustration of what can be achieved," he said. "It not only means the energy independence of a community, but the environmental benefit is you allow them to not have to purchase a half million litres of diesel a year."

Colleen Kimmett reports for The Hook.

Funding powers aboriginals

Scott Simpson,Vancouver Sun

May 20, 2009

British Columbia aboriginals are ratcheting up their support for independent power projects.

A new $7-million "First Nation Regeneration Fund" announced Tuesday will give aboriginal groups access to capital to participate as co-owners in run-of-river power projects, proponents say.

Two aboriginal capital corporations, Ecotrust Canada and the federal government have all kicked in the money -- which David Lantin, chief operating officer of Tribal Resources Investment Corporation (Tricorp), said will enable "four or five" first nations to borrow money to take an equity share in power projects in their communities.

First nations have struggled to ramp up their participation in power development, largely due to difficulty accessing capital -- a situation aggravated by the recent global economic meltdown.

"Originally, we envisioned a larger-scale fund, but this is a start,"

Lantin said in a telephone interview from Prince Rupert, home base for northern B.C.-focused Tricorp. "We will not be adding to it, but we will be looking at probably a second fund if this one works out according to plan."

Tricorp's shareholders include several of B.C.'s major northwest tribal groups -- Haida, Nisga'a, two Tsimshian bands, Gitxsan and Wet'suwet'en.

"In our journeys through the communities, IPP is front and centre in almost every one of them in terms of opportunities," Lantin said. "We are mainly a fishing-forestry region and with those industries doing not so well, Tricorp's capital corporation had to look at diversifying itself.

"This is probably the first time in our community that we've been very proactive -- not sitting back and waiting for the economy to turn us in a certain direction. We see this as the new industry, a new opportunity for us, and we are pretty optimistic."

One project, the Taku River Tlingit run-of-river project at Atlin, has already tapped into the fund.

Ecotrust Canada president Ian Gill said he expects investments will be "low risk" and will take place after generation potential has been assessed and project construction is complete.

"What I'm proudest of ... is that this has a social justice component,"

Gill said in an interview. "It provides first nations with real equity. It has an environmental benefit, and it has an economic component.

"The leverage in this fund type I think is tremendous and I think we may have struck upon a way in a market sense to help finance first nations participation in a whole stream of economic activity in the province."

May 12, 2009

Green oil would cost US$105 a barrel: CERI

COMMENT: "Green bitumen"? How green would this stuff really be? Even if the carbon emissions involved in production of oil from the tar sands could be reduced to something rivalling conventional oil, what kind of achievement is that? Huge carbon emissions remain. The environmental disruption and pollution remains. The cancers and habitat collapses downstream from the tar sands remain. And a new source of spent nuclear fuel and nuclear pollution rises from this ecological mess.

By Claudia Cattaneo

Financial Post

May 12, 2009

Oil sands can meet environmental challenge, but at a cost, study says

Canada's oil sands can meet the challenge of turning "dirty oil" into "green bitumen," but oil prices would have to climb as high as US$105 a barrel to pay for the cost of integrating new technologies, according to a study by the Canadian Energy Research Institute.

With policymakers in Canada and the United States pushing for aggressive reductions in greenhouse gases, CERI took a look over the past 18 months at what it would take to reduce greenhouse-gas emissions from the oil sands to below those of conventional oil.

"Going green is not a cost-saving measure," according to the study, which was made public on Monday. "The benchmark crude would have to be close to US$110 a barrel (or US$105 a barrel under today's exchange rate) for new oil sands projects to go green."

CERI, an independent energy research organization based in Calgary and funded by industry and governments, said the transition to green bitumen could be made by using existing technologies -- widespread adoption of carbon capture and storage for plants using natural gas as a power source, or by replacing natural gas with gasification or nuclear technologies.

Study co-author David McColl, research director at CERI, said carbon capture and storage would be the cheapest option, costing an additional US$2.25 to produce a barrel of bitumen and suggesting oil prices would have to be US$85 a barrel for projects to be economic. Carbon capture would involve capturing carbon at the source and piping it into depleting reservoirs for storage, or into producing reservoirs to enhance hydrocarbon recovery.

Gasification, a new technology that is being pioneered by Nexen Inc. and OPTI Canada Inc. at their recently completed Long Lake oil-sands project, would add US$13.50 a barrel, suggesting oil prices would have to be about US$95 a barrel for projects to be economic. Gasification involves producing synthetic gas from bitumen waste, eliminating the need to use natural gas.

Nuclear power is the most expensive option, adding US$19 a barrel and requiring oil prices in the US$105 range to be economic when using smaller nuclear plants. A large plant could be less costly, adding US$10 a barrel.

"We wanted to provide a sober second thought," Mr. McColl said.

In all cases, the oil price would have to be far higher than it is today, or around US$55 a barrel.

While carbon capture and storage is the most cost-effective and greener alternative because it would achieve the biggest reductions in greenhouse gases, billions in investment would have to be made by industry and governments to build a new pipeline network.

"It really would require cooperation between industry and government, where we are investing in new pipeline capacity very aggressively," he said. The Alberta government has pledged $2-billion to fund a handful of projects to get the technology off the ground.

Even in that case, widespread implementation would take almost 20 years and the complexities of making such a move may drive developers to continue the search for new technologies, he said.

Meanwhile, the cost of emitting carbon would have to rise from current levels to push the oil sands industry to become green, or to $65 per tonne of CO2 equivalent, compared with Alberta's current cost of $15 per tonne.

"As the world moves toward lower-emitting sources, the oil sands will pay a vital role, it's one of the largest resources we have, but the trick is, what is going to be the right mixture of technologies and options to bring the emissions down?" Mr. McColl said. "A benefit of this global recession is it has slowed down the oil sands, it has given people an opportunity to take pause, and it has also reduced growth of emissions over time."

© Copyright (c) The Vancouver Sun

Canadian Energy Research Institute.

May 02, 2009

The Exxon Valdez Oil Spill - 20 Years After: The Analysis

Written by ecomichael

ecoworldly.com

May 1st, 2009

The Exxon Valdez |

Twenty years ago last month, the supertanker Exxon Valdez struck a reef in Prince William Sound and ran aground, releasing 40 million liters {approximately 10 million gallons) into the surrounding sea and onto the beaches. It remains the worst oil spill in US maritime history. In the days that followed, impact inventories revealed the lethal outcome: a quarter of a million sea birds had been killed, along with 22 Orca whales, nearly 3000 sea otters, 300 harbor seals, and unknown millions of fish eggs.

In 1991, the Alaskan and US Governments reached an agreement with Exxon Mobil in a 900 million dollar settlement, almost 200 million of which was set aside for scientific study of the disaster and its impact on the PWS ecosystem. Exxon Mobile also funded its own studies (generating 400 papers and reports) which were frequently in disagreement with the government scientists’ reports and findings.

Twenty years after, the Exxon Valdez spill has become the most studied maritime, industrial disaster ever. A news report in Science Magazine (March 26, 2009) by Lila Guterman (with Jacopo Pasotti reporting) presented some of the scientific findings from the post-spill research.

One of the principle foci of these post-spill studies has been determining the fate of any remaining oil. As late as 2001, a NOAA research team (lead by Jeffery Short) conducted random sample analyses from over 90 beaches in PWS. The team estimated that some 55, 000 liters of oil remain—spread out over 11 hectares of shoreline and beaches (note: NOAA states that only 2% of all the spilled oil remains). This figure was originally criticized as too high by Exxon Mobile scientists, who later nonetheless came to be in agreement with it. Still, industry employed scientists continue to doubt any significant, negative impact on wildlife from the remaining oil.

However, in a NOAA follow up study in 2005 of the same beaches tested in 2001, analysis showed that the remaining oil was decaying at a maximum of just 4% annually (with some samples showing zero decay). The prognosis: oil residue will persist for up to a century. In a second follow up study by Short’s team (published in the journal Marine Environmental Research, in 2007), results showed that bio-active contaminants in these ecosystems were predominantly from the oil spill. Short also believes that “bio-markers” (such as the presence of certain enzymes in animal livers) indicate repeated exposure of organisms to the oil.

More debate and questions remain about the Exxon spill.

|

NOAA scientists inspect and collect samples from the Exxon Valdez oil spillWhat caused two Orca whale pods (observed in the oil slick in 1989) to lose 40% of their members? One of these pods is slowly recovering, but the second, originally composed of 22 members, has now lost all of its female members, making the survival of the pod impossible. Government scientists assert that the sudden and coinciding pod declines were caused by the oil spill—either through breathing the fumes or eating contaminated prey. However, Exxon scientist assert that the pod declines can not be conclusively linked to the spill.

Sea otter populations were also heavily impacted. While most of these populations around the sound have rebounded, many populations that inhabited the worst stricken areas back in 1989 remain notably low. According to a US Geological Survey report, oil remains in the shallow, intertidal zones of many of these beaches, and that digging in these zones by otters (an activity comprising 18% of sea otter dives) continually exposes them to oil residues. To what extent this exposure has prevented these populations from rebounding (perhaps due to hydrocarbon impacts on otter fertility cycles) may be a question that can never be answered satisfactorily.

One issue that scientist on both sides do agree on: the Pacific herring population has declined dramatically (by 85%). But was this due to the oil spill? This is difficult to determine since deeper water animals (like fish) may not feel the impact of such spills immediately; the herring population did not crash until 1993, one year following a particularly weak plankton bloom, which may have left the fish hungry and compromised their immune systems. Using this information, researchers from the British Columbia Ministry of Agriculture and the University of Alaska have developed a model that faithfully replicates the “busts” and “booms” of the herring population for the past 15 years. However, Richard Thorne, of the Prince William Sound Science center, had conducted a hydro-acoustic monitoring survey, using sonar to count fish. His results matched well with the aerial surveys of herring spawn which have been conducted every year for the past thirty. The comparisons indicate that the collapse began in 1989, the same year as the spill. Thorne believes that the spill, followed by three years of unchecked fishing, have caused the herring decline. But due to a lack of pre-spill data on this fish population, the mystery as to why the herring are not coming back remains.

Map of oil movement from the Exxon Valdez Spill of 1989 |

For the future, marine scientist are focusing their efforts on understanding how such a spill combines with other impacts (disease, predation, over-fishing and climate change) to cause animal declines. One route to species recovery is simply to protect the species from fishing and other impacting factors. One idea here is to allow targeted fishing of a the Pacific Herring’s natural predators (pollack). Another is to construct hatcheries for the herring. Both of these bio-remediation strategies carry risks, known and unknown, but, it is believed, they can hardly be worse for these ecosystems than the original spill. There is one other approach: simply waiting ; (although unsuitable for commercial and industrial purposes) many declining species recover over time, as long as threats to that recovery do not multiply.

Image Credits: EPA, Environment Canada, UNEP, NASA, NOAA,

Exxon Valdez Oil Spill Trustee Council, State Of Alaska on www.solcomhouse.com

Oil punt makes big bucks but coastlines at risk

By Tom Bergin

Guardian.co.uk

Friday May 1 2009

* Oil company windfall from contango trade

* Over 120 million bbls of oil, products held offshore

* Environmentalists say boosts risk of spills

* Shipping regulator called on to act

LONDON, May 1 (Reuters) - Big international oil companies are making hundreds of millions of dollars storing crude on tankers offshore in a trading play that environmentalists say sidesteps shipping rules and puts coastlines at risk.

The $100 per barrel drop in crude oil prices since July, to around $50, has pushed the market into an unusually sharp contango -- a scenario where the cost of oil today is much lower than the price of oil in the future.

Meanwhile, the global economic crisis has led to a more than halving in the cost of chartering oil tankers since last year.

This combination has created an opportunity to buy oil, simultaneously sell it for future delivery to lock in a profit, while storing the oil at sea until the delivery date.

London-based oil major BP made an exceptional gain of around $500 million in its downstream arm in the first three months of 2009, mainly due to the contango trade, Chief Financial Officer Byron Grote told analysts this week.

U.S. rival ConocoPhillips said last week that it spent around $1 billion in the first quarter buying crude to take advantage of the unusual market structure.

Other oil companies including Royal Dutch Shellsaid they also benefited from arbitraging the contango, while ship brokers said trading groups such as Swiss-based Gunvor and U.S.-based Koch Industries also participated.

In total, close to 100 million barrels of crude are being stored offshore, compared to none a year ago, Jens Martin Jensen, acting chief executive of Frontline, one of the world's biggest independent oil tanker owners, said last week.

Analysts have since said the figure could be even higher and that around 25 million barrels of refined products, including jet fuel and gasoil, are also being stored.

This compares with global daily consumption of around 84 million barrels a day and the roughly 600 million barrels of crude which is normally in transit on the seas from producers to users, according to International Energy Agency figures.

"This is an insane situation," said Professor Rick Steiner, marine biologist at the University of Alaska Fairbanks, who worked on the 1989 Exxon Valdez oil spill, the U.S.'s worst ever.

The Valdez clean up cost $2.5 billion and twenty years on, still-pungent oil still lingers on some Alaskan beaches.

UNNECESSARY RISKS

Environmentalists object particularly strongly to the armada of tankers currently sitting in the Gulf of Mexico, the North Sea, the Mediterranean, the Persian Gulf and off West Africa, because it serves no function in the supply of oil to consumers.

"The only people who derive any benefit from that activity are the people buying and selling the crude and the risk is borne by the coastal communities," David Santillo, a scientist with environmental group Greenpeace at the University of Exeter.