Vancouver Sun BC Energy Series: Tough choices ahead

ENERGY: Tough Choices Ahead

B.C.'s wealth of energy resources generates both cash and controversy. The Sun examines our place in a world battered by skyrocketing fuel prices, global warming and an unstable oil supply.

Staking a future on fossil fuels

Scott Simpson, Vancouver Sun, 23-Sep-2006

New energy tied to new cooperation

Scott Simpson, Vancouver Sun, 23-Sep-2006

Gas jockey 'pumps' 8 million litres a day

Scott Simpson, Vancouver Sun, 23-Sep-2006

Get ready for oil supplies to dwindle, experts warn

Scott Simpson, Vancouver Sun, 23-Sep-2006

Global meltdown feared: UN report

Scott Simpson, Vancouver Sun, 25-Sep-2006

Restless prairie winds power Alberta's renewable future

Don Cayo, Vancouver Sun, 27-Sep-2006

Solar-power development gathers energy around the world

Scott Simpson, Vancouver Sun, 27-Sep-2006

COMMENT:

This is day 1 of a seven day series of energy articles in the Sun. We'll be adding new articles to this posting as they are published. Check daily at http://www.sqwalk.com/blog2006/000858.html, or buy the paper.

Energy seems to be on everyone's agenda.

The Globe and Mail's Jeffrey Simpson spent last week in the oil sands. His columns are at

Neutralizing the oil sands' carbon emissions

http://www.sqwalk.com/blog2006/000857.html

Mighty sources of energy, mighty big threats

http://www.sqwalk.com/blog2006/000856.html

Oil sands vision, red herrings and a sea of platitudes

http://www.sqwalk.com/blog2006/000853.html

Fort McMurray gives new meaning to 'boom town'

http://www.sqwalk.com/blog2006/000854.html

Even the coal lobby got into the act and bought themselves a multi-page spread in the Globe and Mail. Hillsborough Resources and AES got plenty of coverage, fully paid for. These two companies have teamed up to advance AESWapiti, one of the two coal-fired generation projects accepted by BC Hydro in its 2006 Call for Power. If the infomercials in the Globe's energy supplement are correct, AES is promising a cleaner coal-fired generation plant than Compliance Energy, with its version of a knuckle dragging nineteenth century plant-from-the-past in Princeton. No biases here, folks.

http://www.sqwalk.com/blog2006/000852.html

And get your hands on the next issue of Watershed Sentinel. Fill 'Er Up - about Steve, a Canadian pump jockey, and Canada's headlong rush to send oil to the US.

http://www.watershedsentinel.ca/

If you like this stuff, join gsxlist, where energy issues with a BC spin are the only item on the menu. Write me.

Subscribe to Watershed Sentinel where our environment is the only issue. 20 bucks a year. The best $20 you'll ever spend.

Not quite done. BCSEA is the lobby for progressive energy in British Columbia. Join now.

Staking a future on fossil fuels

Scott Simpson

Vancouver Sun

Saturday, September 23, 2006

CREDIT: Stuart Davis, Vancouver Sun

Mike Griffiths (in red), Mike Zazvlak (in green) and

Bob Gamble (in blue) work on the drilling floor of

Precision Drilling rig #521, contracted by Encana

Corp. The new $12-million rig is drilling its second

hole in the Fort St. John area.

CUTBANK RIDGE, B.C.

It would be tough to find a roughneck anywhere in the world who would describe working on a drill rig as easy, but Bob Gamble, who toils on the deck of Precision Drilling's rig number 521, comes closest.

It is a state-of-the-art rig that bored its first hole just weeks before, an "iron roughneck" that has taken a lot of the backbreaking labour out of a job that has traditionally been recognized as tougher than anything outside a hardrock underground mine.

If you venture to northeastern B.C., you will find dozens of similar rigs probing the landscape like mosquitoes seeking blood, guided by young workers such as Gamble who trade their labour for paycheques that can reach $100,000 a year.

The machines and the workers are the physical manifestations of the biggest natural gas exploration boom in B.C.'s history, part of a global scramble for energy resources that has captured the world's attention like never before.

In the past five years, gas and crude oil prices have tripled, and catastrophists are widely proclaiming that the world's oil era is drawing to close.

More restrained observers, such as the governments of Canada and the United States, expect North America to run out of conventional natural gas by the middle of the next decade or sooner, sparking interest in higher-priced alternatives.

Terrorist threats in the Middle East, the wars in Central Asia, the global population boom and China's emergence as the world's second-largest consumer of oil after the U.S. have pushed consumer prices for gasoline to unprecedented levels. There is no expectation of a return to the cheap fuel and lavish consumption of the 1990s.

An international agency charged with managing developed nations' access to oil supplies finds itself increasingly focused on alternative energy and conservation efforts -- although no clear alternative to oil has yet emerged.

Amid the turmoil there is a deepening anxiety about the cumulative impact that a century's worth of high-intensity fossil fuel combustion -- the consumption of oil, natural gas and coal for energy -- is having on the Earth's climate.

Meanwhile, across Canada, the National Energy Board is anticipating the biggest surge of energy-related development in a decade, with multi-billion-dollar projects for natural gas, oil, and electricity generation development prominent in the minds of many provincial governments.

It is, in essence, a time of both great risk and great opportunity.

In B.C., unlike many other parts of the world, energy-related opportunities prevail.

B.C.'s fossil fuel resources are, as yet, largely untapped -- Alberta's thriving oilsands projects have obscured the fact that production of conventional natural gas is past its peak in that province and is now in a permanent state of decline.

Meanwhile, gas exploration companies will invest an estimated $4.5 billion in 2006 in development of new resources in B.C. -- and the province expects a further $2 billion in gas lease and royalty revenues.

One of the hottest gas plays in B.C. is at Cutbank Ridge, a deep, vast field of energy south and east of Dawson Creek.

Encana set a Canadian record for a single monthly land auction at Cutbank Ridge in 2003, amid estimates that the area would yield four trillion feet of gas. That's enough to supply all of Canada's gas-heated homes for eight years.

The project has supercharged the economy in Dawson Creek, where canny entrepreneurs in the oilwell drilling services industry swept in and became overnight successes.

One father and son team, for example, now has 100 employees in just two years.

The buzz of activity is also attracting good numbers of B.C. residents -- who have traditionally taken a back seat to Albertans in the hunt for employment in the oil and gas sector.

Bob Gamble is a prime example.

The 24-year-old swapped life in the genteel "Garden City'' of Victoria for a roughneck's job in a northern wilderness characterized by short, gaunt trees, bitter winters, muskeg and a succession of temporary worksites where the shin-deep mud sticks like glue to your boots.

On the deck of a brand new rig, Gamble and a co-worker help thread together sections of pipe for insertion into a 2,600-metre-deep drill hole.

"My cousin and I came up here together," Gamble, 24, says during a rare break from the bustle of work. "He works for Phelps. I work for Precision. We both decided to do it because of the money."

Gamble spent a year at college back home on Vancouver Island, and one of his objectives with Precision is to pay off his student loan.

He has also decided to bank his future on the oil and gas industry.

"I'm saving up for a two-year course in petroleum engineering at University of Alberta. I can get bursaries if I have field training. That will pay for a lot of tuition."

Co-worker Mike Zazulak was just five weeks into his career as a roughneck when The Vancouver Sun visited the rig.

He works alongside Gamble on the deck of the drill rig, and like his co-worker, he's staking his future on fossil fuels after he graduated this spring from the University of Alberta.

"Lots of my friends who didn't go to university did this, and they've got lots of money. I've got to pay off my student loans," Zazulak said.

"I wouldn't call this a career, but I'm keeping my options open. If I want to get into human resources for an oil company, a year of working in the field is the best work I can do."

The Precision rig is working under contract to Encana, the Alberta-based independent oil and gas company that is the single-largest investor in B.C.'s thriving natural gas exploration industry.

Encana spends up to $1.4 billion a year in land leases, roads, pipelines, drilling operations and royalty payments to the provincial government.

Industry-wide, the pace is frantic.

Canada is the world's third-largest producer of natural gas and about 60 per cent of output goes to a ravenous market in the U.S.

North American market prices for natural gas have dropped from their 2005 highs but the average is still three times higher than it was at the turn of the decade -- and is not expected to return to its former levels.

B.C. now accounts for 16 per cent of Canadian gas production -- and that could reach 25 or 30 per cent within a decade.

Alberta can tell a similar story with oil.

The U.S. gulped up two-thirds of Canada's crude oil production in 2005, including $24.6 billion worth of crude shipped to the U.S. from Alberta, Statistics Canada stated in a September report titled Boom Times: Canada's Crude Petroleum Industry.

Operating profits for companies extracting the oil "soared by 50 per cent last year" to $30.3 billion, Statistics Canada said.

A more important point for Canada is that crude oil prices rose 30 per cent.

Oil sands projects that were too expensive to develop when the world price for a barrel of oil wallowed in the $20-dollar range are profitable when the world is paying $50 or $60 a barrel.

In fact, the profit threshold is only about $30 -- less than half the current price.

Statistics Canada notes that as a result of rising prices, Alberta's reserve of economically recoverable oil has jumped 35-fold in just three years, to 174 billion barrels of crude.

In the world, that puts Canada behind only Saudi Arabia in terms of crude oil reserves.

CREDIT: Ian Smith, Vancouver Sun

Products from the tank storage area to ships that

berth in Burrard Inlet below the Chevron refinery.

Despite all of that potential wealth, says National Energy Board chairman Ken Vollman, the message for Canadian consumers is simple -- moderate your consumption.

Whether you are considering something as dramatic as the purchase of a new automobile, or as mundane as a replacement for a burned-out light bulb, your decision affects Canada's most lucrative natural resource -- energy.

It's the backbone of the Canadian dollar, the underpinning of a comfortable lifestyle in an uncomfortable climate, and an essential component of economic activity.

"I think you can make a good argument that energy is more important to Canadians, probably, than to citizens of any other country," says Vollman. "We have long winters and a lot of our energy goes into heating our buildings. We are also a very large country with a sparse population, so transportation takes up a lot of energy.

"Probably no other industrialized country has those extreme temperatures for such a long period of time, or faces such long distances to move stuff around."

Conserve more at home, and you can sell more to your neighbours at a profit to the national economy, Vollman notes.

"We've got to look at using energy more efficiently," he says. "Sometimes that makes more sense than developing new supply. Let's investigate all of the supply sources but while we are doing that let's not forget that we can also use energy more efficiently."

Those comments echo the International Energy Agency, a Paris-based organization that serves as energy policy adviser to 26 developed nations anxious to avoid a repeat of the oil crisis of 1973-74.

Not surprisingly, as the world struggles to keep pace with new demand for energy -- China's electricity consumption alone rose nine per cent per year -- conservation is emerging as a priority at the agency.

For example, this summer it released a study recommending that the world's developed nations initiate a transition from conventional incandescent light bulbs to fluorescent lighting as a way of saving energy and avoiding costly new electricity infrastructure investment.

In Canada, Crown agencies such as BC Hydro have struck similar initiatives to cut electricity consumption. Hydro is an international leader in encouraging conservation -- for the last five years encouraging consumers to replace incandescent bulbs with compact fluorescents.

This month, Hydro announced a new project seeking 2,000 homeowners in six communities around the province to volunteer for a program monitoring their electricity consumption on a time-of-day basis.

Hydro hopes the data will eventually enable it to adjust its electricity rates on an hour-by-hour basis -- and reward with cheaper rates any consumers who run power-hungry appliances in off-peak hours.

There isn't another country in the world that would benefit more from conservative use of energy.

According to Natural Resources Canada, the nation's energy sector generates more than $70 billion in gross domestic product, produces a $40-billion surplus in trade with the U.S., annually attracts about 20 per cent of all new capital investment in Canada, and directly employs 230,000 people.

As well as being the the world's third-ranked exporter of natural gas, Canada is the ninth-ranked exporter of petroleum and among developed countries it is the number three electricity exporter.

The U.S. is the main customer for most of that energy and, not surprisingly, steep increases in the world price for crude oil are the primary reason that the value of the Canadian dollar has risen more than 25 cents against U.S. currency since 2003.???

still correct??? KH NOTE: Needs checking

Canada doesn't just profit from the export of energy, however. It relies on it to keep the national economy in motion.

Statistics collected by the IEA and other international groups commonly rank Canada among the world leaders in terms of the amount of energy consumed on a per-person basis.

We even burn more than the U.S., 33 per cent more per-person according to a University of Victoria study, for every dollar of gross domestic product we generate.

Meanwhile, momentum is building in virtually every part of the country to add to Canada's roster of energy resources including oil, natural gas, coal and hydroelectricity -- as well as new pipelines and transmission lines to get it all to market.

Here in Canada, and in the U.S., there is growing recognition that neither nation can count on its own natural gas reserves to satisfy a growing need for gas on both sides of the border.

Projects are underway on both the East and West coasts to develop marine terminals and pipelines in support of ships arriving from other continents with new supplies of gas -- in much the same manner that oil now moves around the continent.

The gas would arrive in condensed, liquid form, then be turned back into gas at shipping ports and piped around the continent.

Already in Eastern Canada, the National Energy Board is anticipating public hearings on the construction of pipelines that would carry that new imported gas into existing cross-continental gas lines.

In Quebec, residents are pondering Premier Jean Charest's $25-billion proposal for new hydroelectric development including a major initiative to develop hydro power for export to Ontario and the U.S.

Ontario Premier Dalton McGuinty has proposed a $70-billion plan that includes development of two nuclear-powered electrical generating facilities, plus conservation and wind power projects. The province's aging transmission system also needs improvements.

NEB hearings are already underway in the Northwest Territories for the 1,220-kilometre Mackenzie Valley gas pipeline project that has been proposed by a consortium of oil companies including Shell, ExxonMobil and ConocoPhillips.

Alberta is in a rapid expansion of its oil sands development, including construction of pipelines to ship that oil to markets in the U.S. and Asia.

Things are moving so fast that the municipal council in Fort McMurray, ground zero for the oil sands industry, is looking to temporarily halt further development of one of the world's biggest remaining oil resources -- saying there aren't enough roads, schools and community services to support the workers who have already swarmed into the city.

B.C., meanwhile, will see a little bit of everything except nuclear power.

The B.C. Utilities Commission is dealing with 43 per cent more paperwork than 2005 -- making 2006 the utility regulating body's busiest year on record.

The northeastern B.C economy, fuelled by exploration and development of Canada's most robust natural gas resource, has surpassed forestry as the single largest generator of resource revenue for the provincial treasury.

A recent report from the Conference Board of Canada described natural gas production in B.C. as "a bright spot on the horizon" compared with Alberta, where production of conventional natural gas is in a permanent decline due to the maturation of the nation's largest gas resource, the Western Canada Sedimentary Basin.

B.C. is also experiencing a flurry of pipeline construction -- thanks in large part to Alberta's need to move its energy to foreign markets.

Kinder Morgan is expanding its Trans Mountain oil pipeline between Alberta and B.C., while Enbridge is moving ahead with plans to develop a rival line taking synthetic crude oil from the Alberta oilsands to the Pacific coast at Kitimat.

B.C.'s electricity sector is also booming, on a scale unseen since the W.A.C. Bennett Dam was completed in 1967.

On July 27, BC Hydro announced the biggest private sector electricity initiative in the province's history, 38 new projects totalling $3.6 billion to generate enough electricity for 700,000 homes year-round.

If all the projects carry through to completion they will meet B.C.'s electricity needs for the next 30 years, BC Hydro chair Bob Elton estimates.

The roster of projects accepted for development includes the first substantive plan to develop energy from wind, as well as two coal-fired generating plants.

The coal-fired plants would be unprecedented in a province that has traditionally relied on hydro power for most of its electricity.

The projects on this year's list would lift the private sector's share of total B.C. electricity production to 28 per cent -- enough to light 1.4 million homes.

There are about 1.8 million households in B.C. -- industry and commercial activities consume about 70 per cent of total annual electricity production.

B.C. Energy Minister Richard Neufeld said the public may not yet appreciate the extent to which Hydro has been able to contract with private sector companies to develop new electricity supply from so-called green or "clean" sources such as run-of-river hydro developments.

"Hydro has been doing a fairly good job of keeping up with electricity demand at a time when growth of the province's economy has been phenomenal," says Neufeld.

B.C. also needs to upgrade existing power transmission lines, with top priority given to new connections for 750,000 Vancouver Island residents.

BC Transmission Corporation is building new high voltage lines from Tsawwassen to the Island -- which could suffer brownouts as early as this winter due to reliance on 50-year-old power lines that are wearing out and can no longer be trusted to carry their original load.

Last February, B.C. Finance Minister Carole Taylor announced a three-year $2-billion borrowing plan for funding redevelopment of BC Hydro dams and generating facilities and the province's badly aging network of transmission lines across the mainland.

Meanwhile, B.C. homeowners could soon join Ontario and Alberta as participants in a deregulated home heating market as the B.C. Utilities Commission mulls a proposal from Terasen Gas -- on orders from the provincial government -- to open up the residential gas market to competition.

Amid all of this activity, there is growing concern among developed countries that the global supply of energy commodities led by oil will not keep pace with the emergence of China, India and other industrializing nations as rival buyers on tight global markets.

"The more we compete for the remaining dwindling supplies of resources, particularly energy and water, in order to maintain a totally unsustainable lifestyle, the more it's going to force us to confront hostilities between nations," suggests William Rees, a professor at the University of B.C.'s school of community and regional planning.

He's anticipating some ferocious conflicts ahead as newly developing nations clash for resources with developed countries which presume to have a sovereign right to energy resources.

"I don't think there's any way you can avoid that between China and the U.S., between China and Europe -- and throw India into the mix because it will soon pass China in population.

"We are headed rapidly for some constraints here that are unprecedented."

Rees gained international recognition in 1996 for his concept of an ''ecological footprint'' as a means of measuring a culture's environmental impact.

The developed world's footprint, he says, is too large -- and attributes the situation to a lack of appreciation of the full cost of fossil fuel consumption.

He supports climate scientists who assert that fossil fuel combustion is adversely affecting the Earth's climate -- and believes more realistic pricing for oil and gas would ease the risk of multinational conflict as well as further risk to the environment.

"I'm a bit notorious I suppose for suggesting we should be paying four or five dollars a litre for gasoline," Rees says.

"In this era we've accepted that economic signals and markets should determine pricing. If people really took that seriously they would want the price we pay to reflect reality, is that not right?

"So there should be no objection whatsoever to the price of fossil fuels including what I would call the total social cost of using them.

"Higher prices will induce conservation, as was demonstrated during that period of high oil prices in the 1970s and early 1980s when per capita consumption declined."

The first benefit would be to stave off any potential crisis in oil supply, perhaps for decades, Rees said.

"The second thing it does is make alternative sources of energy, renewable energy, more competitive in the marketplace.

"When you're going to have to pay a lot more for oil and natural gas, people start to look at the alternatives."

© The Vancouver Sun 2006

New energy tied to new cooperation

Scott Simpson

Vancouver Sun

Saturday, September 23, 2006

Humanity's darkest hour may be just decades away, touched off by a desperate and increasingly violent struggle for energy resources.

Futurist scenarios examined by the International Energy Agency, Shell Oil, a Stockholm-based think-tank, and others see "grim" prospects for civilization if nations fail to manage a smooth transition to new energy systems as conventional fossil fuel supplies dwindle.

An energy demand study prepared by the Organization for Economic Cooperation and Development sees the period between 2010 and 2020 as pivotal to efforts to successfully adapt to new systems that lessen the world's dependence on oil and reduce the impact that fossil fuel combustion has on the climate.

It is expected that without action to curb greenhouse gas emissions, fossil fuel combustion will increase concentrations of carbon dioxide and other gases in the Earth's atmosphere, diminishing food production from both agriculture and fisheries as well as reducing the availability of fresh water.

Optimistic scenarios assume an easy transition to other sources of energy -- including the gasification of coal and its widespread adoption as a replacement for gasoline.

But those scenarios also rely on an unprecedented new era of cooperation among already developed nations, ambitious developing nations, and oil-rich nations that, to date, have put national interests ahead of those of their trading partners.

More gloomy scenarios anticipate heightened conflict as developed nations attempt to lock down supplies of energy on behalf of their own constituents.

Meanwhile, countries with fewer financial resources face revolution and collapse as climate change hampers their ability to produce food.

The Stockholm Environment Institute, whose forecasts have often been cited by the International Energy Agency, anticipates social, environmental, economic, institutional and resource "stress" -- and "dangers" -- without a transformation to more sustainable energy systems.

Tensions will rise between have and have-not populations inside and outside existing national borders, leading to "generalized societal disorder, loss of governance and regional fragmentation."

Privileged "actors" including regions, countries and multinational corporations would be moved to protect their own interests by "entrenching themselves in bubbles of wealth" that exclude the majority of the world's population from access to strategic resources.

Alternatively, the powerful elite will find themselves unable to contain "the tide of violence" arising from extreme inequity in energy supply -- or competition from rival groups.

Multiple stresses including pollution, climate change and ecosystem degradation will amplify the opportunity for conflict.

Some scenarios envision increasingly violent waves of global terrorism -- with large and motivated groups of militants using biological and nuclear weapons with catastrophic effects against their supposed oppressors.

The crisis "spins out of control," a "planetary emergency" is declared, and authoritarian regimes crack the whip in even the most privileged enclaves.

In the worst case, the world suffers a generalized breakdown of civilization including "general disintegration of social, cultural and political institutions, de-industrialization and technological regression."

"Breakdown could persist for decades before social evolution to higher levels of civilization again becomes possible," says a paper written by Stockholm Environment Institute program director Gilberto Gallopin.

© The Vancouver Sun 2006

Gas jockey 'pumps' 8 million litres a day

Scott Simpson

Vancouver Sun

Saturday, September 23, 2006

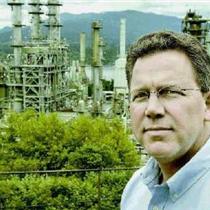

CREDIT: Bill Keay, Vancouver Sun

Chevron's Burnaby refinery general manager Doug Hinzie

says the facility is an integral part of the company's supply

chain that extends to 180 countries around the world.

In the course of a casual conversation with a new acquaintance, somebody might ask Rick Webb what he does for a living.

"I work for Chevron," he tells them.

"They say, 'How do you like pumping gas?' And I say 'No problem, I love it,'" Webb explains with a straight face. If they follow up with any more questions, Webb gets to deliver his punchline.

In a single, 12-hour shift he ''pumps" about eight million litres of fuel through a 15,000-kilometre network of pipes at Chevron Corporation's oil refinery on Capitol Hill in Burnaby.

Oil has been refined on this site since 1936, making it one of the most enduring pieces of industrial activity anywhere in B.C. -- and with the closure over the past two decades of all rival operations it is the only refinery in operation on Canada's West Coast.

It produces gasoline and other products on a 24/7 basis including Christmas -- excluding one annual maintenance shutdown that is crucial to ensuring the continued safe operation of a facility that produces volatile liquids and potentially lethal gases.

Webb has worked there almost 25 years -- long enough to pump 30 trillion litres of crude oil through distillers, boilers and 20-storey metal towers.

The whole operation clings to a piece of rugged Burrard Inlet terrain that still retains enough of its wild character to attract deer, coyotes, cougars and eagles.

"I could see this place from where I grew up so it's a bit of an oddity, really, than I ended up working here," Webb said in a recent interview at the refinery's computerized control room. "My father had a second-class steam certificate. I went to school and got a certificate myself, applied here, and they hired me."

ONE REFINERY LEFT IN B.C.

Greater Vancouver once had four major refineries, but the other three have ceased production and now serve only as vast tank farms storing fuel for the local market.

Chevron continues to spend money here -- more than $123 million in recent years -- to keep pace with ever-tightening environmental regulations and maintain its position as the No. 1 marketer of gasoline in B.C.

The original Burnaby operation, under the banner of Standard Oil, was fed by raw crude oil that arrived here by ship from California to be refined into fuels and related products at the rate of 2,000 barrels a day.

Today, it takes about 10 days for crude oil to travel here via the 1,200-kilometre Trans Mountain pipeline from Alberta's oilfields. The Trans Mountain line, owned by Terasen, delivers crude at the rate of 50,000 barrels a day.

That's enough to fill 50,000 regular-sized bathtubs.

The refinery produces enough gasoline to support between 20 and 30 per cent of automobile use each day in Greater Vancouver, plus propane for gas barbecues, butane for lighters, diesel fuel for trucks, and asphalt for road building.

Chevron provides 40 per cent of jet fuel consumed at the airport, as well as high-sulphur bunker oil for export to nations with lower air emission standards than Canada.

"The refinery is something that's necessary for all of us at this time," says Webb.

"We need to get on a bus and go to work. We need to take jet airplanes, car rides."

Burnaby refinery manager Doug Hinzie describes the facility as "small" in relation to modern international operations that can process 16 times as much oil in a single day.

Canada's biggest is the Irving Oil refinery in Saint John, with a daily capacity of 250,000 barrels -- five times larger than Chevron's Burnaby plant.

Nonetheless, the B.C. operation is an integral part of the Chevron supply chain, which extends to 180 countries around the world.

Hinzie says that's particularly true at a time when the world's appetite for oil is harrowingly close to the amount that refiners are able to process -- 85 million barrels a day.

The very thin line between world oil supply and demand, driven by an accelerating thirst in China and India, is one of the primary reasons consumers in North America, Europe and elsewhere paid record prices for gasoline this summer.

Prices began to ease off in September -- a traditional trend reflecting less gas consumption once summer holidays finish.

But they remain 20 per cent higher than the five-year average, and even without a repeat of the Gulf of Mexico hurricane season of 2005, fundamental problems remain.

The United States' struggles in Iraq, political confrontation in Iran, and government muscle-flexing in Venezuela, and a perceived terrorist threat against the world's oil supply, still cause anxiety among traders who push up the world price of a barrel of oil to lessen the financial risks of trading.

The most notable symptom of higher gas prices is surging interest among consumers for hybrid vehicles.

Hybrid car sales have grown ten-fold in North America since the first models were introduced in 2000.

Otherwise, consumers haven't flinched -- in fact, the U.S. Energy Information Agency projects gasoline consumption to rise 1.5 per cent in 2006.

In Greater Vancouver, motorists grudgingly took this summer's record prices -- more than $1.20 a litre at some venues -- in stride.

Port Moody resident Bill Trenaman said traffic congestion is a bigger issue around the region for most families -- particularly those with active kids who must be shuttled from event to event.

Trenaman has two daughters in soccer and dance, and a son in soccer and hockey -- and he's coach of three of the sports teams.

He's one of Greater Vancouver's more conservation-minded commuters, riding his bike to work each day in downtown Vancouver.

Nevertheless, the family owns two vehicles including one that's reserved for transporting his kids and carpooling some of their teammates to games and practices.

"The way I look at it, if you are going to pay almost $500 for hockey registration, the difference between $1 and $1.20 on a tank of gas isn't going to deter me," Trenaman said.

"Gas is still awfully cheap compared to what it is in Europe. That being said, we do try to carpool as much as possible."

Chevron's Hinzie says the recent price surge took even the oil industry by surprise.

"If we have an unexpected reduction in supply -- such as a hurricane or a number of large refinery incidents that cause unplanned or unscheduled maintenance -- the whole system collectively just doesn't have that extra cushion and you see much more volatility in prices."

The industry's inability to quickly boost oil production is the factor most responsible for driving prices higher.

Hinzie said the industry consensus a decade ago was that there would be significant demand growth in Asia, but "very few were predicting the kind of demand growth we saw in China. In one year alone, China had over 15-per-cent demand growth in oil and gas."

Chevron is not alone in conceding uncertainty about the future price of oil.

As recently as January 2004, the U.S. federal government's Energy Information Agency acknowledged a strong element of uncertainty in the future price of oil -- but suggested a per-barrel price ranging no higher than $51 US by 2025.

The International Energy Agency, a 32-year-old organization comprising of all of the world's developed nations, was even more sanguine.

The IEA's 2005 world energy outlook pegged oil at $37 by 2020, and $39 by 2030.

In recent days, after flirting with a summer high of $77 US, the price has hovered around $62 a barrel.

Oil market unpredictable

Hinzie notes that the world oil market is far less predictable, and more quirky, than most people would assume by looking at a straightforward and efficient link such as that between coastal B.C. and the oilfields of Alberta.

For example, many motorists in Eastern Canada and the eastern U.S. are running their automobiles with gasoline that is refined in Europe -- at prices that can be as low as half those charged to motorists in countries such as France, Italy, Germany, Belgium and the United Kingdom.

Sometimes, fuel movements defy any explanation other than the market's peculiarities -- as in the case of seven Chevron ships' worth of finished gasoline that sailed halfway around the world last year in search of a market.

"We shipped finished gasoline from Wales, where we have a refinery, to California because economically that was the most attractive destination for that fuel. That's just one example of many world-wide. There are both crude oils and finished products literally moving all over the world based on market-driven forces, which ultimately benefits consumers on average world wide because highest prices attract more supply, which tends to bring prices down."

That European connection, incidentally, is one of the reasons to expect North American gasoline prices to remain higher in coming years.

Hinzie said that connection and stringent environmental standards in North America are disincentives to investment in new refineries that would put more fuel onto the market when demand traditionally rises during summer driving season.

A SELLER'S MARKET

In recent years, an incapacity to produce extra fuel to satisfy peak summer demand has turned the North American gasoline market into a sellers' market -- marked by the highest posted prices on record, not including inflation.

Canada has not added a new refinery since 1984, the U.S. since 1976. Meanwhile since 1970, the number of operating refineries in Canada has fallen to 19 from 44, and since 1981, the number of operating refineries in the U.S. has fallen from 315 to 144.

The International Energy Agency warned last year that across the developed world there is "an urgent need for more distillation and upgrading capacity."

"As a result of strong growth in demand for refined products in recent years, spare capacity has been rapidly diminishing and flexibility has fallen even faster. Effective capacity today is almost fully utilized, so growing demand for refined products can only be met with additional capacity."

Chevron has been encouraging public discussion around this, and other issues involving the world's dependence on oil at an Internet energy forum called willyoujoinus.com, on the premise that the issue of energy supply is becoming increasingly urgent.

"Oil and gas have been very cost effective for a long, long time. That's one of the reasons people have not had to think about these issues -- until the price of gas went up," said Hinzie, who worked on the Will You Join Us forum before moving to his new refinery assignment.

Whether it's encouraging public appreciation for the complexity of issues surrounding new refinery investment, or the cost of alternative energy options, or tackling the notion that the world's oil supply has peaked, Hinzie said Chevron believes there is value in encouraging a deeper understanding of what's at stake.

The most stunning aspect of the website is an oil barrel counter in which the numbers must spin almost five times as fast as the crankshaft of an Indy racing car at full throttle in order to keep pace with the world's rate of oil consumption.

"The more fact-based, the more objective the dialogue is around energy, the more likely we are to have accurate opinions and constructive dialogue and wise decisions moving forward at all levels -- whether it's within industry, on the consumer side, generally in society, or in politics and government," Hinzie said.

© The Vancouver Sun 2006

Get ready for oil supplies to dwindle, experts warn

Scott Simpson

Vancouver Sun

Saturday, September 23, 2006

Some observers predict a social and economic meltdown as severe as the Great Depression

Crude oil makes Kjell Aleklett think about wild strawberries.

Aleklett, a Swedish professor of physics, sees inescapable similarities between the steady depletion of the world's most coveted energy source and the foraging habits of berry afficionados.

"In Sweden we have strawberry fields where you can go out and pick for yourself. If you go out there in the morning there is a possibility that you can pick a big volume of strawberries. But the first picker picks the big ones. The last one is left with the small ones. It's very much the same thing when it comes to the production of gas and oil.

"The goodies, the big ones, have been picked. It's true all over the world. Now we have to stick to the small ones. That means it's harder to fill the basket."

Aleklett made his comments during an interview in Vancouver, where he recently gave a speech on the future of global crude oil supply to the annual conference of the international Pulp and Paper Products Council.

Aleklett is a sought-after speaker on this topic -- he is founding president of an ad hoc group of academics, geologists and politicians who have formed the Association for the Study of Peak Oil (ASPO for short).

The U.S. House of Representatives is among the groups that have invited Aleklett to present his message.

The basic notion is that the world's oil producers are close to an absolute peak in terms of the volume of oil they can put onto the market in a given year.

Once that moment arrives, annual crude oil output will begin a long decline -- with grim consequences for national economies.

Aleklett believes the peak could arrive as soon as 2008 -- and that the struggle to adjust to the new energy reality could take 20 years, posing enormous challenges for developed nations.

Some observers suggest that the decline will prompt an economic and social meltdown on a scale last experienced in the Great Depression -- or perhaps when the Black Death swept across Europe in 1347.

Even the International Energy Agency, which mulls global oil issues on behalf of Canada and 25 other developed countries including the United States, Great Britain and Japan, is exploring "barbarization" scenarios in which billions of people starve, national governments collapse, economies are forced to deindustrialize, and many regions of the world return to "semi-tribal or feudal social structures."

"Oil wars are certainly not out of the question," says the U.S. Army Corps of Engineers.

Each day the world gulps down 82 million barrels of oil -- virtually the same amount that is produced.

The United States Energy Information Agency projects consumption to increase to 103 million barrels per day in 2015, and 119 million barrels each day by 2025.

That means global production must increase by 45 per cent -- about five times the maximum annual output available from Alberta's oilsands -- just to keep pace with ordinary economic growth.

There's just one problem.

No one can say with confidence where all that extra oil will come from.

It has been 57 years since Shell Oil senior geologist M. King Hubbert asserted in the journal of the American Association for the Advancement of Science that the dominance of fossil fuel in the global energy mix is just a tiny "pip" in the course of human history.

Hubbert attributed skyrocketing world population and U.S. industrial growth since the 1800s to an exponential increase in energy consumption, driven by cheap and abundant fossil fuel.

"The events which we are witnessing and experiencing, far from being 'normal,' are among the most abnormal and anomalous in the history of the world."

Hubbert said global consumption of fossil fuel rose from an estimated 300 kilocalories per person per day in 1800 to 9,880 by 1900 -- and 129,000 in the U.S. by 1940. (The current number in Canada and the U.S. is 200,000 per day).

Hubbert said sustained consumption at those levels was a "physical impossibility" because our oil, coal and natural gas spree "can only happen once."

Energy is so fundamental to human activity that "the future of our civilization largely depends" on preparing for a post-oil world.

"Cultural degeneration" was possible, he said, with our descendants living at "the subsistence level of our agrarian ancestors."

Six years later, Hubbert followed up with a paper that correctly predicted that oil production in the U.S. would peak in the 1970s.

ASPO members say the world must accept that the supply of its preferred source of energy is topping out -- and move quickly to figure out what comes next.

Aleklett says not even Saudi Arabia, the world's leading crude oil producer, can meet more than a fraction of all the new demand that's expected if the world maintains its current rate of economic growth.

Venezuelan heavy oil and Alberta oilsands are perceived as rich new sources of crude, and there's optimism that deep sea exploration will yield new reserves.

But Aleklett says those efforts may serve only to maintain existing production -- and cannot meet exploding demand growth in the developing world, including an expected five-fold increase in oil consumption by China and India.

China has 21 per cent of the world's population but at present consumes only eight per cent of its annual production of crude oil.

"Should they be allowed to use 21 per cent of the oil produced in the world since they have 21 per cent of the global population?" Aleklett asks.

"They will do whatever they can to make it happen. I have had discussions with leaders in China, with advisers to the president, about peak oil and they said they know about peak oil and they will act accordingly."

CIBC World Markets' chief economist Jeffrey Rubin has been portraying peak oil as a foregone conclusion for a couple of years in the company's provocative Occasional Report series.

Rubin thinks the peak year for cheap, conventional and easy-to-develop sources of crude oil was 2004, and that significant new additions to oil supply will come from unconventional sources such as the deep ocean and the oilsands -- at a much higher average price than at any time in the past.

That suggests that current high oil prices -- which may yet push the world into a recession -- are the new norm.

ExxonMobil recently concluded that about half the world oil supply needed over the next 15 years "has yet to be developed," Rubin said in a February 2006 report.

He calls the depletion of conventional oil "the elephant in the room" and noted that Kuwait's Burgan oilfield, No. 2 in the world behind Saudi Arabia's Ghawar field, "has started to run dry."

Ditto the world's No. 3 field, the Cantarell in Mexico, where production has started to drop off.

"Rising depletion levels mean, in effect, that oil firms these days must run faster just to stand still," Rubin wrote.

A scenario that is potentially more ominous for Canadians and Americans, who are the world's largest per-capita consumers of oil, is a new paradigm in which 80 per cent of the world's future supply is in the hands of nationalist-minded governments -- rather than multinational oil companies who could finesse it back into the automobiles of North American motorists.

Some expert sources are suggesting that a global recession could turn out, in relative terms, to be the best-case outcome. They are urging governments to act immediately to ensure an orderly transition to other kinds of fuel.

Former governor-general and Manitoba premier Edward Schreyer, an economist by training, presented a paper titled Global Energy Crisis Emergent to an ASPO workshop in May 2005.

He said the world's oil supply situation "is building up to a scenario which has all the signs and omens of a global energy crisis -- impacting in a way which challenges our imagination."

"This sobering story is now before our eyes playing out toward an ever more dangerous, and increasingly more likely, tragic conclusion here in the first quarter of the 21st century."

In a recent interview with The Vancouver Sun, Schreyer said "there are many, many geologists, lifelong petroleum engineers, who are saying that we can stand on our heads if we want, and the world simply cannot produce more than 80-something million barrels a day."

That doesn't mean that the world is running out of oil, Schreyer adds, only that the expertise to extract it has reached its limit.

For example, a typical Albertan well that has ceased to produce oil still contains half of its original reserve of oil -- but pressure inside the well has dropped too low to allow any further oil to be pumped out.

A more immediate concern, recalling Kjell Aleklett's anecdote about strawberries, is that new wells are smaller and less productive than those developed 10 or 20 years ago in Canada's greatest oilfield, the Western Canada Sedimentary Basin.

Records of the Canadian Association of Oilwell Drillers and Contractors show that drilling activity is up 25 per cent in Alberta since 1997.

However the actual volume of oil produced by that province is declining at the rate of about three per cent per year -- reflecting a trend that is echoed in conventional oilfields across North America and around the world.

"Drive through the southern stretches of East Texas and you will see graveyards of oil pumping equipment, processing tanks and the like, and you will understand the full meaning of an oil region coming to the end of its days," said Schreyer.

He believes there is "a rude awakening" in store for nations and for corporations that haven't made preparations for dealing with the situation.

"What we are witnessing now is that virtually three-quarters of the important oil producing countries of the world are now past their peak. There is no argument about it whatsoever.

"What is under argument is how soon the remaining one-quarter will be able to slightly escalate their production. But even those oilfields won't last forever."

University of British Columbia civil engineering associate professor Robert Millar reckons that the peak is here now -- but even if he's off by a few years, he said, consumers are beginning to get a sense of what the impact will be upon their pocketbooks.

"Global production has been flat now for a year and a half or more, and demand continues to climb with world economic growth. We are seeing the consequence of that with higher prices," said Millar.

He believes oil prices must remain high -- or climb even higher -- in order to slow the pace of consumption. "It's hard to conclude that we are not looking at substantially higher oil and fuel costs in the future."

Even some of Canada's most bullish oil-watchers are conceding that the peak oil argument has merit.

Vincent Lauerman, senior economist for the Canadian Energy Rese0arch Institute, and author of CERI newsletter Geopolitics of Energy, isn't quite ready to sell his car, but he agrees that the cost of running it has taken a permanent increase.

Lauerman said his outlook became more cautious after he heard a presentation by Jeremy Gilbert, the former chief petroleum engineer for British energy multinational British Petroleum (BP), at CERI's annual oil conference in Calgary. "He was excellent. At that point I was definitely a resource optimist. But after hearing him, pondering and doing some further reading, I have joined the moderate camp," Lauerman said.

From a Canadian perspective the peak may be further away than some imagine -- particularly because world prices have moved well past the point at which more costly and unconventional reserves can be developed.

"Once you get up to $40 a barrel, it opens up a lot of oil that wasn't even considered viable until the last couple of years. The prime example are the oilsands in northern Alberta."

2015 PROJECTED GLOBAL OIL SUPPLY DEFICIT

A large deficit in global oil supply is predicted by 2015, according to chart provided by University of B.C. civil engineering associate professor Robert Millar, based on numbers from Association for the Study of Peak Oil.

Projected annual shortfall in oil supply by 2015:

- 22 million barrels per day, or eight gigabarrels per year, an amount that is equivalent to current total U.S. oil annual consumption.

That shortfall is also equivalent to:

- 13 times the projected 2006-2015 production increase from Alberta oilsands (according to Canadian Association of Petroleum Producers, 2005)

or:

- 220 large (100,000 barrels per day) refinery plants converting coal into liquid fuel.

or:

- 10 times the global vegetable oil production that could be converted to biodiesel fuel

or:

- 1,500 one-gigawatt nuclear power plants.

Ran with fact box "2015 Projected Global Oil Supply Deficit", which has been appended to the end of the story.

© The Vancouver Sun 2006

Global meltdown feared: UN report

Scott Simpson

Vancouver Sun

Monday, September 25, 2006

A landmark climate change report coming early next year will reveal such a strong link between global warming and fossil fuels that the world will have to end its addiction to oil, says a leading Canadian climate researcher.

Ignoring the findings of the report will lead to widespread environmental catastrophes, Andrew Weaver added.

"We do not need more research to tell us what the first-order problem is, and what needs to be done," said Weaver, Canada research chairman at the University of Victoria's school of earth and ocean sciences.

He is one of the authors of a climate change report -- the first major study since 2001 -- that will be released next year by an international panel of scientists.

He was recently interviewed as part of The Vancouver Sun's series on energy and the tough choices ahead for Canada in its role as the world's most energy-dependent nation. Today's stories look at how the warming climate is changing British Columbia's forest environment and threatening migrating salmon.

Weaver said the new report by the United Nations' Intergovernmental Panel on Climate Change will take an unprecedented stance on the urgency of government measures to curb fossil fuel emissions from the combustion of oil, natural gas and coal.

The strongest comment in the panel's last report, in 2001, was that most global warming in the last 50 years was attributable to human activity.

This time around, he expects readers will be stunned by the size and scope of environmental problems that the report will link to fossil fuel combustion.

Weaver said climate change has been detected in patterns of rainfall, rising sea levels, forest fires, extreme weather events -- and even the availability of drinking water supplies.

"We need to move to a complete and utter change in our energy systems so that we no longer rely on fossil fuels. Period," Weaver said in an interview.

"I can tell you for sure that the statements in that report will be far stronger than what existed in 2001. It will be flabbergastingly stronger."

Weaver pointed to an exclusive story last week in The Sun about the disappearance of glaciers in Garibaldi Provincial Park, as an indicator of just one of the challenges humanity will face as the warming trend proceeds.

Simon Fraser University researcher Johannes Koch studied 15 glaciers in the park and found they are at their smallest levels in at least 4,500 to 8,000 years -- and are shrinking faster than at any time in their history.

Weaver noted the Garibaldi trend is being repeated at "virtually every glacier in the world."

"There are communities in this country that rely on summer melt for their water. If these glaciers are on their way out, as you know from Garibaldi, it creates rather a predicament."

Weaver believes the momentum for change is accelerating, and noted several events last week as proof.

Flamboyant Virgin Group founder Richard Branson announced he would donate $3 billion over 10 years to help combat global warming.

Branson plans to donate all the profits from his airline and train services. He made the announcement last Thursday at a Global Initiative conference organized by former United States president Bill Clinton.

Closer to home, Canadian and British researchers published a new study that finds "clearly detectable" evidence of human-caused warming in regions around the world, including Canada.

Study co-author Francis Zwiers, a Victoria-based researcher with the Meteorological Service of Canada, said there is a "large body" of research pointing the finger at human-caused greenhouse gas emissions pushing up temperature on a global scale.

"Virtually everybody who looks at this comes up with the same conclusion," Zwiers said.

Zwiers said the new study, presented in Journal of Climate this month, shows clearly detectable climate impacts right down to regional levels in Canada and elsewhere.

"This isn't the only study to have done this. But this is the first study to use multiple models all at the same time and that makes the assessment a bit more reliable."

Also last week, British Foreign Secretary Margaret Beckett said in reference to environmental concerns, including rising seas and melting polar ice caps, that "It is now extremely difficult to find a serious scientific argument that this is not happening.

"The changes we need to make aren't happening fast enough," Beckett said.

It was a particularly bumpy week for global warming opponents as well.

The United Kingdom's Guardian newspaper previewed a new book, Heat, with an excerpt that eviscerates oil industry-funded groups that deny links between global warming and fossil fuel combustion.

The book's author, George Monbiot, calls them a 'denial industry' largely funded by oil giant ExxonMobil.

And, as reported in The Sun, federal Natural Resources Minister Gary Lunn distanced himself from a retired climate scientist who has been linked by Greenpeace to Exxon's funding activities.

The scientist, Tim Ball, pitches the idea that global warming is good for the environment, and opposes the Kyoto Accord aimed at reducing greenhouse gas emissions.

Ball was the scheduled speaker at a Victoria breakfast meeting of three Conservative electoral district organizations -- but Lunn said he "wouldn't agree" with Ball's opinions.

Also last week, California Attorney-General Bill Lockyer filed a lawsuit against six top automakers, including Ford, General Motors and Chrysler, for the contribution motor vehicles make to global warming.

"Global warming is causing significant harm to California's environment, economy, agriculture and public health. The impacts are already costing millions of dollars, and the price tag is increasing," Lockyer said.

Restless prairie winds power Alberta's renewable future

By Don Cayo

Vancouver Sun

27-Sep-2006

PINCHER CREEK, Alta. -- While British Columbians wait to see if their first wind farms will actually be built, tens of thousands of Albertans are already cooking dinner, drying socks, or lighting their homes and businesses with electrons generated by the restless prairie winds.

It's hard to square with the caricature of an oil-obsessed, red-neck land, but nearly 350 modern windmills -- winged giants that look like children's pinwheels on long, skinny, off-white sticks -- have sprouted near here in southwestern Alberta within the last four or five years, mostly in close-ordered ranks on wind-swept ridges between this town of 3,666 and similar-sized Fort MacLeod a half hour east on Highway 3.

Day in, day out -- on all but a handful of calm days when there's not enough wind to make them spin, or on extra-windy ones when they shut down to protect themselves -- the windmills quietly churn out enough electricity to match a mid-sized coal plant.

Meanwhile in British Columbia, despite dire warnings about running short of electricity and endless talk about embracing environmental values, it has been a mere two months since BC Hydro accepted three wind farm proposals along with 35 other proposals to generate electricity for the provincial grid, and they're still not a done deal. They still have hurdles to clear -- financial or environmental or both -- before construction can start.

There was a little lull in windmill construction here this summer because of limitations of transmission lines between here and the energy-hungry market in Calgary, but Alberta's wind power industry already adds up to about two per cent of the province's electrical needs. This may not sound like much -- unless you assume that it's just a start. Or unless you think about the various scenarios forecast for oil and natural gas -- at best destined to get ever-more expensive as the cheap supplies dry up, and at worst doomed to run out. Or unless you consider how ever-rising demand is sopping up all the electricity the continent can produce, and turning a hydro-rich province like B.C. from a prosperous exporter into a place that can't get by without buying extra electricity from our neighbours.

Yet even with these sobering realities, Alberta, both rich in and obsessed with fossil fuels, seems an unlikely province to become a Canadian leader in this green energy. But three factors drive its growth, and only one of them -- technology -- is, for now, readily transferable to British Columbia.

The other two factors driving the growth of Alberta's wind industry -- the regulatory climate and the tax incentives offered to companies that invest in wind power generation -- are made in Alberta.

And it would take changes in attitude, legislation and the way BC Hydro does business to make them work here.

Fifty-two-year-old Jason Edworthy grew up fascinated by farm windmills. By the early 1980s he was working in the oilpatch by day, and with Vision Quest, a start-up wind-power company he co-founded, whenever he could find time.

In those days, he says, he and his partners assumed they'd be dealing with customers who wanted to be off-grid -- self-sufficient on acreages or farms.

Deregulation changed that. Alberta created an energy market where customers could choose power providers. Edworthy found himself working on big on-grid projects, first with Vision Quest working in partnership with the giant TransAlta energy company and then, since 2002 when TransAlta bought his company, as its managing director of market development.

"At first wind power was a bit like the organic food industry," he says. "It was really expensive.

"Now it's a commodity you can buy almost anywhere."

TransAlta has remained a producer and wholesaler, relying on retail companies to recruit customers. That's a vital role in Alberta's deregulated market.

Enmax, the largest customer, now rolls 10 per cent wind power into large commercial contracts -- a practice that, as technology nudges down the price, still allows it to be competitive.

Though TransAlta gets a federal subsidy of one cent a kilowatt hour, wind economics in Alberta rely most heavily on customers who voluntarily put their hands up to pay a premium to go green.

Initially, says Tom Rainwater, TransAlta's vice-president of corporate development and marketing, consumers who signed on paid an extra $5 a month and were in turn promised that 10 per cent of the power they consumed had been generated by wind.

They still pay $5, but as the wind power price falls, now it's for 30 per cent.

That flat fee is, of course, a little bit of smoke and mirrors -- there's no way to know where the electrons that power a consumer's device actually originate. But the willingness of consumers to pay a premium to support wind power has fuelled the rapid expansion of the industry in the last decade. And Rainwater said TransAlta is poised for another growth spurt in about 18 months when some technical issues, including transmission capacity to markets like Calgary, have been resolved.

TransAlta's first wind farm, built at McBride Lake in partnership with its big retailer, Enmax, looks every bit a prototype on which others are based.

But McBride was built in 2002 -- a couple of generations ago in the head-spinning world of wind technology. Huge as the towers and blades appear as you drive under two of them on a grid road south of Fort McLeod and see the blade tips hurtling down at speeds of up to 240 km/h, they're pun

Posted by Arthur Caldicott on 23 Sep 2006