Energy giant eyes $5B hydro project

TransCanada, ATCO assess Slave River

Geoffrey Scotton

Calgary Herald

Thursday, March 20, 2008

CREDIT: Graphic: Rachel Niebergal, Calgary Herald

Energy and pipeline giant TransCanada Corp., along with ATCO Power Ltd., is eyeing the development of Alberta's last remaining major hydroelectric prospect, on the Slave River -- a potentially $5-billion project supplying emissions-free power.

"We are presently assessing the feasibility of the Slave River project with our partner ATCO," TransCanada's president for energy, Alex Pourbaix, told the Herald, suggesting the site could accommodate a 1,200 to 1,300-megawatt hydro development.

"A very key part of that feasibility analysis (is) we are doing some work to understand the project itself, understand the stakeholders up in the region and people that would be impacted by it. We're in an early feasibility stage," said Pourbaix.

The project is the latest of a raft of massive generating proposals that have emerged to serve a near-doubling of Alberta's power production required by 2027 to satisfy North America's fastest-growing industrial and residential demand.

The Slave River concept -- which would easily be Alberta's largest hydro facility -- comes on the heels of Bruce Power LP announcing it is pursuing an up to 4,400 megawatt, $10-billion or more, nuclear facility near Peace River.

"Obviously we're looking at a major project," ATCO power president Rick Brouwer told the Herald, adding the facility, if completed, would require transmission upgrades. Sister company ATCO Electric is

Alberta's second-largest transmission operator and controls the territory around the Slave River site.

"We're not averse to developing large projects," said Brouwer, adding that emissions-free generation is particularly attractive in the wake of changing and increasingly onerous standards around carbon-dioxide production, particularly in power generation.

"With this type of generation, we can help Alberta and Canada meet some of their environmental goals in terms of greenhouse gas production and reductions," said Brouwer. "This could make a very significant impact."

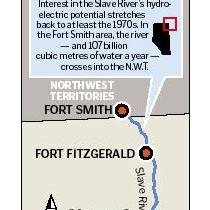

Interest in the Slave River's hydroelectric potential stretches back to at least the 1970s. In the early 1980s, Alberta Environment conducted a study on the hydroelectric potential of the area near Fort Smith., where the river -- and 107 billion cubic metres of water a year -- crosses into the Northwest Territories.

"Due to the high volume of water, the rapids along this stretch of river possess enormous hydroelectric potential," Alberta Environment said in a commentary.

"The monetary and environmental costs were deemed too high for the power demand and the project was put on hold indefinitely," the department added.

Now, TransCanada and ATCO, both Calgary-based, are examining the economics and social and environmental aspects of the project and have already decided a traditional hydro project with a large dam and reservoir is not appropriate.

As an alternative, a so-called run-of-river approach, where river water is directed through turbines without being stored, is being studied.

"The Slave River hydro development is looking at a number of different run-of-river concepts," says a brochure the two firms will use in community consultations. "Most require a structure on the river somewhere between Fort Smith and Fort Fitzgerald . . . without long-term water storage capability."

Brouwer emphasized that TransCanada and ATCO view extensive consultation with local residents and aboriginal communities as an essential first step in the evaluation process for the project, which would take at least 12 years to complete.

"Trust is absolutely critical -- and we have to earn it," said Brouwer. Atco Power, part of the broader ATCO Ltd. network controlled by Calgary's Southern family, operates about 4,800 MW of generation in Alberta and around the world, including the 1,000 MW Barking Power Station in London, England.

"We have people in the community over the next few months to talk about the process they, the community, feel is appropriate," said Brouwer. "That's the first point on our agenda."

Analysts note that a Slave River project will have to compete with roughly 20,000 MW in potential projects that are vying to satisfy the 5,000 MW of additional capacity required by 2017 and the 11,500 MW of additional output needed by 2027.

In a market where the risk of projects is borne completely by the developers, the very long lead times and massive capital costs of a major hydro-electric proposal can put it at a disadvantage.

"A project of that size, scale and magnitude, $5 billion, is significant with a long lead time. That's putting a lot of money at risk for a very long time in an uncertain marketplace," said Duane Reid-Carlson, president of the Calgary-based energy consultancy EDC Associates Ltd. "That's the problem with a project of this size and magnitude. It's very vulnerable."

gscotton@theherald.canwest.com

© The Calgary Herald 2008