August 29, 2007

Speakers Urge Debate On Hydro-Quebec Privatization

Nickle's Energy Analects

29 August 2007

A conference today in Montreal was told that partial or full privatization of Hydro-Quebec would produce greater value for the Quebec's water resources.

Such a move would also enhance Quebec's energy efficiency and improve the health of its public finances, according to Marcel Boyer, vice president of the Montreal Economic Institute, and Claude Garcia, former president of Standard Life.

Deregulation of the North American energy market and a wider opening of the electricity sector on a continental scale have broadened the debate on new options for reform that could benefit all Quebecers, they suggested.

In Garcia's view, selling Hydro-Quebec would enable Quebec to eliminate its public debt, evaluated at $122.6 billion. A debt-free Quebec would save a total of $5.5 billion annually in interest charges, allowing for a 33% cut in income tax, he said. It would also create a highly competitive tax environment, stimulating economic growth, according to Garcia.

In the last few years, electricity rates have risen far more slowly than prices for oil products, and Quebecers are paying well below market value for their electric energy, he said. Electricity rates in Toronto are 75% higher than in Quebec and in New York electricity costs three times as much. Raising rates to market prices would result in energy savings and the kilowatt hours left unused in Quebec following a rate hike would easily find buyers in export markets, said Garcia.

Boyer would not go as far, suggesting that another option would be to consider a partial privatization of Hydro-Quebec. Selling 25% of the company, for example, would suffice in obtaining greater value for the province's energy resources, he said. This could be done by issuing shares and amassing a large quantity of new funds to finance future investments. Some of this could also be used to reduce taxes or repay part of the debt.

With the new shareholders represented on the board of directors, maximizing the value of shareholders' equity and selling electricity at market prices would lie at the core of Hydro-Quebec's mission, said Boyer. This change in mandate "would deny governments the right to reach into Quebecers' collective inheritance and squander their energy resources," he said.

Hydro-Quebec would have incentives to invest in any money-making project and to guarantee sound management of operations.

A rate increase could be spread over several years and if the government wishes to protect or subsidize certain groups of citizens or businesses, such as low-income households or aluminum producers, it would have to do so through direct subsidies rather than by manipulating electricity prices, according to Boyer.

August 28, 2007

Firm to build $6.2B nuclear plant in Alberta

Nuclear plant plan draws fire

Jamie Hall, The Edmonton Journal, 28-Aug-2007

Company seeks approval to build Alberta's first nuclear reactor

Jon Harding, Financial Post, 28-Aug-2007

Firm to build $6.2B nuclear plant in Alberta

Canadian Press, 27-Aug-2007

Alberta nuclear proponent has mystery power buyer

Jeffrey Jones, Reuters, 28-Aug-2007

COMMENT: Mary Poppins' Umbrella

Energy Alberta Corporation (EAC) and Atomic Energy Canada Ltd. (AECL) have entered into a partnership. EAC says with respect to project funding:

"Energy Alberta Corporation is a privately held corporation and will fund the entire project in conjunction with third party investors. Energy Alberta Corporation is not seeking, nor plans to seek any government subsidies.

"Energy Alberta Corporation has an exclusive agreement with Atomic Energy Canada Ltd (AECL) to build the CANDU® reactors. They are comfortable with AECL's excellent track record of building Nuclear plants, using Canadian technology and Canadian expertise, around the world (Romania, Korea, etc.) on time and on budget.

"Energy Alberta Corporation will be looking to fixed price guarantees from AECL before proceeding with the plant."

The trick here is that Atomic Energy of Canada is going to build the project, with a fixed price guarantee. AECL is a federal crown corporation. It exists only because of government subsidies. $160 million in direct parliamentary appropriations. Another $137 million in Canadian revenues, mostly from Ontario nuclear facilities and all of them highly underwritten by the federal and provincial governments.

In effect the full AECL involvement in the project is a public subsidy. Possibly the scariest economic thing with this project is that AECL is taking on the full risk for cost-overruns. In an industry best known for overruns that never stop and projects gone bad, the roof on Montreal's Olympic Stadium will look like Mary Poppins umbrella before this thing is done.

(Can't remember the Big Owe? In 1970, it was going to cost $134 million. In 1976, when it was opened, only half done, for the Olympics, it had already cost $264 million. By 2006, total expenditures came in at $1.61 billion. The stadium project has never really ended. The first roof went on ten years after the Olympics; it's now on its third roof; the stadium is closed during winter months; and through its history parts of it regularly collapse.)

Nuclear plant plan draws fire

Environmentalists question impact on area land and water; company touts 'clean, safe, reliable' power

Jamie Hall

The Edmonton Journal;

With files from the Calgary Herald

Tuesday, August 28, 2007

The Bruce A and Bruce B nuclear generating stations

on Lake Huron, about 250 kilometres southwest of Toronto,

are one of five operating Candu nuclear power sites in Canada.

CREDIT: Courtesy of Bruce Power, file

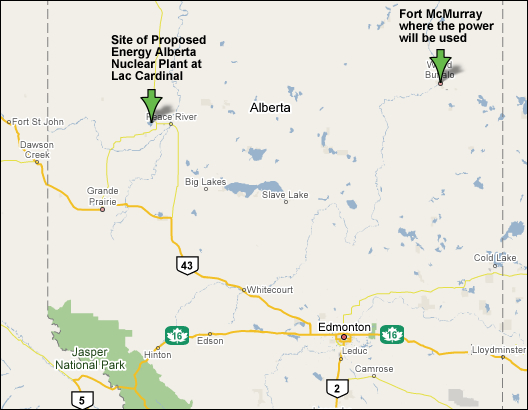

EDMONTON - Energy Alberta Corporation has chosen Peace River as the site of a proposed nuclear power plant.

The Calgary-based company Monday filed an application with the Canadian Nuclear Safety Commission to build a pair of twin-unit Candu reactors on private land adjacent to Lac Cardinal, 30 kilometres west of the town.

The move ends months of speculation about the intended site of the corporation's $6.2-billion nuclear power plant, which was said to be between Peace River and Whitecourt.

Energy Alberta president and co-chair Wayne Henuset says the decision marks "a historic moment for Canada, for Alberta and for the nuclear power industry" and touted the benefits of "clean, safe, reliable nuclear power."

Ontario currently operates five of the Candu 6 reactors, which AECL said were some of the top-performing units in the world last year, with greater than 95 per cent capacity factor rankings.

But environmentalists gave short shrift to the claims, expressing worries over impacts a reactor might have on the area's land and water.

"The nuclear power industry has a long history of over-promising and under-delivering, so I'm skeptical," said Marlo Reynolds, executive director of the Drayton Valley-based Pembina Institute.

"I'm still not convinced there's a need for nuclear power given all the other resources we have here in Alberta."

The institute won't support any form of government financial support for the project and Reynolds said all environmental impacts must be fully accounted for in the final cost of the facility.

"That business case has never been made clear... once you factor in the full environmental cost I don't believe nuclear power competes."

David Schindler has serious concerns, too.

"There are huge issues involved in building this," says Schindler, a professor of ecology at the University of

Alberta who teaches environmental decision-making, "and one of them is reactor safety.

"I would want to know where the waste is going to be stored, how it's going to get there and what the use of the power is supposed to be for.

"(Nuclear power plants) use a lot of cooling water, so I guess this is one reason for putting it in Peace River, so they can get water from the Peace. The needs are around a cubic metre a second, so it's like a small oilsands plant."

Elena Schacherl insists the proposed plant is "a far different beast" than the existing Candu reactors currently in Canada, which are located in Ontario, New Brunswick and Quebec.

"They're approximately half the size of just one of the (twin reactors) that are being proposed," says Schacherl, who represents Concerned Citizens Advocating Use of Sustainable Energy.

"What's being proposed has never been built before."

She fears the plant will get "fast-tracked" before "the other side" can fully air its arguments in front of an environmental assessment panel.

Henuset said the Peace River region was chosen because of its demonstrated support from the community, the existence of essential infrastructure and support services, and technical feasibility.

Lorne Mann, the mayor of the Town of Peace River, says the plant would bring economic stability to the region.

"Today's announcement ... has given our region an opportunity for a more vibrant, exciting and sustainable future," said Mann.

The corporation has partnered with Atomic Energy of Canada Limited, the federal Crown corporation and maker of Candu reactors.

Initially, Energy Alberta plans to build one twin-unit ACR-1000 that will produce 2,200 megawatts of electricity with a targeted in-service date of early 2017.

"Building a nuclear power facility is a long and rigorous process," said Henuset. "This is the beginning of a public and regulatory process that will include environmental, health and safety assessments."

Press conferences will be held in Calgary, Peace River and Whitecourt today to provide more details about the project.

jhall@thejournal.canwest.com

© The Edmonton Journal 2007

Company seeks approval to build Alberta's first nuclear reactor

Jon Harding

Financial Post

Tuesday, August 28, 2007

CALGARY -- A private Calgary-based company aiming to build Alberta's first nuclear reactor took a step in that direction when it filed an application late Monday with the Canadian Nuclear Safety Commission for a licence to prepare a site for the facility.

Energy Alberta Corp., whose backers include Hank Swartout, founder of the country's largest oil and gas driller, Precison Drilling Trust, said in a release it has teamed with Atomic Energy of Canada Ltd. to build up to two twin-unit ACR-1000 Advanced CANDU Reactors, with the first slated for a site 30 kilometres west of the town of Peace River in the province's northwest Peace Country.

The facility would be in service by 2017, according to the company statement.

"This is an historic moment for Canada, for Alberta and for the nuclear power industry," said Wayne Henuset, president and co-chairman of Energy Alberta.

The first unit would ultimately produce a total net 2,200 megawatts of electricity.

© Financial Post 2007

Firm to build $6.2B nuclear plant in Alberta

Canadian Press

Mon. Aug. 27 2007

CALGARY -- Energy Alberta Corporation has chosen Peace River, Alta., as the site for its proposed $6.2 billion nuclear power plant.

The site is on private land next to Lac Cardinal, about 30 kilometres west of Peace River, the company said in a release Monday night.

"We are proud to be pioneers in bringing the benefits of clean, safe, reliable nuclear power to Alberta,'' said Wayne Henuset, president and chairman of Energy Alberta.

The company had also looked at Whitecourt, Alta., as its possible site. But it delayed its decision three weeks ago when Woodlands County withdrew its letter of support for the facility after 300 residents signed a petition saying they wanted more information. Last week, Woodlands County said it would also hold a plebiscite for residents to vote on the proposed plant.

"Energy Alberta has chosen the Peace River region as its preferred site because of the demonstrated support from the community, existence of essential infrastructure and support services and technical feasibility,'' the release said.

The privately owned company has filed an application for a licence to prepare the site with the Canadian Nuclear Safety Commission.

The application is for siting up two, twin-unit Candu reactors. The company has partnered with Atomic Energy of Canada Ltd., the federal Crown corporation that makes Candu reactors, and says it has lined up financing and clients.

Energy Alberta says it plans to start with one twin unit that will produce 2,200 megawatts of electricity with a target start date in early 2017.

Henuset said the application is just one of many steps required to get the licences to build the plant.

He said there will also be environmental, health and safety assessments and public consultations.

Peace River Mayor Lorne Mann said in the release the announcement has "given our region an opportunity for a more vibrant, exciting and sustainable future.''

"We understand that this is just the beginning of a lengthy process and we welcome the chance to become more informed on nuclear energy.''

Alberta nuclear proponent has mystery power buyer

By Jeffrey Jones

Reuters

28-Aug-2007

CALGARY, Alberta (Reuters) - Backers of the first nuclear power plant proposed for the western Canadian province Alberta sketched out their plans on Tuesday, but left questions unanswered including the identity of a mystery buyer for most of the electricity.

Privately held Energy Alberta has agreed to supply a company with 70 percent of the 2,200 megawatt plant's output, but President Wayne Henuset declined to name the firm, its business or describe the stage of the deal, citing confidentiality agreements.

"(The agreement is) as solid as it gets, I guess, five years out," Henuset said at a news conference. He was referring to his goal of starting construction around 2012.

The C$6.2 billion (US$5.8 billion) plant had first been proposed to provide both electricity and steam for the booming oil sands industry in northeastern Alberta.

But Energy Alberta applied to Canada's nuclear safety authority on Monday to build it further west in the Peace River area and to provide just the power.

Since the company first floated the idea two years ago, it has sparked debate among residents and politicians in Alberta, an oil- and coal-producing province that had officially rejected the notion of nuclear energy.

Under the proposal, the debt-financed plant would start up in 2017. Government-owned Atomic Energy of Canada Ltd would build a twin-unit ACR-1000 Candu reactor and Energy Alberta would own and operate it.

Henuset said it could help solve a power supply crunch in Alberta, where he projected to jump by 400 MW annually. The capacity is about 20 percent of the province's current peak load.

"There are no doubts Alberta needs a large, reliable, clean power source to meet its current future needs and there is no doubt in our minds Albertans are ready for nuclear power," he said.

Radioactive waste would initially be stored near the plant, 30 km (19 miles) west of Peace River, but long-term storage is still being studied, said Stella Swanson, an environmental consultant to the project with Golder Associates.

She pointed out Canadian Energy Minister Gary Lunn recently approved the idea of burying waste deep underground at a single location. Environmentalists have condemned the idea as too risky.

Also attending the news conference were representatives of Citizens Advocating Use of Sustainable Energy, a group formed to oppose the plan.

Among its many criticisms is that the Peace River region is susceptible to seismic activity, said CAUSE member Jack Century, a geologist and consultant to the oil industry.

"Just to the west of the Peace River faulted area is Fort St. John (British Columbia), where oil fields have been inducing earthquakes as a result of conventional water-flooding. This is known to all seismologists, but sort of hidden in the oil patch," Century said.

Swanson said the backers have done geological and engineering studies "at a regional level in a preliminary nature" and plan to keep studying such risks.

"You're right, there have been earthquakes in the area, but it was not what we would call a fatal flaw for choosing this area," she said.

Henuset, a Calgary-based businessman, has run a series of oil field service businesses and car dealerships and has also established a chain of liquor stores.

His partner in Energy Alberta, Hank Swartout, founded Canada's biggest oil field service company, Precision Drilling, and is on the boards of a handful of other firms.

August 26, 2007

Exxon seeks legal sympathy over Valdez

COMMENT: This column may appear to be about the unending legal whining that Exxon is committed to instead of forking over the fines it has been assigned by US courts.

But it is also about coalbed methane activity in British Columbia and the contradiction for provincial policy of pushing that agenda whilst having just "joined six U.S. states and Manitoba in the Western Climate Initiative, a partnership to reduce carbon emissions."

And it is also about the inevitability of catastrophe as risky energy programs are embarked upon - whether it's opening the coast to more tanker traffic, or opening the land to coalbed methane development.

By JOEL CONNELLY

Seattle Post-Intelligencer

August 23, 2007

In his Savile Row threads, the senior partner from a distinguished Los Angeles law firm rose in a Seattle courtroom and argued a case that made the blood leave my face: The Exxon Corp. had suffered enough.

Eighteen years have passed, and Exxon is still imploring judges to feel its pain. On Tuesday, it asked the U.S. Supreme Court to review an appellate ruling that it owes $2.5 billion in punitive damages from the 1989 Exxon Valdez oil spill.

The big "E" has been appealing since 1994, when an Anchorage, Alaska, jury awarded $5 billion to class-action plaintiffs. Fishermen, cannery workers and Alaska natives claimed lasting economic damage from the fouling of Prince William Sound and 400 miles of Alaska coastline.

The case has bounced up and down like a Cordova fishing boat in a Gulf of Alaska storm.

The 9th U.S. Circuit Court of Appeals sent it back to District Court, which affirmed the $5 billion judgment. Exxon took it back to the '9ers, who cut the award in half.

An estimated 20 percent of the plaintiffs (some of them Seattle fishermen) have died since Exxon started appealing. One of the appellate judges who heard the Seattle argument, Charles Wiggins, is no longer with us.

Exxon soldiers on: It hopes Antonin Scalia, Clarence Thomas and other Supremes will prove a sympathetic audience.

While acknowledging the spill was "a very emotional event," the world's biggest oil company argues: "The ongoing case is whether further punishment is warranted."

Exxon-Mobil has lately sought to lower its profile. It has cut money to front groups formed to fuel public confusion on causes of global warming.

Other oil companies busily greenwashed themselves.

ConocoPhillips used shots of breaching whales and Beethoven's music to herald the arrival of double-hulled tankers. British Petroleum has run ads claiming its initials stand for "Beyond Petroleum." Shell has aired profiles of a groovy solar scientist and a gorgeous cultural anthropologist who advises indigenous peoples on how to coexist with oil development.

If you put aside the TV spots, however, big oil is giving us the same old gas.

British Petroleum used the cover of a post-Hurricane Katrina refinery bill in Congress for a sneak attack on legal protections against supertankers in Puget Sound. Reps. Jay Inslee and Dave Reichert thwarted it.

As the Senate marked up energy legislation, Sen. Maria Cantwell, D-Wash., tried to shift subsidies from big oil to renewable energy development.

The industry successfully resisted under guidance of lobbyist and ex-Louisiana Sen. John Breaux, a man famous for saying that while his vote was not for sale, it could be rented.

The anthropologist babe was absent this week as Royal Dutch Shell resumed its attempt to drill exploratory wells for a coal-bed methane project in one of British Columbia's most beautiful alpine basins.

A band of protesters from the Tahltan and Iskut Indian bands blocked Shell crews. The company is considering a court injunction, which would likely lead to arrests.

The land at issue is called the Sacred Headwaters: It forms the headwaters of the Nass, Stikine and Skeena river systems: All are major salmon streams. The Nass is a rare case in Canada of a well-managed fishery. The Sacred Headwaters is a major hunting and fishing ground for native peoples.

"Three years ago, with tenure to drill in hand, Shell Canada didn't waste any time: While most Tahltan were attending a funeral, Shell's contractors unceremoniously bulldozed an access road through a Tahltan trapper's camp and quickly drilled three exploratory wells," thetyee.ca, a Vancouver online newspaper, recently reported.

Shell picked a curious week to bulldoze its way back into the Sacred Headwaters. With great fanfare, British Columbia joined six U.S. states and Manitoba in the Western Climate Initiative, a partnership to reduce carbon emissions.

Who cares about a few dozen Indians in ceremonial costumes blocking a road 600 miles north of Vancouver? Isn't it "old news" that fishermen and tribes are still seeking damages 18 years after the Exxon Valdez spill?

Answer: We ought to extend our attention spans and renew a basic sense of social justice.

During four trips to the Sacred Headwaters country, the Iskuts have impressed me as spiritual, sensible, down-to-earth people who don't want the global economy to roll over their gorgeous corner of the world.

They are willing to accept mines, but one at a time, so the region isn't hit by a boom-then-bust economy. And they want hands off the Sacred Headwaters. They're willing to endure stiff contempt sentences that Canadian judges impose on those who defy corporate power.

The Exxon Valdez plaintiffs have a powerful argument in or out of court: We told you what was going to happen.

As Capt. Joseph Hazelwood was drinking at the Petroleum Club in Valdez, a Cordova biologist-fisherwoman, Dr. Riki Ott, was talking by phone to a meeting elsewhere in town.

She forecast that Prince William Sound was due for a catastrophic oil spill, the question was not whether but when, and that it would not be contained.

The prediction came true a few hours later. If only the Exxon Valdez had shown its corporate parent's skill at maneuver and evasion.

P-I columnist Joel Connelly can be reached at 206-448-8160 or joelconnelly@seattlepi.com.

August 23, 2007

Looking to the sun

Revolutionary solar power from Israel

Remarkable solar amplification development in Israel. Could well imagine offsetting any future need to go with traditional generation plants, and even fossil fuel propulsion conversion of the large vessels of the international shipping sector. (Tom Parry/CBC)

Tom Parry's Notebook

CBC

Aug. 15, 2007

The Ben-Gurion National Solar Energy Research Center has a name more impressive than its actual appearance. The centre is a collection of trailers and mobile homes clustered behind a fence in Israel's Negev Desert. Despite the humble surroundings, the work going on behind its doors is at the cutting edge of solar technology. It could change the way we produce energy — in theory, at least.

Prof. David Faiman of Israel's Ben-Gurion National Solar Energy Research Center. (Tom Parry/CBC)

The head of the centre is Prof. David Faiman. When I met him, he looked like a cross between a college lecturer, Santa Claus and Roy Rogers. Faiman sports a thick white beard, a straw cowboy hat to guard against the desert sun and sunglasses, perched slightly askew on his nose.

From the moment we shook hands, he began speaking about his work. And the focus of his work is "The Dish." The Dish appears at first glance to be a giant satellite ground station. In fact, it is a giant mirror. And what this mirror does is focus the sun's rays onto one single super-heated point.

Like an angry child with a magnifying glass incinerating ants, Professor Faiman can concentrate the sunbeams to an intensity a thousand times their strength. But Faiman isn't using this enormous power for something as mundane as zapping bugs, of course. He's using it to create incredible amounts of electricity.

"By concentrating the light a thousand times, we were able to produce 1,500 watts from a cell that normally gives only one watt," Faiman explains.

The breakthrough solar technology?

Faiman and his team have been experimenting with using concentrated sunlight and a very durable solar panel to produce more electricity than ever thought possible. In theory, this is the breakthrough that solar energy has been waiting for — the one that makes it more practical, reduces the price of production and makes it cheaper than coal-fired, nuclear or even hydro-electric plants. But Faiman isn't popping the champagne cork just yet.

"It will feel wonderful when I see the first solar power plant using this technology in use. Until I see that, it's just another theoretical paper."

Prof. Faiman's solar dish in Israel's Negev Desert. (Tom Parry/CBC)

It could be a while before Faiman's experiments pay off with real world results. But he does envision dishes like his dotting the Israeli desert in the not too distant future.

"Take 120 kilometres of highway," he says, "and take 50 metres on each side of the road. That's twelve square kilometres. That's enough for building 1,000 megawatts of generating capacity. So, you can simply have these dishes in a line, hooked up to the overhead power line, and you've basically used land that's not used for anything else."

California Dreamin'

A solar collector made by Solel Solar Systems. (Tom Parry/CBC)

It would be easy to write off Faiman as a dreamer. But the fact is, Israeli solar technology is already producing power, not in Israel but in the United States. In California's Mojave Desert, huge swaths of land are covered in mirrors soaking up the sun's rays and producing formidable amounts of electricity. The mirrors are the work of another Israeli company, Solel Solar Systems Ltd. Its head office is in Beit Shemesh, west of Jerusalem. Beit Shemesh, as you might expect, is Hebrew for "House of the Sun".

On the day I visited, I was greeted by Solel's President Avi Brenmiller. Brenmiller is an advocate, more of an evangelist, for solar power. A tall, imposing man with a voice like Arnold Schwarzenegger, Brenmiller's every word seems to say, "I told you so" to anyone who doubts the potential of solar energy.

"I think it's the beginning of a peak," says Brenmiller, when asked about the current state of the solar power business.

"A couple years ago, I was very busy trying to convince people that they should do it. Right now, everybody is telling me, okay we are convinced. Let's see if you can deliver."

Sounding like The Terminator at times, it makes sense that Brenmiller's biggest business success is in Gov. Schwarzenegger's California. Solel has nine fields of solar collectors soaking up the sun's energy in the state. And just recently, it signed a contract to build another massive expanse of mirrors that will be the world's largest solar generating plant.

New plant will use more than one million mirrors

"That's the largest solar plant ever built in the world. It will be supplying power to 400,000 families. And we plan to build more plants of that size," Brenmiller says.

"The problem was always, 'When can you become really competitive with other sources of energy?' and we calculated that at that size of a plant, we could really compete with other sources of power," he adds.

Close-up of some of the glass tubes used in Solel's collectors. (Tom Parry/CBC)

The new Solel plant in the Mojave will use more than a million mirrors and cover more than 6,000 acres of ground. The technology developed by the company uses curved mirrors to focus sunlight to heat glass tubes filled with oil. The heated oil is used to boil water. The steam drives turbines that produce electricity.

"This is the only working proven [solar] technology in the world which works at commercially supplying power to the grid," boasts Brenmiller.

While California is its biggest customer, Solel has sold its mirrors in Spain and is eyeing India and China as potential markets. As for Canada, the Great White North may not have enough sunshine to make this kind of solar project viable. The technologies developed by Solel and under development at the Solar Energy Center in the Negev are more suitable to desert climates.

Brenmiller, however, says they are working on solar panels that could be used in northern regions. And, Prof. Faiman adds, even if Canada doesn't end up with fields of mirrors and solar dishes, it may one day buy electrical power produced from solar fields in the southern U.S.

A world leader but not in Israel

What disappoints both Faiman and Brenmiller is that while Israel is quickly becoming a world leader in solar technology, Israel has been slow to embrace solar energy on a wide scale. Most Israeli homes are equipped with solar water heaters, but the bulk of Israel's electricity is produced at coal-fired generating stations. Faiman attributes Israel's reluctance to go solar to nervous politicians.

"There is a reluctance of governments to do anything new," he says, "That is a fundamental problem of governments all over the world. No politician wants to risk doing something that nobody's ever done before. Because if it doesn't work, it's the end of his political career."

The Israeli government has expressed interest in building at least one solar generating station like the ones in California. But Brenmiller is waiting to see a signature on a contract before he starts celebrating.

Both Faiman and Brenmiller admit solar power may never replace the electricity produced in hydroelectric, nuclear and fossil fuel plants. But they firmly believe the world can reduce its reliance on these other technologies simply by looking toward the sun.

August 22, 2007

Offshore deal worth $16-billion to Newfoundland

COMMENT: "The agreement to develop the Hebron-Ben Nevis offshore oilfield gives the province an equity stake of 4.9% in the project."

CanWest News Service

August 22, 2007

Danny Williams

CREDIT: Tyler Anderson/National Post

Newfoundland and Labrador Premier Danny Williams said Wednesday that an offshore deal reached with four major oil companies represents an unprecedented gain for the province.

The agreement to develop the Hebron-Ben Nevis offshore oilfield gives the province an equity stake of 4.9% in the project, estimated to contain 731 million barrels of recoverable oil.

The equity stake came at a cost of $110-million, but the deal will mean total revenue of $16-billion over the 25-year life of the project for the province. The federal government will earn $7-billion in the same period, Mr. Williams said.

The combative premier and the oil companies broke off negotiations on the project -- Newfoundland's fourth major oil development -- in April, 2006, when they couldn't agree to fiscal terms.

The premier came under severe criticism, both in his home province and in the oil community, for refusing to back down on his demands, which involve heavy provincial involvement and for which he was likened to Venezuela strongman Hugo Chavez.

The premier was in a triumphant mood Wednesday, proclaiming the memo of understanding was "historic" and the first step toward Newfoundland and Labrador "Taking real and meaningful ownership of our resources."

There is also an improved royalty regime tied to the price of oil. When oil rises above US$50 a barrel, the province will receive a super royalty of 6.5% of net revenue.

Construction could begin by 2010.

The Hebron negotiations were suspended by the oil companies in April 2006, but resumed last month. One of the main stumbling blocks had been the province's demand for an equity stake in the heavy oil project.

"Our goal was to surpass benefits of previous agreements," said Mr. Williams, who touted the investment in his province's workforce, including the local construction of the new oil platform. "Determination and strength of conviction has been our government's guide."

The partners in Hebron are Chevron, ExxonMobil Canada, Petro-Canada and Norsk Hydro Canada.

Nfld. strikes Hebron deal

SHAWN MCCARTHY

Globe and Mail

August 22, 2007

The province of Newfoundland and Labrador will pay $110-million to get a 4.9-per-cent stake in the Hebron offshore project, Premier Danny Williams said in announcing a deal with oil companies to proceed with the $5-billion development.

Some 16 months after talks broke down — and six weeks for a provincial election — Mr. Williams on Wednesday released details of the agreement, which includes a heightened royalty regime and guarantees for local content in the construction of the offshore platform.

“Today marks a historic day in Newfoundland and Labrador, as we enter into a new era of offshore oil development with unprecedented benefits to the people of our province including taking real and meaningful ownership of our resources,” the premier told a news conference in St. John's.

Under the agreement signed with the consortium led by Chevron Corp., the province will pay $110-million in cash for its equity stake, and contribute 4.9-per-cent of the estimated $5-billion in construction costs.

With a provincial election less than two months away, Newfoundland and Labrador Premier Danny Williams has clinched a deal with a consortium of oil companies to proceed with the $6-billion Hebron offshore oil project.

With a provincial election less than two months away, Newfoundland and Labrador Premier Danny Williams has clinched a deal with a consortium of oil companies to proceed with the $6-billion Hebron offshore oil project. (CP)

Mr. Williams acknowledged there was some risk involved in taking a direct stake in the project, but said the province would benefit from payout of profits, as well as super royalty scheme that will remain in effect so long as the price of oil remains above $50 (U.S.) per barrel.

James Bates, vice-president at Chevron Canada Ltd., said the deal was a good one, both for the people of Newfoundland, and for the shareholders of the oil companies.

"We dealt with the net expectations in the context of the entire agreement," Mr. Bates said. "When you at it from that perspective, we were able to meet the expectations of the government and our companies."

Mr. Bates would not discuss the details of the agreement, including which partners would sell equity. He said more work needs to be done to hammer out a binding contract. In addition to Chevron with 25 per cent, ExxonMobil Corp owns 37.5 per cent of the Hebron project. Petro-Canada and Norway's state-owned Norsk Hydro ASA are also partners.

The province's equity will be managed by energy arm of Newfoundland and Labrador Hydro, which has been charged with developing the province's oil and gas, as well as electric power assets.

The premier thanked the people of Newfoundland and Labrador for supporting him when critics — in the business community in St. John's and around the country — slammed him for insisting on an equity stake and accused him of driving investment away from the province.

Talks between the government and the oil companies broke down in April 2006 over a number of issues, including Mr. Williams' demand for an ownership stake in Hebron and the companies' insistence on a package of tax credits.

In his news conference this morning, the premier said his government had increased its offer for the equity by $10-million, agreed to reduce its royalty claim by $20-million to $30-million, and extended the royalty payout period.

For its part, the consortium dropped demands for tax credits, and agreed to accept the government as a partner in the project.

Mr. Williams said that, given current oil price projections, the Hebron project — with reserves of up to 700-million barrels — should generate more revenue for the province, and more jobs than the two previous projects combined.

Hebron will be the fourth offshore oil project for the province since the industry got its start with the Hibernia development in the 1980s. It is located some 340 kilometres from St. John's and will use a similar concrete gravity-based structure (GBS) as a drilling platform. That GBS will be fabricated in the province.

Squeezing oil from stones

There are vast reserves of oil trapped within Alberta's rockbed - the trick is getting it out

NORVAL SCOTT

Globe and Mail

August 22, 2007

CALGARY -- OSUM Oil Sands Corp. believes it might have the answer to one of the oil patch's most perplexing problems - extracting the billions of barrels of crude trapped in Alberta's limestone deposits.

To date, energy companies have largely concentrated on producing crude from Alberta's oil sands, where tar-like bitumen is extracted from sandstone and dirt using either mining or steam-assisted extraction. While the province's limestone deposits - or carbonates - also hold vast amounts of crude, the reserves are too deep for mining and are frequently perceived as being incompatible with steam-assisted extraction, preventing easy recovery.

Nevertheless, the uncertainty over extraction hasn't stopped some enterprising firms from snapping up leases in regions such as Alberta's Grosmont formation. Last year, Royal Dutch Shell PLC paid $465-million for 10 parcels of land in the carbonate region, by far the biggest outlay for staking any exploration claim anywhere in the oil sands, while Husky Energy Inc. also holds substantial acreage in the area.

The only other company to own holdings in the region is the far smaller, privately held OSUM, which used to offer technological and service solutions to other firms before deciding to acquire a slice of the oil sands itself, paying just over $20-million last August for leases that could hold 840 million barrels of recoverable crude.

Not only does the Calgary-based company believe the land can support a project ultimately capable of producing 75,000 barrels of crude a day, it believes the carbonates could be the way forward for Canada's oil patch.

"The carbonates are a stupendous resource, and when they are cracked at a commercial level, that's a material step-change for the industry," OSUM chief operating officer Peter Putnam said in a recent interview.

"Shell didn't spend all that money in the region to get hold of a big science experiment - they're looking for a major project."

So far, Shell and Husky have been tightlipped about exactly how they will produce crude from the carbonates, although Husky has tentatively outlined plans for a 200,000-barrel-a-day project at its Saleski holdings. Industry observers have speculated that the companies could use electrical wires to heat the limestone resource, although such a process would likely be expensive and need a large energy source.

While OSUM isn't giving away its technical secrets either, it says the answer to extracting the crude is far less esoteric than the industry seems to believe, with experiments carried out in Alberta in the 1970s already proving that crude can be extracted from the limestone reservoirs with thermal recovery methods.

"Producing barrels out of the carbonates is not an issue, and we actually think these reservoirs are better than those in Fort McMurray," Mr. Putnam said.

"Most people who work in the oil sands only know about sand - they don't understand these reservoirs and they don't have experience with them."

In conjunction with privately held partner Laricina Energy, OSUM is now pressing ahead with plans for a 10,000-b/d pilot project at Saleski - recently securing $56-million of financing - and expects to file a regulatory application next year.

As well as the carbonate plans, OSUM is also moving forward another project that appears technically challenging - extracting crude from under Marie Lake, in eastern Alberta.

That project will use so-called shaft and tunnel technology to reach the region's crude, with wells drilled from below the reservoir, rather than from above.

While planning for the 30,000-b/d project is in an early stage, OSUM believes the shaft and tunnel system, which requires less drilling and less steam, will lead to substantial cost savings and a smaller environmental footprint.

Alberta regulators gave approval to OSUM to conduct seismic testing at the site earlier this month, despite objections from residents concerned about how the project might affect Marie Lake.

OSUM chief executive officer Richard Todd said seismic testing carried out on lakes elsewhere in Alberta hadn't caused any problems, and that the company was determined to address any community concerns and carry out its program with sensitivity.

"Hopefully, at the end the residents will applaud our approach," he said. "I think people will come to see the whole package as a step forward [from conventional oil sands operations]."

August 21, 2007

Alberta Energy loses gas decision

National Energy Board approves new LNG terminal to be built in Quebec

Gordon Jaremko

Vancouver Sun,

21-Aug-2007

EDMONTON -- Alberta Energy has lost a quiet but hard-fought national duel with importers and consumers over the future of the province's top money-earner: natural gas.

In a July ruling described as "a signal to the global market," the National Energy Board rolled out the welcome mat to tanker cargoes of liquefied natural gas from overseas by approving a controversial cost-sharing scheme for a new LNG terminal to be built in Quebec.

On the heels of the decision, Andrew Pelletier, spokesman for Cacouna Energy -- a major player in the terminal project -- said, "Right now it's a green light. We're working towards a project announcement."

The company's statement -- expected by the end of the year -- will set out a final cost estimate and construction schedule for the Quebec import terminal that is to be developed by the Cacouna partnership of Trans-Canada Corp. and Petro-Canada.

The NEB's technical but far-reaching landmark ruling decided a fight over who will pay for a cornerstone of the project -- and possibly more like it -- over the next 20 years.

The contested item is a $738-million set of additions to Trans-Canada's national gas pipeline, including a 240-kilometre extension and other adjustments needed for markets to use the new tanker terminal at Gros Cacouna, on the south shore of the St. Lawrence River east of Quebec City.

Over vigorous resistance by Alberta Energy lawyer Brent Prenevost, the NEB sided with the Cacouna partners and their supporters, which include the Quebec government, Canadian Industrial Gas Users Association and Montreal distributor Gaz Metropolitain Inc.

The board ruled that the remote terminal is a "receipt point" for gas to enter TransCanada's pipeline, akin to conventional Alberta and Saskatchewan inlets along the main shipping route for gas to central Canada and the United States.

That status qualifies the Cacouna pipeline extension for a utility cost-sharing system known as the "rolled-in toll methodology." The $738-million bill for the LNG import terminal will become, in effect, an added mortgage to be paid off with tolls charged to all shippers, including Alberta gas producers and merchants.

TransCanada estimated the extra bill will be as little as two-tenths of a penny and no more than three cents a gigajoule by the time it is spread out over many years and all the traffic on the national pipeline system.

Alberta Energy argued the scheme creates a big subsidy for LNG imports by saving the terminal the expense of paying for its own pipeline link to Quebec, Ontario and U.S. markets.

In a strongly worded final argument before the NEB, Alberta Energy lawyer Prenevost predicted the rolled-in system will give LNG imports a competitive advantage of $1.10 per gigajoule against Alberta gas in Quebec.

He acknowledged the Alberta government was alone in resisting the scheme, but suggested it was no accident the gas production industry stayed conspicuously silent.

Gros Cancouna documents at NEB registry

Proposed plant in Cowlitz County to test pollution law

Craig Welch

Seattle Times

20 August 2007

When Gov. Christine Gregoire signed a new law in May to reduce greenhouse-gas emissions, she called it a "testament to the unique, broad-based coalition that came together - utilities and environmentalists, faith communities and business leaders."

Four months later, that coalition is already splintering over one of the first real tests of the new law: a fight about whether developers of a proposed power plant in Cowlitz County are trying hard enough to limit its climate-changing pollution.

The dispute highlights how efforts to reduce carbon emissions increasingly run up against a growing region that needs more and more electricity.

Energy Northwest has proposed a plant at the Port of Kalama that would burn gas made from coal. That process is cleaner than simply burning coal, but it still would emit millions of tons of carbon dioxide into the atmosphere each year.

At issue is whether Energy Northwest has made a sincere effort to find ways to trap the excess greenhouse gases in the earth - a process known as "carbon sequestration" - instead of spewing them into the sky.

The state Attorney General's Office and the Department of Ecology, environmentalists and some lawmakers insist the electricity suppliers behind the new plant are trying to bypass the intent of the law.

Those suppliers - including Seattle City Light and more than a dozen public-utility districts represented by Energy Northwest - say that's not true.

Under the new law, signed with great fanfare at the end of the last legislative session, new power plants have to trap their carbon emissions unless the utilities demonstrate, after a "good-faith effort," that it's impossible.

Only then can plant operators instead offset emissions, by buying rights to another utility's unused pollution capacity, for example. Lawmakers and Ecology officials have said such offsets should be a last resort.

When it submitted pollution-control plans to the state for the Kalama plant, Energy Northwest simply professed that sequestration remains unworkable in real-world practice. So until it is, the utility wants to pay to offset emissions.

"We represent openly and honestly the current state of technology for sequestration, and it's just not available yet," said Brad Peck, a spokesman for Energy Northwest.

State officials and environmentalists heatedly objected.

"This document is not a sequestration plan, it is merely a plan to have a sequestration plan," Assistant Attorney General Michael Tribble wrote. The Ecology Department said Energy Northwest's proposal was too deficient to even consider.

Both agencies urged a third state agency that reviews power-plant proposals, the Energy Facility Site Evaluation Council (EFSEC), to reject the plan as inadequate.

Instead, EFSEC agreed to move forward with a review. The panel plans to hear arguments about the issue next month.

"There's no good reason not to proceed," said Jim Luce, chair of EFSEC. "The first thing we're going to do is debate compliance with the law."

Now environmentalists worry that EFSEC will give utilities the benefit of the doubt and that if the utilities are allowed to move ahead without concrete sequestration plans, they may never develop such plans.

"I find it incredible that EFSEC rejected the rather explicit advice from the attorney general," said Marc Krasnowsky, spokesman for NW Energy Coalition, a Seattle-based environmental group that promotes renewable energy and conservation. "Once it's built, does anybody really believe politicians will demand the plant shut down?"

Energy Northwest's Peck responded that lawmakers knew sequestration was experimental when they passed the law, hence the provision for other options such as offsets.

"If anyone knows a sequestration technique that's available and viable, we'd appreciate them letting us know," Peck said.

Equally important, Peck said, is that the state needs more power. Even if economic growth slows, he said, utilities expect an increase in demand of 1,200 to 2,400 megawatts over the next six years - about how long it takes to get a new plant built and operating. The Kalama plant would produce about 680 megawatts.

"We don't see better options, and this one meets our criteria: reliable, affordable and environmentally responsible," Peck said.

But state Sen. Erik Poulsen, D-West Seattle, who chairs the Senate's energy committee, said the Legislature "had every expectation" that Energy Northwest would try to resolve technical issues with sequestration before pushing ahead.

"In winning the battle, they may lose the war," Poulsen added. "If they succeed in avoiding sequestration this easily, you can be sure the Legislature will put tighter restrictions on coal plants.

"As chair of the energy committee, I can virtually guarantee it."

August 19, 2007

The new dirty energy

It's big, it's growing -- and it's bad for the environment. Inside the other alternative-energy movement.

By Drake Bennett

Boston Globe

August 19, 2007

FOR THOSE WHO dream that high oil prices will help drive America toward a brave new world of clean energy, the MacKay River project in Alberta, Canada, offers a glimpse of the future.

The complex is a showpiece of cutting-edge engineering, wresting energy from beneath a swath of boreal forest. Under an unobtrusive spread of buildings, holes drilled at oblique angles free unprocessed fuel from the earth with jets of steam.

Thanks to government and private investment, the complex is providing more energy every year, and by 2020, Alberta as a whole is predicted to generate enough to replace a quarter of the United States's current daily oil usage. And as oil prices rise, projects like MacKay River become more and more cost-effective, and more popular.

The only problem: The thick, tarry petroleum that the Alberta project pulls from beneath that forest is far dirtier than oil.

Alternative energy wasn't supposed to look like this. For years, leading environmental thinkers have argued that high fossil fuel prices are good for the planet, driving investors and customers toward biofuels, solar power, and a host of new energy sources that will quickly become cost-effective.

But as oil prices stay high, the real beneficiary often turns out to be a very different alternative-energy industry, one focused on dirty fuel sources such as oil sands, oil shale, and coal. Environmentally speaking, the oil-sand plants of Alberta are no better than petroleum drilling, and in some ways decidedly worse. In North America, in terms of energy output, this so-called "unconventional oil" sector already dwarfs clean and renewable-energy technologies, and is poised to grow even faster in the next decade.

"To assume that high energy prices mean we'll switch to wind or solar or other renewables is simply unrealistic," says Amy Myers Jaffe, an energy expert at the James A. Baker III Institute for Public Policy at Rice University. "It only means that if we make that a concerted policy."

For the past two years, oil prices have been fluctuating around historic highs. Although $3-per-galllon gasoline may be frustrating to drivers, it has been welcomed by environmentalists and many economists, who see expensive oil as a crucial spur to the clean-energy business. In announcing last fall that he was dedicating $3 billion to fight global warming, the British billionaire entrepreneur Richard Branson said of high oil prices, "Thank God it's happened. . . .A high oil price is what we needed to actually wake up the world" to deal with climate change.

When oil is expensive, biofuels start to look more affordable by comparison, and investors start seeking ways to make them more affordable still. When natural gas -- used primarily for generating electricity -- is expensive, it adds to the appeal of wind and solar-generated electricity. The best-selling author and New York Times columnist Thomas Friedman, among others, has gone so far as to advocate an oil price floor to ensure that oil never gets cheap enough to undercut alternative energy sources.

In part, the expectations of Branson, Friedman, and others are starting to come true. Investments in renewable energy by governments, corporations, and venture capitalists have surged in recent years, driven in part by the cost of oil. A United Nations Environment Programme study released in June reported that, worldwide, $70.9 billion was invested last year in clean energy generation, about a third of that in the United States.

But these renewable sources still supply just a fraction of the world's energy needs, and many of them remain high-tech speculations. The best-known, like wind and solar, are for electricity generation, not vehicle fuel, the role oil currently plays. And according to Department of Energy figures, ethanol, the only widely available biofuel, currently meets only 1.6 percent of American vehicle fuel needs.

Meanwhile, the high price of oil has given a dramatic boost to a very different set of energy sources -- one of which is now generating fuel on a huge scale. These "unconventional oil" sources pull carbon out of the ground in forms that were once too expensive, or too technically difficult, to compete with cheap oil.

By far the most developed of these are the oil sands of Canada. A thick slurry of sand, water, and a hydrocarbon tar called bitumen, oil sands -- also called tar sands -- can, with enough processing, be refined into something very similar to the petroleum pumped out of the Saudi Arabian desert.

The discovery of tar sands in what would become northeastern Alberta long predates the internal combustion engine: Native Americans found the tar seeping from the ground and used it to caulk their canoes. Efforts to mine the sands for oil go back to the 1960s, but were never economically competitive with oil drilling, and the early mines struggled. No longer.

"With higher prices there's a terrific interest up there," says David Pommer, a spokesman for Chevron Canada, co-owner of one of Alberta's largest oil-sands mines.

Geologists estimate that Alberta's oil sands contain 1.7 to 2.5 trillion barrels of oil -- more than Saudi Arabia -- a few hundred billion of which are recoverable using current technology. (A similarly vast oil-sands reserve lies beneath Venezuela, but remains mostly undeveloped.) Already today, Alberta's oil-sands industry produces a million barrels of oil a day, most of which comes to the United States.

Environmentalists see this as a growing disaster. The oil in oil sands is not easily separated out, and the immense amounts of heat required are usually generated with natural gas, giving the oil-sands industry a greenhouse gas footprint much larger than the traditional oil business -- estimates range from 40 percent more to five times the emissions. The process also uses enormous amounts of water: a study by the Pembina Insitute, a Canadian environmental watchdog organization, found that, depending on the method of extraction, every barrel of oil produced requires 2.5 to 4 barrels of water, all of which is then rendered too polluted to return to the water supply. And most oil-sands operations are mines, not steam wells like the MacKay project, making them very disruptive to surrounding ecosystems.

Behind oil sands, two other "unconventional oil" technologies, at this point far less developed, wait in the wings.

One of them is oil shale, a sedimentary rock impregnated with solid bitumen. Three-quarters of the world's known oil shale deposits lie in the western United States, concentrated in Colorado, Utah, and Wyoming, giving the country an immense hidden oil reserve of around 1.8 trillion barrels. To extract the bitumen and turn it into oil, however, requires a massive amount of heat. Either the rock is mined, then crushed and cooked in huge pressurized caldrons, or the bitumen is melted out by physically heating the earth that holds it to temperatures above 600 degrees Fahrenheit.

Energy and emissions estimates for oil shale are hard to come by, since there are no large-scale production facilities, but the energy expenditure to cook the oil shale is likely to be considerable. Terry O'Connor, a vice president of Shell Unconventional Resources, insists that the company is looking at ways to cut down on both energy and emissions. "That's the reason we're still years away from making a commercial decision," he says.

An even bigger wild card is liquid fuel made from coal. The United States and China, the countries with the world's largest energy appetites, also contain the world's largest deposits of coal. While the basic technology to turn coal into fuel is nearly 90 years old, in the past it was too expensive to be anything but a last resort for fuel-starved countries such as Nazi Germany and apartheid South Africa.

A few firms in the United States and China are trying to use new technology to make the process economically competitive with oil, but again, the environmental costs are high. The favored coal liquefaction method today requires first turning solid coal into a gas at very high temperatures; combined, the production and consumption of coal-derived diesel releases roughly twice as much carbon into the atmosphere as traditional oil -- though various research efforts are underway to capture these emissions. It also uses more than a dozen barrels of water per barrel of fuel produced, according to a recent Department of Energy study. And coal mining takes a toll on landscapes and animal habitats.

The lesson for policy makers is that economics alone won't help solve the world's greenhouse-gas problems. The markets care about money, not the environment, so the most important alternatives to oil will be the biggest and cheapest, not the greenest.

What's needed, say many clean energy advocates, isn't just high oil prices, but high carbon prices. If fuels were taxed on their carbon content, climate change would be priced into the economics of energy production.

"If you have a carbon tax, or some other concerted carbon policy," says Mike Jackson, an energy analyst with Stanford University's Freeman Spogli Institute for International Studies, "then high oil prices drive industry toward clean technologies."

Otherwise, he says, "you're just going to see more people building these wacky projects that are a disaster for the environment."

Drake Bennett is the staff writer for Ideas. E-mail drbennett@globe.com.

© Copyright 2007 The New York Times Company

August 18, 2007

Royalties: As Big Oil pumps Alberta

COMMENT: This is an excellent essay on Alberta’s royalty review, with a bad sub-heading. Too bad you can’t read it from the bottom up, because many of the reasons why royalties should be increased, appear later in the report.

Don Gunderson, speaking to the royalty review panel summed up thus: “I think the most solid evidence that the current royalties are too low is the fact that the oil companies are happy with the current rates.” He continued, “We don't want a fair price; we want the best price.”

Industry is quick to whine about how tough things are, and an increase in royalties will surely lead to investment going elsewhere. But investment is flooding into Canada, and more specifically to the oil sands, irrespective of royalties, high exchange rates, and everything else industry might complain of. It is coming because US investors see safety and stability in Canada, and they see a huge secure supply of oil. The oil industry is engorged on profit in recent years. So enough of the whining and the empty threats.

Some of the things that are wrong with royalties:

- as oil (and gas) prices rise to unprecedented levels, royalty rates don’t rise with them. They’re capped. Free lunch for shareholders. Bag lunch for citizens.

- a vast and generous array of allowable costs, which are deducted from the nominal royalty payable, are another free lunch for shareholders.

- North America is already the most profitable jurisdiction in the world for oil producers

Meanwhile, in Newfoundland, Premier Danny Williams “is close to introducing new legislation that would require state participation in all developments.”

And what of British Columbia? Still looking to Alberta for guidance in all things with oil and gas, BC is probably going to follow whatever lead Alberta takes. For the record:

- in fiscal 2006, BC produced 12.69 million barrels of oil and took in $127 million in royalties. The nominal price of oil was US$66.06 per barrel. That’s a net royalty of US$10 per barrel and a net royalty rate of 15.15%

- in fiscal 2006, BC produced 1,095 petajoules of gas and took in $1,392,000,000 in royalties. The nominal price of gas was $5.65/gigajoule. That’s a net royalty of $1.27 per gigajoule and a net royalty rate of 22.50%.

Most of this is from the 2007 Budget, Table A10

http://www.bcbudget.gov.bc.ca/2007/pdf/2007_Budget_Fiscal_Plan.pdf

The 2006/07 forecast oil production is from MEMPR’s 2005/2006 Annual Service Plan Report

http://www.em.gov.bc.ca/DL/GSBPubs/AnnualReports/AR2005-2006.pdf

As Big Oil pumps Alberta for profit, the province's royalty take is shrinking.

Is it time to get greedy?

DAVID EBNER

Globe and Mail

August 18, 2007

Royalties have existed as long as humans have spun wealth from the world's underground riches, digging and drilling to produce personal and collective fortunes. The first royalty believed to have been collected occurred in ancient Greece, creating great wealth for Callias, a top aristocrat whose home was the finest in Athens and was the setting for one of Plato's dialogues.

Callias owned silver mines at Laurion, which is now a suburb of Athens but was once the chief source of revenue for the Athenian city state, where slaves mined the ore. Callias received royalties on the production and the mine operators took their slice. This division of wealth became the foundation of a fiscal system for the sharing of dollars generated from the extraction of natural resources that is generally unchanged more than two millennia later.

The owner of a resource, be it silver in Greece or oil and natural gas in Alberta, receives a royalty as a right of ownership from the person producing the resource and aiming for their own profits. But what the rate should be is a difficult debate, as the arguments are relative in the absence of absolutes – reflected in the fact that there are a thousand or so royalty systems for energy around the world. The question is also clouded and confused by the word at the heart of the argument: Fair.

Royalties paid on oil and natural gas production in Alberta are one of Canada's most crucial economic calculations. Within two weeks, the provincial government receives an extensive report from a six-member panel that conducted a public review of royalties, taxes and other fees paid by energy producers – with a core mandate to determine if citizens are getting their fair share. The report, and what rookie Premier Ed Stelmach's government does with it, could have significant repercussions across the Canadian economy.

“This is a critical issue,” said Frank Atkins, an economist at the University of Calgary.

Hitting the right note on royalties helps spur development, bringing wealth to Alberta and to all Canadians. But getting it wrong means kicking over an economic domino with countrywide repercussions. The energy business obviously has enriched Alberta but it has also very much made the nation wealthier, starting with federal taxes that get shared east, centre, west and north, to things such as auto sales, with Alberta recently underpinning record domestic vehicle sales, an engine of the Ontario economy. The oil sands, in fact, pay more corporate income taxes to Ottawa than Edmonton.

In sleepy sessions from Grande Prairie to Medicine Hat, the unprecedented public review started in late April and ended mid-June but occurred beyond the attention of many Albertans and most Canadians. The panel heard more than 100 public presentations, with roughly half of those made by industry players. Another 224 submissions were made on paper.

Greg Stringham, a vice-president at the Canadian Association of Petroleum Producers, was one of the people near the heart of the debate helping lead the industry lobby, but he made his points without thumping his chest or threatening impending doom, as was the case with so many other Alberta oilmen. Mr. Stringham knows there isn't one easy answer.

“Our answer to the question of whether it is fair, we'd say yes,” Mr. Stringham said in an interview. “But fair is a nebulous word, it's hard to define.”

Figuring out fair is critical for Alberta because royalties aren't just one little thing in a much bigger picture: They are the thing. Resource revenues are the province's No. 1 source of income, ahead of corporate and personal income tax. In 2006-07, Alberta collected $9.8-billion in oil, natural gas and oil sands royalties, as well as $2.5-billion from the sale of new exploration rights – accounting for one-third of the province's income.

Without energy, Alberta's gross domestic product would be about half the size, according to economists Robert Mansell and Ron Schlenker of the University of Calgary, who added that without royalties, a provincial sales tax of 16 per cent would be needed to make up the revenue. And they said the calculations were probably understated, alluding to the fact that without energy, there'd be hardly any economy at all in Alberta, with no need for all the engineers, lawyers and accountants, never mind all the restaurants and Canadian Tires.

It is this dependence that backstopped the don't-choke-the-golden-goose argument issued by industry, which is powerful in sound bites, because who dares ruin a good thing? It was these comments that gained the most attention in the local media. Jim Buckee, the gruff retiring chief executive officer of Talisman Energy Inc., employed rhetoric when he sat before the panel in May in Calgary, saying a zero per cent royalty generates zero dollars and a 100 per cent royalty also produces zero, as it drives all activity elsewhere. “The current regime has worked and it's best left alone,” Mr. Buckee declared.

Also in Calgary, Steve Laut, president of Canadian Natural Resources Ltd., the country's No. 2 producer, said: “What we have to be very cognizant of is any significant change – or any change – to the royalty system could [produce] a drastic – I mean drastic – reduction in activity in Alberta.”

The review looked at all aspects of oil and gas in the province but the focus was clearly on the oil sands. The giant resource, concentrated in the remote boreal forest of northeastern Alberta, has commanded the energy world's attention after being recognized several years ago as the second-largest reserve of oil after Saudi Arabia.

It is a huge change from a decade ago when the oil sands languished unloved, considered a fringe resource with the price of crude at a quarter of today's level.

Industry, hoping to jump-start the near-dead business, sponsored a national task force to find ways to overcome development challenges to seize the alluring promise of enormous long-term potential. A key idea, proposed in 1995, was an enticing royalty regime, quickly adopted by Alberta. The province takes just 1 per cent of gross revenues until an oil sands plant has recovered the billions of dollars it took to build the operation, a rate that then rises to 25 per cent of revenues minus costs.

The system, then and now, is among the world's most generous regimes.

And it worked: Oil sands production reached one million barrels a day in 2004 – a milestone that had been forecast for 2020. According to current projections, by 2020 the oil sands could produce four million barrels a day, which would make Canada the No. 4 oil producer in the world behind Saudi Arabia, Russia and Iran.

While the royalty regime was a spark for the boom, it is one of several important factors that attracted billions of dollars of investments. The most important element was the price of oil, which has surged fourfold. Among the other important changes is markedly improved oil sands technology, as well as fewer opportunities for large projects elsewhere.

For global oil companies, royalties are one component in a complicated equation with the key variable – oil prices – in constant and often extreme flux. Given this, even with Alberta looking at royalties, some of the world's biggest oil companies have made major moves since the review began. Statoil ASA of Norway, looking to expand beyond the North Sea, an oil region in decline, spent $2.2-billion in April for an undeveloped oil sands project, making Alberta its top international expansion priority. Royal Dutch Shell PLC has pinned much of its future growth on the oil sands, spending $8.7-billion this year to buy the part of Shell Canada it didn't already own, and this month it announced it is looking to spend an additional $27-billion to build a giant new upgrader to process raw oil sands output.

In May, Brian Straub, Shell's senior vice-president of oil sands, added his voice to the chorus of industry warnings but conceded higher royalties won't stop Shell. “They're not going to drive us out of the province,” he said to reporters after presenting to the review panel, “but certainly our ability to invest is put in jeopardy.”

CHAPTER ONE

FROM BUST TO BOOM … TO BUST TO BOOM

When Alberta became a province in 1905, natural gas had already been discovered around Medicine Hat, in the southeastern corner of the young jurisdiction. There was also an oil strike near Calgary in 1914 that sparked a mini-boom, but the frenzy fizzled quickly. However, for the fledgling province, most of the resources were still owned by Ottawa, as well as a small portion held by private hands.

It was not until 1930 that the federal government relinquished its ownership of regional natural resources to Alberta and the other western provinces.

At the onset of the Depression, Alberta was sparsely populated, mostly poor and dependent on agriculture. The initial royalty rate was set at a flat 5 per cent, not that it particularly mattered, as the province produced little oil and gas. The birth of the province's modern industry, and its launch to “have” province from long-time “have not,” came in the late 1940s, when a gusher of crude, and then another, were discovered near Edmonton.

The royalty rate was tinkered with several times and by the 1960s, the province had used its newfound status as a significant oil producer to demand more from energy companies, which at the time were mostly American. Royalties had been raised but the high end was capped at 16.7 per cent of gross revenues – which was undone in the early 1970s by then-premier Peter Lougheed as the price of oil jumped far higher after the Middle East flexed its new muscle.

Having unseated a government that ruled for more than three decades, Mr. Lougheed, a left-leaning Conservative who began the dynasty that still exists today, tied royalties more closely to the price of the commodities and jacked up the maximum rates past 30 per cent. Ron Ghitter represented downtown Calgary in those days and recently recalled the reception from oilmen in a radio interview. “They cried bitter tears,” he said, half-joking that he had to use back alleys to avoid confrontations.

But higher royalties didn't deter industry from chasing growth and riding soaring commodity prices. In the six years after royalties were raised, before the global energy boom of the '70s peaked, oil and gas production in Alberta remained strong, the number of wells drilled each year doubled and money spent to acquire new exploration rights exploded tenfold. The industry only came undone when commodity prices collapsed.

During the 1980s bust, the royalties scale began to tilt back, with programs created to encourage activity as the price of oil and natural gas remained low. In the early 1990s, desperate to spur new exploration, the government of then-premier Ralph Klein cut royalties, charging less than 10 per cent when prices were low or, significantly, when a well's output was modest.

Even with the last overhaul, a goal of taking 20 to 30 per cent for royalties was in place, and the province's take bounced around the low end of the range, averaging 22.4 per cent from 1995 through 2003. In 2002, seeing that 30 per cent was out of reach with the system as is, the province reduced its ambitions, cutting the range to 20 to 25 per cent.

The take continued to fall, slipping below the bottom end of the goal to 19 per cent in 2004, where it remains three years later. A senior Alberta Finance official warned in April that the figure could fall further. Industry says Alberta needs to recalibrate the goal, lowering it to align with what it says is the reality of a changing business.

This year's provincial budget acknowledged that the system as it stands will return citizens less each year, warning royalties could fall by a third to $6.6-billion in 2009-10 from the $9.8-billion received in 2006-07.

Part of the story behind the numbers is the fact that explorers have carefully combed over the Western Canada Sedimentary Basin since Leduc No. 1, the first big oil discovery in February, 1947. All of the easy oil and natural gas and most of the big hits have been uncovered, leaving each new find smaller than those in years past. Even just a decade ago, the typical oil or gas well was relatively prolific and many generated a high rate of royalties. But as the years passed, the average well's output fell. Initial production of a natural gas well today, for instance, is less than half of what it was in the mid-1990s.

So as the system Mr. Klein's government put in place sees more oil and gas wells paying citizens less, energy companies are still chasing profits furiously, emboldened by high commodity prices and testified by the more than 17,000 or so wells drilled in Alberta last year.

Even this year, during a slump, almost 13,000 holes are expected to be cranked into the earth. This slowdown, due to low natural gas prices and high drilling costs, is much less brutal than crashes of the past – and record oil prices has ensured the search for crude remains robust.

Compounding the money situation for the province is that royalties were capped at prices that are far lower than current market rates, though the cap was well above the market when the system was drawn up. Further exacerbating Alberta's new reality is the emergence of the oil sands and the low royalties paid there, steadily replacing higher royalties previously paid on conventional crude and natural gas.

CHAPTER TWO

THE MYTH OF PROFITABILITY?

While Alberta's royalties take sits at 19 per cent now, energy companies are making the biggest profits they have ever enjoyed, led by EnCana Corp., the sector's No. 1 player, which in 2006 made $6.4-billion, the largest profit in Canadian corporate history. Add on Suncor Energy Inc.'s $3-billion profit, and two large oil and gas companies made about as much in profit as the entire industry paid the province in royalties last year.

All in, the five most profitable energy companies in Canada saw their bottom lines shoot up more than 50 per cent in 2006 from 2005. And despite rising costs and other challenges, the trend is still very much intact.

PricewaterhouseCoopers, in its annual Canadian energy survey in June, said the positive trend is one that “we don't see changing any time soon.” EnCana's operating profit this year is up about 50 per cent from a year earlier and cash flow has climbed more than 20 per cent.

Canadian Natural in early August said its cash flow has surged 35 per cent higher to a record of $3.1-billion.

These results contrast with the main argument of industry, that energy companies are hardly as profitable as they appear to be and are in fact struggling with soaring costs and worried about eroding profit margins – so they simply can't afford an increase of royalties, adding that such a change would ruin Alberta's reputation as a dependable place to do business.

“It's a myth out there that this is a hugely profitable business,” Mr. Laut of Canadian Natural told the royalty review panel.

Mr. Laut routinely presents a different picture to investors. Canadian Natural next year will begin production at a $7.6-billion oil sands mine. In every presentation marketing the company, Mr. Laut said its Horizon project will produce a “wall of cash flow” of nearly $1-billion annually (with oil at $45 [U.S.] a barrel) that will be “sustainable for decades.”

Mr. Lougheed, whose blue eyes still sparkle, remains a champion of the people. At a luncheon at Rouge, a restaurant housed in the home of one of Calgary's founders, Mr. Lougheed – who as a boy watched his family lose his grandfather's home due to debts in the Depression – worried about the average person: “People are not having an easy time in this province that aren't tied into the oil industry.” Over a meal, he gave a primer to a group of British journalists visiting to tour the oil sands. Mr. Lougheed began with 1930, stressing that Albertans are the owners and oil companies lease rights to do their work.

He was specifically skeptical about the many costs deducted from gross oil sands revenues to produce the net number from which royalties are calculated. “My instinct,” he said, “tells me they've been allowing a system where the operators, the lessees, have been deducting too aggressively – and that has been hurting the royalty flow to the people of Alberta.”