December 25, 2007

Liquefied natural gas poised to surpass oil as energy source

By Leah Bower, Special to Gulf News (Dubai)

http://archive.gulfnews.com/articles/07/12/25/10177107.html

December 24, 2007

Oil may be the energy source on everyone's mind right now, but there is a good chance that liquefied natural gas (LNG) will surpass it as oil prices remain astronomical.

Once a bit of a backwater in the energy field, demand for LNG has been on a steady rise because it is relatively clean burning and because its liquefied state allows for transport to remote locations without construction of elaborate and expensive pipeline networks.

And while it can't hold a candle to oil's price, quite a few analysts seem to see it as the bandwagon of choice to jump on to.

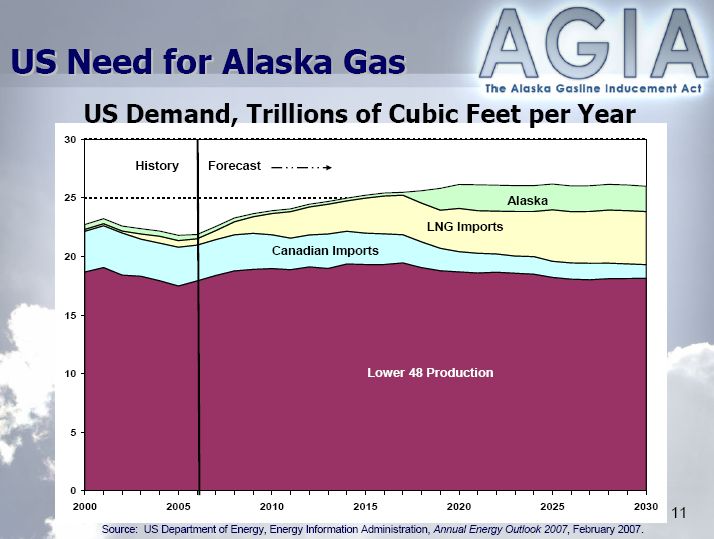

Worldwide demand for LNG during the first half of 2007 was pegged at roughly 115 billion cubic metres (bcm), roughly nine per cent growth over the same period in 2006, and demand in East Asia has been growing even faster.

Calgary-based Ziff Energy says it expects demand for natural gas in North America will rise by 1.8 per cent a year through 2015, and US Energy Department data backs up that claim, reporting that they expect imported LNG to increase from three per cent of total gas consumption to 14 per cent by 2020.

Currently, Japan is the world's largest LNG consumer, importing 81.86 bcm of natural gas as LNG in 2006. South Korea is second and the US currently ranks as the fourth-largest consumer.

LNG is natural gas, but it is reduced to a liquid state by cooling it to about minus 160° Centigrade, which reduces the volume of the gas by about 600:1 and makes transportation far simpler. Before it can be used, LNG must be returned to its gaseous state at a regasification plant. For countries like Qatar, which is sitting on the world's largest natural gas reserves - 25 trillion cubic metres - the renewed interest in LNG is a boon, since there is no need for pesky pipelines that travel through neighbouring countries before reaching their destinations.

Just ask the Europeans, who saw their natural gas get cut off in early 2006. Russia, where the pipeline originated, and Ukraine, which hosted part of the pipeline, had a price dispute. The two countries disagreed and so did the Europe's energy supply. The dispute even resurfaced in 2007, although the gas continued to flow this time.

So LNG, with its ability to be shipped by sea or land, is slowly building a power base. And people like Qatar's Energy Minister, who once said it was "bad news" that the country only had gas reserves and no oil, are starting to change their tune.

The International Energy Agency (IEA) reported that by 2010 Qatar could own 20 per cent of the global LNG market.

Other countries with reserves are hopping on board as well.

The Australian government expects energy production growth down under will be led by LNG, with exports of the fuel set to grow by more than seven per cent yearly, through 2030. That would have LNG output rise from less than 16 million metric tonnes in 2007, to 24 million by 2012, and possibly reaching as high as 76 million by 2030 as new projects come online.

Without the ability to ship liquefied natural gas, this type of growth would have been almost inconceivable. Already the $16 billion) North West Shelf venture is expanding LNG capacity, while Perth-based Woodside is building the Pluto project, also in Western Australia.

Chevron is planning to expand its $10 billion liquefied natural gas project known as Gorgon, which now calls for three liquefaction production lines, instead of two. Inpex Holdings and BHP Billiton are also proposing new plants.

Get on board while the year is new.

The writer is a freelance journalist based in Alaska, USA.

Russia’s Big Energy Secret

Putin wields gas as a weapon. But the reality is that Russia can barely meet its own growing demand.

By Owen Matthews

NEWSWEEK

Dec 22, 2007

Not Enough in the Pipeline: An oil and gas plant in Novy Urengoy, Russia. EPA-Corbis

Gazprom, the Russian natural-gas giant, is often portrayed as the 1,000-pound gorilla of the energy world. Over the past few years, the company has had huge success in locking in lucrative European markets. It has also been ruthless about making consumers in the former Soviet Union pay something close to world prices for their gas—cutting off supplies, if necessary, to force reluctant customers like Ukraine to pay up. But problems are brewing. Gazprom, it turns out, has too many customers, and too little gas.

The surprising Achilles' heel of Gazprom is that it produces only about 550 billion cubic meters (bcm) of gas—just enough to supply its own domestic market. It relies on cheap imports from Central Asia to meet the majority of its other commitments to customers in Europe, amounting to nearly 80bcm. And since only Gazprom's foreign customers pay full market value, it's the company's exports which make up the bulk of Gazprom's revenues—$21 billion for the second quarter of 2007 alone. Now those nations on which Gazprom's profits rely—including Turkmenistan, Uzbekistan and Kazakhstan—are beginning to cut their own deals with big new customers like China. The deals are in turn becoming an existential threat to Gazprom, one of Russia's most valuable strategic levers of power.

Russian control of a quarter of Europe's gas supplies is a key plank of its foreign policy and renewed national pride; supply of cheap electricity and heat to Russian homes is a touchstone of the Russian government's credibility. Central Asia is now undermining both those fundamentals—and could threaten Vladmir Putin's petro-politics.

Gazprom hasn't opened up a new gas field since 1991, and its existing fields are dwindling. A recent report by the Russian Industry and Energy Ministry warned that if the decline continued, Russia may be unable to service even its own domestic gas needs by 2010, and recommended doubling prices, a conservation move that has upset business and could also put a damper on economic growth.

Meanwhile, Gazprom chairman Dmitry Medvedev—also first deputy prime minister and Vladimir Putin's anointed successor for the next presidential elections in March 2008—has announced a radical plan to revive the company's domestic production, investing $420 billion in exploration and new gas-production facilities.

Relying on cheap imports to supply foreign customers is nothing new for Gazprom; for years the company's been buying gas from the Central Asians for knockdown prices. Until earlier this year, Gazprom was paying just $65 per 1,000 cubic meters to the Turkmens—then selling the same gas to customers in Western Europe who pay up to $250 (possibly only because of Russia's pipeline monopoly). Now ''Russia's monopoly is under attack," says Steve Levine, author of "The Oil and the Glory," a study of Central Asia's energy politics. ''Other neighbors are starting to build pipelines, and local producers are getting smarter, too."

No threat is more potent than that of China's move into Turkmenistan. Last year China's President Hu Jintao signed a deal with the late Turkmen leader Sapurmurat Niyazov to buy 30bcm of Turkmen gas each year for the next 30 years, and finance a giant new gas pipeline to China's Xinjiang province. That's in addition to a deal signed with Iran in March, which promises 14bcm a year of Turkmen gas to Tehran. At the same time, the Turkmens have also signed a deal with Russia for 50bcm a year until 2009. ''There's no doubt that Turkmenistan has promised to sell more gas than it can feasibly pump," says one top U.S. diplomat in the region not authorized to speak on the record. ''The question is, which customer will they choose?"

A lot rides on that choice: no less, in fact, than the future of Russia as an energy superpower. But Gazprom insists there's no problem. ''We do not consider China to be a threat or a competitor in Central Asia," says Gazprom spokesman Igor Volobuyev. ''We have a 25-year, long-term contract with the Turkmen government; they are obliged to fulfil their responsibilities. Our contract with the Turkmens is longer than any of our contracts with our European customers." Putin earlier this year assured Gazprom customers that ''there is complete certainty that Russia will fulfill all its contracts."

Europeans now fret about possible shortages, even as Americans are gleeful. It's no secret that the United States would like to put a dent in Russia's stranglehold over the region's energy resources—as well as shake Putin's ''complete certainty" a little. The diplomatic code word is "encouraging diversity of supply"; deciphered, that means encouraging any and every other pipeline project that bypasses Russia. ''It's one of those areas where we and Beijing see pretty much eye to eye," says the U.S. official in the region. ''The more export routes there are, the happier we'll be."

To that end, the United States is encouraging a number of pipeline projects that cut Russia out of the loop; only one has been built so far, connecting Baku, Azerbaijan, to the energy-rich Caspian direct to the Mediterranean—but the United States hopes that others will follow. Needless to say, Moscow is working hard to keep its monopoly from being undermined. It most recently signed a new deal with Kazakhstan this past September to build a pipeline on the Caspian coast to Russia.

For the Central Asians themselves, selling energy is more than a matter of dollars and cents; it's about winning real independence from an old colonial master. One Kazakh government minister—who didn't wish to have his name used while criticizing Russia—recalls a recent incident when a Russian ministry didn't bother to send a car to pick up visiting Kazakh officials in Moscow. "Kazakhstan is constantly being treated like a kid brother by our Russian neighbors," he complains. Another slight was the banning of all Lufthansa planes from Russian airspace last month after the German company prepared to switch its Asian cargo hub from Krasnoyarsk in Russia to Astana in Kazakhstan. "The Russian government thought they would frighten us by flexing their muscles, the same way they did with Georgia and Ukraine," says the minister. "But we have others we can turn to."

It looks like China, rather than the United States, is best positioned to be the big winner in Central Asia's search for new friends. Though Washington has gone out of its way to turn a blind eye to the region's undemocratic practices, local despots are still irritated by even low-key criticism from the U.S. American insistence that the Central Asians forgo business with Iran also rankles. Kyrgyzstan, America's closest ally in the region, has been racked by instability and economic underperformance.

Kazakhstan, meanwhile, is booming, and plans to nearly double oil production to 150 million tons a year by 2015. A large chunk of that will be exported to China, through new Beijing-funded routes, or to other markets through the Baku-Ceyhan pipeline, bypassing Russia."Pretty soon the Chinese are going to exchange their bicycles for cars, so their oil needs will boom. We're happy to have such as a big, stable neighbor just on our border," says Kamal Burkhanov, a Kazakh parliamentarian. "How long should Central Asian countries be locked in by Gazprom's prices? The transit fees they pay us are kopecks."

True enough. For all its pretensions to being Europe's dominant energy supplier, Gazprom has stood on feet of clay. Now that Russia's former vassals are discovering their power, Moscow may have to ditch its trademark energy strong-arm tactics, and adopt a new gas diplomacy.

URL: http://www.newsweek.com/id/81557

See also Last Major Russian Field Goes Online

December 24, 2007

Big Oil lets sun set on renewables

by Terry Macalister

Guardian

December 11th, 2007

Shell, the oil company that recently trumpeted its commitment to a low carbon future by signing a pre-Bali conference communique, has quietly sold off most of its solar business.

The move, taken with rival BP's decision last week to invest in the world's dirtiest oil production in Canada's tar sands, indicates that Big Oil might be giving up its flirtation with renewables and going back to its roots.

Shell and BP are among the biggest producers of greenhouse gases in the world, but both have been keen to paint themselves green through a series of clean fuel initiatives.

BP, under its former chief executive, John Browne, promised to go "beyond petroleum" while Shell has spent millions advertising its serious interest in the future of the environment.

But at a time when interest in solar power is greater than ever, with the world's first "solar city" being built at Phoenix, Arizona, a small announcement from Environ Energy Global of Singapore revealed that it had bought Shell's photovoltaic operations in India and Sri Lanka, with more than 260 staff and 28 offices, for an undisclosed sum.

The sell-off, to be followed by similar ones in the Philippines and Indonesia, comes after another major disposal executed in a low-key way last year, when Shell hived off its solar module production business.

The division, with 600 staff and manufacturing plants in the US, Canada and Germany, went to Munich-based SolarWorld. Shell has however formed a manufacturing link, with Saint-Gobain, and promised to build one plant in Germany.

The Anglo-Dutch oil group confirmed yesterday that it had pulled out of its rural business in India and Sri Lanka, saying it was not making enough money.

"It was not bringing in any profit for us there so we transferred it to another operator. The buyer will be able to take it to the next level," said a spokeswoman at Shell headquarters in London.

The oil group said it was continuing to move its renewables interests into a mainstream business and hoped to find one new power source that would "achieve materiality" for it. Shell continues to invest in a number of wind farm schemes, such as the London Array offshore scheme, which has government approval. Shell has also been concentrating its efforts on biofuels, but declined to say whether it had given up on solar power even though many smaller rivals continue to believe the technology has a bright future.

Environmental groups have always accused Shell of using clean energy initiatives as "greenwash" to deflect criticism from its core carbon operations, especially tar sands. The latest pull-out has annoyed rival business leaders at London-based Solar Century and local Indian operation, Orb Energy, who fear the impact of a high-profile company selling off solar business. Jeremy Leggett, chief executive of Solarcentury and a leading voice in renewable energy circles, said Shell was undermining the credibility of the business world in its fight against global warming.

"Shell and Solar Century were among the 150 companies that recently signed up to the hard-hitting Bali Declaration. It is vital that companies act consistently with the rhetoric in such declarations, and as I have told Shell senior management on several occasions, an all-out assault on the Canadian tar sands and extracting oil from coal is completely inconsistent with climate protection.

"This latest evidence of half-heartedness or worse in Shell's renewables activities leaves me even more disappointed. Unless fossil-fuel energy companies evolve their core activities meaningfully, we are in deep trouble," he said.

Damian Miller, former director of Shell Solar's rural operations and now chief executive of Orb Energy, said Shell was missing an opportunity by pulling out at a time when renewables markets were starting to mature in the developing world. He alleged some customers were complaining of being abandoned by Shell and worried about the servicing of equipment they could expect from Environ. "We see former Shell customers who are highly disappointed not to be receiving proper service for the solar systems they have invested in. These customers have often invested 20-30% of their annual income in a system to ensure they have some minimum amount of lighting and access to radio, TV, or a fan," said Miller.

He added that the oil majors, including Shell, had invested time and energy in promoting their plans for renewable energy in the press and on TV, but were not able to lead the transformation the world needs towards renewable energy and energy efficient solutions.

Shell declined to comment on these criticisms or talk about where its priorities lay. But the chief executive, Jeroen van der Veer, did make a number of comments last summer which could have paved the way for a change in policy. Alternative energy sources such as renewables will not fill the gap, he argued, forecasting that even with technological breakthroughs they could give supply only 30% of global energy by the middle of the century. "Contrary to public perceptions, renewable energy is not the silver bullet that will soon solve all our problems," he said.

Meanwhile, BP has been accused by Greenpeace Canada of lining itself up to help commit "the biggest environmental crime in history". This follows its decision to swap assets with Husky Oil, giving it an entrance ticket to the Alberta tar sands, which are said to be five times more energy-intensive to extract compared to traditional oil.

John Browne, the group's former chief executive, had said BP would not follow Shell into tar sands as he established an alternative energy division and pledged to take the group "beyond petroleum." The new boss, Tony Hayward, has pointed the corporate supertanker in a new direction although his public relations minders insist BP remains committed to exploring the potential of renewables.

"Tony Hayward has been part of the management team at BP for many years and has endorsed the low-carbon strategy that involved BP creating its alternative energy business late in 2005. We are spending $8bn (£4bn) over ten years and are pressing ahead with 450 megawatts of wind production capacity in the US," said a spokesman. "The tar sands deal in Canada does not represent a change in direction, it was just a very good opportunity which represents a broadening of the portfolio."

Greenpeace climate campaigner Joss Garman said: "If Shell is to survive the climate change age... it needs to become not just an oil company but an energy company. One wonders if Shell's executives have noticed what's happening in Bali or if we'll see slick adverts on TV boasting about their retreat from renewables. Probably not."

December 21, 2007

Petrocan's Libyan dream

COMMENT: Note that in Libya, Petro-Canada is agreeable to terms that "may seem steep" - it pays 50% of the development costs for only 12% of the profit, considerable up-front costs, AND it shares the play with Libya's national oil company, AND political stability and certainty in Libya ain't quite the same as Alberta.

Yet listen to these guys whine about a bigger royalty bite in Alberta.

It would appear that just about EVERYWHERE in the world, except Canada and the US, oil and gas companies are accepting terms that would precipitate a capital exodus here.

But an exodus to where? Libya? Russia?

Alberta is still the biggest and best deal going for oil companies. And BC is the sweetest show in the world for gas producers.

For the legacy in those resources? For the people in these jurisdictions? Well, gee, we don't want to upset the companies, do we? Don't want to lose the golden goose.

NORVAL SCOTT

Globe and Mail

December 14, 2007

CALGARY — Petro-Canada already once had a dream of creating a huge business empire in North Africa, in which it would supply energy to Europe after developing vast natural gas projects in Algeria and Tunisia. What happened?

It went up in smoke; Petrocan and Algeria couldn't come to terms over the proposed developments and the company's interest in the countries dwindled. Now the company hopes its second time in North Africa works out better.

Mind you, Petrocan is not running back to Algeria any time soon. From being a major player in the country in the late 1990s, Petrocan now has no production left there, and the firm shut down its Tunisian office last year.

Instead, Petrocan's dream has been shifted one country to the east, to Libya, and all of a sudden it's become reality. This week, the company said it is to ramp up output in the country after successfully arranging new development terms, now intending to spend $3.5-billion (U.S.) on existing fields in the Sirte basin. The investment is expected to double Petrocan's Libyan production by 2014 to 100,000 barrels a day.

“We've been looking at this for some time, and it's a very logical spot for us to be in,” says Petrocan chief executive officer Ron Brenneman, who signed the deal in Tripoli this week. “[Libya] is recognized as one of the most prospective regions in the world. It has huge potential.”

The Gadhafi factor

However, investors haven't always been convinced that the country could deliver on its promise. After the 2001 attack on New York's World Trade Center, Libya was perceived as a risky investment destination for firms; leader Moammar Gadhafi was linked to international terrorism in the 1980s and 1990s and the U.S. only lifted economic sanctions against the country in 2004, although Libya's international standing was improving after the country made conciliatory steps to the West in the late 1990s.

Nevertheless, Petrocan's stock sold off immediately after its acquisition of Germany's Veba Oil & Gas GmbH in 2002 for $3.2-billion (Canadian), the deal in which Petrocan accumulated most of its current Libyan holdings.

The deal was curiously timed, not only due to Petrocan's travails elsewhere in North Africa, but also because other Canadian firms were fleeing the region in droves. PanCanadian Petroleum, the company that became EnCana Corp., was withdrawing from Libya in 2002 in order to concentrate on North America, while Talisman Energy sold up its holdings in Sudan that same year after a hugely controversial dispute over the extent of its involvement in that country's civil conflict.

While Mr. Gadhafi's history may still cast a shadow over some perceptions of Libya, energy companies have found the country an infinitely more stable investment destination than, say, Venezuela, where oil firms have essentially seen their contracts ripped up.

Petrocan itself hasn't encountered any regulatory or governmental difficulties in Libya, which has never been anything but professional to deal with, Mr. Brenneman says. “The national oil company is a very sophisticated organization that's very business-like in its approach,” he said. “We've had a very good working relationship with them – it's a wonderful place to do business.”

Better timing

A more significant problem for Petrocan that stymied development until now was that it wasn't certain of its position in Libya. The rights to develop oil at the fields it bought from Veba were set to expire in 2015, at which time they would revert to Libyan control.

While the clause is a normal one in oil and gas contracts, – as it forces companies to develop the leases acquired from countries, instead of just sitting on the acreage – the relatively close deadline made it difficult for Petrocan to consider ramping up its Libyan plans, as it wasn't sure if any large-scale investment would be worthwhile.

“As you get closer and closer to that date, the time to recover your investment starts to run out, and we weren't prepared to put a lot of capital in if we didn't have that time,” Mr. Brenneman said.

The problem was recognized both by Petrocan and the Libyan National Oil Co. (NOC), which was also keen to renegotiate its contracts with oil companies operating in Libya so it could benefit more from higher prices. Consequently, Petrocan came to a deal under which it will now receive 12 per cent of the profit from its Libyan production, while paying 50 per cent of the development costs.

Barrels ‘to die for'

Petrocan and NOC will jointly invest $7-billion in developing existing fields, while Petrocan will pay a $1-billion signature bonus in three stages, as well as $460-million over the next seven years to explore new opportunities in Sirte. While the price may seem steep, it extends Petrocan's rights to the Sirte fields, effectively securing the company's position in Libya for the next 30 years.

“Now we've got lots of time to exploit these resources, recover our capital and generate good returns,” Mr. Brenneman said.

Petrocan has had a long wait to get the certainty in North Africa that it's needed to start developing a major project. However, the reason that the company has been so patient is clear; Sirte is seen as being one of the most prospective oil blocks in the world. Of the last nine wells Petrocan has drilled in the region, its had seven successes – a high strike rate in the oil exploration game.

“This is a large, large field that will be producing for some length of time,” Mr. Brenneman said. “If you ask anyone who's in the international oil business, they'll tell you that the Sirte basin is to die for.”

December 18, 2007

Last Major Russian Gas Field Goes Online

How Long Will Siberia's Gas Last?

By Christian Wüst

Der Spiegel

18-Dec-2007

Europe depends on Russia for its natural gas, but, as Gazprom begins production at the last major field, it is unclear how much gas is left in Siberia. Developed fields are almost exhausted, and tapping new reserves involves huge technical difficulties.

The Gazprom pipeline under construction near Novy Urengoy. Gazprom is developing the Siberian Yuzhno-Russkoye gas field in the region. REUTERS

The Russian gas industry was celebrating on Tuesday. At a ceremony in Moscow, Gazprom board chairman Dmitry Medvedev, who is widely expected to be the next president of Russia and the German foreign minister, Frank-Walter Steinmeier, pressed a ceremonial button and the last major natural gas field in the world's most productive region went on line. A live video link showed footage from northwestern Siberia where the actual event was taking place, namely valves being opened.

The process, prosaic as it was, prompted executives in the energy industry to wax poetic. Burckhard Bergmann, the head of German energy conglomerate E.on-Ruhrgas, calls the site "Siberia's last pearl."

The new field, which is called Yuzhno-Russkoye, lies about 900 meters (2,953 feet) below the surface and contains more than 800 billion cubic meters (28.6 trillion cubic feet) of natural gas -- a number that seems inconceivably large and yet is ultimately very small. Yuzhno-Russkoye's entire reserves hardly amount to more than one year's worth of production for the entire Russian natural gas industry.

Demand for energy is growing, both domestically and abroad, and Russian energy forecasters predict Siberia will satisfy that demand. Alexander Grizenko, an advisor to the board of directors of Russian energy giant Gazprom, expects production volume to increase until 2030 when, according to his predictions, a peak level of well over 800 billion cubic meters a year will have been reached. Grizenko also emphasizes that the country will be able to maintain a very high level of production for another 30 years after that.

But Jean Laherrere, chief statistician at the Swedish-based Association for the Study of Peak Oil and Gas, paints a completely different scenario. He believes that production will peak in only eight years and decline rapidly after that. According to Laherrere's prognosis, in 2060 -- when Russian visionaries predict that production levels will still be higher than they are today -- it will in fact be close to zero.

Who is right? The answer to this question will be critical to energy supply in Europe, which already buys close to half of its natural gas from Russia today -- a share that is expected to increase now that the North Sea gas fields are almost exhausted.

Russia's future is also closely linked to the future of its gas reserves. Natural gas is the central currency of the new economic miracle that has blessed this vast country stretching from the Baltic Sea to the Pacific Ocean. Russia's gas reserves lie north of the Ural Mountains, in one of the world's most inhospitable regions. It's a flat wasteland, icebound in the winter and a swamp in the summer, where temperatures can drop to as low as -60° Celsius (-76° Fahrenheit) and climb as high as 40° Celsius (104° Fahrenheit).

Geologists estimate that about 150 million years ago, when the region was a warm ocean inlet, the bodies of dead creatures turned into dark sediments rich in organic matter. Over the course of the ensuing millions of years, the organic matter then turned into oil and natural gas reserves stored between layers of sandstone.

Siberia's gas fields supply much of Europe's energy. DER SPIEGEL

More than 50 years ago, when the first drilling teams arrived in what was then a virtually uninhabited region, the ground was so saturated with fossil fuels that some of the Soviet mining pioneers, along with their equipment, were blown up in explosions.

Sergei Chernezky, a spokesman for the Russian gas industry in the Siberian city of Yamburg, talks about one of these accidents as if it were the big bang that set off the region's energy bonanza. An explosion occurred near a town called "Little Birch Village," just as a drilling supervisor was about to enter his hut to document the fact that his team had found nothing. "All of a sudden it was clear that there was gas here," says Chernezky. "A lot of gas."

In 1966, scientists working near the Arctic Circle discovered what was then the largest-known natural gas field on earth: Urengoy. The field, 120 kilometers (75 miles) long, contained at least 10 trillion cubic meters (357 trillion cubic feet) of natural gas in the upper sediment layers alone. Father north, the Yamburg field was discovered a few years later, a hydrocarbon giant almost the size of Urengoy and containing vast reserves of methane and liquid condensed gas.

The first shipment was sent to Austria in 1968, and soon afterwards other Western countries began appearing on the Soviets' list of customers. The Soviet Union, still the West's political nemesis at the time, gradually became Europe's most important supplier of natural gas.

An energy highway unparalleled worldwide extends for 5,000 kilometers (3,108 miles) from western Siberia to European Russia and on to Western Europe. It consists of a dozen steel pipes, each up to one and a half meters (5 feet) in diameter and capable of handling an operating pressure of 70 to 90 bar. It takes about a week for a gas molecule to make the journey from Yamburg to Hamburg. Compressor stations placed at roughly 200-kilometer (124-mile) intervals maintain flow pressure.

Natural gas flares at a Gazprom facility in the town of Novy Urengoy. AFP

The abundance of natural gas acts as a tremendous incentive for consumption. Russians are wasteful when it comes to natural gas, the cheapest fossil fuel and the one that is least harmful to the climate, says E.on-Ruhrgas CEO Bergmann. But Western Europeans aren't exactly parsimonious in their use of the highly refined fuel, either. Russia exports roughly one-third of its natural gas, and Germany is its biggest customer.

According to official Russian figures, the country still has viable natural gas reserves of 48 trillion cubic meters (1.7 quadrillion cubic feet). At constant production levels, this would be enough to last almost to the end of the century. But where is this natural gas? Can it even be extracted? A skeptical Laherrere estimates existing reserves to be around 43 trillion cubic meters (1.5 quadrillion cubic feet), but believes that only a fraction of these reserves are in fact extractable.

"The days of easy gas production are gone," says Bernhard Schmidt, the head of exploration for the Wintershall Group. A subsidiary of chemical giant BASF, Kassel-based Wintershall is the only German company currently involved in the development of Gazprom fields.

To date, gas fields in western Siberia have only been tapped to depths of little more than 1,500 meters (4,921 feet). Developing these reserves dating from the mid-Cretaceous period is relatively easy for mining experts. Schmidt, a native Austrian, calls the process "skimming the sugar off the top."

Urengoy and Yamburg were precisely the kinds of sweet finds Schmidt is referring to -- enormous and easily exploited -- and they have been drained at rates corresponding to their accessibility. Both fields are already more than halfway depleted. If they were oil reserves, production would already have been discontinued. However, because gas is lighter than petroleum, up to 80 percent of the underground treasure can be extracted. But once that point is reached, little else can be done. Siberia's largest natural gas reserves are close to this point. Satellite fields like Zapolyarnoye and Yuzhno-Russkoye are still full, but much smaller.

Opinions differ as to how much gas is left. DER SPIEGEL

There is more gas to be found, but only at far greater depths. The gas content is especially high in Lower Cretaceous sediments in the region, but they are located at 3,500 meters (11,480 feet) beneath the Earth's surface.

Gazprom, in a joint venture with Wintershall, is currently tapping the so-called Achimov Formation in the Urengoy field. Five wells have already been drilled, and production is expected to begin next year. The German partner's experience is apparently in high demand, because gas is extremely difficult to extract at this level.

Contrary to what some people might imagine, oil and gas fields do not consist of underground caverns. The fuel is found in porous rock formations (the word petroleum is derived from the Latin terms for rock, "petra," and oil, "oleum"), and must travel through the pores into the drilling pipe. In the deep Urengoy sediments, the rock is extremely solid and fine-pored. In addition, the gas has a high content of liquid condensate that can clog the pores. To overcome these difficulties, Wintershall plans to use a high-pressure technology known as "fracturing." In this process, the rock is fractured and sand is forced into the cracks.

Despite all of these efforts, deep drilling will never be as productive as extraction from upper layers of rock. The Achimov Formation of the Urengoy field will yield 2 trillion cubic meters (71 trillion cubic feet) at best, or barely a fifth of the upper-level reserves. Clearly these sorts of finds will not be sufficient to meet Russia's production targets.

These limitations have prompted Gazprom to explore potential new reserves. On the opposite end of the Ob River delta, northwest of the current drilling areas, lies the Yamal Peninsula. Geologists have already explored the peninsula and have discovered formations indicating the presence of fields containing more than 10 trillion cubic meters (355 trillion cubic feet) of natural gas -- potentially another Urengoy.

But the gas exploration teams are operating in highly challenging terrain. "Yamal is probably the world's most difficult extraction region," says Roland Götz, an expert on Russia at the Berlin-based German Institute for International and Security Affairs. The peninsula is covered with countless rivers and lakes, completely impassible in the summer, and its coastlines are surrounded by shifting masses of pack ice that sometimes tear meter-deep gashes into the ocean floor, making it difficult, if not impossible, to lay pipelines.

Dashed lines representing the pipeline through the Kara Sea that the Russians hope to install within the next few years -- despite doubts from within the industry -- have been shown on maps for some time. But at a meeting on July 19, 2005, the Russian union of oil and gas pipeline builders argued that there are no known "engineering solutions" for the problems associated with building the pipeline.

Another danger, according to Götz, is that the peninsula, which is barely above sea level today, could "sink during the course of gas production and become completely submerged." Gazprom's prospecting creed of preserving the untouched natural environment on the Yamal Peninsula "for future generations" would sink along with it.

But the energy giant brushes off environmental and technological concerns. Within four years, says Gazprom spokesman Sergei Kupriyanov, the company will be pumping natural gas from the Bovanenkovo field on the Yamal Peninsula and shipping it through pipelines. Two years later, the company plans to follow suit in the offshore Shtokman field in the Barents Sea northeast of Murmansk.

Gazprom is also convinced that other reserves in the ice-covered sea off Yamal can be tapped. "Gazprom has such technologies and we don't expect any surprises," Kupriyanov says tersely.

Skeptics are not welcome in the natural gas emirates along the Arctic Circle. The region's wealth of natural resources has created a standard of living well above the national average: A mechanic working in a gas field makes a better living than many a university professor in Moscow.

Within three decades, a medium-sized city developed out of nothing in this icy wasteland. Today more than 100,000 people live in Novy Urengoy, a collection of drab tower blocks. One in two residents owns a car. Supermarkets sell tropical fruit and California wine, and the city boasts recreation centers, cinemas and theaters -- and almost everything belongs to the benevolent Gazprom.

Officials proudly take visitors on a tour of the company-owned luxury kindergarten -- complete with a swimming pool and an assembly hall. Well-behaved children in native dress sing songs that sound disconcerting coming from the mouths of five-year-olds, songs about full tanks of gasoline, warm living rooms and the many blessings of an invisible fuel: "The cold is bitter, it bites us on the nose -- but we are not afraid, because we have natural gas."

Elsewhere, economists specializing in natural resources are already conjuring up scenarios of potential shortages. Russia expert Götz, for example, analyzed what would happen if the start of production at the Shtokman and Yamal fields was delayed by a mere five years.

The consequences of this small delay, says Götz, would already be significant. "The natural gas supply in the regions that supply Europe would stagnate at 2005 levels until 2025 at least," he says. But who will have to do without gas in a world in which everyone wants economic growth?

For Götz, the answer is obvious. "A supply bottleneck will affect Russia first," he says. "Export is much more lucrative for Gazprom."

Translated from the German by Christopher Sultan

More Bali-hoo

UN CLIMATE CHANGE CONVENTION: BALI ROAD MAP

Geoffrey York, Globe and Mail, 17-Dec-2007

Disappointments on Climate

Editorial, New York Times, 17-Dec-2007

Stalling in Bali

Editorial, Washington Post, 18-Dec-2007

Bully for Bali

Editorial, The Sunday Times, 16-Dec-2007

Canada, U.S. back off Bali deal

Mike De Souza, National Post, 17-Dec-2007

Willingness to talk climate change what counts

Richard Gwyn, Toronto Star, 18-Dec-2007

The Day After..

Walden Bello, Focus on the Global South, 16-Dec-2007

HAPPY ENDING ON BALI

Markus Becker, Der Spiegel, 15-Dec-2007

We've been suckered again by the US.

George Monbiot, The Guardian, 17-Dec-2007

UN CLIMATE CHANGE CONVENTION: BALI ROAD MAP

Accord fails to set targets, but activists still optimistic

Shift in global mood sees growing number of countries agree on need for deep reductions in greenhouse-gas emissions

By GEOFFREY YORK

Globe and Mail

Monday, December 17, 2007

NUSA DUA, INDONESIA -- In the end, the much-anticipated "Bali Road Map" was disappointingly vague and unenforceable, weakened by politics and self-interest. Yet beyond the words of its compromised text, the Bali agreement could still herald a new era of tougher action against global warming.

Most of the world's biggest emitters of greenhouse gases - including the United States, China and India - were unwilling to accept any limits on their growth. Even after 15 days of intense negotiations, the conference failed to reach any global accord on targets for emission cuts by 2020 or even 2050, despite strong pressure from Europe and others.

The scientific consensus on the need for deep cuts - the best research of the world's top scientists, endorsed by this year's Nobel Peace Prize -- was relegated to a mere footnote to a preamble to the main agreement.

But now begins a crucial two years of negotiations on a stronger deal to replace the pledges of the Kyoto accord, which expire in 2012. And the mood of the Bali conference, swinging strongly against the United States on its final day, offered hope to those who seek a more ambitious deal.

"What we have seen disappear is the Berlin Wall of climate change," said Yvo de Boer, chief of the United Nations climate agency. "This is a real breakthrough, a real opportunity for the international community to successfully fight climate change."

The optimism of the environmentalists is based on the clear evidence of a shifting global mood. A growing number of countries agree on the need for deep cuts in emissions by 2020. The small band of skeptics - including the United States, Canada and Japan - were able to remove the emission targets from the final accord, but they did not dare to kill the conference's other achievements, including crucial agreements on fighting deforestation, transferring clean technology to developing countries, and achieving bigger emission cuts among the wealthy Kyoto nations.

"Now the hard work begins - getting the science back into this agreement, the science that had been stripped out, and getting meaningful commitments by the U.S. onto the table to do our responsible share of dealing with this urgent problem," said Alden Meyer, director of strategy and policy at the Union of Concerned Scientists, a U.S.-based group.

"The hardest work is ahead of us, but we averted the disaster that would have been the collapse of these talks. Once the United States saw that it would be seen as the one bringing down the talks, they thought twice. And to their credit they stepped back from the brink."

Environmentalists are pleased that the Bush administration finally signed onto the Bali agreement, no matter how weak it is, because it brings the U.S. directly into the climate process for the first time in years.

Their optimism is further fuelled by the U.S. presidential election next year, which is widely expected to produce a new president with a more aggressive position on tackling climate change. The new administration will take office at a critical time, in early 2009, with a year remaining until the deadline for a new climate deal.

"We hope to inject some new energy into this process in 12 months with a new administration that can build on the momentum here and join the European Union in providing real leadership in the second half of the negotiations," Mr. Meyer said. "I think we can do this in the time we have available, building on the spirit we saw in Bali."

Liberal Leader Stéphane Dion said he is confident an agreement will be possible by 2009. "It will require a lot of goodwill and a lot of determination, and some countries must change their attitudes," he said. "We will have an election in the United States, and I'm sure that will help, and we may have an election in Canada, and I hope that will help too."

Environment Minister John Baird, the subject of much criticism at Bali, pledged to work for a new agreement by 2009. "We're going to work tremendously hard over the next two years, and see if we can get the very best deal for the environment and the planet," he said.

Business leaders, too, promised to join the campaign for a post-2012 deal in the wake of the Bali agreements. "This is an historic decision and a turning point for mankind," said Guy Sebban, secretary-general of the International Chamber of Commerce.

"All the players - governments, business, non-governmental organizations and intergovernmental organizations - are finally banding together to confront what is perhaps the most important and urgent issue of our age."

The Bali agreement on deforestation, in particular, is considered a huge step forward, since 20 per cent of the world's carbon emissions are produced by deforestation - almost as much as the entire amount of U.S. emissions from all sources.

Canadian environmentalists will try to use the Bali agreement to force Ottawa to work harder on climate change. "The government's current targets and policies fall far short of the standard set in Bali," said Matthew Bramley of the Pembina Institute. "Nothing less than a massive scale-up of federal efforts on climate change is required for Canada to play a responsible part in the next two years of negotiations."

Disappointments on Climate

Editorial

New York Times

December 17, 2007

A week that could have brought important progress on climate change ended in disappointment.

In Bali, where delegates from 187 countries met to begin framing a new global warming treaty, America’s negotiators were in full foot-dragging mode, acting as spoilers rather than providing the leadership the world needs.

In Washington, caving to pressures from the White House, the utilities and the oil companies, the Senate settled for a merely decent energy bill instead of a very good one that would have set the country on a clear path to a cleaner energy future.

The news from Bali was particularly disheartening. The delegates agreed to negotiate by 2009 a new and more comprehensive global treaty to replace the Kyoto Protocol. (Kyoto expires in 2012 and requires that only industrialized nations reduce their production of greenhouse gases.) They pledged for the first time to address deforestation, which accounts for one-fifth of the world’s carbon dioxide emissions. And they received vague assurances from China — which will soon overtake the United States as the biggest emitter of greenhouse gases — and other emerging powers that they would seek “measurable, reportable and verifiable” emissions cuts.

From the United States the delegates got nothing, except a promise to participate in the forthcoming negotiations. Even prying that out of the Bush administration required enormous effort.

Despite pleas from their European allies, the Americans flatly rejected the idea of setting even provisional targets for reductions in greenhouse gases. And they refused to give what the rest of the world wanted most: an unambiguous commitment to reducing America’s own emissions. Without that, there is little hope that other large emitters, including China, will change their ways.

There is some consolation in knowing that the energy bill approved last week included several provisions — among them the first significant improvement in automobile mileage standards in more than 30 years — that over time should begin to reduce the United States’ dependency on foreign oil and its output of greenhouse gases. The bill would have had much greater impact if the Senate had not killed two important provisions opposed by the White House and its big industrial contributors.

One would have required utilities to generate an increasing share of their power from renewable sources like wind. The other would have rolled back about $12 billion in tax breaks granted to the oil companies in the last energy bill and used the proceeds to help develop cleaner fuels and new energy technologies.

The decision to maintain the tax breaks was particularly shameful. Blessed by $90-a-barrel oil, the companies are rolling in profits, and there is no evidence to support the claim that they need these breaks to be able to explore for new resources. Yet the White House had the gall to argue that the breaks are necessary to protect consumers at the pump, and the Senate was craven enough to go along.

This Senate will have another chance to provide the American leadership the world needs on climate change. An ambitious bipartisan bill aimed at cutting America’s greenhouse gas emissions by 70 percent by midcentury has been approved by a Senate committee and may come to the floor next year. Though the bill is far from perfect and will provoke intense debate, it could offer a measure of redemption for the administration’s embarrassing failure in Bali.

Stalling in Bali

The Bush administration continues to say one thing and do another on climate change.

Editorial

Washington Post

Tuesday, December 18, 2007

THE BUSH administration wants everyone to believe that all along it has taken the threat of global warming as seriously as the rest of the world has. Advisers point to Mr. Bush's comments on climate change made as early as 2001 and to the nibbling-at-the-edges actions he has taken on research, regulation and funding. Then rhetoric meets reality, as it did at the climate talks in Bali.

Representatives of 187 nations were in the Indonesian resort destination for almost two weeks this month trying to plot a road map to a successor treaty to the Kyoto Protocol, which mandated reductions in greenhouse gas emissions by 36 industrialized countries and which expires in 2012. The European Union and other countries wanted binding emissions reductions of 25 to 40 percent by 2020. As he has consistently, Mr. Bush said no.

That's not to say something good didn't come out of Bali. The new framework agreement calls on developing nations, such as India and China, to consider adopting national policies to address their respective greenhouse gas emissions that are "measurable, reportable and verifiable." But the heavy lifting for both developed and developing countries will be done in treaty negotiations over the next two years.

The administration's resistance to mandatory cuts led U.N. Secretary General Ban Ki-moon to declare last week that the proposed reductions may be "too ambitious." He added: "Practically speaking, this will have to be negotiated down the road." Practically speaking, down the road means when there is a new American president. Palming off the leadership and the tough decisions that go with it to his successor seems to be fine with Mr. Bush.

Congress and the states shouldn't wait. The Senate will take up the Lieberman-Warner Climate Security Act next month. Sponsored by Sens. Joseph I. Lieberman (I-Conn.) and John W. Warner (R-Va.), the bill would put a price on carbon through a declining cap in greenhouse gas emissions for each year between 2012 and 2050. In this cap-and-trade system, companies in the transportation, electric power and manufacturing sectors would purchase and trade allowances for the right to pollute the air. Meanwhile, governors are so fed up with federal inaction on the environment that they're forming their own binding regional compacts for reducing greenhouse gases. This is the kind of leadership the world and many in this country are looking for.

ad_icon

The last report from the U.N. Intergovernmental Panel on Climate Change warned that if action is not taken within the next decade, the effects of global warming may be irreversible. Waiting for the next president shouldn't be an option.

Bully for Bali

Editorial

The Sunday Times

December 16, 2007

It was always likely that the Bali climate change conference would cobble together some kind of deal. Sure enough, in the early hours of yesterday morning after tears, tantrums, boos and recriminations, a “Bali road map” was agreed setting out what the United Nations described as a clear agenda for two years of talks aimed at negotiating a successor to the Kyoto framework. “This is a historic breakthrough and a huge step forward,” said Hilary Benn, environment secretary. “For the first time ever all the world’s nations have agreed to negotiate on a deal to tackle dangerous climate change concluding in 2009.”

It is easy to dismiss such claims as hyperbole and the Bali deal as yet another fudge from governments, particularly the US government, unwilling to face up to the hard decisions on global warming. The price of getting the United States to sign up was the removal of hard numbers from the road map. Friends of the Earth dismissed it as a “weak outcome” and accused rich countries of letting the developing world down.

Yet Bali was always going to be a holding operation. There was pressure for specific targets to be included in the text. The European Union wanted a commitment to emissions reductions by advanced countries of 25% to 40% by 2020, as well as references to a peak in global emissions over the next 10 to 15 years and a halving by 2050. It is reasonable to argue, however, as America did, that such targets should emerge during the negotiations of the next two years, not be imposed at the outset. America also made important concessions.

Al Gore said it outright in Bali but the unspoken message of yesterday’s deal is that things will change over the next two years, most importantly in the White House. Attitudes are moving in America. Politically this has been led at state level by the likes of Arnold Schwarzenegger and at city level by the mayors of most US cities. George W Bush has looked increasingly out of step with public opinion. Next November’s presidential election should see a new era in the White House on climate policy. The Democratic frontrunners, Hillary Clinton and Barack Obama, are both seemingly green. Mr Obama wants to introduce an economy-wide “cap-and-trade” programme to cut US greenhouse gas emissions and to invest heavily in energy efficiency.

Mrs Clinton, running a “carbon neutral” campaign, has a similar plan for cutting emissions but also wants a windfall tax on oil companies to be invested in an energy fund to provide one-fifth of US electricity from renewables by 2020. On the Republican side, Senator John McCain was the first to highlight global warming and, while he has little chance of securing the nomination, his rivals have jumped on the band-wagon. Oil at $90 a barrel and a determination to reduce dependence on the Middle East are enough to convince even the sceptics.

Political change is important but so is technology. Developing countries suffer from the effects of climate change but often cannot afford the equipment needed to limit their own pollution and greenhouse gas emissions. Even China, growing at a breakneck pace, is still building dirty coal-fired power stations rather than using the clean coal technology available in the West. One significant breakthrough in Bali was an agreement to step up the rate of technology transfer and provide the private sector with more incentives to give poor countries access to the latest innovations.

Bali should not be dismissed. It is not long since Tony Blair said there would never be a successor deal to Kyoto. Now a deal looks distinctly possible, if only after some hard negotiations over the next two years. And it will have America, China and India on board. It is easy to be gloomy but political will and technological change are powerful allies. If these bleary-eyed declarations are followed up with action, there is every reason to be hopeful.

Continue reading "More Bali-hoo"

December 17, 2007

Proponents hope to get pipeline flowing

COMMENT: It may be pointless to note that in 2001, when the Mackenzie Gas Pipeline made its first appearances on this website, the project was going to cost a mere $3 billion. Now it's $16 billion and climbing. But it's undeniably interesting.

Not once have the MGP proponents (led by Imperial Oil) stopped clamouring for a reduced regulatory burden and a greater public subsidy.

But in the 1970s with the Mackenzie pipeline proposal at that time, and in 2001 with this version of it, and today, the big concerns remain the environmental and social impacts on the land and communities of the north. Construction of the Mackenzie Gas Pipeline will unleash immediate and extensive gas production all along the pipeline route.

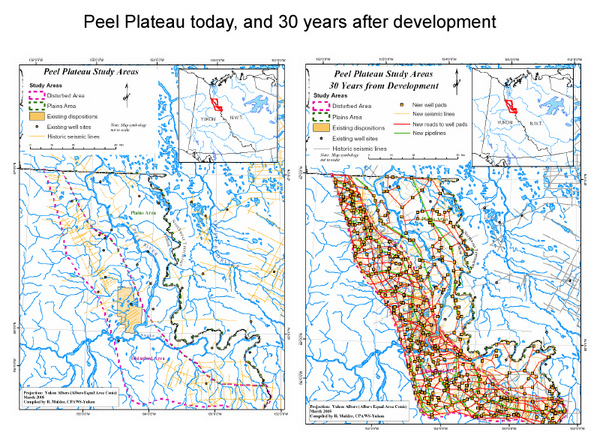

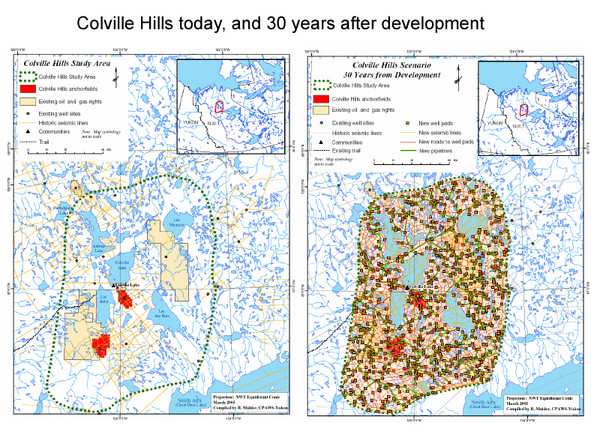

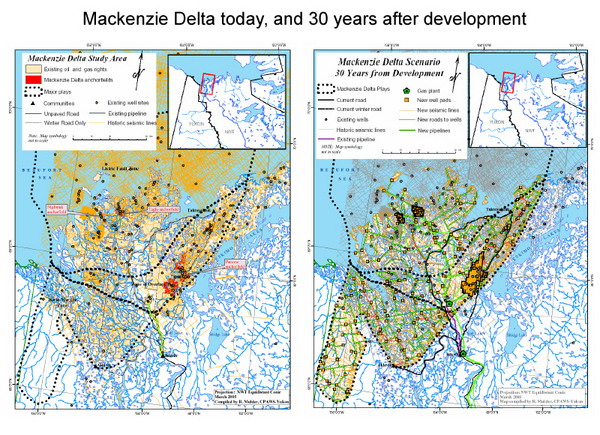

In 2005, the Canadian Parks and Wilderness Society undertook a mapping exercise designed to illustrate these impacts at various stages to full build-out. Small versions of these maps are copied below. They are published in higher resolution in a Pembina Institute publication entitled A Peak into the Future.

Infrastructure - pipelines, roads, transit - begets construction and development. Building this pipeline will have the same consequences in the north as did Clark Griswold (Chevy Chase) on his house in Christmas Vacation, when he finally connected the power to the lights. (and if you don't know the reference, don't be a Grinch - it's a modern Christmas classic; go rent it now.)

SHAWN MCCARTHY

Globe and Mail

December 14, 2007

Proponents of the $16-billion Mackenzie Valley Pipeline have presented a new financial plan to the federal government in hopes of kick-starting the long-stalled gas pipeline from the Arctic, Industry Minister Jim Prentice said yesterday.

Mr. Prentice met in Calgary yesterday with executives from Imperial Oil Ltd. and TransCanada Corp., who have fashioned a new partnership to finance the proposed main pipeline and natural gas gathering system in the Mackenzie Delta.

"I intend to analyze and review their proposal as expeditiously as possible," Mr. Prentice said in the statement.

It is believed that TransCanada, an energy infrastructure company, would take a majority stake in the mainline pipeline project, which would cover half the estimated $16-billion cost, while the producers, which include Imperial, ConocoPhillips and Royal Dutch Shell, would finance the gathering system and the development of the gas fields.

The Aboriginal Pipelines Group - representing native groups in the north - would have a large minority stake in the pipeline, perhaps as much as 40 per cent.

TransCanada chief executive Hal Kvisle said in an interview this week that the pipeline project is essential if Canada is to have the gas it will need in the coming years, and that some federal assistance would be required.

Imperial Oil Ltd. had been leading the consortium of producers that intended to finance and build the project. However, last winter, Imperial announced that the projected cost had mushroomed to $16.2-billion from $7-billion, and indicated it would be impossible to proceed without significant federal assistance.

TransCanada, which also has submitted a proposal to build an Alaska natural gas pipeline, has long been waiting in the wings to assume control of the Mackenzie project. It stepped in when it was clear Ottawa and Imperial Oil had reached an impasse earlier this year.

Mr. Prentice - who has responsibility for the northern pipeline - said last summer the pipeline project would have to be "reinvented."

Still, a spokesman for Imperial Oil said this week that the company remained committed to the pipeline project.

David MacInnis, of the Canadian Energy Pipeline Association, said yesterday that his group has long advocated that Ottawa and the oil companies move to a "Plan B" that would see a pipeline operator build the main leg of the Mackenzie project, while the producers focused on field development and the gathering system.

He said TransCanada and APG would be able to finance the pipeline themselves if they could get long-term commitments of sufficient quantities from the big four producers, plus a host of small operators who have been exploring for gas in the Arctic.

While he stressed that he was not privy to details of the plan, Mr. MacInnis said the federal government would likely be called upon to streamline the regulatory process to protect against costly delays, and to provide accelerated tax write-offs of capital expenditures.

Prentice reviewing Mackenzie Valley pipeline financial plan

CanWest News Service

Monday, December 17, 2007

Canada's Industry Minister Jim Prentice is reviewing a financial plan submitted to him Friday by the backers of the $16.2-billion Mackenzie Gas Project.

Following meetings in Calgary with the project's key participants, Prentice would not detail the fiscal package but said it would be reviewed and analyzed as expeditiously as possible.

Projects proponents led by Imperial Oil Ltd. have been in talks with Ottawa for a year to try to hammer out fiscal terms for the giant, 1,220-kilometre pipeline and gathering system that could deliver as much as 1.9-billion cubic feet of natural gas per day from fields in the Mackenzie Delta of the Northwest Territories to the Alberta hub and onwards into the North American market.

While regulatory hearings have wrapped up, the project has stalled as a result of cost increases and a failure to reach a fiscal deal with the government.

Imperial has at times in the past looked for financial help from Ottawa to help make the project economic.

In recent weeks, the Financial Post reported the producer partnership of Imperial, Imperial's parent Exxon Mobil Corp., Conoco Phillips and Royal Dutch Shell would be prepared to hand control of the pipeline over to TransCanada Corp., Canada's largest pipeline company, which has financially backed the project's fifth partner, the Aboriginal Pipeline Group (APG), an aboriginal enterprise.

TransCanada would take the lead with 60-per-cent ownership, with the rest going to the APG, sources close to the project said.

That structure, under which the project and its tolling system would be regulated by the National Energy Board, was preferred in the eyes of Ottawa based on comments made by Prentice last summer.

Under that project structure, sources said Ottawa would be asked to assist via loan guarantees, guaranteed shipping commitments or other breaks.

Prentice's statement Friday said the government of Canada has no interest in owning any portion of the project or "in subsidizing petroleum companies."

"It must be a private sector investment, driven by commercial considerations," he said.

"It must result in tangible benefits for northerners and Canadians in general. Participation of the Aboriginal Pipeline Group must remain an important aspect of the project."

TransCanada Corp. chief executive Hal Kvisle told reporters last week that his company taking the lead role is just one in a range of options that had been discussed.

© CanWest News Service

December 15, 2007

No opposition to Chevron plan to sell Aitken

Facility is B.C.'s main storage venue for natural gas

Scott Simpson

Vancouver Sun

Saturday, December 15, 2007

Chevron Canada's application to turn B.C.'s main natural gas storage facility into a saleable asset is meeting virtually no opposition, according to documents on file with the B.C. Utilities Commission.

Earlier this year the BCUC granted Chevron's Aitken Creek facility, the only world-class gas storage venue in the province, exemption from regulation on the price it charges producers to store gas coming out of northeastern B.C.'s gas patch.

The BCUC ruled that Aitken Creek was a public utility -- but lacked market power to unduly influence gas pricing in B.C.

The approximate value of the facility, which has no counterpart in B.C., is $1 billion, and one potential buyer estimated Friday that about $420 million worth of gas will annually move through Aitken Creek. The facility holds gas for pipeline delivery to southern B.C. and to United States markets as far east as Chicago.

Chevron acquired Aitken Creek, which includes an underground storage cavern that originally held a gigantic natural gas deposit, as part of a larger purchase of Unocal Corp. in 2005. It has since decided the asset does not conform to its Canadian business model.

In preparation for sale, Chevron is asking BCUC permission to create a separate company to operate Aitken Creek -- a move that would then allow it to sell the facility to a new owner.

They are asking the BCUC to approve its proposals "at its earliest convenience."

In a final submission this week to the BCUC, Chevron notes that only two parties, Terasen Gas and the B.C. Old Age Pensioners took the time to provide written comment on the proposed transaction -- and documents on file with the BCUC show that neither party oppose the proposed arrangements.

The facility has a working capacity of 71 billion cubic feet and could be expanded by about 40 per cent.

The National Energy Board has noted that gas storage is "extremely limited in B.C." -- consisting of Aitken and a small liquefied natural gas (LNG) facility on Tilbury Island near the mouth of the Fraser River.

Several companies have been proposed as potential buyers but only one -- a new Alberta-based venture -- has publicly announced its intentions.

Chevron officials did not respond to The Vancouver Sun's request for an interview.

"There is no question that it is a world-class facility," said Rex Kary, founder of prospective Aitken buyer Moneta Energy. "The volume of gas handled there is substantial."

Kary said Moneta was formed a few months ago with the specific intention of acquiring gas storage assets as long-term investments.

"It comes from a fundamental belief that North America is depleting its natural gas reserves," Kary said. "There is not as much gas that can be delivered as easily as several years ago yet the demand is still increasing. What's starting to happen is that the volatility in the price, the price difference between summer and winter, is becoming greater."

© The Vancouver Sun 2007

UNOCAL - Aitken Creek - Exemption Application

UNOCAL - Disposition of Aitken Creek Gas Storage

Moneta Targets Gas Storage Opportunities

Nickel's Energy Analects

12-Dec-2007

Recently formed Moneta Energy Services says it intends to focus on developing natural gas storage opportunities.

Led by Rex Kary, a gas marketing services veteran, Moneta is focused on developing and/or acquiring infrastructure within the Canadian energy sector to extract additional value by trading the commodities that it stores and ships in its own assets.

Moneta is backed by Yorktown Energy Partners LLP, a $2.7-billion private equity fund solely devoted to investment in energy assets, and E&C Capital, the energy and commodities private equity group of BNP Paribas, a global bank that is a leading financial institution.

Moneta intends to use this capital to acquire and build infrastructure including storage facilities and pipelines to facilitate trading in gas futures.

“We have been given a mandate to develop a Canadian energy infrastructure organization,” Kary said in a statement. “Our partners, who are in the business of investing significant sums of money with known management teams, want us to become a significant natural gas storage player in Canada.”

One component of the company’s business plan is to partner with producing companies by purchasing their output as well as depleted gas fields for further development into underground storage.

The company will also work with utility companies to build storage in underground salt caverns and manage gas price exposure by optimizing the risk associated with futures trading.

Moneta said its strategy would eliminate environmental risk of abandonment for producers, while also monetizing remaining reserves to accelerate returns from a particular field.

Besides Kary, who has as president and chief executive officer, was a founder of Continental Energy Marketing in 1989, Moneta’s executive team includes: Bob Tomes as chief financial officer, with over 25 years of experience working on finances, strategy, treasury management, budget modeling and business development; Brad Johns as vice-president of operations, who has been involved in the technology sector for over 17 years, including focusing the last few years exclusively in the oil and gas sector; Glen Gill, vice-president of business development, with over 26 years of energy industry experience, including founding the first producer-owned and unregulated gas storage facility in Canada; Linda Wiebe, with five years experience at Continental Energy; Chris Richards as vice-president of trading optimization, with over 12 years of marketing, operations management and business development, including handling gas trading at AltaGas Income Trust; and Bob Stepan as vice-president of corporate development, with over 22 years of business experience in the energy sector, including positions with BC Gas Inc. and Union Gas Limited, the latter working in the storage planning group.

Moneta Energy Services Will Be Taking Producers Old Reservoirs and Turning Them Into New Natural Gas Storage

Moneta News Release

Marketwire

14-Dec-2007

CALGARY, ALBERTA--(Marketwire - Dec. 14, 2007) - Recently-formed Moneta Energy Services has entered the dynamic fast pace natural gas marketplace to capture value embedded in the commodity by helping producers shed depleted oil and gas fields and better deal with natural gas prices that have recently seen wild fluctuations. The new Canadian-based company, founded by gas marketing services veteran Rex Kary, is focused on developing and/or acquiring infrastructure within the Canadian energy sector to extract additional value by trading the commodities that it stores and ships in its own assets.

Moneta is backed by the financial strength of its partners - Yorktown Energy Partners LLP, a $2.7 billion private equity fund solely devoted to investment in energy assets, and E&C Capital, the energy and commodities private equity group of BNP Paribas, a global bank that is a leading financial institution in the energy and commodity sectors. Moneta will use this capital to acquire and build infrastructure including natural gas storage facilities and pipelines to facilitate trading in gas futures.

"We have been given a mandate to develop a Canadian energy infrastructure organization," says Rex Kary, who leads Moneta's hand-picked management team. "Our partners, who are in the business of investing significant sums of money with known management teams, want us to become a significant natural gas storage player in Canada."

One component of the company's business plan is to partner with producing companies through the purchase of their gas production as well as their depleted gas fields, further developing them into underground storage. The company will also work with utility companies to build storage in underground salt caverns and manage their gas price exposure by optimizing the risk associated with trading in gas futures.

Moneta plans to use underground reservoirs to store gas by putting it back into the ground in order to sell the gas in a period of greater demand and higher prices.

When Moneta takes over these underground reservoirs, it eliminates the producer's environmental risk of abandonment and, more importantly, monetizes the last remaining reserves, accelerating the producer's return from a particular gas field. "Their dollars are best spent drilling and finding new reserves, not trying to squeeze the last ounce of gas from the ground," Kary says. "We, on the other hand, need the gas in the ground to operate the storage field. It is a win-win relationship."

Alberta is an international hub for gas production, exporting 13 billion cubic feet of natural gas daily, with more physical gas traded in Alberta than any other location in North America. A simple example of gas storage utilization for trading in the commodity market is purchasing lower priced gas in summer months and selling during peak winter months.

Moneta Energy Services also offers producers and industrial users much needed assistance in managing gas prices at a time of very low or very high prices in the marketplace. "We offer producers and large industrial/commercial users energy management solutions so they aren't exposed to wide price fluctuations and can manage their business much better," says Kary

"The price of gas in the last few months has been very low and some wells can no longer produce economically, creating a financial hardship for many natural gas producers," Kary says. "With our financial strength, we can structure a variety of arrangements with producers to help ease the pain of the current low natural gas prices."

Moneta Energy Services Ltd. has combined industry knowledge and expertise with patient and persistent financial depth with a goal to become one of the leading asset-backed energy services companies in North America.

For more information, please contact

Moneta Energy Services Ltd.

Alyn Edwards

(604) 689-5559 or Cell: (604) 908-7231

or

Moneta Energy Services Ltd.

Rex H. Kary

(403) 770-4156

Email: Posted by Arthur Caldicott at 01:28 PM

Bali climate delegates eke out `weak' deal

a collection of news articles and news releases following the close of the Bail UN climate conference, where a surprise turnaround by the US and Canada resulted in a consensus, albeit in a watered-down agreement among the 188 nations present…

Gateway to the UN System's Work on Climate Change

Proceedings and Documents from the Bali Conference

Canada Bows to Pressure at Bali's 11th Hour

Canadian Action Network on Climate Change, 15-Dec-2007

Climate delegates eke out `weak' deal

Peter Gorrie, The Star, 15-Dec-2007

Bali breakthrough launches climate talks

David Fogarty, Reuters, 15-Dec-2007

FACTBOX: Achievements at Bali climate talks

Reuters, 15-Dec-2007

Isolated Canada grudgingly accepts Bali deal

Geoffrey York, Globe and Mail, 15-Dec-2007

U.S., Canada agree to framework at climate conference

Mike De Souza, CanWest News Service, 15-Dec-2007

Canada's environment minister says he regrets watered-down climate deal

Alexander Panetta, The Canadian Press, 15-Dec-2007

A Look at the Bali Climate Change Plan

The Associated Press, 15-Dec-2007

WWF says Bali Roadmap "weak on substance"

China View, 15-Dec-2007

PRESS RELEASE - CLIMATE ACTION NETWORK CANADA - RESEAU ACTION CLIMAT CANADA

December 15, 2007

Canada Bows to Pressure at Bali's 11th Hour

Environmental Groups Give Deal a Qualified Welcome

Bali - Nations agreed today on a "Bali roadmap" to launch negotiations for a post-2012 global climate agreement that will be guided by scientific analysis of the emission cuts needed to avoid dangerous climate change.

Key developing countries signalled a willingness to take on new commitments at the two-week-long UN climate conference. However, Canada worked with the United States for most of the meeting to oppose crucial elements of the Bali roadmap. As a result, parts of the deal are too vague to assure a successful outcome of the next round of UN negotiations, due to be completed in 2009.

"The world moved forward in Bali today, but we had the opportunity to do much more," said Steven Guilbeault, Équiterre. "The good news is that the Bali deal recognizes that rich nations need to cut their greenhouse gas pollution by 25 to 40 per cent below 1990 levels by 2020, and nations will negotiate the next phase of Kyoto on that basis."

Canada initially opposed this emissions reduction range in the final negotiating session, but agreed not to block the consensus position when it found itself virtually isolated.

"Canada worked against the key elements of this deal for most of the two weeks in Bali, and was singled out by other countries and high-ranking UN officials for its obstructive behaviour," said Dale Marshall, David Suzuki Foundation. "In the end, the government responded to public pressure and allowed this deal to go through."

The first phase of the Kyoto Protocol ends in 2012, and today's deal launches a two-year negotiation process for the post-2012 "Kyoto phase 2". In addition to setting a range of emission reduction targets for industrialized countries, the Bali roadmap contains commitments to negotiate actions to control emissions in developing countries; financial agreements for adaptation and the transfer of climate-friendly technology; and an agreement to tackle the problem of deforestation in developing countries.

"Now is when the real work begins," said Matthew Bramley, Pembina Institute. "The government's current targets and policies fall far short of the standard set in Bali. Nothing less than a massive scale-up of federal efforts on climate change is required for Canada to play a responsible part in the next two years of negotiations."

"Canada came to Bali demanding unfair commitments from developing countries, and was roundly criticized for it," said Emilie Moorhouse, Sierra Club of Canada. "In the end, the only bridge that Canada built in Bali was one that led to the U.S."

"The agreement to develop approaches to reduce deforestation and forest degradation is a key outcome of this meeting," said Chris Henschel, Canadian Parks and Wilderness Society. "Protecting carbon stored in forests and other ecosystems is an important complement to deep cuts in fossil fuel emissions."

-30-

Contacts:

Jean-Francois Nolet, Equiterre, +62-81-338-969139

Dale Marshall, David Suzuki Foundation, 613-302-9913

Matthew Bramley, Pembina Institute, +62-81-338-969113

Emilie Moorhouse, Sierra Club of Canada, +62-81-338-969125

Claire Stockwell, Greenpeace, +62-81-337-949709

Climate delegates eke out `weak' deal

Peter Gorrie

The Star

December 15, 2007

After hours of chaotic, sometimes angry haggling, the United Nations conference on climate change last night appeared set to approve what critics describe as a weak deal on cutting greenhouse gas emissions.

Nerves were frayed as sleep-deprived delegates from nearly 190 countries repeatedly edged to the brink of agreement, then pulled back into more acrimonious debate. Each move further diluted a compromise that, from the outset, was, "a lot of structure with not a lot of content," said Dale Marshall of the David Suzuki Foundation.

Public opinion forced delegates to find a way to agree, UN climate chief Yvo de Boer told reporters. "I don't think any politician can afford to walk away from here."

But after one nasty exchange, de Boer left the conference stage in tears, an observer said.