June 28, 2007

Nuclear power too expensive

Think-tank also fears weapons proliferation

Reuters

June 28, 2007

Note: The report, Too Hot To Handle -- The Future of Civil Nuclear Power

will be published on July 3. (www.oxfordresearchgroup.org.uk)

LONDON -- The world must start building nuclear power plants at the unprecedented rate of four a month from now on if nuclear energy is to play a serious part in fighting global warming, a leading think-tank said yesterday.

Not only is this impossible for logistical reasons, but it has major implications for world security because of nuclear-weapons proliferation, the Oxford Research Group said in its report Too Hot To Handle -- The Future of Civil Nuclear Power.

The report fired a series of broadsides against the growing momentum for more nuclear-generated electricity to help cut climate-warming carbon emissions from burning fossil fuels.

"A world-wide nuclear renaissance is beyond the capacity of the nuclear industry to deliver and would stretch to breaking point the capacity of the IAEA [International Atomic Energy Agency] to monitor and safeguard civil nuclear power," it said.

The report comes less than a week after the World Energy Council -- the global organization of electricity generators -- said nuclear power had to be a significant part of the new energy mix both to beat global warming and guarantee security.

Nuclear power now provides about 16 per cent of a world electricity demand that is set to at least keep pace with the growth in population -- predicted to rise by more than half to 10 billion people by 2075.

The report said that if it was to play a significant part in curbing carbon emissions, nuclear power would have to provide one-third of electricity by 2075.

That, it said, meant building four new nuclear plants a month, every month, globally for the next 70 years.

Not only had top civil nuclear power France, which gets 78 per cent of its electricity from 59 nuclear reactors, never got remotely near that rate of construction, but the implications for wholesale weapons proliferation were overwhelming, it said.

"Unless it can be demonstrated with certainty that nuclear power can make a major contribution to global CO2 mitigation, nuclear power should be taken out of the mix," the report said.

The report said there were 429 reactors in operation, ranging from 103 in the U.S. to one in Armenia, with 25 more under construction, 76 planned and 162 proposed.

June 25, 2007

MPs call for Northern B.C. oil-tanker ban

Fear of spills could shut down shipping and drilling in 'voluntary exclusion zone'

SCOTT SUTHERLAND

Globe and Mail

June 25, 2007

VICTORIA -- Growing interest in routing new oil and gas pipelines to British Columbia's northern coast has some decades-old fears about oil spills bubbling to the surface again.

Natural Resources Minister Gary Lunn is fuelling those fears with comments that there is no moratorium on oil-tanker traffic on the West Coast because nothing was ever written down in the 1970s.

The minister said that doesn't mean an increase in such traffic would be allowed without oversight.

However, federal and provincial politicians want Ottawa to institute a full, formal ban on oil tankers in B.C. coastal waters, a move that is being backed by environmentalists and some first nations.

"There actually is no moratorium for [oil tanker] traffic coming into the West Coast," Mr. Lunn said.

There is what he called "a voluntary exclusion zone" that historically has applied to U.S. tankers carrying Alaska oil to terminals in Washington State through the Strait of Juan de Fuca

The strait separates the United States and the southern tip of Vancouver Island.

"This is something that was brought in quite a long time ago and is being respected."

But while denying there is any tanker moratorium, the Vancouver Island Tory MP said there is a ban on offshore oil and gas development "that's absolutely clear."

That was not good enough for Denise Savoie, the New Democrat MP for Victoria.

She presented a motion in the House of Commons calling on Parliament to reaffirm the moratorium on coastal drilling and to affirm a formal moratorium on international tanker traffic.

Ms. Savoie's motion seeks to ban international tanker traffic in the northern B.C. waters of Dixon Entrance, Hecate Strait and Queen Charlotte Sound.

Ms. Savoie said she wants parliamentary hearings with public participation on the issue when MPs return to Ottawa in the fall.

Such a ban would not affect the current shipping of oil and gasoline, mostly by barge and small tankers, to Vancouver Island and other parts of the coast.

"British Columbians feel the same way about it today as they did in the 1970s," said provincial New Democrat Rob Fleming. "They are opposed."

Mr. Fleming said a ban on both tankers and offshore development has survived eight prime ministers and nine B.C. premiers.

"What's changed in 30 years? Has the risk to our coastal waters been reduced?" he asked. "No, the science has not changed. The risk has not been reduced."

The issue has gained prominence mainly because of several proposals to construct pipelines linking Alberta with the coast at Prince Rupert or Kitimat. Crude oil from the oil sands would be pumped west for export, while "condensate" used to thin the thick crude in the pipeline would be removed and sent back eastward along a parallel pipe.

There is also a proposal that could see a liquefied natural-gas terminal built in Kitimat to accept cheap gas from Asia for distribution to North American markets.

"There's lots of talk and people trying to raise an issue, but there is nothing on the table at this point in time," said Mr. Lunn, reiterating that the Canadian government has not even been asked to consider any project so far.

If a proposal should come forward, he said, it would have to involve a comprehensive environmental evaluation, an assessment by Transport Canada and public consultation.

Environmentalists and first nations say any one of these schemes would inevitably lead to a high volume of tanker traffic through extremely sensitive coastal waters, including the channel where B.C. Ferries' Queen of the North sank.

Mr. Lunn's denial of the existence of a tanker moratorium exasperates long time anti-tanker crusader and former federal environment minister David Anderson.

"It doesn't make logical sense to say we did not commit to keeping tankers off the coast," said Mr. Anderson, the retired Victoria Liberal MP. "That is basically wrong. We did!"

The United States went to great lengths, and great expense, to route tankers bound from Alaska well away from Canadian waters, he said.

"Why would they have done all that to protect the Canadian shore unless Canadians were willing to do the same to protect their own coast? I mean, it just doesn't make sense."

He warned that if Canada were to permit tankers to enter B.C.'s northern waters, there would be an immediate call to increase oil exports though Vancouver.

Mr. Anderson, who fought the tanker issue in U.S. federal court in the 70s and won, is worried about the message Mr. Lunn and the Harper government would be sending to the Americans if Canada does anything that deviates from a policy that for decades has kept tanker traffic to a minimum.

"I don't think it's good news to give Americans cause to say Canada acts in bad faith," he warned. "If you are dealing with Americans, you should be pretty straight forward and honour your agreements."

Ironically, Mr. Anderson said, it was the tanker ban that was the catalyst for the companion moratorium on offshore oil development that is still being acknowledged by the federal Conservatives.

"If they succeed in allowing oil tankers along the coast, it brings us much closer to lifting the moratorium on oil and gas exploration and drilling once the means of transporting oil is established," said Ken Wu of the Western Canada Wilderness Committee, a group that has campaigned to keep the ban in place since the B.C. Liberals came to power.

June 22, 2007

Flathead: Fish odyssey may help sink energy development plan

The impact of the potential mine on downstream could be devastating

Randy Boswell

CanWest News Service

Thursday, June 21, 2007

The cross-border sexual odyssey of six fish from northern Montana to southern B.C. could help sink a planned multi-billion-dollar Canadian energy development that has spawned years of conflict between the U.S. and Canada.

A half-dozen cutthroat trout captured on the Flathead River south of the B.C.-Montana border and fitted with radio transmitters were tracked by researchers as they swam to spawning beds in Canada, giving hope to both American and Canadian critics of a proposed B.C. coal mine that efforts to protect the trout's trans-boundary travels will help scuttle the controversial project.

"The potential downstream impacts of mining development in the Canadian Flathead can be difficult to comprehend in terms of long-term water quality degradation," one Montana newspaper has editorialized.

"But the impact of mining on fish is a more tangible matter. And that's why it's so gripping to look at recent findings about the relationship between Montana fisheries and Canadian waters . . . Make no mistake: Montana fish will bear the brunt of mining development in the Canadian Flathead."

WILDLIFE STUDY

As part of a Montana Wildlife Department study aimed at gathering evidence of possible downstream damage from the proposed mine, state scientists surgically implanted transmitters in 14 fish captured near Kalispell, about 100 kilometres south of the border.

The monitoring revealed that six of the adult cutthroats moved up the Flathead's north branch and into Canadian territory to reproduce at sites not far from Cline Mining Corp.'s proposed open-pit coal mine.

"The fish don't know these political boundaries," Clint Muhlfeld, a fisheries biologist with Montana Fish, Wildlife and Parks, told CanWest News Service Wednesday.

"They've evolved here since the last glaciers melted 13,000 years ago. This research shows they need the entire watershed to complete their life history."

The Flathead River -- which has its headwaters in southeast B.C. near the Alberta border but flows south through northwest Montana before spilling into Flathead Lake -- has for decades been a source of conflict between environmentalists determined to preserve its "pristine" upper valley and energy companies hoping to exploit the drainage basin's rich supply of coal and methane.

A coal mine proposal in the 1980s was rejected after a panel under the International Joint Commission responsible for shared U.S.-Canadian waterways ruled the development could adversely affect fish populations.

Cline's proposed Lodgepole mine, located about 50 kilometres south of Fernie in the Flathead Valley, would produce an estimated two million tonnes of coal per year over the mine's 20-year lifespan, generate hundreds of jobs and some $3 billion.

Although the company has tried to reassure critics that its economic objectives would be carefully balanced by measures to protect the Flathead ecosystem, the proposal has sparked opposition on both sides of the border.

Currently under environmental review in B.C., the planned mine has been denounced by Canadian and American nature groups as ecologically ruinous and has drawn fire from Montana officials who say there's a risk to water quality along the U.S. stretch of the river.

A separate proposal from the energy conglomerate British Petroleum to extract coal-bed methane from the area has added to concerns in Montana about the Flathead's future.

Meanwhile, B.C. and Montana water resource management officials have been struggling to work out a contentious trans-boundary agreement that would eventually govern development and conservation plans within the river's drainage area.

"This most recent study pretty much confirms the movement of fish across the border," Mark Angelo, rivers chairman of the B.C. Outdoor Recreation Council, said Wednesday.

"It's one more piece of evidence to support the position that so many people have. You can go all along the Canada-U.S. border and there is no other region that sustains such a diversity of wildlife."

Angelo added: "The public response to the proposed mine has been overwhelmingly negative.

We don't need to industrialize another landscape."

ENDANGERED RIVER

In March, the council ranked the Flathead No. 1 on its annual list of B.C.'s most endangered rivers because of the proposed Cline development.

At the time, Cline vice-president Gordon Gormley insisted that no one should prejudge the mine application at such an early stage of its environmental assessment.

"The B.C. standards for mine development . . . are more than adequate and strenuous in terms of the objectives we must meet," he said. "We have a system that works in B.C."

Muhlfeld said he and other Montana wildlife officials -- in co-operation with first nations representatives on the Canadian side of the border -- will continue studying the Flathead watershed to gather more information about both the cutthroat and bull trout, a vulnerable species in the U.S. that is also thought to spawn regularly in B.C. waters.

Muhlfeld said he believes the cutthroat trout "are moving across the border because they're from there; they were born in Canada" and the Flathead's north branch offers "the best intact habitat areas for spawning."

© The Vancouver Sun 2007

Flathead River trout spawn north of the border

Associated Press

The Missoulian

18-Jun-2007

KALISPELL - Some westslope cutthroat trout that live in the Flathead River spawn in Canada, state wildlife officials say, meaning protecting fisheries will be a central issue in an effort to prevent Canadian companies from mining coal or drilling for coal-bed methane north of Glacier National Park.

Montana Fish, Wildlife and Parks researchers captured 14 westslope cutthroat trout on the Flathead River between Kalispell and Columbia Falls and fitted them with radio transmitters.

Two weeks ago, there were six adult cutthroats spawning north of the border in British Columbia. Last week, two remained.

“Four have moved out and are back in the river” near Polebridge, said research specialist Durae Belcer, who has been flying the North Fork Flathead drainage, tracking the cutthroats.

There have been similar results in three previous years of tracking tagged cutthroat, said Clint Muhlfeld, a state fisheries biologist who is leading the research.

“Every year that we’ve tagged cutthroat in four years we’ve had cutthroat spawning in B.C.,” Muhlfeld said.

The tracking results are part of an increased effort to gather biological information in the Canadian Flathead because of a looming potential for energy development.

Concerns about mining impacts have been heightened recently by news that the energy conglomerate British Petroleum is seeking a permit to pursue coal-bed methane exploration in the Canadian Flathead.

The fisheries research also shows bull trout use the Canadian Flathead extensively, Muhlfeld said.

FWP research also has involved bull trout spawning-bed counts in the upper tributaries of the Canadian Flathead.

Last fall’s count came up with 75 bull trout “redds” in a two-mile stretch just below the Flathead River’s convergence with Foisey Creek, the drainage where the Cline Mining Corp. is proposing an open-pit coal mine.

“That tells us that a lot of fish that are spawning in British Columbia are spawning right below Foisey Creek,” Muhlfeld said.

Muhlfeld’s crew also undertook electrofishing surveys in Foisey Creek and two converging tributaries. The survey found 74 cutthroat, 18 bull trout and 93 sculpin in Foisey Creek.

“We did these intensive surveys to document what was there,” Muhlfeld said.

That is the main goal behind a broader ongoing baseline data study aimed at determining existing ecological conditions in the transboundary Flathead. The work, focusing on water chemistry, sediment measurements, fisheries and wildlife, will enable Montana to demonstrate impacts should energy development proceed in the Canadian Flathead.

See also:

Flathead Wild

Citizens Concerned about Coalbed Methane

The Flathead Coalition

June 21, 2007

Customers, 1; fish, 0

A mad scramble to meet Northwest energy demands forces the BPA to make a tough -- and illegal -- call to put salmon protections second

MICHAEL MILSTEIN

The Oregonian

Thursday, June 21, 2007

The crisis grew clear after midnight when the display in front of Cathy Schaufelberger showed her that power could soon run out for untold numbers of people.

She was halfway through a 12-hour shift April 3 at the Bonneville Power Administration, managing electricity pulsing from Columbia River hydroelectric dams.

Just two choices loomed: Adjust dam turbines to boost power, thrashing and possibly killing federally protected salmon; or cut off people's power just as they turned on heaters and furnaces amid a cold snap.

The BPA, in a series of faulty calculations days earlier, had sold power companies more electricity than it could draw from the dams.

And its marketers couldn't buy enough back to cover the shortfall.

Schaufelberger, in urgent phone calls as dawn approached and power demand rose, learned the BPA had no procedure for what to do. So she and co-workers finally made the call -- for people.

"That is, unfortunately, an issue we have been dodging for about five years," supervisor Steve Kerns had told her at 4:21 a.m.

The BPA action violated federal commitments to operate the dams with minimum harm to young fish headed for the ocean.Transcripts of the anxious phone calls emerged recently in a landmark federal court case weighing the fate of threatened Columbia River salmon against the region's rising need for hydroelectric power.

U.S. District Judge James Redden, who is overseeing the case, learned what happened only through an anonymous phone message left at his Portland chambers. He was upset, having already lost patience with repeated federal failures to address the damage dams do to salmon.

"Apparently, BPA's sales commitments to customers always trump its obligation to protect (Endangered Species Act)-listed species,"

Redden wrote in a stern order afterward. "This was a marketing error and ESA-listed fish paid the price. This, the law does not permit.

"Under the circumstances here, threatened and endangered species must come before power generation," he wrote, ordering that from now on dams be operated with full salmon safeguards and he be notified of any deviations.

He directed the BPA to distribute his order to all employees with duties involving the dams.

The April episode highlights the delicate balance within the region's energy supply, where one miscalculation means either harming salmon or blacking people out. It's a hard reality hidden from a public that depends on power from dams, but all too obvious to the people dealing with it April 3.

Running out of ideas

"I don't have any more rabbits to pull out of the hat,"

Schaufelberger told supervisor Cindy Hutchison after waking Hutchison up at 3:55 a.m.

A half hour later, Schaufelberger told BPA dispatchers there was no power to buy from other utilities. Coal and natural gas power plants that might otherwise provide backup energy were shut down while their owners used cheap hydropower instead.

"We've tried everything everywhere to purchase and at any price -- no one has anything to sell us," she said.

"I am desperate for generation," Schaufelberger pleaded with an operator at John Day Dam at 4:46 a.m.

The dam operator laughed, according to a transcript.

"If I had more, I'd give it to you," he said. "But I've got no more."

Dams on the Willamette River, in Idaho and even Montana were maxed out on power. Finally the BPA persuaded operators at Bonneville, The Dalles and McNary dams to adjust their turbines to produce more energy -- though it harms fish drawn through them.

After getting the anonymous message a week later, Redden demanded that federal officials explain what happened.

Too much power sold

They told him the BPA had been selling lots of surplus power as Grand Coulee Dam released extra water to bring lake levels down for fish.

But an analyst overestimated the BPA's April 3 power supply and the BPA sold more energy than it would actually generate, officials explained in court documents.

On top of that, colder temperatures suddenly forced power demands higher.

Once BPA marketers realized the problem, they spent $1.1 million buying back power to make up for $382,253 worth of energy they sold earlier, court documents say. But that still wasn't enough.

The BPA did not want to cut off power to utility companies because they might then have to black out customers -- a threat to public health and safety, BPA Vice President Steve Oliver said in a court filing.

So instead, the BPA overrode fish protections for two hours at McNary Dam, four hours at The Dalles and one hour at Bonneville. The move produced about $50,000 worth of extra energy, Oliver wrote.

"What happened April 3 was a rare, unplanned and unexpected event that occurred during a narrow window of time due to a series of unfortunate circumstances," BPA spokesman Michael Hansen said this week. A BPA team is examining how to better handle emergency situations such as the one April 3, he said.

That could involve finding ways to halt power deliveries from dams in critical conditions, he said.

Federal officials said injury to salmon April 3 was likely minimal because few fish move past the dams so early in the season, and many of those go around the turbines, not through them.

Judge unconvinced

But Redden didn't buy it, saying the already "dangerously low rate of returning adult fish" makes each one that much more important.

The judge said there's no reason to think the BPA would have handled the situation differently even if salmon numbers had been at their peak. He cited Oliver's statement that if the BPA did not find extra power to meet its sales obligations, an automatic control system would increase energy output from dams to meet demands.

If fewer salmon were hurt thanks to the season, he wrote, "that result is more likely a product of good fortune rather than reasoned decision-making or planning."

June 10, 2007

Role of major north slope producers unclear with signing of AGIA

COMMENT: Interesting comments about the waning popularity of the oil and gas industry in Alaska, corruption, Mackenzie Gas Pipeline, and nosing at the question as to how much subsidy and bribery it takes to get a major pipeline project built.

See also these somewhat related articles, Pipeline Canada and Stumping for VECO

There is more than you will ever want to read about the Alaska Gasline Inducement Act (AGIA) at Governor Sarah Palin's AGIA website (www.gov.state.ak.us/agia/)

AGIA is a set of inducements to companies to build a pipeline to move natural gas from Alaska's North Slope to "markets" - either LNG shipping to the continental US or through Canada to Alberta pipeline connections, with at least five delivery points in Alaska itself. The economic analysis used to build the AGIA is 4.5 billion cubic feet per day and a cost of US$20.5 billion (ahem). There are 35 trillion cubic feet of proven reserves in the North Slope and many more waiting to be discovered.

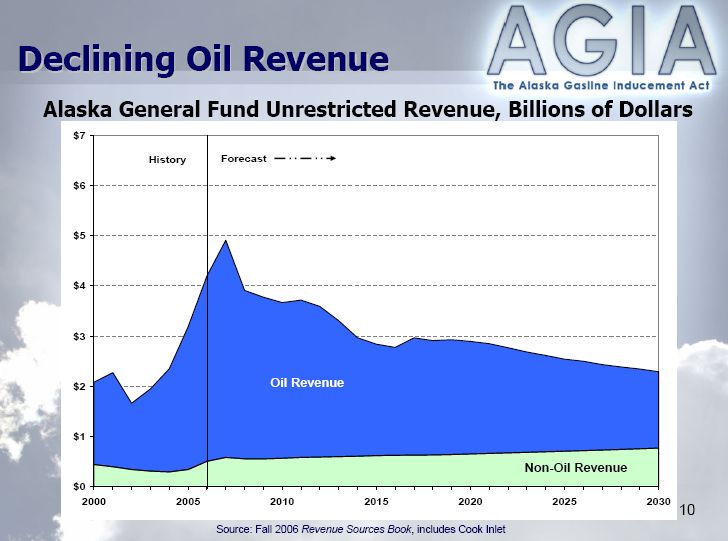

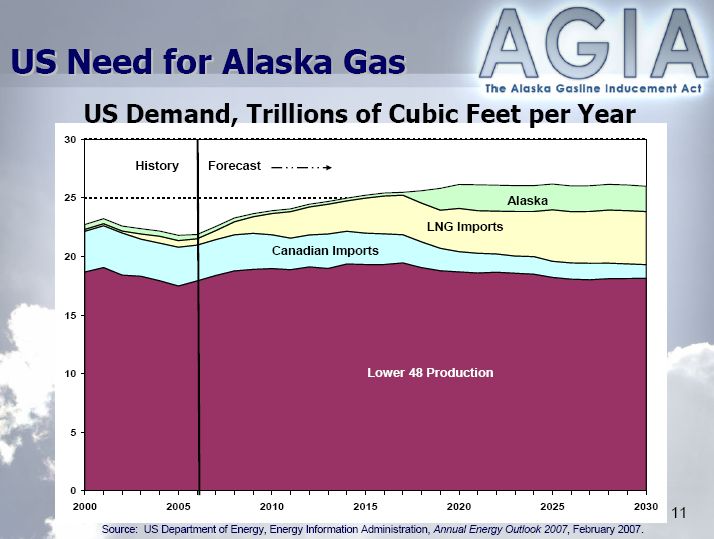

Here are a couple of charts showing Alaska's forecast decline in oil revenues and where the US expects to get its gas from in the next 23 years. 23 years - that's not a very long period of time, is it?

Role of major north slope producers unclear with signing of AGIA

Bill McAllister

KTUU Television

June 9, 2007

ANCHORAGE, Alaska -- The Alaska Gasline Inducement Act is now law. Gov. Sarah Palin signed the potentially historic legislation last night, setting up a competition to build the natural gas pipeline. But as Alaska moves into uncharted territory, the role of major north slope producers remains a big question mark.

The oil industry as a whole has fallen from the lofty perch it once enjoyed in public opinion polls in Alaska. One prominent public official says the recent corruption scandal involving oilfield services company VECO has tainted the producers as well. The producers have said they will not submit a bid under AGIA, but if they change their minds, they can expect to be under a strong spotlight.

"We cannot move the project forward if it is not commercially viable. AGIA, as written, does not provide for a commercially viable project," said Marty Massey, Exxon Mobil.

Before AGIA became law last night, all three of the major north slope producers testified before the Legislature that they would not compete for the rights to build the natural gas pipeline.

No one from BP, Exxon or Conoco Phillips would comment today, but one legislator says he expects them to change their minds.

"I'll be greatly surprised if they do not bid. They know this is an enormously profitable project. This is a project that will take their gas to market. I don't think they're going to stand on the sidelines and let someone else build that pipeline," said Sen. Hollis French, D-Senate Judiciary Chair.

But if the producers do compete, it will be in a climate in which they face new negative feelings and suspicions in the public.

Last month Ivan Moore Research found that public sentiment was barely in favor of the oil industry, with a positive rating of 44.8 percent compared to 43.1 percent negative. That's a drop from a positive of 53.3 percent in July 2005 and 76.4 percent in October 2001. Pollster Moore says that a slight recent drop in the numbers might be the result of the public corruption scandal involving guilty pleas by former executives of oilfield services company VECO.

"Clearly I think you've got the perception out there in the public that there's a degree of complicitness in the whole affair, which is driving down the popularity of the industry as a whole," said Ivan Moore.

A longtime critic of the industry, former legislator Jim Whitaker, who heads up the Alaska Gasline Port Authority, says the suspicion is warranted.

"If you've got a crooked politician, run his fanny down the road. Get rid of him. If they take money from the oil industry, it's tainted money. That money comes with a price tag associated with it. I've seen it. If you took money from the oil industry or from VECO or from contractors who work for the oil industry, it's clear, they expect you to respond to their requests for favorable legislation," said Whitaker.

But Sen. Hollis French, a former prosecutor, says there's no evidence to implicate the producers.

"It's a bit like blaming the Sierra Club for something that Greenpeace did. Obviously BP and Exxon and VECO have the same objectives and the same goals, but without some evidence, without an e-mail, without a document, without a wired phone call to show collusion, I think it's a stretch to say that BP and Exxon are responsible for what VECO did," said French.

The producers have no comment on any of that, either, and now Alaskans will have to wait for their next move.

During the ceremonial signing of AGIA on Wednesday, Fairbanks Rep. Jay Ramras noted the recent statement by the CEO of Exxon that neither the Mackenzie Pipeline in Canada nor the Alaska project is economic. Ramras says that indicates that Alaskans are in for a period of struggle with the producers.

Sen. French added his name to the list of politicians calling on Rep. Vic Kohring to resign.

Kohring himself put out a news release today saying he would announce his decision to the Wasilla Chamber of Commerce on June 19. In the news release Kohring acknowledged the increasing pressure for him to step down, but he said if he does so, it will not be an admission of guilt.

Contact Bill McAllister at

www.ktuu.com

A delicate balance between Slope's gas, oil

When Slope's gas is tapped, its oil must be protected, commissioner warns

By WESLEY LOY

Anchorage Daily News

Published: June 10, 2007

Over the Memorial Day weekend, Cathy Foerster and her husband flew to St. Paul Island, in the middle of the Bering Sea, and saw an abundance of Lapland longspurs, gray-crowned rosy-finches, rock sandpipers and even a great knot blown in from Asia.

"I confess -- Jane Hathaway and I are birders," said Foerster, a Texas-raised oil engineer and a fan of that old TV show "The Beverly Hillbillies."

Lately, Foerster has a bird of a different kind on her mind -- the North Slope oil reserves, or what she calls our "bird in the hand."

Her message is that Alaskans need to take great care not to kill that bird by rushing to produce our "bird in the bush" -- the natural gas that sits in the same fields as the oil.

Foerster, 52, a member of a state agency called the Alaska Oil and Gas Conservation Commission, has been on the speaking circuit lately, talking with considerable urgency to the Legislature, industry groups, even a local Lions Club.

Ignoring for a moment some complex technical details, her message is pretty simple: If we build a multibillion-dollar natural gas pipeline and start shipping gobs of gas, as many Alaskans have so long desired, we risk stranding millions upon millions of barrels of valuable crude oil deep underground. Forever.

And that could cost Alaska dearly.

The good news is Foerster and other experts see ways to avoid this costly tradeoff -- in short, a way to enjoy our bird in the hand and catch the bird in the bush too.

Foerster and her fellow members on the oil and gas commission -- lawyer John Norman and geologist Dan Seamount -- are key state decision-makers in planning for a gas pipeline to the Lower 48.

One of the agency's main jobs is to prevent waste -- that is, it aims to make sure every possible drop of oil and molecule of natural gas are wrenched from the rocks.

Two fields hold the bulk of the North Slope's estimated 35 trillion cubic feet of gas: Prudhoe Bay, the nation's largest oil field, with about 24 trillion cubic feet, and the undeveloped Point Thomson field to the east with perhaps 8 trillion.

At Prudhoe, gas plays a huge role in producing oil -- and that's why state regulators and the oil industry must think carefully before piping away the gas, Foerster said.

UNDER PRESSURE

The geologic structure that holds Prudhoe reserves is built kind of like a layer cake -- a layer of water on the bottom, a layer of oil next, topped by what is called the gas cap.

Over its nearly 30-year history, drillers have pierced those layers with some 2,600 holes. Production wells send a mixture of oil, gas and water to the surface, where they are separated.

Now here's the most important thing, the point Foerster wants you to hear: Most of that gas is shot back down into the ground, where it serves to keep pressure in the oil field and to keep the oil from migrating upward into "dry" rock, where it tends to stick like glue.

The pressurizing gas forces out more oil. It's like the aerosol in the can, Foerster said. The fizz in your soda pop.

To impatient Alaskans, Prudhoe's gas isn't going to market and thus isn't generating tax dollars and worker paychecks. But it's indirectly creating great wealth.

"That gas up there, it's doing all the heavy lifting to get the oil out," Foerster said.

STRANDING AN OIL FORTUNE

With Gov. Sarah Palin courting companies to build a gas line, the oil and gas commissioners are taking steps to determine how much natural gas can be siphoned off without significantly harming oil production.

Prudhoe, which is entering old age, still holds an oil fortune -- an estimated 2 billion barrels. The commission wants to make sure as much of that as possible is produced before significant gas is removed, Foerster said.

The agency recently hired an engineering consultant, Blaskovich Services Inc. of Aptos, Calif., to help study the impact of major gas sales on Prudhoe.

The commission in 1977 set a limit on how much gas producers could withdraw -- 2.7 billion cubic feet per day. The thinking then was that a gas pipeline would be built right away, and nobody expected Prudhoe would still be producing oil today, Foerster said.

Commissioners believe they might have to adjust this limit in light of the significant oil remaining in Prudhoe, the need for gas to help push it out, and the fact that builders want a pipeline capable of carrying as much as 4.3 billion cubic feet a day.

Commissioners have scheduled a June 19 hearing to discuss the consultant's report.

A decision on how much gas can leave Prudhoe is years away. First, the commissioners need to know when a gas pipeline will start operating, what volume of gas it will carry and how much oil is left in the field.

Gordon Pospisil, technology and resource manager for BP Exploration (Alaska) Inc., which runs the Prudhoe field, said he doesn't see a big oil sacrifice coming.

"We're very well-positioned to maximize oil recovery and produce the gas," he said.

AN ACE IN THE HOLE

One major recommendation from consultant Blaskovich is for oil companies to produce as much oil as possible from Prudhoe before a gas pipeline comes online. That's not expected for at least eight years.

The consultant also said it's important to avoid oil field breakdowns, such as last year's corrosion-related pipeline leaks, which can interrupt oil production.

The equation is simple: The more oil that's produced now, the less left stranded once major gas shipment begins.

Pospisil said his company has done many things to juice oil production now. These include drilling more wells to tap the oil, installing bigger compressors to force gas back underground, and flooding the field with billions of gallons of seawater to flush out oil.

An important thing to remember, he said, is that Prudhoe engineers already have achieved "a world-class production level" from the field, recovering 11.5 billion barrels, or about 50 percent of all the oil originally trapped in Prudhoe's porous rocks.

Once gas production begins, field engineers will have a potential ace in the hole -- carbon dioxide, which will be separated from the natural gas coming out of the ground. Engineers believe they can shoot this waste gas underground to force out oil, Pospisil said.

While some tradeoff in oil production is almost certain, Foerster agrees Prudhoe likely will be ready for a gas pipeline, so long as oil is produced steadily before gas line startup.

THE POINT THOMSON PUZZLE

When it comes to Point Thomson, Foerster is worried.

State officials and industry players agree the gas in Point Thomson -- about a quarter of the North Slope total -- is vital to make a pipeline project costing $20 billion or more pencil out.

But the Point Thomson field is different from Prudhoe, and not as well understood. Much technical analysis is needed to determine the effect of producing its gas, Foerster said.

Most people regard Point Thomson as a gas field, but what concerns the oil and gas commissioners is the fate of its sizable reserves of liquid hydrocarbons -- estimated at several hundred million barrels.

"We're talking about an Alpine field or two," said Foerster, referring to Alaska's third-largest oil field.

The question has been complicated by legal wrangling in which the state is trying to revoke leases Exxon Mobil Corp. and other companies hold for failure to develop Point Thomson since its discovery 30 years ago.

Daily News reporter Wesley Loy can be reached at wloy@adn.com or 257-4590.

June 03, 2007

Alcan bid prepared by Norsk Hydro

Takeover battle involving Montreal aluminum producer said to widen

By Robert Daniel

MarketWatch

May 28, 2007

TEL AVIV (MarketWatch) - Norsk Hydro, the Oslo energy, power and metals company, is preparing a more than $30 billion bid for Montreal aluminum producer Alcan Inc., the online edition of Canada's Globe and Mail reported on Monday.

The bid would compete with a $27 billion hostile bid for Alcan disclosed by Alcoa on May 7. And it would heat up and widen an already busy fray surrounding Alcan.

A number of companies have been mentioned as possible suitors for the Montreal aluminum producer.

And analysts have raised the prospect that Alcan could execute what's known as a Pac-Man defense, in which it turns around and bids for Alcoa, its bigger rival.

Alcan has rejected Alcoa's $73.25-a-share cash-and-stock proposal as inadequate and uncertain. The bid price was a 20% premium to Alcan's closing price at the close of the prior trading day.

Alcoa has said it acted after pursuing a friendly merger for two years. And it said on Wednesday that its bid price was "full and fair."

On Friday, Alcan said in a Securities and Exchange Commission filing that management and the board "have not foreclosed any options." Alcan said the board would consider a new Alcoa proposal "that made sense for our shareholders" but "certainly not under the currently proposed terms and price."

Alcan also has said it's in talks with third parties on its alternatives.

Norsk Hydro is owned 43% by the Norwegian government, and it can look for support to the government's $292 billion pension fund, which it built with North Sea oil revenue, the Globe and Mail reported. Norsk Hydro's current aluminum division accounts for 4% of world output of the metal, the paper reported.

Other mining giants, including Australia's BHP Billiton, are considering competing for control of Alcan, the Globe and Mail said. On Monday, shares of Rio Tinto and BHP Billiton were up in Sydney trading amid speculation that the mining groups could be preparing separate bids for Alcan.

The Sydney Morning Herald and the Age reported Monday that Rio Tinto, the world's No. 3 miner by sales, hired Deutsche Bank AG to advise it on a possible takeover bid for Alcan. A Rio Tinto spokesman declined to comment on the issue.

Last week, the Globe and Mail reported that BHP had initiated talks with Alcan. The bid is believed to be still in the early stages, or roughly on par with other companies that have made preliminary expressions of interest in the aluminum giant, the Sydney Morning Herald report said.

In addition to bids by Rio Tinto and BHP Billiton, Australian media reports said other potential suitors for Alcan also include Brazil's Co. Vale do Rio Doce, the U.K.'s Anglo American, of Switzerland and Russia's Rusal. The reports also said Chinese companies and private-equity groups could emerge as potential bidders.

Alcoa and Alcan together would have revenue of more than $54 billion and would easily hold the rank of the world's No. 1 aluminum producer.

End of Story

Robert Daniel is MarketWatch's Middle East bureau chief, based in Tel Aviv.